Table of Contents

Last updated on December 29th, 2025 at 02:35 pm

If you’ve been typing “how to become an investment banker” into Google at odd hours, this probably isn’t casual curiosity. It’s that quiet, persistent thought that keeps coming back. The kind that shows up after you hear about someone closing a big deal, see a jaw-dropping salary screenshot on LinkedIn, or realise you want a career that moves faster than the usual options.

You’ve likely seen both sides of the story by now.

On one hand, money, prestige, exposure to global deals, and rapid career growth.

On the other hand, long nights, tight deadlines, high pressure, and the very real question: Is this life actually sustainable for me?

So before we glorify anything, let’s slow this down and talk like real people.

This isn’t a glossy dream career pitch or a checklist copied from some research forums. It’s a grounded, honest guide meant to help you think clearly – especially if you’re navigating investment banking from the Indian context.

Because the real questions most people have aren’t just what investment banking certification is. They’re deeper and more personal:

How to become an investment banker – step by step?

Can I get into investment banking in India without an Ivy League degree or a famous college name?

What if I’m starting after BCom, CA, engineering, or switching careers with little to no direct experience?

These are valid questions. And more importantly, thousands of people ask them quietly while trying to figure out their next move.

By the end of this guide, you won’t just have definitions or career jargon. You’ll understand what investment banking truly demands day-to-day, what the learning curve feels like, where people usually get stuck, and how those who succeed actually break in.

Most importantly, you’ll be able to decide – clearly and honestly – whether investment banking fits you, how to become an investment banker, and what your next practical step should be.

Did you know?

Most people who eventually break into investment banking research the career for 6 to 12 months before taking their first serious action. The difference-maker isn’t speed – it’s follow-through.

First Things First: What Does an Investment Banker Really Do?

You can’t genuinely figure out how to pursue investment banking without first understanding what is investment banking, and what it actually involves. Before asking “how to become an investment banker or how can I become an investment banker?”, it helps to know what the job looks like.

At its core, investment banking is about helping companies make very big financial decisions, usually decisions that can change the future of the business.

Investment bankers work with companies to:

| What Investment Bankers Do | What It Means in Simple Terms |

| Raise capital | Help companies get money through IPOs, bonds, private placements, or other funding options |

| Buy or sell businesses (M&A) | Advise on mergers, acquisitions, divestments, and strategic company sales |

| Restructure finances | Manage debt, fix balance sheets, and support companies during difficult financial phases |

| Strategic advisory | Guide leadership on high-stakes decisions involving money, markets, and timing |

That’s the headline version. What most people don’t see is how this work gets done – especially early in your career.

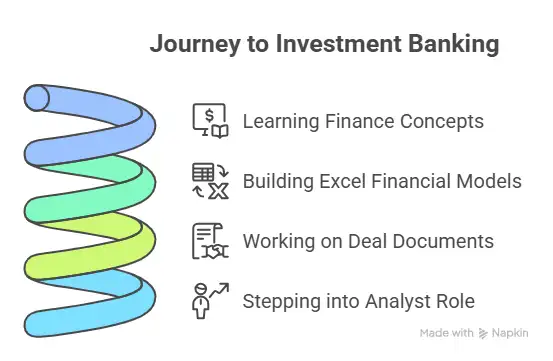

Students and aspirants often ask me how to become an Investment Banker in India. So, I always tell them – to become an investment banker in India, you need to build strong Excel, financial modelling, and valuation skills, gain practical exposure through internships or projects, and target analyst, valuation, transaction advisory, or IB operations roles as entry points into the industry.

If you’re still trying to wrap your head around what investment banking actually looks like, here’s a short video that breaks the core concept down in a clear, real-world way of showing how investment bankers connect companies with capital, structure deals, and support big financial decisions. Watching it before you go deeper can make the rest of the path feel even more practical and grounded.

Day-to-Day Reality of Investment Banking

Just like getting an answer to how to become an investment banker is important, it’s quite essential to know what your day would look like if you pursue investment banking.

If you’re imagining deal meetings and boardroom strategy from day one, here’s a reality check – in your initial years, investment banking is very execution-heavy.

Your days in investment banks are usually filled with:

- Financial modelling in Excel – building and fixing models, sometimes repeatedly.

- Valuation analysis – understanding what a company is really worth and why.

- Pitch decks – yes, a lot of PowerPoint, often revised many times before it’s client-ready.

- Industry and company research – digging through reports, data, and numbers.

- Working under tight deadlines – often with multiple seniors, teams, and clients involved.

- It’s detailed work – It’s deadline-driven. And it requires focus for long stretches of time.

This is also why investment banking rewards accuracy, stamina, and learning speed far more than textbook theory. Knowing definitions isn’t enough. You’re expected to apply concepts quickly, fix mistakes fast, and keep going even when the pressure is high.

That doesn’t mean the job is mindless or mechanical. Over time, as you gain experience, you start seeing the why behind the work – how numbers influence decisions, how deals are structured, and how strategy plays out in real life. But earning that seat at the table requires proving you can handle the groundwork first.

Understanding this reality early saves you a lot of confusion later. It helps you decide whether this career excites you for the right reasons – and whether you’re ready for what investment banking actually demands, and how to become an investment banker.

Interesting fact:

Investment banking analysts often work on multiple deals at once, which is why attention to detail matters more than raw intelligence early on.

Is It Hard to Become an Investment Banker?

Let’s address the uncomfortable question upfront: How hard is it to become an investment banker?

Well, it’s competitive – but not impossible.

People fail not because they aren’t smart, but because:

- They underestimate the skill gap.

- They rely only on degrees, not practical exposure.

- They don’t understand how hiring really works.

If you’re willing to put in focused effort for 12 to 24 months, investment banking is achievable – even in India.

How to Become an Investment Banker in India

I am going to answer one of the most searched questions: how can I be an investment banker? Investment banking in India works a bit differently from Wall Street.

When someone asks me – How to get into investment banking in India. Key hubs:

- Mumbai

- Bangalore

- Gurgaon

- Hyderabad

If you are stuck on how to get into investment banking. Here are some of the most common employers:

- Global banks (offshore teams)

- Indian investment banks

- Boutique advisory firms

- Big 4 transaction advisory arms

If you’re asking how to become an investment banker in India, focus on:

- Strong Excel and valuation skills.

- Understanding global markets.

- Being flexible with entry roles.

This is how many analysts eventually move into core deal teams – India and abroad.

Still curious about what investment banking really involves beyond text and definitions? This video breaks down the core roles, responsibilities, and daily work in a way that’s easy to grasp – especially if you’re just starting your research:

Lesser-known insight:

CAs and engineers often move faster once inside investment banking because of their discipline and analytical training, even if entry takes longer.

How to Become an Investment Banker After BCom, CA, or Engineering

No matter where you’re starting from, the path into investment banking looks a little different. Your degree doesn’t disqualify you – but it does shape where you start, what skills you need to add, and how you position yourself as you work toward how to become an investment banker in practice.

Here’s a simple breakdown of what aspiring investment bankers should focus on based on their academic background:

| Background | What to Focus On to Break Into Investment Banking |

| After BCom | Build technical finance skills early, don’t wait for “perfect” campus placements, and focus on practical deal exposure. |

| After CA | Leverage strong accounting knowledge, add valuation and financial modelling skills, and target M&A, transaction advisory, or IB operations roles. |

| After Engineering | Transition into finance early, demonstrate analytical strength, and build financial skill credibility as quickly as possible. |

Still curious about what investment banking really involves beyond text and definitions? This video breaks down the core roles, responsibilities, and daily work in a way that’s easy to grasp – especially if you’re just starting your research:

How to Become an Investment Banker: The Actual Entry Roadmap

Many students ask me how to get into investment banking. If you strip away the noise, the path into investment banking is fairly consistent across backgrounds. What changes is where you start, not the steps themselves.

This section focuses purely on how people actually break in – before titles, salaries, or long-term payoffs enter the conversation.

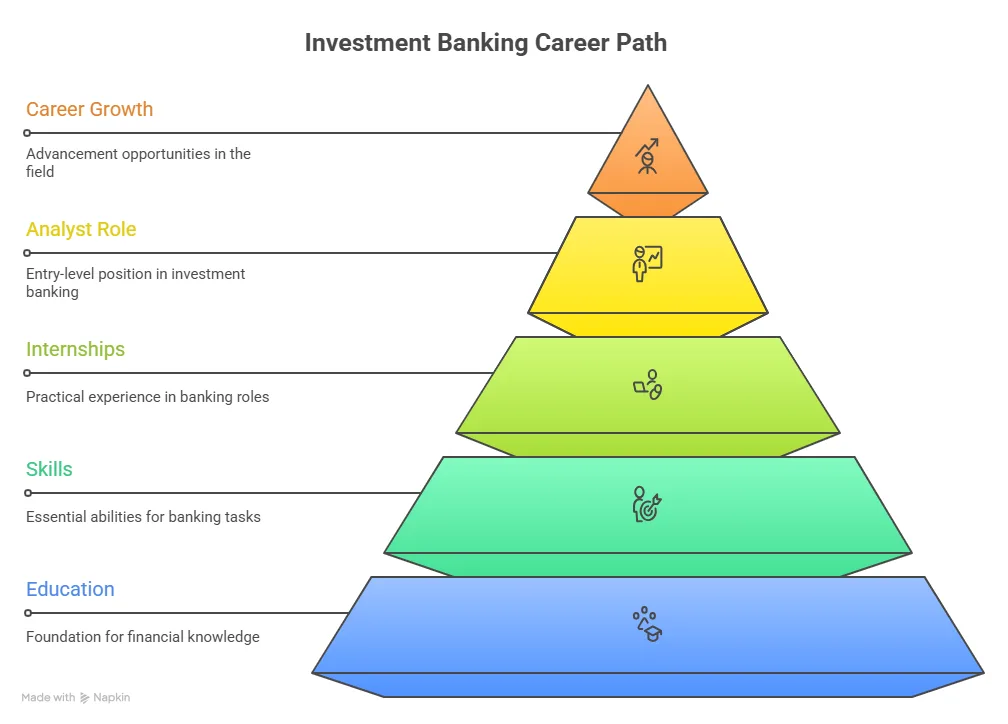

Step 1: Build a Solid Educational Base

Most investment bankers begin with a degree in commerce, finance, economics, engineering, or management. This education helps you qualify for entry-level roles, but it does not prepare you for the job on its own.

At this stage, the goal is simple:

- Understand accounting and finance fundamentals.

- Develop comfort working with numbers.

- Build discipline for high-pressure, deadline-driven work.

- Think of your degree as a starting platform – not the finish line.

Step 2: Learn Core Investment Banking Skills

This is where many aspirants fall behind. To get into investment banking, you must be able to apply finance concepts, not just understand them.

That means learning:

- Financial modelling and valuation

- Practical accounting application

- Capital markets basics and deal structures

Without these skills, breaking into investment banking is extremely difficult – regardless of your degree or college name.

Step 3: Get Practical Exposure

Banks don’t hire potential alone; they hire proof. Internships, live projects, deal simulations, or transaction support roles matter far more than certificates.

What recruiters look for is evidence that you can:

- Work with real financial data.

- Follow deal timelines.

- Handle feedback and tight deadlines.

Even short-term exposure can dramatically improve your chances of entry.

Step 4: Enter Through Analyst or Support Roles

Many professionals get into investment banking through:

- Investment banking analyst roles.

- Transaction advisory teams.

- Valuation or IB operations roles.

These roles are not detours. For many, they are the most realistic and effective entry points into the industry.

Step 5: Grow Internally Through Performance

Once inside, background matters less than execution.

Investment banking rewards people who:

- Deliver accurate work consistently.

- Learn quickly under pressure.

- Earn trust from seniors and clients.

From this point onward, growth is driven by performance.

Did you know?

India-based investment banking teams support deals worth billions of dollars globally, even when the client is based in the US or Europe.

Is Investment Banking Worth It? Effort vs Reward Over Time

Once you understand how people get into investment banking, the real question becomes more personal: Is the effort actually worth the money, pressure, and lifestyle trade-offs?

Investment banking follows a compounding career model. Each phase builds skills, credibility, and earning potential. Skip steps, and growth slows. Do it right, and compensation can increase dramatically over time.

Here’s how the effort typically translates into reward.

Early Career Phase: Foundation Before Payoffs

In the early years, salaries aren’t the focus. What matters is building technical confidence and work stamina.

You’re paid modestly at this stage because:

- You’re learning execution.

- You require supervision.

- Your value lies in accuracy, not decision-making.

Earning impact: Indirect, but critical. This phase supports every future salary jump.

Acceleration Phase: Skills That Change Your Trajectory

Once you add strong investment banking skills – especially modelling, valuation, and deal understanding – your career path starts to diverge.

This is where candidates separate into – Generic finance roles, or Investment banking analyst tracks.

Earning impact: Strong skill-building can push starting salaries from ₹4-5 LPA to ₹6-10 LPA in India.

Entry-Level Banking Phase: Analyst Roles

This is where most of the investment banking career formally begins.

As an analyst, you’ll:

- Build and update financial models.

- Support senior bankers on live deals.

- Work long hours during active transactions.

It’s intense – but structured. Promotions, bonuses, and salary hikes follow a defined path for strong performers.

Typical earning range in India:

- Investment Banking Analyst Salary: ₹6-12 LPA

- Monthly take-home: ₹50,000 to ₹1 lakh+

Growth Phase: Associate to Vice President

As you move from analyst to associate and beyond, your role changes.

You’re no longer just executing tasks. You begin:

- Managing deal processes

- Coordinating teams

- Interacting with clients

Investment banking salary progression accelerates sharply:

| Career Stage | Primary Focus | Salary Range |

| Analyst | Execution & accuracy | ₹6-12 LPA |

| Associate | Deal management | ₹15-30 LPA |

| Vice President | Client & deal leadership | ₹40-70 LPA |

| Director / MD | Business generation | ₹80 LPA-₹1 Cr+ per annum |

At senior levels, bonuses and deal success matter more than base salary.

Why Salaries Jump, Not Climb Gradually

Investment banking jobs don’t reward time alone – it rewards trust:

- Trust in your technical skills.

- Trust in your judgment.

- Trust in your ability to handle clients and risk.

That’s why compensation doesn’t increase linearly. It jumps at key career milestones.

A Quick Reality Check

There’s no shortcut to a high investment banker package. But there is a clear, repeatable roadmap.

Those who:

- Invest early in skills.

- Choose the right entry roles.

- Stay consistent through the first demanding years.

…are the ones who see the biggest long-term upside.

Did you know?

Investment banking salaries don’t grow gradually – they jump at promotion milestones, which is why early years feel slow but later growth feels sudden.

How to Become an Investment Banker With No Experience

If you’re searching for how to become an investment banker with no experience, you’re not alone – and you’re not disqualified.

What banks really mean by “experience” is:

Can you work with numbers accurately?

Do you understand how deals flow?

Can you handle deadlines and feedback?

You can build this credibility by:

- Completing hands-on financial modelling projects.

- Working on valuation case studies.

- Taking internships at boutique firms or advisory teams.

- Learning IB operations or transaction support roles first.

Many professionals enter investment banking without prior finance jobs, but none enter without skills.

How to Become an Investment Banker After 12th

If you’re thinking about how to become an investment banker early, that’s a good sign. After 12th, your goal isn’t to become an investment banker immediately – it’s to set the right foundation.

Smart choices include:

- Commerce, economics, or finance degrees.

- Engineering – if you’re strong analytically.

- Developing Excel and accounting skills early.

Investment banking is a long game. The decisions you make after 12th simply decide how smooth your entry will be later.

How to Become an Investment Banker After Graduation

Graduation is where most people get serious.

At this stage, focus on:

- Identifying your entry route through analyst, advisory, and operations.

- Closing skill gaps quickly.

- Avoiding endless waiting for perfect placements.

Many successful bankers start preparing after graduation, not before. What matters is focused execution, not timing.

How to Become an Investment Banker After an MBA

An MBA can help – but it’s not a shortcut.

What matters is:

- The quality of your MBA program.

- Your finance specialisation.

- Internship and project exposure during the MBA.

Top-tier MBAs place you directly into front-office roles. Others still need to build technical depth before entering core investment banking.

How to Become an Investment Banker Without a Degree

This is one of the most searched questions – how to become an investment banker, and one of the hardest paths. In theory, it’s possible, but in practice, it’s rare.

Investment banking involves regulated environments, client trust, and high-stakes investment decisions. Degrees act as a baseline filter. Without one, you’d need exceptional skills, strong networks, and proven deal exposure to be considered.

If you’re ready to move from research to action and actually land your dream job in investment banking, check out this video. It breaks down practical steps, mindset shifts, and real strategies top candidates use to get noticed by recruiters:

Important fact:

Banks rarely teach financial modelling from scratch. Most expect analysts to be productive within weeks, not months.

Who Investment Banking Is Not a Good Fit For

Investment banking is often talked about as a “dream career.” And for some people, it genuinely is. But it’s not a great fit for everyone – and pretending otherwise only leads to frustration later.

Knowing how to become an investment banker is important, but it’s also more important to know whether you are the right fit to be one.

An investment banking degree may not be the right path if:

- You strongly value fixed working hours and predictable schedules.

- You dislike detail-heavy, repetitive work under tight deadlines.

- You prefer slow, steady career progression over steep learning curves.

- You struggle with frequent feedback, revisions, and pressure.

- You want early autonomy without first proving execution ability.

This doesn’t mean you’re not capable or ambitious. It simply means your strengths may be better suited to other finance roles like corporate finance, equity research, FP&A, consulting, or entrepreneurship.

Investment banking rewards a specific mindset: high tolerance for pressure in exchange for accelerated growth. If that trade-off doesn’t excite you, it’s okay to choose differently.

Did you know?

Most entry-level banking roles are filled through skill-aligned hiring, not brand-name degrees – this is why job-focused programs matter.

Why Imarticus Fits the Investment Banking Path

If you’ve read this far, you might be searching for answers for how to become an investment banker and already know something important: Investment banking isn’t about collecting degrees – it’s about being job-ready.

This is where many aspirants get stuck. They understand what investment banking is, but they don’t know how to build the exact skills banks expect at the entry level. That gap between education and execution is what programs like the Investment Banking Course at Imarticus are designed to solve.

Imarticus doesn’t position itself as a shortcut into investment banking. Instead, it focuses on helping you build the skills and exposure that actually get used inside banks – especially in analyst, operations, and transaction support roles that act as real entry points into the industry.

Here’s what makes it relevant if your goal is to become an investment banker:

- The program focuses on investment banking operations and deal-support roles, not generic finance theory. You learn how banking teams actually work-trade flows, deal support, and the importance of accuracy and timelines.

- Training includes hands-on exposure to real workflows like trade lifecycles, settlements, and compliance processes, helping you understand day-to-day banking from the start.

- It’s well-suited for freshers and career switchers – including BCom/BBA graduates, CA aspirants, engineers, and candidates with little or no prior banking experience.

- Alongside skills, there’s interview and career support aligned with how banks hire, focusing on practical understanding rather than theory.

For those serious about breaking into investment banking through realistic entry roles, a focused investment banking course like this can significantly shorten the learning curve.

FAQs About How to Become an Investment Banker

If you’re exploring how to become an investment banker, these frequently asked questions clear up the most common doubts – so you can focus on what actually matters and decide your next step with confidence.

How do I become an investment banker step by step?

To become an investment banker step by step, you typically:

- Build a finance or analytical education base.

- Learn financial modelling and valuation.

- Gain practical exposure through internships or projects.

- Enter through analyst, advisory, or IB operations roles.

- Grow internally through performance and deal exposure.

Many candidates bridge the skill gap through practical, job-aligned programs from Imarticus Learning, which focus on real investment banking skills rather than just theory.

There’s no shortcut – but the path is repeatable.

How hard is it to become an investment banker?

It’s competitive, but not impossible. Most people struggle not because the work is too hard or complicated, but because they:

- Underestimate the skill gap.

- Focus only on degrees instead of execution skills.

- Apply without understanding how hiring works.

With focused effort over 12-24 months, many candidates break in – especially in India.

How do people get into investment banking, according to Reddit or Quora?

Most real-world stories on Reddit and Quora follow similar patterns:

- Strong skill-building outside college

- Boutique internships or advisory exposure

- Entering through support or analyst roles

- Gradual movement into core deal teams

There’s no single perfect profile – but consistent preparation shows up in almost every success story.

Can I become an investment banker without experience?

Yes – but not without skills. Banks don’t expect prior banking jobs, but they do expect:

Financial modelling ability

Understanding of deal workflows

Comfort with deadlines and feedback

Projects, internships, and transaction support roles help bridge the gap.

Can I become an investment banker without a degree?

It’s rare to become an investment banker without a degree. Investment banking operates in regulated, high-trust environments. Degrees act as a baseline filter. Without one, you’d need exceptional skills, strong networks, and real-deal exposure to be considered.

How do I start investment banking if I’m from a non-finance background?

Many successful bankers come from engineering or non-commerce backgrounds.

The key is to:

- Transition into finance early.

- Build technical credibility fast.

- Demonstrate analytical strength through projects and internships.

- Background matters less than execution ability.

How to become an investment banker after CA?

After CA, you can move into investment banking by adding financial modelling, valuation, and M&A knowledge to your accounting base. Many CAs enter through transaction advisory, valuation, or IB operations roles, then move into core deal teams with experience.

How to become an investment banker after BCom?

After BCom, focus on building financial modelling, valuation, and Excel skills, gain practical deal exposure through internships or projects, and target analyst, valuation, or IB operations roles as entry points into investment banking.

How to do investment banking?

To do investment banking, you need strong finance fundamentals, financial modelling and valuation skills, and practical deal exposure. Many aspirants build these through structured programs like Imarticus Learning, which focus on real banking workflows and help candidates prepare for analyst and entry-level investment banking roles.

Next Steps in Your Investment Banking Journey

If you’ve reached here, you might have already understood how to become an investment banker. Investment banking isn’t mysterious. It’s demanding, structured, and very real. The people who do well aren’t necessarily the smartest in the room – they’re the ones who prepare properly, learn fast, and stay consistent when the work gets repetitive and the hours.

There is a clear path in. But it doesn’t reward shortcuts. It rewards people who take the time to build real skills, understand how the industry actually works, and are willing to start where most learning happens – on the ground.

If the pace excites you, if responsibility motivates you, and if you’re okay earning your way up rather than skipping steps, investment banking can be a genuinely rewarding career.

And if you’re ready to move from thinking about it to doing something about it, the next step isn’t another article. It’s building the skills that banks actually look for – whether that’s through focused self-study, hands-on projects, or a structured investment banking course that mirrors real-world work.

Whatever path you choose, make sure it’s a conscious one. That clarity alone puts you ahead of most people still stuck in research mode, trying to figure out how to become an investment banker.