Last updated on March 29th, 2024 at 10:57 am

Last Updated on 2 years ago by Imarticus Learning

Credit risk underwriting is the process of evaluating a potential borrower’s ability to repay their debt. Understanding credit risk management will help you create more successful business relationships with your customers by ensuring that they can pay back what they owe you. This blog post discusses the importance of credit risk management and some widely used models for understanding it.

What is Credit Risk Management?

Credit risk management is the process of managing risks to organizations from their financial obligations. Credit risk underwriting is a process by which an institution determines how risky it will be to extend credit. There are two types of credit risk: default and loss given default, or LGD.

In this process, financial institutions are managed against risks arising from their exposure to loss on loans or due to insolvencies by their clients. It is an essential part of any organization’s strategy that helps in minimizing losses and maximizing profits. As per reports, credit risk management is a rapidly growing field, with many new products and techniques emerging in this arena every year.

Why credit risk underwriting?

When you go to the bank or a financial institution for any loan, credit cards, mortgages, etc., there is an underwriting process. Underwriters are people who make decisions about whether someone should be given a particular product and on what terms. They consider factors such as income level, employment history, length of time at current job/residence, payment record (both positive and negative), and age of an applicant, among others, before making their decision. The general goal in most cases would be to minimize risk while maximizing profit potential.

Some Commonly used Credit risk management models:

– Credit scoring model: Based on statistical analysis, this model considers several factors to predict if a particular borrower will be able to repay a loan or not. The process involves collecting data about individuals, analyzing it, and categorizing them into different groups according to their creditworthiness to ascertain the final decisions.

– Grading: This model grades customers according to their ability & willingness to repay loans or fulfill other obligations. The system takes into account factors like age, employment history, payment record, length of time at current job/residence, etc.

– Loan officer scoring: A loan officer is given a certain number of points based on the risk they are willing to take for any given borrower. These scores help banks understand which officers are more likely to take higher risks, thus enabling them to monitor employees better so that high-quality decisions can be taken by those having years of experience in credit evaluation.

– Income Verification: This method involves verifying the information provided by borrowers related to their income status. It is one of the most effective ways for lenders to reduce

risk as it helps them see if an applicant can afford a specific loan.

– Collateral evaluation/analysis: Another important credit risk management model which includes collateral valuation, analysis, and other risks associated with any particular type of

security.

Make A Career in CRU with Imarticus Learning:

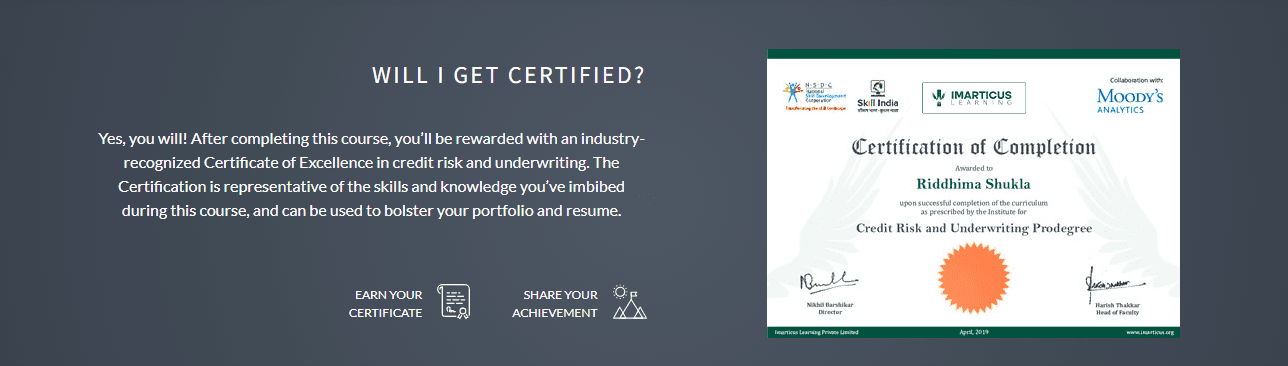

Looking for a credit analyst course? Imarticus Learning offers the only program globally that gives students an in-depth understanding of the lending landscape, credit underwriting, credit administration, legal & regulatory requirements, and the impact of new-age technology.

Through these Credit Risk and Underwriting courses, students acquire a powerful toolkit that helps them understand India’s credit landscape, learn the entire loan assessment process and due diligence and conduct financial analysis.

Through these Credit Risk and Underwriting courses, students acquire a powerful toolkit that helps them understand India’s credit landscape, learn the entire loan assessment process and due diligence and conduct financial analysis.

Credit Risk Management courses at Imarticus Learning allow students to gain hands-on learning experience by exploring comprehensive case studies.

Career Options to Explore after Credit Risk Underwriting Course

- Operational Risk Manager

- Risk Analysis Researcher

- Enterprise Risk Management Lead

- Credit Analysis Associate

- Credit Risk Analyst

- Credit Financing Manager

- Insurance Underwriting

- Investing & Lending Engineering

Credit Risk Management Course USPs:

- Advanced Curriculum

- Profile Enhancement

- Resume Building

- Interview Preparation

- Placement Assistance