In the competitive world of finance, landing a job as a Financial Analyst requires more than-just a degree or a knack for numbers. Recruiters today are on the hunt for well-rounded candidates who not only meet the…financial analyst job requirements but also show potential for long-term success in a fast-paced… high-stakes environment. So if you’re wondering how to get hired as a financial analyst, you’re in the right place. This guide-breaks down the traits, skills & qualifications recruiters are really looking for, along with practical financial analyst resume tips to help you stand out.

Understanding the Financial Analyst Role

Before diving into what recruiters seek, it’s essential to grasp- what a Financial Analyst actually does. These professionals evaluate financial data, create reports, forecast trends, support budgeting, & offer investment recommendations. Their work plays a critical role…in shaping key business decisions. Whether in corporate finance, investment banking or asset management, the analyst’s job is all about turning raw numbers into meaningful insights.

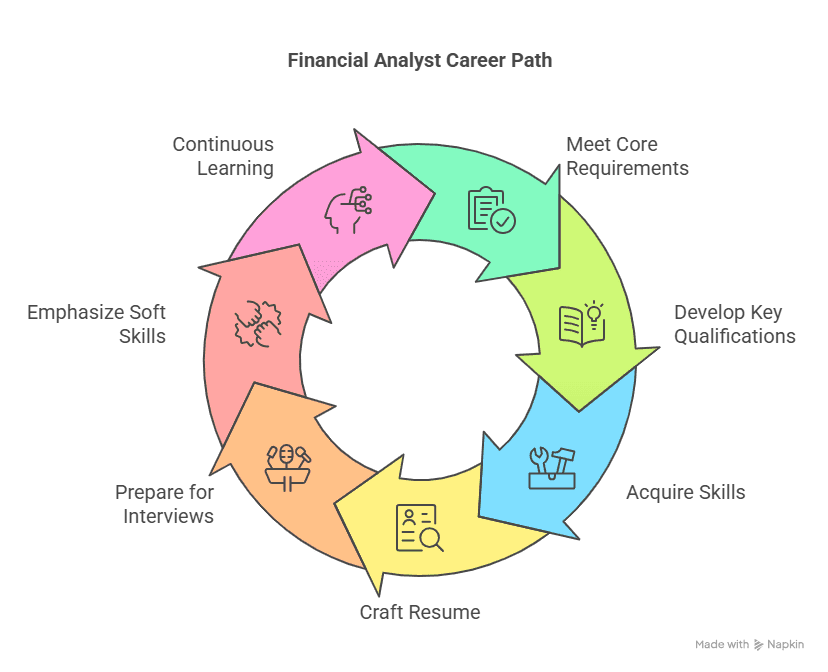

1. Meeting Core Financial Analyst Job Requirements

Let’s start with the basics. Every job listing comes with its own set of financial analyst job requirements, but generally, most employers look for the following:

- A degree in finance, economics, accounting or a related field

- Proficiency in Excel & financial modelling

- Knowledge of accounting principles, forecasting, budgeting & analysis

- Familiarity with tools like Power BI, Tableau, or SQL

- Strong communication & presentation skills

But checking off these boxes only gets you so far. Recruiters go beyond the basics when choosing the right candidate.

2. Key Qualifications for Financial Analysts

So what are the key qualifications for financial analysts that make a candidate stand out?

First, having a strong educational background helps, but adding a professional certification (like CFA or a specialised finance program) can boost your profile significantly. One such program is the Postgraduate Financial Analysis Program by Imarticus, which is designed to equip candidates with real-world analytical skills, domain knowledge, & placement support.

Next, recruiters value practical experience. Even internships or project work can demonstrate that you’ve applied financial concepts in a real setting. Industry exposure matters more than just theory.

Finally, your ability to interpret financial statements & derive actionable insights is a must. To better understand the difference between financial analysis & statement analysis, check out this helpful blog on financial statement analysis.

3. Skills Recruiters Seek in Finance

Now let’s talk about those all-important soft & technical skills. When evaluating candidates, here are the top skills recruiters seek in finance:

- Analytical Thinking: The ability to break down complex financial data & identify patterns

- Attention to Detail: Accuracy is everything in financial reporting

- Problem-solving: Making data-backed decisions to solve real business challenges

- Communication: Explaining financial findings to non-finance stakeholders

- Tech Proficiency: Advanced Excel, data visualisation tools, ERP systems

Don’t underestimate soft skills—teamwork, adaptability & time management also rank high on the list.

4. Financial Analyst Resume Tips to Get Noticed

Your resume is your first impression. So how do you make it recruiter-friendly? Here are some essential financial analyst resume tips:

- Use a clean, professional format with clear sections

- Start with a strong summary highlighting your unique value proposition

- Use metrics to show impact (e.g., “Reduced forecasting errors by 25%”)

- Tailor your resume for each role using relevant keywords from the job description

- Showcase certifications & tools you’ve mastered

Also, make sure your resume doesn’t just list responsibilities. Show how your work added value.

5. How to Get Hired as a Financial Analyst

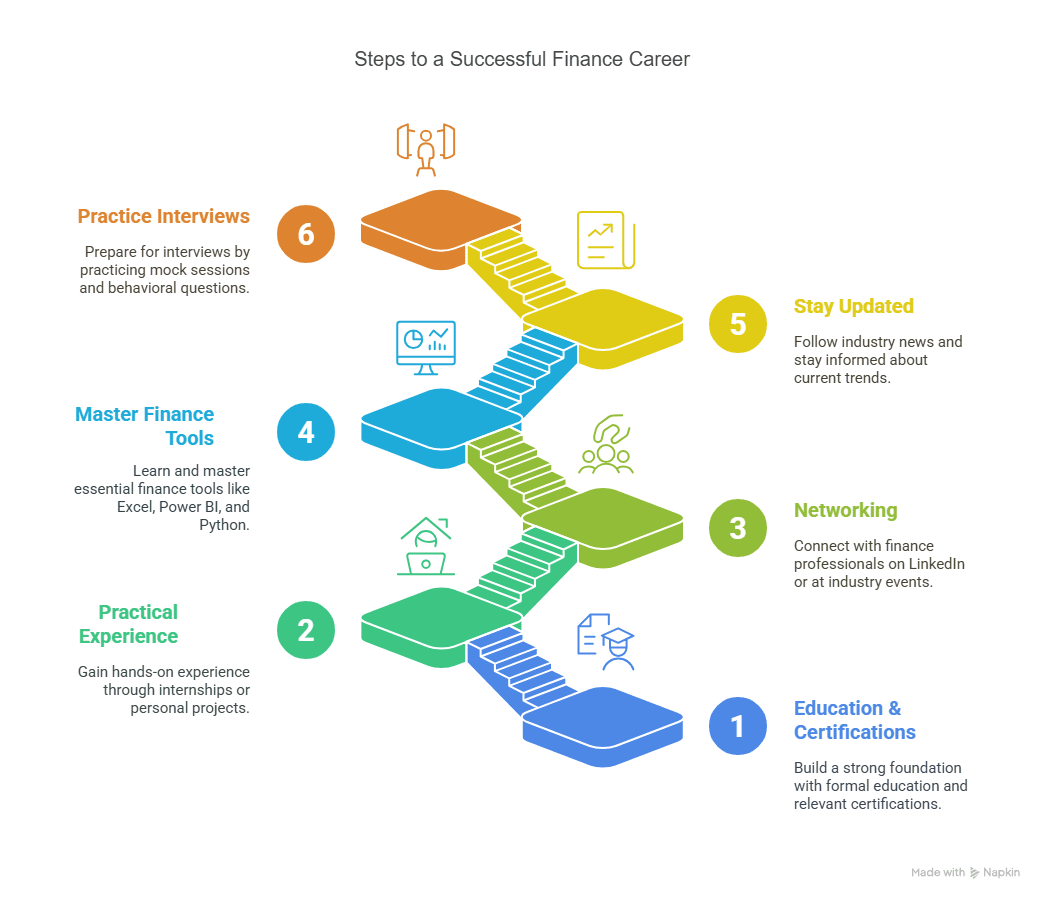

If you’re wondering how to get hired as a financial analyst, here’s a checklist that can significantly increase your chances:

✅ Build a strong foundation with education & certifications

✅ Gain practical experience through internships or projects

✅ Network with finance professionals on LinkedIn or at industry events

✅ Learn & master finance tools like Excel, Power BI & Python

✅ Follow industry news & stay updated on trends

✅ Practice mock interviews & behavioural questions

For fresh graduates wondering where to start, this blog on getting your first accounting job offers some useful direction.

6. Understanding Investment Banking Hiring Criteria

If you’re eyeing a role in investment banking specifically, it’s crucial to-understand the investment banking hiring criteria. These roles are extremely competitive & demand top-notch skills.

Here’s what investment banks typically look for:

- Top academic performance from a reputed institution

- Strong quantitative & analytical skills

- Exposure to valuation models, M&A, or capital markets

- Internship or deal experience in finance

- Ability to work long hours under high pressure

Candidates from commerce or BCom backgrounds often ask if they stand a chance. Absolutely yes—with the right training. If that’s your path, explore this blog on finance careers after BCom.

7. Finance Job Interview Preparation

Cracking a finance interview takes more than just knowing technical concepts. Smart finance job interview preparation includes:

- Reviewing common interview questions on valuation, ratios, forecasting & financial statements

- Practising case studies & scenario-based problems

- Being ready for brain teasers or mental maths questions

- Rehearsing your personal pitch or “tell me about yourself” answer

- Knowing the company’s financials & latest news

Interviewers often judge not just your knowledge but also how clearly & confidently you present your ideas. So practice in front of a mirror or with a friend—it really helps.

8. Soft Skills & Cultural Fit Matter Too

It’s not just about technical brilliance. Recruiters also assess cultural fit. Are you collaborative? Do you align with the company’s values? Will you work well under pressure?

During interviews, your soft skills & personality often tip the scales. Use stories to show how you’ve handled challenges or solved problems. That emotional intelligence piece often separates the good from the great.

9. The Role of Continuous Learning

Finance is a dynamic industry. What worked five years ago may not work today. That’s why recruiters appreciate candidates who show a willingness to learn. Enrolling in online programs, attending webinars or reading industry reports are all signs of a proactive mindset.

If you’re serious about building a long-term career as a Financial Analyst, consider structured learning paths. Programs like Imarticus’ Postgraduate Financial Analysis course not only teach you the tools of the trade but also provide placement support—a game-changer for freshers & early professionals.

10. Putting It All Together

To recap, landing a job as a Financial Analyst requires more than just academic knowledge. Recruiters are looking for candidates who meet financial analyst job requirements, demonstrate the skills recruiters seek in finance, & present themselves well through polished applications & confident interviews.

Your journey becomes easier when you:

- Understand key qualifications for financial analysts

- Follow actionable financial analyst resume tips

- Know investment banking hiring criteria

- Master your finance job interview preparation

- Keep learning, adapting & growing

Wondering how to get hired as a financial analyst? The answer lies in being prepared, persistent & proactive.

FAQs

1. What are the key qualifications for financial analysts?

To land a role in this space… you’ll usually need a degree in finance, economics or business… plus strong analytical skills, Excel know-how & ideally a-professional certification like CFA or-a postgraduate program in finance.

2. How do I prepare for a finance job interview?

Start by brushing up on key financial concepts like ratios, valuation techniques & market trends… then practise case studies, review your resume thoroughly & stay confident in your communication.

3. What are the top skills recruiters seek in finance?

Analytical thinking- data interpretation, financial modelling, communication & attention to detail… these are some of the top skills recruiters seek in finance professionals today.

4. How can I improve my financial analyst resume?

Keep it clean, concise & relevant. Add quantifiable achievements, highlight tools like Excel or Power BI… and always tailor your resume to match the specific financial analyst job description.

5. Is it hard to get hired as a financial analyst?

It’s competitive, yes… but not impossible. With the right mix of qualifications, skills, networking & a solid resume, your chances improve significantly.

6. What are common financial analyst job requirements?

Most employers look for a finance degree, strong Excel & data skills, and experience with financial reporting… along with great problem-solving & communication abilities.

7. What is the investment banking hiring criteria?

They usually look for top academic performance, internships, strong modelling skills… and the ability to handle high-pressure environments with confidence.

8. Are there any recommended courses to become a financial analyst?

Yes… the Postgraduate Financial Analysis Program by Imarticus is a great place to start if you want real-world training, expert guidance & career support.

Conclusion:

Ready to start your journey? Don’t wait for the “perfect” time. Whether you’re fresh out of college or looking to switch roles, the financial sector offers immense opportunities for those who are ready to take charge.

Explore the Postgraduate Financial Analysis Program & take the first step towards your dream career today.