Last updated on October 30th, 2025 at 06:09 pm

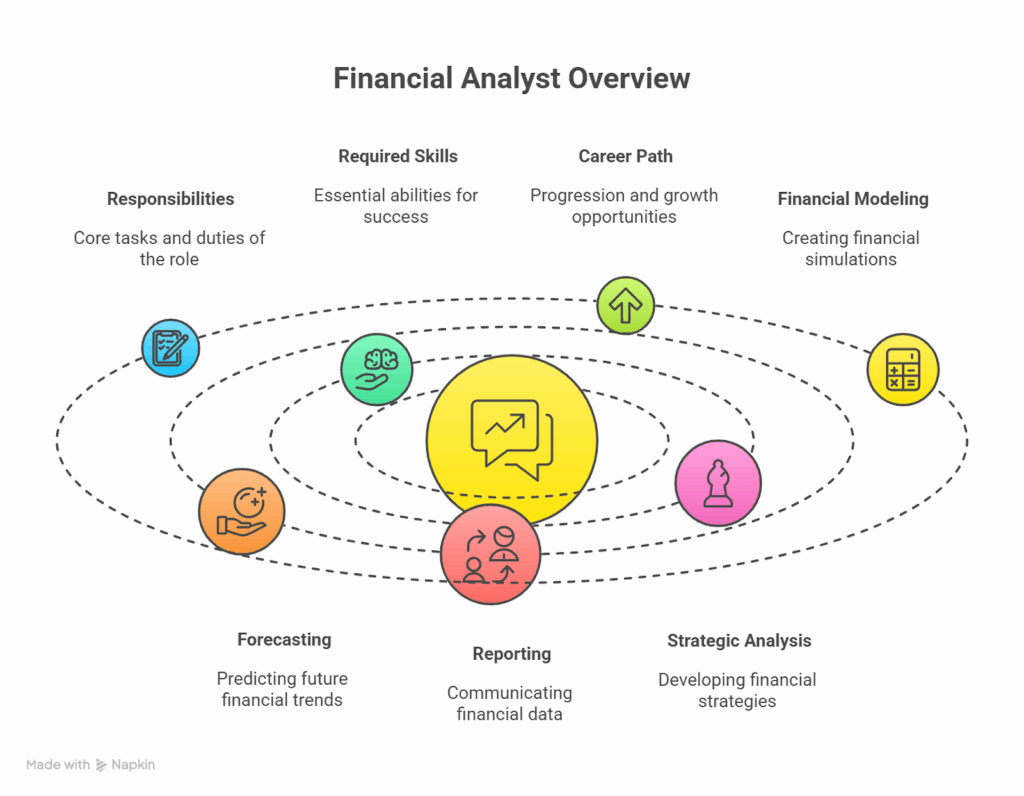

If you’ve ever wondered “What is a Financial Analyst?” then you’re already on the right path toward exploring one of the most rewarding careers in finance. A financial analyst is a professional who evaluates financial data, prepares models, and provides insights that guide investment and business decisions. In today’s competitive market, financial analyst jobs are highly sought-after because they serve as the backbone of strategic planning for companies, banks, and investors.

From career realisation of financial analyst to job and career realisation of financial analyst, this blog will guide you with a quick guide of information. We will also uncover the skill needed by the financial analyst, career development of finance, and will also guide the newcomers how to find a new job as a financial analyst.

To make it even more practical, we’ll also introduce the Postgraduate Financial Analysis Program by Imarticus Learning—a job-assured pathway to launch your career in finance.

Financial Analyst Job Description: A Snapshot

At its core, the financial analyst role revolves around interpreting financial data to provide meaningful insights. Employers expect analysts to identify trends, prepare forecasts, and support key decisions.

Key highlights of a financial analyst job description:

- Gathering and analysing financial statements.

- Construction of finance models to develop future revenues forecasts.

- Equity and market analysis.

- Facilitating M&A deal-making and company value forecasts.

- Reporting and presentation.

It’ll be corporate finance, banking, consultancy, or private equity-perfumed—but same concept. Facilitating companies to make more informed financial decisions.

Roles and Responsibilities of a Financial Analyst

Being a financial analyst is not just about crunching numbers. It’s analysis, strategy, and communications in one.

Common responsibilities include:

- Data Collection & Analysis – Reconcilation of balance sheets, reconcilation of cash flows, reconcilation of income statements, and reconcilation of company accounts.

- Forecasting – Set the revenue forecast, expenditure forecast, and profit margin forecast using financial models.

- Valuation – Set the value of the company by conducting discounted cash flow (DCF), precedent transactions, and comparables.

- Equity Research – Monitor the market trend, predict the shares, and buy/sell orders.

- Budgeting & Planning – Leave the capital usage and cost controls to the in-house team.

- Reporting – To show to the investors or to the management report and dashboards.

This work above is day-time meeting with top managers, business units, and investors—therefore, this would be interpersonal as well as analytical in nature.

Skills Required for a Financial Analyst

Technical and soft skills would be needed for work.

Technical Skills

- Financial Modelling – Company performance using spreadsheets.

- Valuation Approaches – DCF, comparable transaction, and precedent transactions.

- Excel & PowerPoint Proficiency – Reporting and analysis.

- Accounting Proficiency – P&L, balance sheets, and cash flows deeply comprehended in detail.

- Equity Analysis Tools – Bloomberg, FactSet, or data tools of similar nature.

Soft Skills:

- Analytical ability.

- Numeral narrative with communications.

- Time management capability.

- Problem-solving ability.

- Attention and accuracy.

Technical skills and outcome reporting skills to stakeholders by the firm on behalf of the firm for the recruitment of a financial analyst.

Career Growth in Finance: Analyst to Leadership

Career development of a financial analyst has career development lines feed into investment banking, corporate finance, and C-suite executive career careers.

Traditional career development path:

- Junior FP&A, investment banking, or equity research financial analyst role.

- Senior Analyst / Associate – You get to be in charge of small teams once you already have 2–4 years of experience.

- Manager / Vice President – Organisational financial planning, strategy, or negotiation.

- Director / CFO – Organisational financial planning.

Finance career graph is quick for individuals who continue to keep their skill set updated and aligned with the current market trends.

Entry-Level Financial Analyst Jobs: Where to Start

Freshers would like to ask for the first finance job. Reality is that there are enough junior financial analyst jobs in every single business.

Most sought-after jobs are:

- FP&A Analyst – Assist with budget and forecast.

- Equity Research Analyst – Research the stocks and report.

- Treasury Analyst – Handle the cash and liquidity.

- Corporate Development Analyst – Assist with mergers and acquisitions.

- Investment Banking Analyst – Assist with transactions and transactions.

These gateways guide the students through every nook and corner of finance, and serve as stepping stones to specialist expertise in the long run.

Know how to be a successful financial analyst in this video- Here

The Postgraduate Financial Analysis Program: A Career Accelerator

Professional advancement is no shoestring ride on the velvety couch. Closing the gap then is Imarticus Learning’s Postgraduate Financial Analysis Programme.

Why it’s the perfect option for someone who needs to be a financial analyst

- 100% Job Guarantee – 7 sure-shot interview calls.

- Placement Success – Over 56,000 placements with over 500 employer partners.

- Guaranteed Outcome – 60% average salary hike with course completion.

- Convenient Timings – weekday course in 4 months or weekend course in 8 months.

- Timely recognition – Best Education Provider in Finance for 30th Elets World Education Summit 2024.

Skills you’ll learn:

- Analysis of financial statements.

- Valuation concept and modeling.

- Equity research and trading execution.

- PowerPoint and Advance Excel.

- LinkedIn optimisation and personal brand management.

The course is packed with class room classes, simulation software, and live projects, so you would be job-ready at the time of graduation and not book-smart.

Why Choose a Job-assured Program?

Job-sure programs offer career opportunity and not conventional programmes. Why? Because the financial industry is competitive and the companies need to hire such candidates who, other than training, are job-ready.

Postgraduate Financial Analysis Programme offers:

- Mock test practice and mock interview.

- Case preparation to prepare.

- Employer level industry networking.

Such a school-to-work employment match makes it number one to be as a career in finance.

Day in the Life of a Financial Analyst

Neck deep in nothing but “What is a financial analyst?”

Average day, i.e.:

- Morning: Tracing market releases and company announcements.

- Midday: Numb crunching on some finance models and projections.

- Afternoon: Brainstorming with managers or investors.

- Evening: Performing under pressure to meet internal stakeholders or customers’ deadlines.

The profession is extremely dynamic with frequent restructuring as per business objectives and company trends.

FAQs

Q1. What is a financial analyst?

Financial analyst interprets financial information, builds models, and suggests concepts on business and investment.

Q2. What is a financial analyst?

It encompasses firm account statement analysis, forecastings, valuations, and corporate finance assistance.

Q3. What is the role and responsibility of a financial analyst.

Forecasting and budgeting, equity analysis and reporting, and provision of insight to inform business strategy.

Q4. Finance analyst skills requirement

Financial modeling, valuation, accounts know-how, Excel, effective communication and effective analysis are all essential skills.

Q5. Freshers’ how to become junior financial analyst

Through specialist course training such as Postgraduate Financial Analysis Programme with interview and placement assurance.

Q6. Professional financial analyst career progression to professional-level finance career financial analysis

Senior.analyst, manager, vice president, then CFO level of work.

Q7. Is financial analysis a profession in India?

Yes, since there will be an increasing economy, surely there has to be an increasing demand for professional financial analysts for any sector.

Q8. Postgraduate Financial Analysis Programme for how many months?

Weekday 4-month or weekend 8-month classes.

Q9. Average income of financial analyst in India

Freshers are offered 4–6 LPA, and experienced are offered 15+ LPA based on experience.

Q10. Is it possible for me to shift my career into finance from another one?

Yes, properly structured courses like Imarticus’s make it easy for professionals to shift into finance jobs.

Conclusion

Who then is the financial analyst? Quite simply, it is an evidence-based decision-maker. From interpreting finance reports to investment recommendations, financial analysts are the conduits to the new economy.

For the most current career prospects for a finance career as a financial analyst, the most sought-after option is on an internationally competitive job-protection career path. Financial job protection, moral benefits, and international career opportunities are its benefits. It is the most sought-after option for postgraduates.

Postgraduate Financial Analysis Programme provides you with the much-needed skills, in-job training, and placement guidance to your career of choice. Get started today—your finance career is waiting!