Table of Contents

There is a very specific moment when the CPA vs ACCA question shows up. It is not at the start of a career. It appears after some exposure. After you have seen how finance teams actually work. After you have noticed that two people with similar skills end up being trusted with very different responsibilities.

One person is asked to review numbers before they go out. The other is asked to explain numbers after they are out. Both are strong. Both are global. Yet their careers start bending in different directions.

That moment is where CPA vs ACCA becomes real. This is really a question of how you want your expertise to be used. CPA certification builds depth around a specific regulatory system. The other builds breadth across markets and industries. Neither is abstract. These differences show up in emails you answer, meetings you attend, and the kind of decisions you are trusted with at work.

Here is a simple way to sense the difference.

If someone drops a US client escalation on your desk at 6 pm, does that feel like an opportunity or a burden? If your answer leans toward opportunity, you are already thinking in a CPA-aligned way. If you enjoy stitching together numbers from different regions and explaining them to non-finance teams, that instinct often aligns more with ACCA-style roles.

As you read this comparison, it helps to shift the question slightly. Instead of asking which qualification is better, ask which one makes people rely on you for the kind of decisions you want to be known for. Viewed this way, CPA vs ACCA stops feeling confusing. It starts feeling precise. Both are global accounting credentials. Both demand discipline. Both open doors to strong careers. Yet the way they fit into careers in India, the USA, and global roles varies a lot. That is the lens this blog uses.

How CPA and ACCA Are Structured at the Core

Before salary or difficulty comes into the picture, structure matters. Structure shapes how you study and how employers read your qualification.

When people ask what is CPA, the simplest way to understand it is this: it is built for professionals who will work closely with US financial statements, audits, and reporting standards on a regular basis.

CPA, or Certified Public Accountant, is a licensure-based qualification regulated in the United States. It is administered at the state level and designed for professionals who work with US financial accounting standards, auditing, and regulatory frameworks. The CPA exam consists of four sections, each focused on applied knowledge rather than theory alone. The structure assumes that candidates will operate in environments where accuracy, compliance, and regulatory accountability are central to the role.

Now contrast that with what is ACCA. ACCA is a globally governed qualification with a broader academic and professional scope. It is structured across multiple levels and papers, allowing candidates to progress gradually. The syllabus spans financial reporting, audit & taxation, performance management, and strategic finance across different jurisdictions. ACCA is designed for professionals who may work across regions, industries, and finance functions rather than within one regulatory system.

Core Structural Differences at a Glance

The table below captures how the two qualifications are fundamentally designed.

| Aspect | CPA | ACCA |

| Governing Body | State boards in the United States | Global professional body |

| Nature | Licensure-based | Qualification-based |

| Exam Structure | 4 exam sections | Multiple papers across levels |

| Primary Focus | US GAAP, US audit, US regulation | IFRS, global finance, multi-country exposure |

| Study Style | High-intensity, focused preparation | Progressive, stage-wise learning |

| Intended Work Environment | US accounting and reporting roles | Global and multinational finance roles |

This structural difference becomes important later when people ask CPA vs ACCA which is better. Better depends on where you plan to apply your skills every day.

Geography Shapes Value More Than Difficulty

Exams feel personal. Still, difficulty without context is misleading. Geography changes value.

In the US market, CPA is a legal requirement for many senior accounting and audit roles. In global finance centres, ACCA is widely accepted. In India, both are valued but in different job clusters.

This is why CPA vs ACCA in India is searched so often. Indian professionals want global exposure without leaving the country. Shared services, GCCs, and Big 4 offshore teams now hire heavily for US reporting roles. This pushes CPA demand upward.

At the same time, ACCA remains popular in roles linked to IFRS reporting, global audits, and multinational finance teams. So when people ask ACCA vs CPA in India, the answer depends on which desk you want to sit at. One desk handles US clients daily. The other works across regions.

Also Read: Everything You Should Know About CPA Salary in India

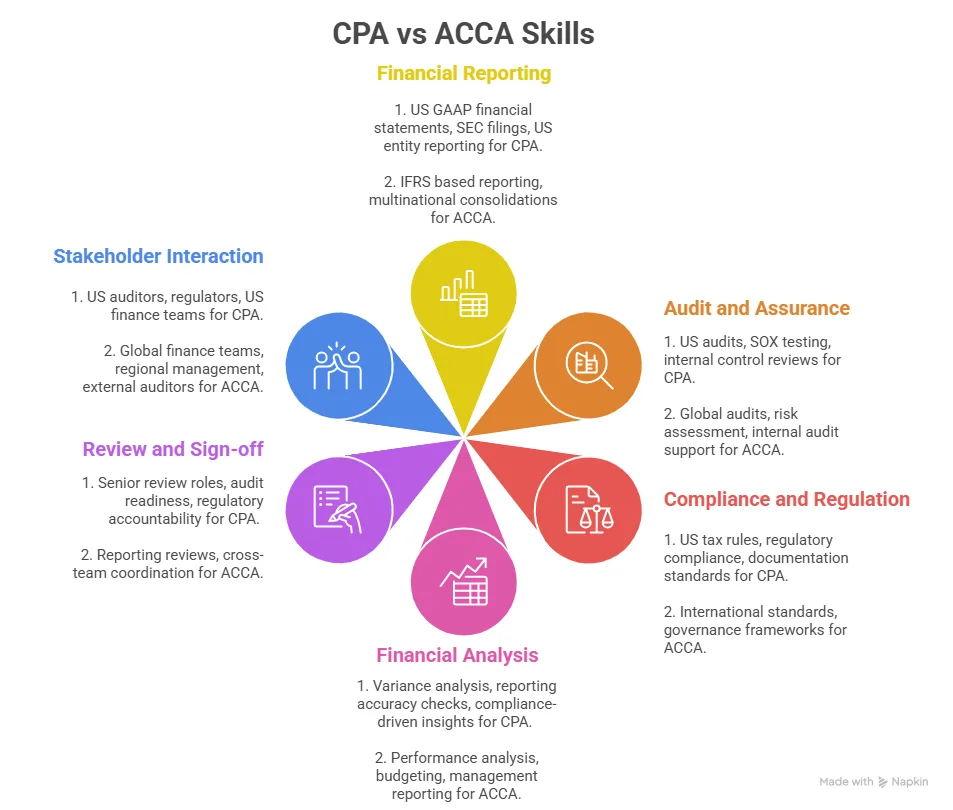

CPA vs ACCA: How a Typical Workday Looks

Think of a regular workday.

A CPA focused role may involve closing US books, handling SOX controls, preparing filings, and working with US auditors. Your calendar follows US timelines. Your knowledge stays deep and focused.

An ACCA-focused role may involve working with multiple regions, consolidations, and IFRS-based reporting. You speak to teams in Europe, Asia, and the Middle East. Your knowledge stays wide.

Neither is superior by default. This is why ACCA vs CPA, which is better, has no single answer.

Success in the CPA exam is less about covering everything and more about knowing how to prepare with focus and structure. The right approach helps candidates use their study time efficiently while building confidence across all four sections.

Eligibility and Entry Requirements for CPA vs ACCA

Another gap in many CPA vs ACCA discussions is how people actually enter these programs. CPA eligibility depends on education credits. Indian candidates usually need an evaluation of their degrees. Many candidates pair CPA with structured training providers. This is where guided programs matter.

Eligibility and Entry Requirements: CPA vs ACCA

| Eligibility Aspect | CPA | ACCA |

| Governing Authority | State Boards of Accountancy in the USA | ACCA Global (UK-based body) |

| Minimum Education | Bachelor’s degree or equivalent | 10+2 or equivalent qualification |

| Credit Requirement | Typically, 120-150 US education credits, depending on the state | No credit requirement at entry |

| Degree Evaluation | Mandatory evaluation of Indian degrees by approved foreign credential evaluators | Not required for most entry routes |

| Eligibility for Indian Candidates | Commerce graduates, CA, CMA, and MBA holders commonly qualify after evaluation | Students can start after 10+2 or graduation |

| Entry Flexibility | Entry depends on meeting state-specific rules | Highly flexible entry points |

| Work Experience Requirement | Required for CPA licensure, varies by state | Required for ACCA membership but not to sit exams |

| Typical Candidate Profile | Graduates or working professionals | Students and early-career professionals |

| Learning Environment | Often mixed with working professionals | Often includes students at early career stages |

ACCA eligibility is more flexible. Students can begin earlier in their academic journey. This attracts students who want a longer learning runway. This difference changes the age and career stage of candidates in each program. It also changes peer learning and classroom dynamics.

Where CPA Quietly Stands Out

One reason many professionals tilt toward CPA in the CPA vs ACCA debate is signalling power. CPA is a license. Employers associate it with accountability and regulatory responsibility. This perception matters in leadership hiring.

In India, this perception is growing fast due to US accounting outsourcing. This shift explains rising searches for CPA vs ACCA in India and the US CPA vs ACCA.

Also Read: Can You Really Earn a CPA Certificate With Zero Experience?

Did You Know? According to the AICPA, more than 75% of US accounting firms report difficulty hiring qualified accountants. You can read the data here on the AICPA website. This shortage increases the relevance of CPA focused roles globally.

Career Outcomes for CPA vs ACCA Decision

Career outcomes give real meaning to the CPA vs ACCA discussion. Exams end. Jobs continue for decades. This part looks at how the scope of CPA career, pay, and progression actually play out in daily working life.

Before any table or number, I want to frame this with a simple idea. A qualification works like a lens. It shapes how employers see you. It also shapes how you see problems at work. Over time, that lens influences promotions, project ownership, and even stress levels.

Career Outcomes in Practice: CPA vs ACCA

| Career Aspect | CPA | ACCA |

| Early Career Roles | US staff accountant, audit associate, reporting analyst | Finance executive, audit associate, reporting analyst |

| Mid-Level Progression | Senior accountant, audit senior, compliance lead | Senior analyst, finance manager, regional reporting lead |

| Nature of Responsibility | High ownership over accuracy, compliance, and reviews | Broader responsibility across analysis, coordination, and reporting |

| Employer Expectations | Precision, regulatory understanding, accountability | Adaptability, cross-functional understanding, and communication |

| Exposure Over Time | Deeper exposure within the US accounting and audit frameworks | Wider exposure across regions, industries, and finance functions |

| Promotion Triggers | Reliability, review capability, and regulatory confidence | Business understanding, stakeholder management, analytical depth |

| Stress Profile | Deadline-driven, compliance-focused cycles | Ongoing coordination, multi-region timelines |

| Long-Term Career Shape | Specialist leadership within accounting and reporting | Versatile leadership across finance roles |

Both outcomes offer strong and respected career paths. They serve different organisational needs. This distinction explains why CPA vs ACCA leads to different career narratives even when both are labelled as global qualifications. Understanding these outcomes early helps ensure the qualification supports not just your first role, but the kind of professional identity you want to build over the long run.

How Employers Read CPA vs ACCA on a Resume

When recruiters scan profiles, they do not read exam syllabi. They read signals.

CPA sends a strong signal of US accounting depth. It tells employers you can handle US GAAP, audits, compliance, and reporting with confidence. This matters a lot for companies serving US clients or listed entities.

ACCA sends a signal of global finance exposure. It tells employers you understand IFRS, performance management, and multinational reporting.

This difference explains why CPA vs ACCA in India has become a serious topic only in the last few years. India’s finance job market now includes thousands of US-focused roles that did not exist earlier.

Also Read: How an Indian professional can ace the US CPA exam!

Role Mapping for CPA and ACCA

Before comparing pay, it helps to understand where each qualification usually lands.

Common CPA aligned roles include:

- US Staff Accountant

- US Audit Associate

- SOX Compliance Analyst

- Financial Reporting Analyst for US entities

- Controller track roles in US captive units

Common ACCA career roles include:

- Financial Analyst

- IFRS Reporting Specialist

- Global Audit Associate

- FP&A roles in multinational firms

- Finance Business Partner roles

These lists overlap. Still, the centre of gravity is different. This is why ACCA vs CPA, which is better cannot be answered without role clarity.

Also Read: Top 5 Reasons to Join a US CPA Course Today

CPA vs ACCA Salary Patterns in India

Salary discussions often sound abstract. I prefer anchoring them to real job clusters.

In India, CPA roles linked to US accounting teams often start higher. Entry level CPA aligned roles in metro cities commonly pay more than equivalent ACCA jobs. This gap widens with experience.

The ACCA vs CPA salary in India varies by industry. In Big 4 offshore teams, CPA holders often move faster into review and client-facing roles. In global industry roles, ACCA professionals see steady growth across regions.

Salary Range Comparison: CPA vs ACCA in India

| Experience Level | CPA Salary (India) | ACCA Salary (India) |

| Entry Level (0-2 yrs) | ₹6 – 9 LPA on average, can go up to ₹12 LPA in metro roles | ₹4 – 8 LPA on average |

| Mid Level (3-7 yrs) | ₹12 – 22 LPA depending on role and industry | ₹10 – 20 LPA in multinational roles |

| Senior Level (8+ yrs) | ₹25 LPA and above in leadership roles | ₹15 – 30 LPA+ in senior finance leadership roles |

This explains why CPA vs ACCA salary in India searches are rising. Professionals want predictable growth. You can see hiring trends reflected in reports from firms like Deloitte and PwC. Their annual reports often highlight growth in US accounting services. You can explore these reports directly on their official websites.

Also Read: Why is CPA a Lucrative Career Choice: Eligibility, Opportunities and CPA Salary?

CPA vs ACCA Salary Outside India

Globally, CPA vs ACCA salary patterns follow market demand. In the USA, a CPA is often mandatory for senior accounting roles. This pushes average salaries higher. ACCA is respected but does not replace licensure requirements.

- In the United States, ACCA professionals can earn around $60,000-$80,000 annually at the entry level, with experienced ACCAs earning over $100,000 in senior finance or audit roles.

- In the United Kingdom, ACCA salaries often range around £45,000 per year, with higher earnings of £50,000-£80,000 in financial hubs like London.

- In the UAE and Middle East, ACCA-qualified professionals may start around AED 60,000-90,000 per year, with mid to senior roles often exceeding AED 150,000.

- In countries like Canada and Australia, ACCA salaries can range from roughly CAD 50,000-100,000+ and AUD 55,000-110,000+, depending on experience.

- In some major financial centres, experienced ACCA professionals are known to earn $120,000+ and above in senior positions, reflecting strategic and managerial responsibilities.

In regions like the Middle East and Europe, ACCA performs strongly. Many employers value its IFRS focus and broad syllabus. This is why searches like ACCA vs CPA USA and ACCA vs US CPA exist together. Aspirants want clarity before committing years of effort.

US CPA roles cover a wide range of accounting, audit, and reporting positions, each with distinct responsibility levels and pay structures. Understanding how these roles are structured helps set realistic expectations around career growth and salary progression.

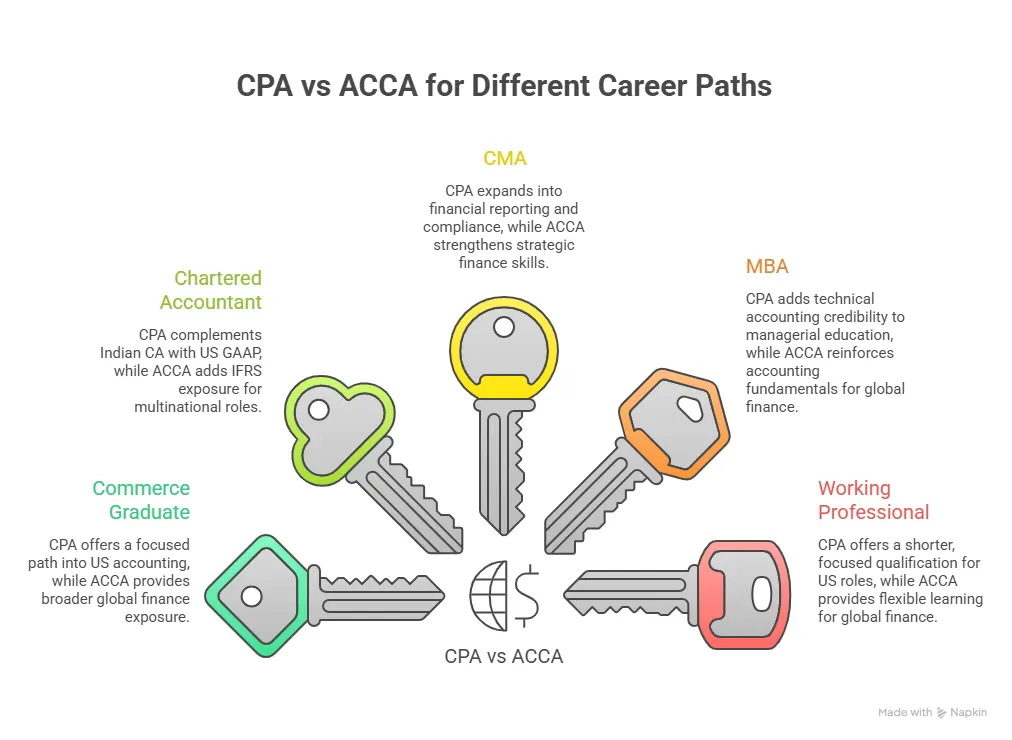

Comparing CPA With Other Qualifications

Many aspirants do not stop at CPA vs ACCA. They compare across multiple credentials.

In discussions like CMA vs CPA vs ACCA or ACCA vs CA vs CPA, the deciding factor often becomes specialisation.

→ CPA aligns strongly with accounting and compliance.

→ ACCA blends accounting with finance and management.

→ CMA focuses on cost and management accounting.

→ CA in India remains deeply tied to local regulations.

CFA vs CPA vs ACCA vs CMA: Career & Practical Fit Comparison Grid

| Comparison Factor | CPA | ACCA | CMA | CFA |

| Core domain focus | Accounting & Compliance | Accounting & Finance | Management Accounting | Investment & Finance |

| Global recognition | ✅ | ✅ | ✅ | ✅ |

| Strong fit for US accounting roles | ✅ | ⚪ | ⚪ | ❌ |

| Strong fit for global finance roles | ⚪ | ✅ | ⚪ | ✅ |

| Relevance for Indian GCC & offshore roles | ✅ | ⚪ | ⚪ | ❌ |

| Alignment with Big 4 hiring | ✅ | ✅ | ⚪ | ⚪ |

| Focus on financial reporting | ✅ | ✅ | ⚪ | ❌ |

| Focus on business & strategic decisions | ⚪ | ⚪ | ✅ | ⚪ |

| Typical completion timeline | ✅ | ⚪ | ⚪ | ⚪ |

| Preferred by employers for accounting leadership roles | ✅ | ⚪ | ⚪ | ❌ |

Legend:

✅ Strong alignment

⚪ Partial alignment

❌ Not a primary focus

When people search CA vs CPA vs ACCA, they are usually asking where future growth lies. The answer depends on whether they want domestic practice, global finance, or US-aligned roles.

Similarly, searches like ACCA vs CPA vs CFA show confusion between accounting and investment careers. CFA leans toward portfolio management and analytics. CPA stays rooted in financial reporting.

Why CPA Is Gaining Attention in India

The rise of global capability centres has changed India’s finance landscape. US companies now run accounting operations from India. This increases demand for CPA aligned skills.

- US companies are expanding accounting and compliance operations through Global Capability Centres in India.

- Core US accounting work, such as reporting, audit support, and compliance, is now handled by India-based teams.

- This shift has increased demand for professionals with US GAAP and regulatory expertise.

- Big 4 and consulting firms are scaling US-focused practices in India.

- As a result, CPA vs ACCA in India reflects real hiring demand rather than theoretical preference.

As a result, CPA vs ACCA in India is no longer theoretical. It reflects real hiring demand.

Also Read: Role of a CPA: Tax Planning

CPA vs ACCA Difficulty Through a Work Lens

Instead of labelling difficulty, I prefer to talk about pressure. CPA exams demand high-intensity preparation. Each paper carries weight. Many candidates describe it as a sprint-like focus.

ACCA exams spread pressure over time. Multiple papers require consistent study habits. This is why CPA vs ACCA difficulty feels different, rather than higher or lower. Learning temperament matters more than intelligence.

Daily Work Experience Matters

Imagine two professionals at the same company. One prepares quarterly filings for US regulators. Deadlines are strict. Documentation matters. Accuracy is non-negotiable.

The other works on budget forecasting and performance reviews across regions. Meetings span time zones. Analysis and communication matter.

Both are respected. Both are busy. The skills used each day feel different. This daily experience shapes job satisfaction more than exam difficulty. This is why CPA vs ACCA, which is easier, is the wrong question for many people.

The comparison between CPA and CA often comes down to where and how accounting skills are applied. While both are respected qualifications, their relevance shifts based on geography, regulatory exposure, and the type of roles professionals aim to pursue.

A Practical Way to Decide Between CPA and ACCA

I find that decisions become easier when they are broken into everyday questions.

Ask yourself how your ideal workweek looks. Do you see yourself working deeply with one set of accounting rules and becoming known as the go-to person for that system? Or do you see yourself working across regions and handling a wide mix of financial reporting tasks?

The first picture aligns more closely with CPA. The second often aligns with ACCA. This is why CPA vs ACCA, which is better, depends on daily work preferences more than exam content.

A Practical Decision Matrix: Choosing Between CPA and ACCA

| Decision Factor | CPA | ACCA |

| Preferred Type of Work | Deep focus on one accounting system | Broad exposure across multiple systems |

| Accounting Framework | US GAAP and US regulations | IFRS and global standards |

| Nature of Daily Tasks | Reporting accuracy, audits, compliance reviews | Analysis, consolidation, regional reporting |

| Work Style | Structured, rule-driven, detail-intensive | Adaptive, multi-context, analytical |

| Geographic Focus | US-focused roles, including offshore teams | Global and multinational roles |

| Role Identity Over Time | Subject-matter specialist | Versatile finance professional |

| Ideal for Students Who | Prefer depth and clear frameworks | Prefer variety and cross-functional work |

| Career Recognition | Licensure-based credibility | Qualification-based global recognition |

| Long-Term Career Shape | Leadership within accounting and compliance | Leadership across finance and business roles |

Time Commitment and Completion Reality

Another area that needs clarity is time.

CPA typically involves four exams. With focused preparation, many candidates complete the exams within a year. Some move faster. Others take longer due to work commitments.

ACCA involves multiple levels and papers. Completion timelines often stretch across several years, especially when combined with work experience requirements.

This is where structured guidance matters. Programs like the CPA pathway at Imarticus Learning are designed to help working professionals plan study time without burning out. This makes CPA more realistic for people with limited study hours.

Employer Acceptance and Big 4 Hiring

A common question is whether large firms value one qualification over the other. Big 4 firms hire both CPA and ACCA professionals. The difference lies in role allocation.

In India, Big 4 offshore teams serving US clients actively recruit CPA aligned talent. These roles involve US audits, reporting, and compliance. ACCA professionals are commonly placed in global audit and advisory teams. This explains why searches like US CPA vs ACCA and CPA vs ACCA in India are rising. The market now offers clear paths for both.

CPA vs ACCA and Long-Term Mobility

Mobility matters over a long career.

CPA offers strong mobility within US-aligned roles across countries. Many professionals use it to move between India, the Middle East, and the USA in US accounting functions.

ACCA offers mobility across regions and industries. It works well for professionals who want flexibility in geography and function.

When people ask ACCA vs CPA, which is better, they are often asking which door stays open longer. The answer depends on which door you plan to walk through first.

Also Read: Top Job Roles After Completing a US CPA Certification

Why Choose Imarticus Learning for your CPA Journey

When people compare CPA vs ACCA, the decision often comes down to how clearly the CPA path is structured and supported. I look at preparation the same way I look at any serious professional commitment. The right guidance reduces friction, keeps effort focused, and makes progress predictable.

With the CPA Course preparation at Imarticus Learning, the preparation is designed around how US accounting roles actually function. The focus stays on academic alignment, practical exposure through industry-linked learning, and consistent mentoring, so candidates can prepare with clarity and confidence instead of relying on guesswork.

- Industry-Led Partnership: The CPA course is offered in collaboration with KPMG in India, integrating real-world case studies and curated resources into the curriculum.

- First-of-Its-Kind Provider: Imarticus Learning is India’s first and only approved prep provider for world-class finance certifications, including US CPA, ACCA, CFA, US CMA and FRM.

- Pass Confidence with Money-Back Guarantee: If you are unable to pass all CPA exams, Imarticus offers a 50 % refund guarantee, reinforcing confidence in the preparation pathway.

- Internship Opportunity: Top performers can earn the chance to intern with KPMG in India, gaining hands-on experience and exposure to global industry practices.

- Tailored Resources & Webinars: Learners benefit from exclusive resources, monthly webinars on industry trends, and live sessions with practitioners to bridge theory and practice.

- Pre-Placement Support: Dedicated mentoring for interview preparation and soft skills helps candidates transition successfully into accounting roles after certification.

FAQs on CPA vs ACCA

Now, let’s look at the most frequently asked questions from candidates who are trying to make a clear and confident career choice. The answers focus on practical concerns around validity, salary, difficulty, and long-term relevance.

Is a CPA better than ACCA?

The idea of better depends on career alignment. In the CPA vs ACCA discussion, CPA offers stronger alignment with US accounting and regulatory roles. ACCA offers broader global exposure. For professionals targeting US-focused finance roles, CPA vs ACCA often tilts toward CPA because employers associate it with licensure and accountability. This is why many candidates in India now choose CPA programs through providers like Imarticus Learning.

What is the salary of an ACCA CPA?

When people ask about salary, they usually mean CPA vs ACCA salary across regions. In India, CPA aligned roles often start at a higher range due to demand from US clients. ACCA roles offer stable growth across global finance teams. The CPA vs ACCA salary gap depends on role type, location, and experience rather than the qualification alone.

Is CPA valid in India?

Yes, CPA is valid in India for employment. In the CPA vs ACCA context, CPA is widely accepted by multinational firms, Big 4 offshore teams, and global capability centres. Many Indian professionals use CPA to work on US accounting and reporting roles while staying in India.

Is CPA tougher than CA?

This question often appears in CPA vs ACCA searches due to overlapping comparisons. CPA and CA test different skill sets. CPA focuses on US accounting, auditing, and regulation. CA focuses on Indian laws and practice. Difficulty depends on familiarity with the syllabus and learning style rather than one being universally harder.

Is a 75% on the CPA exam passing?

Yes, a score of 75 is the passing mark for each CPA exam section. In the CPA vs ACCA discussion, this scoring system reflects competency rather than percentage accuracy. It measures whether a candidate meets the professional standard required for licensure.

Does Big 4 hire CPA in India?

Yes, Big 4 firms actively hire CPA professionals in India. In the CPA vs ACCA landscape, CPA holders are commonly placed in US audit, tax, and advisory support roles. Demand has increased due to growth in US-focused offshore work.

Can I do CPA in 3 months?

Completing the entire CPA qualification in three months is unrealistic. However, candidates can complete individual exam sections in that time with focused preparation. In the CPA vs ACCA comparison, CPA is often chosen because its shorter structure allows faster overall completion with disciplined planning. Structured programs from Imarticus Learning help candidates plan realistic timelines.

Is CPA better than an MBA?

A CPA and an MBA serve different purposes. In the CPA vs ACCA discussion, CPA is a technical accounting credential. An MBA focuses on management and leadership. CPA is often preferred for specialised accounting roles, while an MBA suits broader managerial paths. Many professionals even combine both over time.

Where the CPA vs ACCA Decision Leads You Next

By now, the CPA vs ACCA conversation feels less overwhelming. Once the noise is removed, the decision becomes practical. It comes down to where you want your skills to be used and how you want your career to grow over time.

CPA vs ACCA is not about choosing a popular qualification. It is about choosing a direction. One path builds deep expertise in US accounting and reporting. The other supports wide exposure across global finance roles. Both create value when they align with the work you want to do each day.

What matters most is clarity before commitment. Time, effort, and focus are limited. When they are invested in the right qualification, progress feels steady instead of stressful. Careers move faster when choices are intentional.

For many professionals aiming for global roles linked to US markets, CPA continues to stand out as a focused and efficient path. The challenge often lies in knowing how to prepare while balancing work and life. This is where structured support makes a difference. Guided CPA Program prep at Imarticus Learning is designed to simplify preparation, keep momentum strong, and help candidates stay on track without overcomplicating the journey.

Once the decision is clear, the next step becomes simple. Preparation turns into progress. And progress, over time, turns into a career that feels well planned rather than rushed.