Last updated on September 30th, 2025 at 10:29 am

- What is CMA Accounting Certification?

- CMA Syllabus: What You’ll Learn

- CMA Course Duration: Fast-tracking Your Career

- CMA vs CPA: Which One Should You Choose?

- CMA Certification Value: Why It Matters?

- MA Accounting Career Path: Where Can It Take You?

- Imarticus Learning + KPMG in India: Your CMA Success Partner

- CMA Certification Fees: Investment in Your Future

- CMA Certification Advantages Over Other Qualifications

Finance has been front and back stage two-edged. Backstage is where the masters develop skills, credibility, and marks so they are welcome to that VIP club. Front stage is where the CEOs, CFOs, and financial leaders seal billion-dollar business deals. The best passport to gain entry there is the CMA accounting certification.

This globally accredited certificate not only puts your accounting skill to test—it also assures your numeracy, money management, and multinational firm decision-making capability. The Certified Management Accountant accounting certification is the sole qualification to prepare management, strategy, and analytics skills professionals needed by companies.

Within just 6–8 months of study, professionals can transition from mid-level finance roles into international opportunities, earning packages ranging between ₹8 LPA and ₹18 LPA in India, with much higher figures abroad. If you’re considering the next big leap in your career, the CMA accounting career path may just be your backstage pass to the finance elite.

What is CMA Accounting Certification?

CMA accounting certification is provided by the Institute of Management Accountants (IMA), USA. It is in great demand as a master CMA accounting certification that separates masters from the masses. In contrast to conventional accounting careers, which are rule-based and report-driven, CMA professionals are able to achieve:

- Strategic financial planning

- Performance management

- Corporate finance

- Risk analysis

- Decision support

- Professional ethics in international finance

Key Highlights of CMA Accounting Certification:

- Study period: 6–8 months

- International Acceptance: Accepted in 100+ countries

- Salary Range: ₹8 LPA – ₹18 LPA in India; higher abroad

- Scope: MNCs, Big 4 firms, consulting, technology, and manufacturing

This blend of speed, recognition, and career impact makes CMA certification one of the most sought-after qualifications for finance professionals today.

CMA Syllabus: What You’ll Learn

Among the outstanding characteristics of the Certified Management Accountant accounting professional is that it has a limited but specialised syllabus. Two sections of the CMA examination are fixed syllabus topics in management accounting and strategic finance.

Part 1: Financial Planning, Performance, and Analytics

- External financial reporting

- Budgeting and forecasting

- Cost management

- Performance management

- Technology and analytics

- Internal controls

Part 2: Strategic Financial Management

- Corporate finance

- Investment decisions

- Risk management

- Decision analysis

- Professional ethics

- Financial statement analysis

Not only does it turn CMA pass-outs into accounting professionals but also generalists, with the courage to use it for business planning.

CMA Course Duration: Fast-tracking Your Career

In contrast to long certifications, which run for years to finish, CMA’s accounting certificate is a career accelerator. Average candidates finish the course in 6–8 months, which is a great shot in the arm for prospects who would be so eager to start their careers.

Flexible Study Options:

- Weekday Courses: best suited for full-time students and students

- Weekend Courses: best suited for professional employees with work and study schedules

- Self-Paced Study: with flexibility of examination scheduling

All such convenience puts the CMA course in the number one spot on the list of top choice among professional employees who prefer to make maximum impact with minimum loitering around.

CMA vs CPA: Which One Should You Choose?

Among the leading finance practitioner arguments is CMA vs CPA. Both are both established, but their practice application is quite different:

| Feature | CMA Accounting Certification | CPA Certification |

| Focus | Management, analytics, corporate finance | Compliance, auditing, financial reporting |

| Duration | 6–8 months | 18–24 months |

| Global Reach | Recognised worldwide | Mostly US-focused |

| Career Roles | Financial Analyst, CFO, Consultant, FP&A | Auditor, Tax Accountant, Controller |

If top-level jobs, strategic business decisions, and worldwide action are your goals, the CMA accounting certification is the winner.

CMA Certification Value: Why It Matters?

The benefit of CMA certification is that it has the power to change lives. It doesn’t just instruct technical skill but leadership and strategy to fill executive positions.

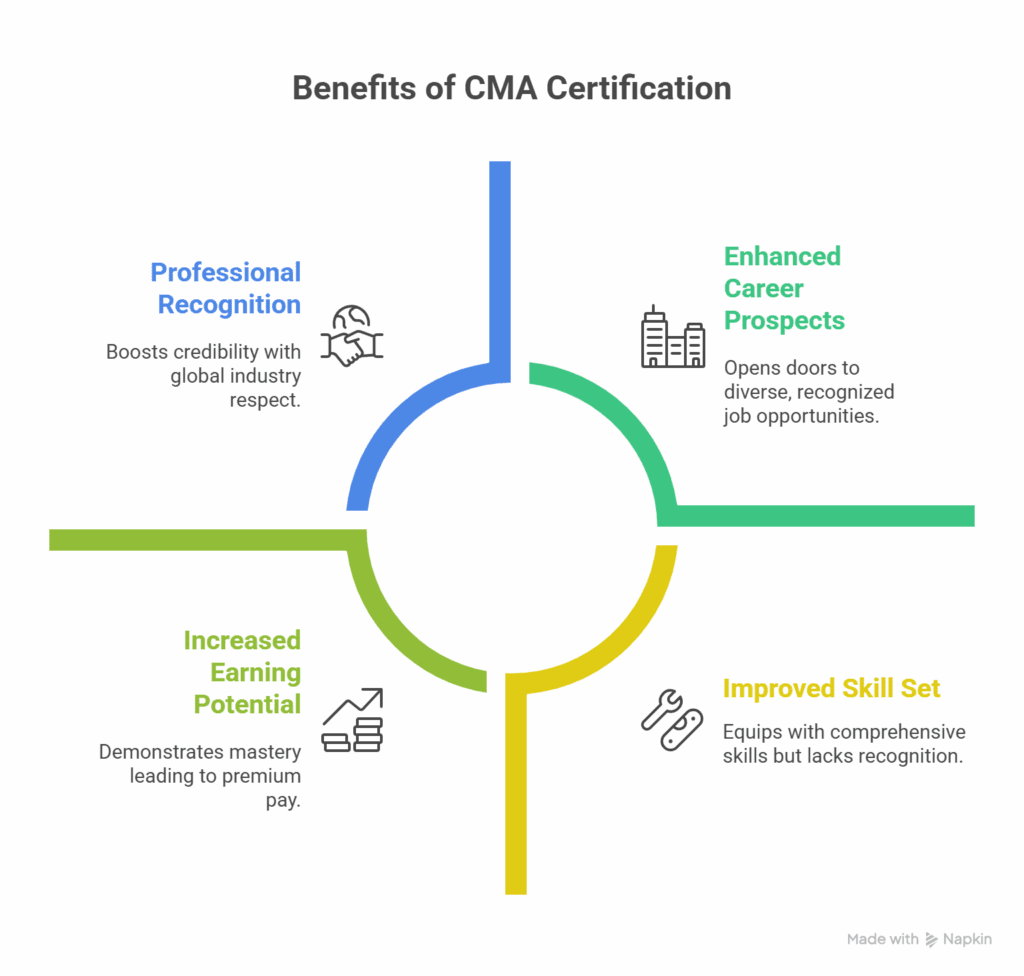

Benefits of CMA Certification Value:

- Pay Increase: By nearly 60%, as compared to non-certified colleagues.

- Global Recognition: Mobility in over 100 countries.

- Professional Progress: Increased chances for senior-level management.

- Various Professions: From consulting to investment banking, CMA has opportunities in various professions.

In simple words, CMA is a certification—a career booster.

MA Accounting Career Path: Where Can It Take You?

You have a career path to multiple career opportunities in India and globally with the CMA accountancy certification.

Popular Career Paths:

- Financial Planning & Analysis (FP&A) Analyst

- Corporate Finance Manager

- Risk Consultant

- Treasury Analyst

- Equity Research Analyst

- CFO (senior)

Industries Hiring CMA Professionals:

- Big 4 Accounting Firms (KPMG, EY, Deloitte, PwC)

- Multinational companies in tech, pharma, and manufacturing

- International investment firms

- Financial services firms

This wide CMA accounting career line is thus an extremely brilliant option for anyone who would like to climb his/her corporate ladder at an extremely rapid rate.

Imarticus Learning + KPMG in India: Your CMA Success Partner

Learning CMA is boring in the absence of appropriate hand-holding. And that’s where a firm like Imarticus Learning, with its association with KPMG in India, comes in.

Why Choose Imarticus Learning?

- Gold Learning Partner of IMA, USA

- Joint Certification with KPMG in India

- Surgent Study Materials available (83% pass rate)

- Pre-Placement Bootcamp (resume guidance, mock interview preparation, mock interview)

- Internships and practical case studies

- Money-Back Guarantee (50% refund in case not cleared in the exams)

All the education background and industry inclusion renders students exam-ready, but career-ready as well.

CMA Certification Fees: Investment in Your Future

CMA accounting certificate fee is a costly one, yet the return is well worth it.

Approximate Fee Structure:

- IMA Membership: $245

- Entrance Fee: $300

- Exam Fee (both): $460

- Training + Study Material: ₹1.5–₹2 lakh

As mentioned above, salary hikes (₹8–₹18 LPA in India), ROI is unbeatable. All return within certificate year.

CMA Certification Advantages Over Other Qualifications

The Certified Management Accountant accounting course is actually a superior one compared to other finance certifications:

- Short Duration: 6–8 months completion.

- International Acceptability: 100+ countries accepted.

- Management Focused: Analytics, strategy, and leadership focus.

- Career Flexibility: Can be used to work in any sector.

- Good Return on Investment: High salary boost and professional development.

These are the most advanced finance certifications.

Watch this video to know top 10 reasons to pursue US CMA course

FAQs

1. What is CMA accounting certification?

It’s an internationally recognized certificate awarded by IMA, USA, and deals with something other than company finance, management accounting, and analysis.

2. How is CMA different from CPA?

CMA is planning and management focused while CPA is compliance and audit focused.

3. How quickly will it take to get CMA certified in accountancy?

6–8 months of study, say, will be needed in order to pass both exam sections successfully.

4. What is CMA certification?

It provides global career mobility, increases earnings, and speeds up career advancement to executive levels.

5. What are job opportunities after CMA?

Experts were employed in job roles such as FP&A analyst, corporate finance manager, consultant, risk manager, and CFO.

6. What is the cost of CMA certification in India?

Fees: ₹1.5 lakh to ₹2 lakh, including training, study material, and exam fee.

7. Why join as a CMA training candidate with Imarticus Learning?

Because it is co-certified with KPMG in India, includes Surgent study guides, internship, and placement assurance support.

Conclusion

In accounting, you simply can’t reserve front-row seats in the upper echelons of decision-makers. But with CMA accounting certification, it’s not an audience seat you’ll get—it’s a backstage pass to the money leaders.

It’s global recognition, the shortness of the course duration, the pluralistic CMA accounting professional career path, or industry-leading ROI—whichever you choose. This certification is a career transition you cannot afford to miss.

With partnerships like Imarticus Learning and KPMG in India, backed by Surgent’s game-changing tools, your journey to becoming a finance leader gets simplified, guided, and guaranteed.

So, if you’re ready to elevate your career, the Certified Management Accountant accounting certification is not just a choice—it’s your secret pass to the world of finance leadership.