For ambitious professionals looking to break into high-paying finance roles, investment banking seems like the golden ticket. The career is fast-paced, prestigious, & offers lucrative salaries. But like all rewarding paths, it comes with its costs—literally. Whether you’re a fresh graduate or a mid-career switcher, one of the biggest questions you’re likely to ask is: Are the investment banking courses fees really worth the ROI?

Let’s unpack the numbers, assess the returns, and understand the finance course value you truly get when investing in an investment banking certification.

Understanding Investment Banking Courses Fees in India

When we talk about investment banking courses fees… the range can vary significantly depending on the institution, course duration, and whether the program offers placement support. Typically, you can expect fees between ₹75,000 to ₹3,50,000.

Here’s a quick comparison of some popular investment banking courses:

| Institute | Course Name | Duration | Investment Banking Courses Fees | Placement Support |

| Imarticus Learning | Certified Investment Banking Operations Program | 3-6 Months | ₹1,60,000 | Yes (7 interview guarantees) |

| NSE Academy | Investment Banking Operations | 2 Months | ₹85,000 | No |

| EduBridge | Investment Banker Program | 6 Months | ₹1,50,000 | Limited |

| Coursera (Wharton) | Investment Management | Self-paced | ₹75,000+ (varies) | No |

For those looking for a placement-backed, comprehensive learning experience tailored to India’s job market, the Certified Investment Banking Operations Program by Imarticus stands out as a solid investment.

Cost of Investment Banking Course: Beyond Tuition Fees

The cost of investment banking course isn’t just the price tag on the brochure. Consider these hidden or indirect costs:

- Time commitment – Will you need to cut back on your job?

- Opportunity cost – Could that time and money be invested elsewhere?

- Certification fees – Some international courses have exam or licensing charges.

- Tech/tools – Access to Bloomberg terminals or simulations may cost extra.

When assessing banking course fees, factor in these non-tuition expenses to gauge the total financial input accurately.

ROI of Finance Course: What’s the Payback?

Return on Investment (ROI) isn’t just a corporate metric—it’s crucial for your career decisions too. Let’s break it down.

How ROI is Measured

| Metric | Calculation |

| Initial Investment | Total course fees + additional costs |

| Return | Salary increase or new job post-certification |

| ROI | (Return – Investment) / Investment × 100 |

Example:

Let’s assume you’re a commerce graduate earning ₹3.5 LPA. After completing an investment banking certification, you land a role offering ₹7 LPA. You spent ₹1.5L on the course.

ROI = ((7 – 3.5) – 1.5) / 1.5 × 100 = 200%

A 200% ROI is highly attractive and not uncommon in finance certifications with strong industry backing. This is the true ROI of finance course—what it enables you to earn, faster and more confidently.

Investment Banking ROI: The Long-Term View

Immediate salary jumps are tempting, but a smart careerist also thinks long term. Here’s where the investment banking ROI really starts to shine.

Career Growth Trajectory

| Role | Approximate Salary (₹/year) |

| Entry-level Analyst | 5 – 8 LPA |

| Associate | 10 – 18 LPA |

| VP/AVP | 20 – 40 LPA |

| Director/MD | 50 LPA+ |

Your ₹1.5L investment today could pay back 10–20X over a 5–8 year period.

To see how business skills enhance your trajectory, check this video on core business management skills that aid investment banking success.

Finance Course Value: Skills, Network & Confidence

Still wondering what makes the finance course value so high? It’s more than the degree or the placement—it’s the transformation it brings.

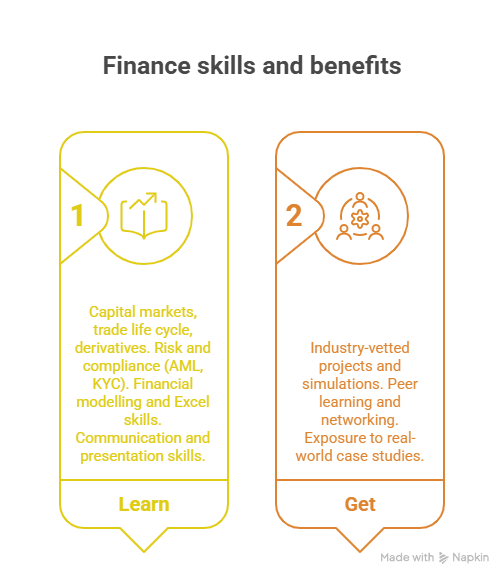

You Learn:

- Capital markets, trade life cycle, derivatives

- Risk and compliance (AML, KYC)

- Financial modelling and Excel skills

- Communication and presentation skills

You Get:

- Industry-vetted projects and simulations

- Peer learning and networking

- Exposure to real-world case studies

These are the kind of skills that separate top investment bankers, making your candidature stand out.

Is Banking Course Worth It? Let’s Be Honest

Many aspirants ask: Is banking course worth it when I can learn online for free?

Fair question. But here’s a practical way to look at it:

| Aspect | Free YouTube Learning | Structured Banking Course |

| Depth of Knowledge | Shallow | Deep & curated |

| Industry Validation | None | Yes |

| Placement Support | No | Yes |

| ROI of Finance Course | Low | High |

| Learning Path | Unstructured | Step-by-step |

A self-taught route may work for hobby learners or extremely disciplined individuals. But if you’re serious about a career in investment banking, a guided program with mentorship and placement is more effective.

Explore this video that outlines how to start your career with a certification.

Comparing Investment Banking Course Fees to Salary Outcomes

Let’s examine the correlation between course investment and job outcomes.

| Course Fees (₹) | Placement Assistance | Average Post-course Salary (₹) | ROI Outlook |

| 1,60,000 | Yes (Imarticus) | 6.5 – 8 LPA | High |

| 1,20,000 | No | 4.5 – 6 LPA | Medium |

| 80,000 | No | 3 – 4.5 LPA | Low |

This clearly shows how a slightly higher upfront investment banking courses fees with placement and mentorship leads to a stronger investment banking ROI.

Investment Course Benefits: Intangible Yet Impactful

Some of the biggest investment course benefits are intangible—but deeply valuable:

- Credibility: A recognised certificate improves your LinkedIn profile and recruiter interest.

- Structured Thinking: You learn how bankers think and communicate.

- Access: You get entry into interviews you might never reach otherwise.

- Resilience: The intensive course structure prepares you for the pace and stress of real jobs.

These are critical when competing in a talent-heavy market. And that’s exactly why so many successful professionals today are opting for the Certified Investment Banking Operations Program to gain an edge.

What Hiring Managers Think

Employers today are inundated with applications. Here’s what makes a certified candidate more appealing:

“When we see someone who’s taken the time to complete a well-recognised investment banking course, it signals dedication and readiness for the job. That’s the kind of candidate we prioritise.” – Senior Recruiter, MNC Bank

Recruiters often prefer trained candidates as it cuts down onboarding and training costs. A relevant course can shorten your path to that much-awaited interview.

Not Just ROI – It’s About Career Acceleration

While analysing the ROI of finance course is crucial, don’t overlook the speed and certainty it brings to your career journey. A structured course shortens your struggle period and gives you a sense of direction.

If you’re still debating whether to make the leap, reflect on these questions:

- Are you stuck in a career plateau?

- Do you lack interview calls despite applying often?

- Are your peers moving faster than you?

If the answer is “yes” to any of these, it’s worth considering the investment course benefits not just in salary terms, but in life satisfaction and career confidence.

FAQs

What are the average banking course fees in India?

Banking course fees typically range from ₹1,00,000 to ₹3,00,000.

How do you measure the ROI of finance course?

The ROI of finance course is the salary boost compared to course cost.

Is banking course worth it for career growth?

Yes, especially if it includes certifications and placement support.

What affects the cost of investment banking course?

The cost of investment banking course depends on duration, institute, and content.

What’s a good investment banking ROI?

A strong investment banking ROI is when salary hikes outweigh the fees.

How does finance course value reflect in jobs?

Finance course value shows up in better roles, faster promotions, and hiring ease.

Is banking course worth it without experience?

Yes, many entry-level roles welcome certified freshers with the right skills.

What are the key investment course benefits?

Top investment course benefits include skill-building, credibility, and job support.

Final Verdict: Is Banking Course Worth It?

So, is banking course worth it? Based on:

- The substantial investment banking ROI

- The practical skills and network you gain

- The accelerated access to high-paying roles

Yes, it is absolutely worth it—provided you choose the right course.

And if you’re looking for one that ticks all the boxes—industry curriculum, mentorship, placement, affordability—Imarticus’ Certified Investment Banking Operations Program should be your top consideration.

It not only aligns with the cost of investment banking course most are willing to bear, but also delivers an unmatched finance course value in terms of placement, credibility, and career acceleration.

Choosing to invest in your education is one of the few decisions that consistently pay off—especially in investment banking. So rather than viewing investment banking courses fees as a cost, reframe it as a stepping stone to a future of greater earning potential, impact, and purpose.

And if you’re still unsure, explore this blog on how business management skills can help in investment banking to understand how complementary skills multiply your ROI even further.

The decision is yours—but the returns could change your life.