Introduction

Imagine a world where algorithms not only automate your investment decisions but also evolve with every transaction, every market movement, and every economic signal. That world is already here, and it’s powered by AI tokens. The merging of AI in Finance with blockchain-based cryptocurrencies has ushered in a new age of decentralised intelligence—adaptive, predictive, and deeply insightful.

The union of AI and crypto technology is no longer a theoretical idea. We are witnessing a movement where AI tokens, with embedded smart functionality, are impacting financial services, investment behavior and also how trust is developed in the financial ecosystem. So what does this mean – for finance professionals, traders and tech-savvy investors? Let’s go ahead and answer that.

Table of Contents

- Introduction

- What Are AI Tokens?

- AI-Driven Financial Models Reshaping Investment

- The Role of Intelligent Fraud Detection Systems

- How AI Tokens Optimize Credit Scoring through Machine Learning

- Innovation in Digital Banking and Investment Strategies

- Benefits of AI Tokens in Financial Ecosystems

- Challenges and Risks

- Case Studies and Real-World Applications

- Key Takeaways

- FAQs

- Conclusion

What Are AI Tokens?

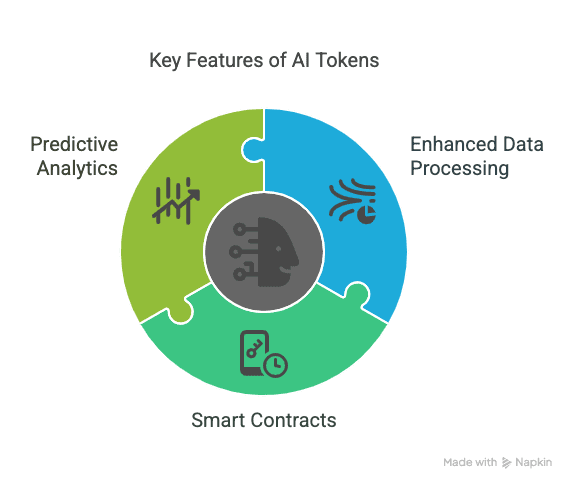

At their core, AI tokens are cryptocurrency assets that power decentralised applications (dApps) with artificial intelligence functionalities. Unlike traditional tokens, these are designed not just for transactions, but to enable learning, prediction, automation, and optimisation within blockchain ecosystems.

They serve various functions—from powering AI models for data analytics and financial forecasts to automating smart contracts and decision-making mechanisms. Platforms like Fetch.ai and SingularityNET are leading examples where AI tokens serve as the utility layer between data inputs and intelligent outcomes.

Types of AI Tokens

| Token Type | Use Case | Examples |

| Utility Tokens | Powering AI services and dApps | FET, AGIX |

| Governance Tokens | Voting on AI model updates and directions | Ocean Protocol |

| Transactional Tokens | Payments for AI-based analytics or insights | Numeraire |

AI-Driven Financial Models Reshaping Investment

Financial models used to be static—relying heavily on historical data and fixed assumptions. With AI in Finance, these models have become dynamic, adaptive, and significantly more accurate. AI tokens now fuel models that adjust themselves in real-time based on market volatility, social sentiment, and macroeconomic indicators.

Traders and institutions alike are leaning into this revolution. AI tokens enable data monetisation, decentralised model training, and real-time investment predictions—automating what was once a laborious task.

Benefits of AI-Driven Financial Models:

- Enhance real-time investment decision-making

- Reduce dependence on outdated historical data

- Enable self-learning algorithms for continuous improvement

- Offer decentralised data sharing and model training

- Improve forecast accuracy by incorporating non-traditional data

Source: Nasdaq on AI in finance

The Role of Intelligent Fraud Detection Systems

Fraud detection has long been a critical but complex area for financial institutions. Traditional systems are reactive and rule-based, but today’s AI in Finance allows proactive, intelligent fraud detection—powered by machine learning and blockchain transparency.

AI tokens fund and operate decentralised fraud detection systems that continuously learn from global patterns of transaction behaviour. These systems identify red flags in milliseconds, making fraud prevention more scalable and real-time.

Key Features:

- Pattern recognition from diverse datasets

- Anomaly detection without predefined rules

- Blockchain transparency ensures data integrity

- Peer-based verification of suspicious activities

- Automated blocking and alert generation

Source: Forbes on AI-based fraud detection

How AI Tokens Optimize Credit Scoring through Machine Learning

Traditional credit scoring methods often miss the bigger picture. They rely heavily on limited financial records and credit histories, which can be biased or incomplete. AI tokens offer an inclusive solution by enabling intelligent systems that assess financial behaviour across multiple data points.

Using AI in Finance, creditworthiness can now be gauged through social signals, transaction histories, digital identities, and even behavioural patterns—creating opportunities for unbanked populations to access loans and financial products.

Traditional vs AI-Driven Credit Scoring

| Feature | Traditional Model | AI-Driven Model |

| Data Sources | Credit history only | Social, behavioural, digital |

| Bias & Accessibility | High | Low |

| Real-Time Assessment | No | Yes |

| Predictive Accuracy | Moderate | High |

| Tokenised Execution | Not possible | Enabled via AI Tokens |

Source: World Economic Forum on digital credit scoring

Innovation in Digital Banking and Investment Strategies

AI tokens are creating new paradigms in digital banking, allowing banks to offer predictive services, personalised portfolio management, and intelligent chatbots. Through AI in Finance, banks are no longer just transaction facilitators—they are becoming intelligent advisors.

Meanwhile, investment strategies are evolving with AI tokens enabling real-time portfolio balancing, risk profiling, and automated reallocation—all guided by intelligent algorithms.

Innovations You Should Know:

- Smart robo-advisors powered by AI tokens

- Real-time client profiling for customised banking

- Predictive analytics for financial planning

- Voice and chat-based AI financial assistants

- Blockchain-based autonomous investment DAOs

Benefits of AI Tokens in Financial Ecosystems

AI tokens don’t just add value; they redefine value in the financial landscape. By merging decentralisation, AI, and data economy, these tokens eliminate intermediaries and reduce inefficiencies.

In the broader context of AI in Finance, these tokens support privacy-preserving analytics, on-chain data computation, and fair access to intelligent financial services—ultimately democratising finance.

Long-Term Benefits:

- Decentralised intelligence in finance

- Lower operational costs for institutions

- Fairer access to credit and investment tools

- Transparent and accountable decision-making

- Continuous system learning and improvement

Challenges and Risks

As promising as AI tokens are, they come with their own set of challenges—technical, regulatory, and ethical. The combination of blockchain’s permanence and AI’s adaptability needs a new framework for compliance, ethics, and interoperability.

Moreover, the decentralised nature can lead to misinformation or misuse of AI outputs if not monitored carefully. Ensuring data privacy, algorithm transparency, and model fairness will be essential to widespread adoption.

Case Studies and Real-World Applications

Let’s explore a few notable use-cases where AI in Finance is successfully implemented through tokenisation:

Real-World Examples:

- SingularityNET (AGIX) – Decentralised AI marketplace using tokens to exchange intelligent services.

- Ocean Protocol – Allows data monetisation with privacy-focused AI models powered by blockchain.

- Numerai – A hedge fund that runs entirely on crowdsourced AI models, rewarded via AI tokens.

These platforms demonstrate how AI tokens are not just theoretical innovations but functioning tools reshaping finance.

Key Takeaways

- AI in Finance is rapidly transforming traditional financial models.

- AI tokens fuel decentralised, intelligent systems with predictive power.

- They enable smarter fraud detection, inclusive credit scoring, and automated investments.

- Despite challenges, the fusion of AI and crypto offers immense opportunities.

- Real-world use cases validate the practical viability of this evolution.

FAQs

1. What exactly do we mean when we say AI Token?

An AI token is a type of cryptocurrency that enables a decentralized application or system that uses an AI algorithm to learn and act autonomously to make predictions, and put money to work through financial transactions.

2. How does AI in Finance improve an investor’s strategy?

AI allows the creation of dynamic real-time models, built to continually learn about market data, macroeconomic factors, and sentimental insights – thereby increasing the accuracy of prediction as well as improving investor returns.

3. Are AI tokens safe?

Like anything in cryptocurrency, there are risks on all tokens. Platforms with good utility or governance and transparency of a model will be safer in the long term.

4. Can AI tokens replace traditional banking?

No, AI tokens cannot replace traditional banking, but they can improve services, improve understanding of customers, and support new decentralized finance solutions.

5. What role does blockchain have to play in AI-powered finance?

Blockchain allows for the transparency, immutability, and decentralization of processes – all of which are essential for safe, trust-based AI to work in finance.

6. How do intelligent systems detect fraud on behalf of AI powered token systems?

They leverage real-time data, on-chain blockchain provenance, and behavioral-based theories, so they can detect transactions to analyze for risk and prevent suspicious transactions.

7. How do AI tokens democratise finance?

They lower entry barriers, support inclusive credit scoring, and allow access to intelligent financial services without intermediaries.

8. What makes AI-driven credit scoring better?

These systems use broader, real-time datasets to assess risk more accurately, fairly, and inclusively—particularly for underbanked users.

9. Are AI tokens regulated?

Regulatory frameworks are still evolving. While some governments are exploring AI and crypto regulations, global standardisation is yet to be achieved.

10. Which platforms are leading the AI token space?

SingularityNET, Fetch.ai, Ocean Protocol, and Numerai are among the top platforms integrating AI in Finance through decentralised, token-powered models.

Conclusion

The integration of AI in Finance with cryptocurrency has transitioned from concept to reality, reshaping how we invest, transact, and evaluate financial systems. AI tokens aren’t just a speculative asset; they are the engine for the next generation of intelligent, decentralised, and inclusive financial systems.

As the space grows-up, it has the potential to address the inefficiencies of traditional finance while providing access and intelligence at a scale and volume never seen before. For professionals, investors, and policymakers, getting ahead of this evolution is not an option; it is a requirement.