Table of Contents

When people search for investment banking salary, they’re rarely just curious about numbers. What they’re really asking is whether investment banking is worth the effort – long hours, steep learning curve, and intense competition – and whether it truly delivers one of the highest-paying careers in finance.

I get this question a lot, especially from commerce students and early professionals: Is the payoff real, or is investment banking just hype?

The short answer: yes, it can pay extremely well.

But like most high-paying finance roles, the investment banker’s salary doesn’t grow overnight. It grows with skills, experience, and most importantly, by making the right career choices for the path you choose to enter the industry.

That’s where many people get stuck. A general degree alone rarely leads straight into high-paying roles. This is why questions like after BCom, which course is best for high salary come up so often – because the answer usually lies in choosing structured, role-specific pathways. Programs like the Investment Banking Course are designed to bridge this gap by preparing candidates for real investment banking roles and helping them enter the ecosystem faster, especially through operations and execution functions.

In this guide, I’ll break down:

The investment banking salary in India

Fresher pay and monthly earnings.

How salaries grow with career progression.

Which courses after BCom or BBA actually lead to high-salary outcomes

And whether investment banking is the right high-paying finance career for you.

“Investment banking operations are one of the most practical entry points into global banks. It is designed with this long-term career progression in mind.”

Understanding Investment Banking

Investment banking is where big money decisions actually take shape. It’s the space where strategy, numbers, and execution all come together to help businesses grow, transform, or even survive tough phases – and that level of responsibility is exactly why investment banking salary ranks among the highest in finance.

I get asked this a lot – what is investment banking? Simply put, it’s the part of finance where the stakes are high, the responsibility is real, and the outcomes directly impact how businesses grow or survive. Because the financial consequences of these decisions are so significant, the professionals handling them are paid accordingly. That’s why investment banking consistently ranks among the highest-paying jobs in finance.

What Does an Investment Banker Do?

An investment banker’s role goes far beyond spreadsheets and presentations. On a day-to-day basis, they work on:

- Valuation and financial modelling

- Mergers and acquisitions (M&A) advisory

- Equity and debt fundraising

- Client presentations and deal negotiations

As you grow in seniority, the role shifts from analysis to decision-making, client management, and leadership, which is also where investment banking salary and compensation increase sharply.

Quick Facts – Investment Banking offers one of the fastest salary growth curves in finance, driven by performance and deal exposure.

Investment Banking Salary in India: An Overview

When people talk about investment banking salary in India, it’s easy to assume there’s one big number everyone earns. In reality, salaries in investment banking can look very different from one person to another.

How much you earn depends on a few key things:

- The role you’re in – front-office deal roles usually pay more than operations or support roles.

- Where you work – global investment banks, boutique firms, and advisory companies all pay differently.

- How you enter the industry – your education, internships, and early exposure matter a lot.

- How you perform over time – promotions and bonuses can change your pay faster than in many other finance careers.

Another thing many people don’t realise is that an investment banking salary isn’t just a fixed salary. A big part of the investment banker package comes from bonuses, especially once you start working on live deals. In good years, bonuses can make a noticeable difference to your total take-home pay.

Average Investment Banker Salary in India

Investment Bankers earn around:

- Entry-level / Fresher: ₹6-10 LPA

- 2-4 years of experience: ₹12-25 LPA

- Mid-level professionals: ₹30-50 LPA

- Senior bankers and directors: ₹75 LPA to multi-crore packages

This wide range is why searches like salary of investment banker and investment banker package are so common – growth is steep for those who perform well.

What Investment Banking Salary in India looks like

Investment banking rewards responsibility and results. Two people with similar experience can earn very different salaries depending on the deals they work on and the value they bring to the firm.

At a broad level, this is what investment banking salary and overall compensation typically look like across roles and experience levels:

| Role | Experience Level | Base Salary | Bonus Range |

| Front Office Analyst | Fresher – 2 years | ₹6-12 LPA | 20% – 50% |

| Associate | 2 – 5 years | ₹15-30 LPA | 30% – 70% |

| Vice President (VP) | 5 – 9 years | ₹40-70 LPA | 50% – 100% |

| Investment Banking Operations | Fresher – 4 years | ₹4-7 LPA | 10% – 25% |

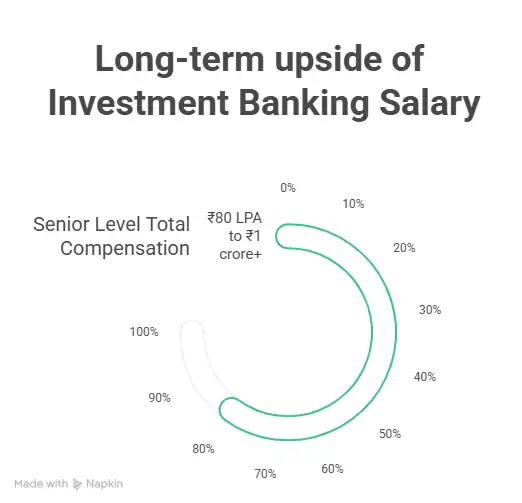

| Director / Managing Director | 10+ years | ₹80 LPA – ₹1 Cr+ | Performance-linked |

Entry-Level Reality – Freshers typically earn ₹50,000-₹80,000 per month, with sharp jumps often within 2-3 years.

Investment Banking Salary for Freshers

The investment banker fresher’s salary depends heavily on how you enter the industry.

Freshers joining front-office analyst roles earn more than those starting in support or operations. That said, even investment banking operations salary roles often pay better than many traditional entry-level finance jobs and offer long-term growth if you upskill.

What matters most early on is exposure and learning speed, not just the first paycheck.

Investment Banker Fresher Salary: What Entry-Level Professionals Can Expect

Most freshers can expect faster increments compared to many other finance roles. Bonuses that grow with deal exposure. With the right skill development, salary jumps often come within the first 2 to 3 years.

| Role / Experience Level | Monthly Salary | Annual Salary (Approx.) |

| Entry-Level (Fresher) | ₹50,000 – ₹80,000 | ₹6 – ₹10 LPA |

| 1–2 Years Experience | ₹80,000 – ₹1.5 lakh | ₹10 – ₹18 LPA |

| 2–3 Years Experience | ₹1.5 – ₹3 lakh | ₹18 – ₹30 LPA |

Salary Snapshot: Freshers earn ₹6-10 LPA, while senior investment bankers can reach ₹80 LPA – ₹1 Cr+, including bonuses.

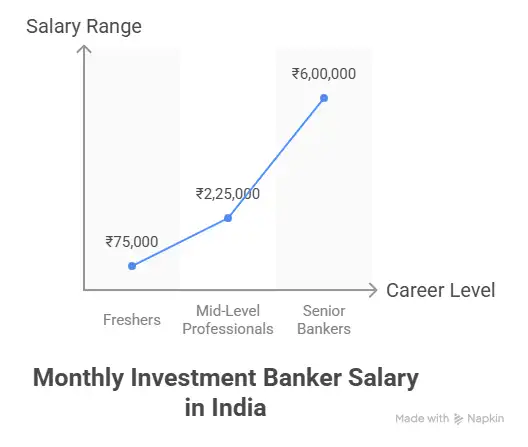

Investment Banker Salary Per Month

Looking at the salary per month helps put things into perspective:

- Freshers earn around ₹50,000-₹80,000 per month.

- Early professionals begin with a monthly salary of ₹1.5-3 lakh.

- Senior bankers get paid over ₹5 lakh per month.

Bonuses are typically paid annually and can significantly increase total earnings.

Monthly Pay Breakdown Across Experience Levels

Unlike fixed-salary roles, investment banking compensation accelerates with responsibility. As you move up:

- Base salary increases steadily.

- Bonuses become larger and more performance-linked.

- Client and deal ownership drives earnings.

This is why long-term earning potential matters more than starting pay.

What Drives Pay – Your salary grows with deal complexity, revenue impact, and client responsibility – not just experience.

Investment Banking Salary by Experience Level

One thing investment banking does better than most finance careers is clarity. Investment banking salary growth isn’t random – it follows a fairly structured path, especially in large banks and established advisory firms.

Most investment bankers move through these stages over time:

Analyst → Associate → Vice President → Director → Managing Director

With every step, the work changes. You’re not just getting paid more – you’re being trusted with bigger investment decisions, clients, and deals. And that’s why compensation rises sharply at each level.

Salary Growth from Analyst to Managing Director

At senior levels, investment banking salary is less about hours worked and more about deals closed, clients managed, and revenue generated. This is where multi-crore compensation becomes possible.

| Level | Typical Experience | What You Actually Do | Key Skills Used | Salary Range |

| Analyst | 0-2 years | Build financial models, prepare pitch decks, research companies, and support live deals | Excel, PowerPoint, valuation, attention to detail | ₹6-12 LPA |

| Associate | 2-5 years | Review models, manage analysts, coordinate deal execution, and interact with clients | Financial modelling, deal structuring, and communication | ₹15-30 LPA |

| Vice President (VP) | 5-9 years | Lead deals, manage client relationships, and oversee execution | Leadership, negotiation, decision-making | ₹40-70 LPA |

| Director | 9- 12 years | Originate deals, maintain senior client relationships, and guide teams | Strategic thinking, networking, and industry expertise | ₹70 LPA – ₹1 Cr |

| Managing Director (MD) | 12+ years | Bring in business, close deals, and set a firm strategy | Relationship management, sales, and leadership | ₹1 Cr+ (plus bonuses) |

Why the Salary Jump Is So Significant at Each Level

Early in your career, your investment banking salary reflects execution and accuracy. As you move up, it increasingly rewards judgment, relationships, and revenue generation.

That’s why:

- Analysts are valued for speed and precision.

- Associates are paid for managing complexity.

- VPs and above are paid for winning deals and clients.

By the time you reach senior levels, your salary is tied less to hours worked and more to the value of deals you bring to the table.

Did you know that Front office roles pay more but demand longer hours; operations roles offer stability and a strong entry path.

Investment Banking Salary by Job Role

Not all investment banking roles pay the same – and this is where a lot of confusion comes in.

When people talk about investment banker salary, they’re usually thinking of front office roles. But investment banking also includes operations and support functions, which play a very different role in how deals get done. Understanding this difference early helps you set realistic investment banking salary expectations – and choose the right entry point.

Front Office vs Investment Banking Operations Salary

The investment banking salary range differs based on the roles in the investment banking division. Here’s a brief overview:

| Role Type | Typical Functions | Working Hours | Salary Range (₹ LPA) |

| Front Office (M&A, ECM, DCM) | Valuation, deal structuring, and client advisory | Long & intense | ₹8-40+ LPA |

| Middle Office | Risk analysis, compliance, reporting | Moderate | ₹6-12 LPA |

| Investment Banking Operations | Execution support, documentation | More stable | ₹4-7 LPA |

(Source – Glassdoor, Ambitionbox, Indeed)

Front office roles (M&A, capital markets): highest pay, highest pressure – Front office roles are the ones directly involved in deals and client interactions. These include:

- Mergers & Acquisitions (M&A)

- Equity Capital Markets (ECM)

- Debt Capital Markets (DCM)

This is where the highest investment banking salaries are paid – but it’s also where the pressure is intense and working hours are long.

Operations & Support Roles (Lower Pay, More Stability) – Operations and support roles focus on:

Deal documentation and execution support

- Compliance and risk checks

- Process management and reporting

These roles don’t usually command front-office pay, but they offer more predictable hours and are often used as entry points into investment banking.

Many professionals start in operations and move to the front office with the right upskilling.

Can You Move from Operations to Front Office?

Yes – and it happens more often than people think.

Many professionals start in investment banking operations to:

- Get industry exposure.

- Understand deal workflows.

- Build credibility within the bank.

With the right upskilling in financial modelling, valuation, and capital markets, internal moves or external switches to front office roles are possible – often leading to a significant jump in investment banking salary.

That’s why operations roles are often seen as stepping stones, not dead ends.

Earning impact: Strong courses can push starting salaries from ₹4-5 LPA to ₹6-10 LPA.

Investment Banker Package: Fixed Pay vs Bonuses

When people talk about investment banking salary, they’re often referring to the total package – not just the number that hits your bank account every month. In reality, an investment banker’s compensation is made up of two key components, and understanding this split is important if you want realistic expectations.

Fixed Base Salary

The fixed base salary is the guaranteed part of your investment banking salary. This is what you earn regardless of market conditions or deal flow. It increases steadily as you move up from analyst to associate and beyond, providing income stability even during slower periods.

Performance-Linked Bonus

The bonus is where investment banking salary becomes performance-driven. Bonuses are tied to:

- Deals completed

- Revenue generated

- Individual and team performance

In strong market years, bonuses can equal or even exceed the base salary, especially at the associate level and above. In quieter markets, bonuses shrink – which is why investment banking is often described as a high-risk, high-reward career.

As you move from analyst → associate → VP, you’re no longer just executing work – you’re managing people, deals, and clients.

| Career Stage | Focus Shifts To | Salary Range (₹ LPA) |

| Analyst | Execution & accuracy | ₹6-12 LPA |

| Associate | Deal management | ₹15-30 LPA |

| Vice President | Client & deal leadership | ₹40-70 LPA |

| Director / MD | Business generation | ₹80 LPA – ₹1 Cr+ |

Early in your career, most of your salary comes from fixed pay. As you gain experience and start contributing directly to deals and clients, bonuses make up a larger share of your total compensation.

That’s also why two bankers with similar titles can earn very different amounts in the same year – performance and deal exposure matter just as much as seniority.

How Performance Incentives Impact Total Compensation

In strong years, bonuses can equal or exceed base salary. In slower markets, they shrink – making this a high-reward, performance-driven career.

Which Role Should You Choose?

Choose the front office if:

- You’re comfortable with long hours and pressure.

- You want faster salary growth.

- You enjoy deal-making and client work.

Choose operations if:

- You want stability and predictable hours.

- You’re entering from a non-target background.

- You plan to upskill and transition later.

Both paths can lead to strong careers – but they reward very different strengths.

Did You Know? General degrees = slower entry into high-paying roles

How Education Affects Investment Banking Salary

Education plays a direct role in both your starting salary and how quickly that salary grows over time. The way you prepare before entering the industry often determines not just your first role, but the quality of opportunities you get early on.

This is also why searches for investment banking courses’ salary are so common -because the right course doesn’t just teach concepts, it directly influences the role you enter, your starting pay, and how fast your salary grows in the first few years.

Searches like investment banking course salary and investment banking course pay after placement reflect a simple truth:

Better preparation leads to better entry roles.

Better entry roles usually mean a stronger starting investment banking salary and faster long-term growth.

Investment Banking Course Pay After Placement

Candidates with:

- Financial modelling expertise

- Deal exposure

- Industry-aligned training

Often secure higher-paying analyst roles earlier in their careers.

Investment Banking Analyst Salary: ₹6-12 LPA in India

Investment Banker Salary Per Month: ₹50,000 to ₹1 Lakh+

After BCom, Which Course Is Best for a High Salary?

This is one of the most common questions among commerce graduates. If you’re asking after BCom, which course is best for a high salary, investment banking-focused programs consistently rank high.

Best Courses After BCom With High Salary Potential

Popular options include:

- Certified Investment Banking Operations Professional

- Financial Modelling and Valuation Courses

- CFA (Chartered Financial Analyst)

- MBA in Finance

These courses also appear frequently in searches like best courses after BCom with high salary.

Here’s a brief overview of how each course’s features align with your goals:

| Outcomes | Certified Investment Banking Operations Professional | Financial Modelling & Valuation Courses | MBA in Finance |

| Direct relevance to investment banking roles | ✅ | ✅ | ✅ |

| Job-ready from day one | ✅ | ❌ | ❌ |

| Focus on investment banking operations. | ✅ | ❌ | ❌ |

| Short-term & focused | ✅ | ✅ | ❌ |

| Practical, industry-aligned skills | ✅ | ❌ | ❌ |

| Placement/career support | ✅ | ❌ | ❌ |

| Suitable for freshers | ✅ | ❌ | ❌ |

| Suitable for career switchers | ✅ | ❌ | ❌ |

| Cost- and time-efficient | ✅ | ✅ | ❌ |

| Best for quick entry into the investment banking ecosystem | ✅ | ❌ | ❌ |

After BBA, Which Course Is Best for a High Salary?

For many BBA graduates, the question isn’t just about job roles, but after BBA, which course is best for a high salary, and in most cases, specialised finance and investment banking programs offer a faster and more realistic path than general degrees.

Finance Career Paths That Lead to Investment Banking

Strong analytical skills, finance fundamentals, and practical exposure matter more than your undergraduate title.

Education Impact: Role-specific training often leads to better entry roles and faster salary progression than general degrees.

Why Investment Banking Ranks Among High-Paying Jobs in Finance

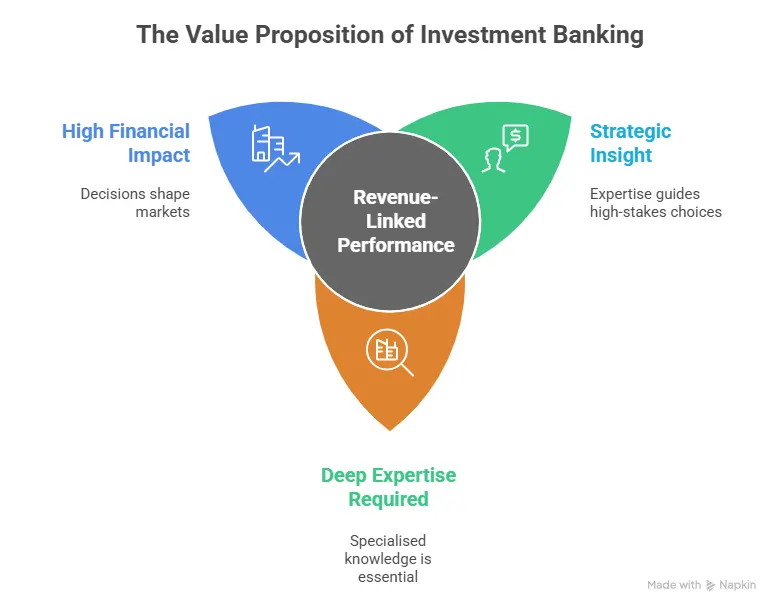

Investment banking isn’t high-paying by accident. The salaries are high because the value at stake is high, and very few finance roles combine responsibility, skill, and revenue impact in the same way.

Let’s break down why.

The Financial Impact of Decisions Is Massive

Investment bankers don’t work on small, low-risk tasks. They advise on:

- Multi-crore mergers and acquisitions

- IPOs and large capital raises

- Business restructurings that affect thousands of jobs

When a single deal can be worth hundreds or thousands of crores, even a small mistake can have serious consequences. Companies are willing to pay a premium for professionals who can handle that responsibility.

That’s a major reason the investment banker’s salary sits well above many other finance roles.

The Work Demands Deep, Specialised Expertise

Investment banking isn’t just about knowing finance theory. It requires:

- Advanced financial modelling and valuation

- Strong understanding of markets, regulations, and industries

- The ability to analyse complex data under tight deadlines

These skills take years to develop – and not everyone can sustain the learning curve. Roles that demand this level of expertise naturally command higher pay.

Performance Is Directly Linked to Revenue

In many jobs, performance is hard to measure. In investment banking, it’s very clear.

- Deals close or they don’t

- Capital is raised, or it isn’t

- Clients return, or they don’t

Your contribution is closely tied to how much money the firm earns. When performance directly impacts revenue, compensation follows. That’s why bonuses form such a large part of the investment banking package, especially at senior levels.

The Pressure and Workload Are Part of the Pay

Long hours, tight deadlines, and high expectations are part of the job – particularly in front-office roles. The salary reflects not just skill, but the intensity and accountability that come with the work.

In simple terms, investment banking pays well because not everyone is willing or able to do it consistently.

Why This Combination Is Rare and Valuable

Plenty of jobs involve responsibility. Others require expertise. Some impact revenue.

Investment banking is rare because it combines all three:

- High financial stakes

- great technical and strategic skills

- Direct revenue accountability

That combination is valuable – and that’s why investment banking continues to rank among the highest-paying jobs in finance, year after year.

Did you know? India pays less initially, but faster early responsibility and mobility narrow the global salary gap.

Investment Banking Salary in India vs Global Markets

A question that naturally follows, once you understand investment banking salaries in India, is this: how do they stack up against the rest of the world?

What matters more than geography is role, exposure, and performance. Investment banking rewards those who handle complex deals, manage clients, and deliver results – no matter where they’re based.

How Indian Salaries Compare with the US, UK, and Middle East

One of the most common follow-up questions I get after discussing investment banking salary in India is this: How does it compare to what bankers earn abroad?

The short answer is – global salaries are higher, but the context matters. The cost of living, tax structures, hiring barriers, and career expectations all play a role in determining how much investment bankers earn in different markets.

Let’s look at the comparison clearly.

| Region | Fresher Salary | Mid-Level Salary | Senior Roles |

| India | ₹6 – ₹12 LPA | ₹25 – ₹40 LPA | ₹80 LPA – ₹1 Cr+ |

| United States | $90k – $120k | $180k – $300k | $500k+ |

| United Kingdom | £50k – £70k | £120k – £200k | £300k+ |

| Middle East (UAE) | AED 180k – 300k | AED 500k+ | AED 1M+ |

| Singapore | SGD 70k – 100k | SGD 180k+ | SGD 350k+ |

Why Imarticus Learning for Investment Banking Operations?

When it comes to breaking into investment banking, where you study matters almost as much as what you study. I’ve seen this repeatedly across finance careers – the right training partner doesn’t just teach concepts, it prepares you for how the industry actually works.

That’s where Imarticus Learning stands out.

Imarticus doesn’t approach investment banking education as an academic subject. Their programs are designed around real job roles, real workflows, and real hiring expectations, which is exactly what most aspirants are missing when they struggle to land interviews.

What Makes the Certified Investment Banking Operations Professional Program Different?

The Certified Investment Banking Operations Professional program is built for people who want a practical, realistic entry point into the investment banking ecosystem – not just a certificate.

Here’s what sets it apart.

- Role-Focused, Not Theory-Heavy – Unlike generic finance courses, it is designed specifically around investment banking operations roles. This clarity is why the program feels directly applicable from day one.

- Industry-Aligned Curriculum Built for Real Jobs – The curriculum mirrors what banks expect from entry-level professionals. You’re not just learning what investment banking operations are – you’re learning how to do the work.

- Strong Placement & Career Support – One of the biggest reasons learners choose Imarticus is the career support.

- Faster Entry Into the Investment Banking Ecosystem – Not everyone starts directly in front-office roles – and that’s okay.

- Balanced Time, Cost, and ROI – Compared to long, expensive degrees, the program offers a shorter learning timeline, lower opportunity cost, and faster employability.

If your goal is to enter investment banking operations with confidence, clarity, and job readiness, the Investment Banking Course is designed to give you exactly that foundation.

FAQs About Investment Banking Salary

If you’re considering investment banking as a career, it’s natural to have questions about pay and what salaries actually look like at different stages. From fresher earnings and monthly pay to bonuses, courses, and long-term growth, these are the most frequently asked questions people ask when trying to understand whether investment banking is worth it financially.

What is the investment banking salary for freshers?

For freshers, the investment banking salary in India usually starts in the range of ₹6-10 LPA. What really makes a difference at the fresher stage is how you enter investment banking. Candidates who come in with practical, job-ready training – through structured programs from institutions like Imarticus Learning – tend to be better prepared for interviews and real-world work, which can positively influence both role quality and starting pay.

The bigger picture to keep in mind is this: fresher salaries are just the starting line. In investment banking, income grows quickly once you gain deal exposure, build strong skills, and move up the career ladder.

What does an investment banker earn per month?

If you’re looking at this monthly, freshers usually take home ₹50,000 to ₹1 lakh per month. With a few years of experience, that number can climb to ₹1.5-3 lakh per month, and senior professionals earn significantly more. Bonuses, which are common in investment banking, can make a big difference to annual earnings.

Do investment bankers earn bonuses?

Yes. Most investment bankers earn a fixed salary plus bonuses. Bonuses are performance-linked and can form a large portion of the total investment banker package, especially at the associate level and above.

Which course is best for a high investment banking salary after BCom or BBA?

There isn’t one best course. However, courses that focus on practical investment banking skills tend to lead to better salary outcomes. These include:

- Investment banking and operations programs

- Financial modelling and valuation courses

- CFA (long-term)

- MBA in Finance

Role-specific programs often help candidates enter the industry faster.

Is the investment banking operations salary lower than front office roles?

Yes, the investment banking operations salary is generally lower than front office roles. However, operations roles offer more predictable hours and are commonly used as entry points into global investment banks, with scope to move into higher-paying roles over time.

How long does it take to reach a high investment banker salary?

Investment banking rewards consistency. Most professionals see meaningful salary growth within 3-5 years as they move from analyst to associate roles. Those who continue to build skills and take on responsibility can see their income rise much faster than in many other finance careers.

Is the investment banking salary in India lower than abroad?

In absolute terms, yes. Investment banking salaries in the US, UK, and the Middle East are higher. However, India offers:

- Lower entry barriers

- Faster early-career progression

- Strong long-term global mobility

Many professionals start in India and later move to international markets.

Is investment banking worth it only for the salary?

Salary is a major draw, but not the only factor. Investment banking is worth it beyond salaries, if you:

- Enjoy high-impact work

- Can handle pressure and long hours

- Want rapid career and income growth.

What is the average investment banker salary in India?

Most investment bankers in India start at around ₹6-12 LPA. Structured, industry-aligned training, such as programs offered by Imarticus Learning, can help candidates build the practical skills needed to enter higher-paying roles earlier in their careers.

Investment Banking Salary and Career Potential

Investment banking can absolutely be one of the highest-paying careers in finance – but the salary doesn’t come just from the job title. It comes from the skills you build, the roles you choose, and how early you position yourself inside the industry.

For freshers, the starting numbers may look modest compared to the long hours. But investment banking is a compounding career. Once you gain deal exposure, move up the ladder, and take on more responsibility, salary growth accelerates much faster than in most other finance roles. That’s why people who stick with it for 3 to 5 years often see dramatic jumps in both pay and career scope.

What consistently makes the difference is how you enter the industry. A general degree alone rarely leads straight into high-paying roles. Candidates who choose structured, role-specific pathways – especially those that focus on real investment banking operations, workflows, and hiring expectations – tend to enter better roles earlier and progress faster. This is exactly where programs like the Investment Banking Course from Imarticus Learning fit into the picture: they’re designed to help learners get inside the investment banking ecosystem with clarity, confidence, and job readiness.

At the same time, it’s important to be honest with yourself. Investment banking rewards ambition, resilience, and consistency. It’s not for everyone – and that’s okay. But if you enjoy high-impact work, can handle pressure, and are willing to invest in the right skills early on, the financial and career upside is very real.

In short, investment banking salary is not just about what you earn – it’s about what you build over time. Make smart entry choices, focus on learning over shortcuts, and the money tends to follow.