In today’s fast-evolving financial world, a finance course is more than just a learning opportunity; it’s your passport to a promising career in investment banking operations. Whether you’re a recent graduate or a professional aiming to pivot into finance, understanding how a practical and strategically designed finance course can unlock global finance career opportunities is the first step in rewriting your future.

Why a Finance Course is the Launchpad You Need?

To be a successful banker today, you need to know something about finance theory, markets, operations, and compliance procedures. Unlike theory-heavy old-school degrees, today’s finance courses have a built-in equilibrium of academics and skills.

What Makes a Finance Course So Powerful?

A finance course for investment banking operations is not formula and theory alone. It makes you think like an analyst, remain a banker conducting the transaction, and talk to markets in compliance mentality.

Such a shift is especially required in a job where accuracy, regulatory knowledge, and millisecond decision-making are the minimum requirements.

Finance Course for a High-Impact Career in Investment Banking Operations

Foreign banking operations is the force behind foreign banking institutions. Career professional opportunity in it demands complete technical proficiency, discretion of detail, and a feeling of always being alert as much as foreign finance law is concerned. A Finance course is the professional tool to fill the gap between class-level theoretical exposure and ground-level application.

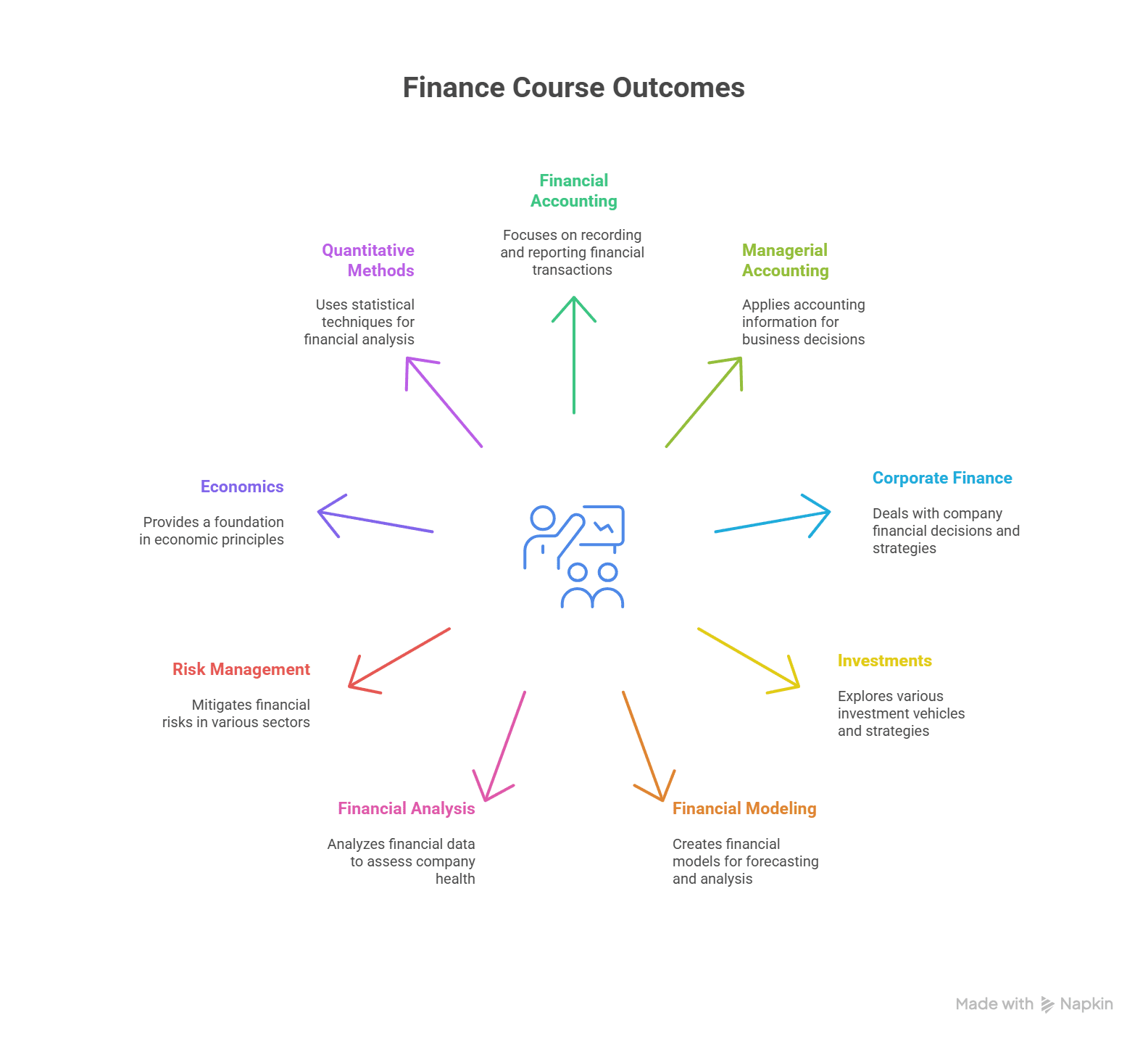

What Are the Core Components of a Top-Tier Finance Course?

- Securities & Financial Market Infrastructure: Get to know the infrastructure of the equity, debt, and derivatives markets.

- Trade Lifecycle Management: Get to know trade flows from execution through to settlement.

- Risk & Compliance Frameworks: Get to know the most salient risk management concerns and anti-money laundering (AML).

- Global Banking Regulations: Get to know regulations such as Basel III, MiFID II, and FATCA.

- Practical Simulations & Projects: Practical simulation of concepts by capstone projects and case studies.

Alternatives to an MBA: Focused Courses With Greater ROI

MBA strategic thinking may be costly and time-consuming. If investment banking operations are occupying your mind, learning a course of finance for early career specialists or beginners can yield quicker and specialized returns.

Specialized courses like Certified Investment Banking Operations Professional (CIBOP) are a viable alternative to traditional MBAs, with specialized training and career placement guarantee.

Practical Finance Training Program vs Traditional Academia

A practical finance training program prioritises hands-on skills. You’ll master:

- Excel-based financial modelling

- Regulatory reporting dashboards

- Workflow automation in banking tools

- KYC, AML, and compliance case handling

Unlike broad-based academic finance, these programs narrow their scope to job-critical competencies that are in high demand.

Global Finance Career Opportunities With the Right Training

With the proper high-impact finance course, you are stepping into international financial hubs of London, Singapore, New York, and Dubai. Career in investment banking operations provides you with mobility and anchor in companies like:

- Investment Banks

- Wealth Management Companies

- Custodians

- Hedge Funds

- Regulatory Bodies

Career prospects in international finance are defined when you acquire certifications that match international benchmark and expectation levels.

Choosing the Best Finance Certification in India

While looking for the best finance certificate in India, keep the following points in mind:

- Job Placement Guarantee and Placement Record

- Industry-Supported Curriculum

- Live Projects and Simulations

- Alumni Association and Industry Network

A certificate such as CIBOP does all this with a well-structured springboard to next-generation experts.

Career Roles After Completing a Finance Course

After completing a tough course in finance, the candidates are ready to take care of:

- Investment Banking Associate

- Collateral Management Analyst

- Risk Management Consultant

- KYC Analyst

- Client Onboarding Associate

- Settlement and Clearing Analyst

- Regulatory Reporting Analyst

All the above stated jobs, besides providing marvelous entry-level benefits, also promote long-term achievement in global institutions.

Introducing the Certified Investment Banking Operations Professional (CIBOP)

Genuinely interested in an investment banking operations career? Then, Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP™) is the crème de la crème best.

Why Choose CIBOP?

- 100% Job Guarantee for 0–3 years experience finance graduates

- 85% offer rate with maximum ₹9 LPA

- Option for 3-month and 6-month versions

- Best Education Provider in Finance award at 30th Elets World Education Summit 2024

- 7 interview guarantees, chance for 60% salary hike

- 1200+ batches trained, 50,000+ trainees trained

- Supported by 1000+ recruitment partners

CIBOP Curriculum Highlights

CIBOP training is project-based in nature. You will be learning:

- Anti-Money Laundering investigations

- Trade-Based Money Laundering cases

- Real-time compliance screening

- Ethical Challenges in Bank Operations

What Roles Can You Step Into?

- Investment Banking Associate

- Hedge Fund Operations Analyst

- Trade Surveillance Analyst

- Regulatory Reporting Director

- Wealth Management Coordinator

Career Support That Goes Beyond the Curriculum

- Aptitude Training to pass employer tests

- Mock Interview Practice with feedback and mock interviews

- Profile Building through one-to-one resume-creation sessions

Conclusion

Finance is one area where experience, know-how, and hard work pay off. A sound finance course doesn’t promise a job, but it sharpens your mind and instils the learnings to propel your career. With career prospects in global finance increasing day by day, pursuing a special course in investment banking operations might turn out to be the most intelligent career choice that you can make today.

Imarticus Learning’s CIBOP™ certification is not just another cert – it’s just the start for finance geeks who are shortly going to rule the world.

FAQs

1. What is the difference between a finance course and an MBA?

A finance course is short, concise, and employment-ready focused. An MBA is theoretical and generic and might or might not have live job training.

2. Is investment banking operations a good career choice in 2025?

Yes. Since there will be more regulation and finanical digitisation, the world needs more operations professionals.

3. Can freshers take a finance course for investment banking?

Yes. Finance graduates with 0–3 years of experience can go through courses such as CIBOP™.

4. What salary can I expect after a finance course?

Freshers can be given first-year salary packages of ₹4–5 LPA in India, with performers at ₹9 LPA. Foreign assignments give even larger packages.

5. Which is the best finance certification in India for investment banking?

Imarticus Learning CIBOP™ is the best because of its curriculum, placement record, and assurance of employment.

6. Do finance courses include practical training?

Yes. Imarticus students are doing actual-case examples of AML and risk and compliance related topics in project-first culture.

7. Are there global job opportunities after completing a finance course?

Yes. With proper certification and hands-on training, you can get hired in UK, US, UAE, and Singapore.