Last updated on November 26th, 2025 at 11:45 am

Last Updated on 3 months ago by Imarticus Learning

Choosing a professional qualification is easier when you understand what it prepares you to do. CMA stands out because it builds the kind of financial thinking companies rely on today. The CMA syllabus does not focus only on accounting or costing. It brings together analysis, strategy, compliance, technology, taxation, and operational insight in a way that reflects how modern businesses actually function.

Whether you come from a commerce background or you are exploring finance for the first time, the CMA journey feels structured and purposeful. Each level strengthens a different part of your skill set. You begin with commercial fundamentals, progress into analytical and regulatory concepts, and eventually learn how to interpret financial signals that guide organisational decisions. This progression is what makes the CMA USA syllabus both challenging and rewarding.

The demand for professionals who understand cost behaviour, performance metrics, financial reporting logic, and strategic decision-making has grown across industries. Manufacturing, FMCG, IT services, consulting, banking, logistics, and even emerging sectors like clean energy look for talent that can convert numbers into meaningful business insight. The syllabus has been designed with this demand in mind.

If you are planning to explore the full structure of the CMA syllabus, understand what each level builds, and see how different subjects connect to real roles in finance, this guide walks you through it in a clear, organised manner. It is built to give you clarity, not complexity, so you can approach your preparation with direction instead of doubt.

What Is CMA and Its Syllabus Framework

There is a certain kind of finance professional who does more than record numbers. They decode the story behind those numbers, understand how business behaviour shifts in response to economic forces, and guide decisions that influence an organisation’s future. When students begin exploring what is CMA, they often discover that this qualification was created precisely for this breed of professionals. Offered by the IMA, CMA is not just a credential. It is a framework for developing financial intelligence at a managerial level.

Management accountants operate in environments where clarity matters more than complexity. They interpret patterns, evaluate strategies, and support leaders during moments when decisions cannot rely on instinct alone. The CMA Syllabus is built to cultivate this style of thinking. It does not simply teach accounting or costing. It trains you to move from understanding data to shaping decisions, from knowing numbers to influencing outcomes.

The structure of the syllabus reflects this evolution. This section explains the full structure of the CMA course so that every reader can visualise the path ahead. Before opening a study module, you should know what the exam is trying to build in you as a finance professional. These CMA course details also help you see how the syllabus is intentionally layered.

Cost and Management Accounting as a profession requires four core capabilities:

- Technical accounting literacy

- Quantitative and analytical stamina

- Regulatory accuracy

- Strategic financial judgement

The US CMA syllabus created by the Institute of Management Accountants (IMA) revolves around strategic financial leadership in modern business ecosystems.

Whether you choose the Indian CMA or the US CMA, your long-term career trajectory benefits from mastering both analytical and managerial skills. This is why the structure of the CMA syllabus feels intense, yet beautifully coherent when approached with a plan.

The US CMA Syllabus: A Global Lens on Strategic Finance

This section provides a comprehensive view of the CMA USA syllabus, which is globally recognised and aligned with real-world managerial finance. The US CMA pathway is compact, rigorous, and frequently chosen by professionals seeking international roles.

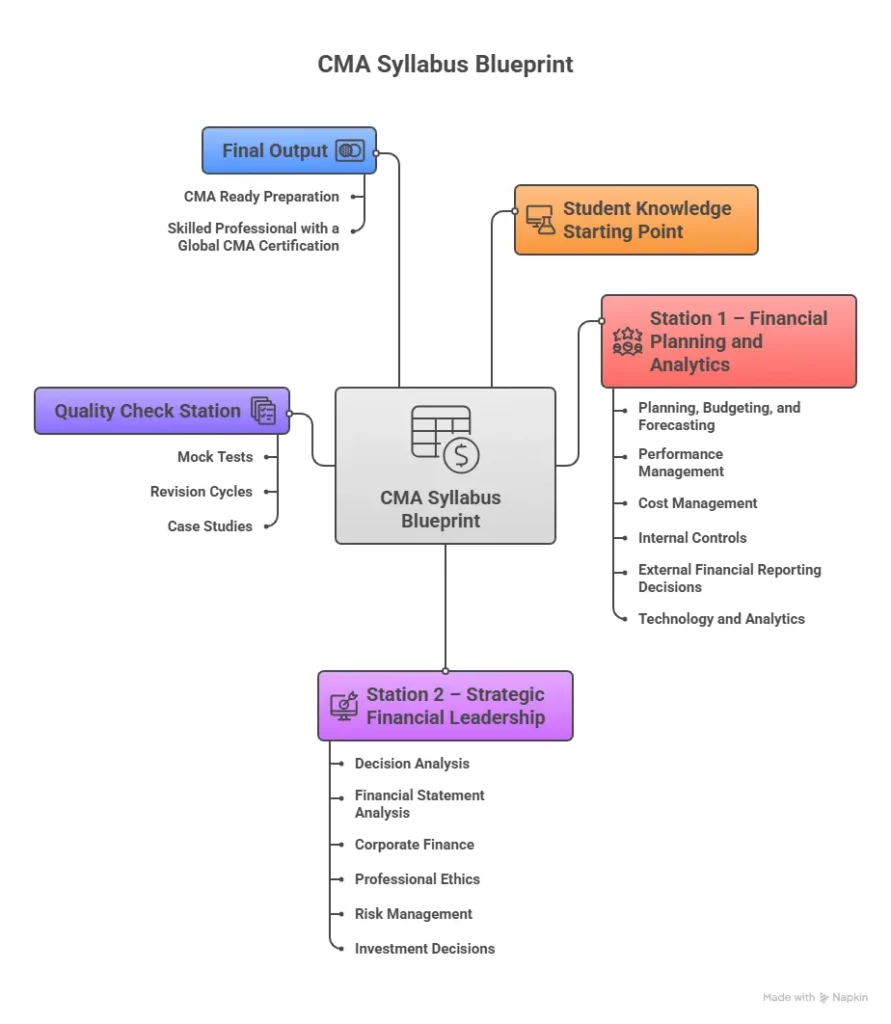

The US CMA exam consists of two parts. Both parts test professional judgement, analytical discipline, and the ability to interpret business scenarios.

US CMA Exam Overview

The US CMA exam is structured to test applied finance rather than rote learning. It contains multiple-choice questions as well as essay-type business scenarios. The passing score is 360 out of 500.

Candidates often pursue the US CMA alongside full-time jobs because the syllabus focuses on managerial outcomes, not memorisation.

- US CMA Part 1 Syllabus: Financial Planning and Analytics

This section lays out the US CMA Part 1 syllabus, explaining what each area teaches you and why organisations value these skills.

US CMA Part 1 – Topic Areas and Weightage

This table shows how the syllabus is distributed across topic clusters, allowing candidates to allocate study time smartly.

| Topic Cluster | Weightage | Skill Area Developed |

| Planning, Budgeting, and Forecasting | 20% | Ability to design budgets and forecast performance. |

| Performance Management | 20% | Measuring organisational effectiveness through KPIs. |

| External Financial Reporting Decisions | 15% | Understanding GAAP-based reporting logic. |

| Cost Management | 15% | Identifying, analysing, and controlling organisational costs. |

| Internal Controls | 15% | Ensuring process and financial integrity. |

| Technology and Analytics | 15% | Exposure to data analytics and modern tech tools. |

This part is practical. Budgeting, forecasting, and cost management are exactly the tasks finance teams perform in industry roles.

- US CMA Part 2 Syllabus: Strategic Financial Leadership

Here, we explore the US CMA Part 2 syllabus, the section of the course that tests real decision-making expertise.

US CMA Part 2 – Topic Areas and Weightage

This table highlights how the topics develop the financial leadership mindset required for senior roles.

| Topic Cluster | Weightage | Skill Developed |

| Decision Analysis | 25% | Evaluating choices using quantitative and qualitative factors. |

| Financial Statement Analysis | 20% | Interpreting financial health and forecasting futures. |

| Corporate Finance | 20% | Capital structuring, risk, and long-term financial planning. |

| Professional Ethics | 15% | Ethical thought process in sensitive business situations. |

| Risk Management | 10% | Identifying and managing organisational vulnerabilities. |

| Investment Decisions | 10% | Selecting and evaluating investment opportunities. |

Together, Part 1 and Part 2 represent the essence of the CMA USA syllabus, turning candidates into strategic value creators.

Why the US CMA Syllabus Matters Globally

The US CMA syllabus is recognised worldwide because it teaches the kind of financial thinking companies use daily. It focuses on:

- Strategic decision-making

- Performance analysis

- Risk evaluation

- Internal controls

- Technology-driven finance

- Data interpretation

The US CMA syllabus is structured around exactly these capabilities.

Where You Use US CMA Knowledge

Here are practical, bite-sized examples:

- Planning budgets for a hospitality chain expanding into new cities

- Evaluating risk before launching a new consumer product

- Interpreting cash flows for a start-up seeking investors

- Assessing cost behaviour when production volume changes

- Comparing two investment proposals during a board presentation

These situations happen across real companies. The US CMA syllabus exists to prepare you for them. The following visual gives an overview of the US CMA levels and the subject areas.

Study Techniques That Make the CMA Syllabus Easier

Every year, I meet students who tell me the same thing. The syllabus feels long when you look at it on paper. The trick is to stop staring at the list and start understanding how the topics behave. A topic behaves the way a financial problem behaves in real life. It sits inside a structure, it interacts with another concept, and it layers itself across multiple situations. The moment you see this, preparation starts becoming intuitive.

This part focuses on the deeper methods for absorbing the CMA course subjects. You will learn how to cluster topics, how to revise in cycles, how to use industry examples to anchor your concepts, and how to track your progress using data-driven methods instead of guesswork.

- Designing a Preparation Framework Around the CMA Syllabus

Students often start their preparation by opening the first page of a module and reading like a storybook. The syllabus is not meant to be consumed this way. It helps to design a structure first. Consider this section your blueprint. It shows how you can use the natural flow of the syllabus to create a preparation system that scales with your progress.

Three-Phase Study Loop

The three-phase loop is a system based on how the brain creates long-term memories.

- Input Phase

You read the concept, understand related examples, and write down short notes. - Association Phase

You link the concept with related CMA syllabus topics. This creates mental clusters. - Application Phase

You solve questions, attempt mock scenarios, and practice cross-topic problems.

Repeating this loop across the CMA syllabus creates high retention.

Why Topic Clustering Changes Everything

Topic clustering is the habit of grouping syllabus areas based on their behaviour. Here are clusters you can begin with.

- Financial Literacy Cluster: Journal entries, accounting cycle, financial reporting, consolidation logic.

- Cost Behaviour Cluster: Marginal costing, variance analysis, budgeting, standard costing.

- Regulatory Cluster: GST, IT Act provisions, Companies Act, and audit requirements.

- Strategic Cluster: Business strategy, risk management, analytics, investment decisions.

Clustering also prepares you for integrated case-based questions that appear in the higher levels of the CMA syllabus.

2. How to Build a Weekly Study Plan Around the CMA Syllabus

This section breaks down the process of creating a realistic weekly timetable that is aligned with the CMA syllabus structure. Instead of giving rigid hours, this guide teaches you how to adapt your schedule based on your attention span, your exam month, and your mastery of fundamentals.

Weekly Structure Template

Below is a simple and flexible pattern you can use.

- Day 1 and 2

Heavy theory topics such as laws, accounting standards, and audit fundamentals. - Day 3 and 4

Numerical topics such as costing, financial management, and analytics. - Day 5

Revision of whatever was completed in the past four days. - Day 6

Mixed question bank practice, including old questions and unit tests. - Day 7

Light revision through podcasts, concept videos, or flashcards.

How to Allocate Study Hours Without Burning Out

If you are preparing for the Indian CMA and the US CMA exam together, do not mix topics from both syllabi on the same day. The frameworks differ and require separate mental spaces. To begin with, understand the CMA eligibility criteria and the syllabus in detail to develop an approach that works best for you.

A good rule is to follow a 60 to 40 balance for the Indian CMA first, then adjust as you get closer to your US CMA attempt.

Watch this video to prepare yourself to ace the CMA exams with a mock interview. Check how far you’ve come in the preparation journey and what aspects still need to be tightened:

A Structured Look at CMA Syllabus Focus Points

As you work through the CMA pathway, certain subjects naturally take up more space in your preparation than others. Some topics appear repeatedly across levels, some grow deeper as you progress, and a few become central to the way you think about costing, finance or strategy.

This section pulls those patterns together so you can see how the syllabus distributes its focus, how each stage builds on the one before it and where your study energy will create the most impact over time.

US CMA Part 1: Financial Planning, Performance and Analytics

Part 1 sets the foundation for how finance teams plan, measure and interpret business activity. It brings together the areas you will use most often in day-to-day roles, from budgeting and forecasting to performance tracking, cost behaviour and analytical tools. The following breakdown helps you understand how these topics connect and why they form the core operating layer of the US CMA syllabus.

Planning, Budgeting and Forecasting ████████████ 20%

Performance Management ████████████ 20%

External Financial Reporting ████████ 15%

Cost Management ████████ 15%

Internal Controls ████████ 15%

Technology and Analytics ████████ 15%

Key takeaway: Part 1 is evenly distributed across six major buckets. Planning, performance and reporting form the bulk of exam focus, with analytics and controls gaining importance in recent years.

US CMA Part 2: Strategic Financial Management

Part 2 moves deeper into the strategic side of finance, where decisions carry long-term consequences and require a broader understanding of how businesses grow, invest and manage risk. The topics in this section shape your judgment as a future finance leader, connecting financial analysis, corporate strategy and ethical reasoning into one cohesive skill set.

Decision Analysis ██████████████ 25%

Financial Statement Analysis ██████████ 20%

Corporate Finance ██████████ 20%

Professional Ethics ███████ 15%

Risk Management █████ 10%

Investment Decisions █████ 10%

Key takeaway: Part 2 shifts into judgment-heavy topics. Decision analysis dominates, supported by financial statement insights and corporate finance. Ethics, risk and investment decisions complete the strategic framework.

Why CMA Candidates Struggle and How to Solve It With the Syllabus Itself

There are predictable challenges students face across the CMA syllabus. This part explains those hurdles and shows how using the syllabus and the content specification outlines provided by IMA as a navigation tool helps you move past them.

Common Struggles and Their Solutions

- Struggle 1: Feeling lost between accounting and cost accounting

Solution: Keep a journal where you write the similarities and transitions. For example, cost allocation feels easier when you recall how overheads behave in financial accounting. - Struggle 2: Getting stuck in taxation

Solution: Use tax flow diagrams. Draw how income enters different heads or how GST flows through the Input Tax Credit. - Struggle 3: Weak retention of formulas

Solution: Create a formula wall. Write formulas on sticky notes and update them every week. - Struggle 4: Panic during mock tests

Solution: Practice with time pressure. Set a 30-minute timer for 20 questions. This trains your brain to stay calm in the real exam.

These strategies work across both the Indian CMA and the CMA USA syllabus, especially because both exams expect you to think, not memorise.

Real-World Applications of CMA Syllabus Topics

This part shows how different syllabus topics of CMA appear in the real world. Students often understand better when real scenarios are explained. These examples also improve your retention during revision.

Everyday Corporate Illustrations

- Budgeting and Forecasting

FMCG brands like Hindustan Unilever frequently forecast demand across 30 to 40 product lines. The budgeting section of the US CMA Part 1 syllabus mirrors these real workflows. - Transfer Pricing

Global companies such as Amazon manage internal prices between warehouses, manufacturing hubs, and retail units. CMA students learn this under management accounting and international tax. - Variance Analysis

Automobile plants track the variance between planned labour hours and actual labour hours. This becomes vital for cost control. - Investment Decisions

Banks and private equity firms use capital budgeting techniques to decide whether an investment is financially sound. Students encounter these techniques in Part 2 of the US CMA syllabus and in the final level of the Indian CMA. - Internal Controls

According to the ACFE 2024 Fraud Report, weak internal controls contribute to More than half of occupational frauds occurring due to a lack of internal controls or an override of existing internal controls. (Source)

This shows the practical power of internal controls, a topic covered in both the Indian CMA syllabus and the US CMA course syllabus.

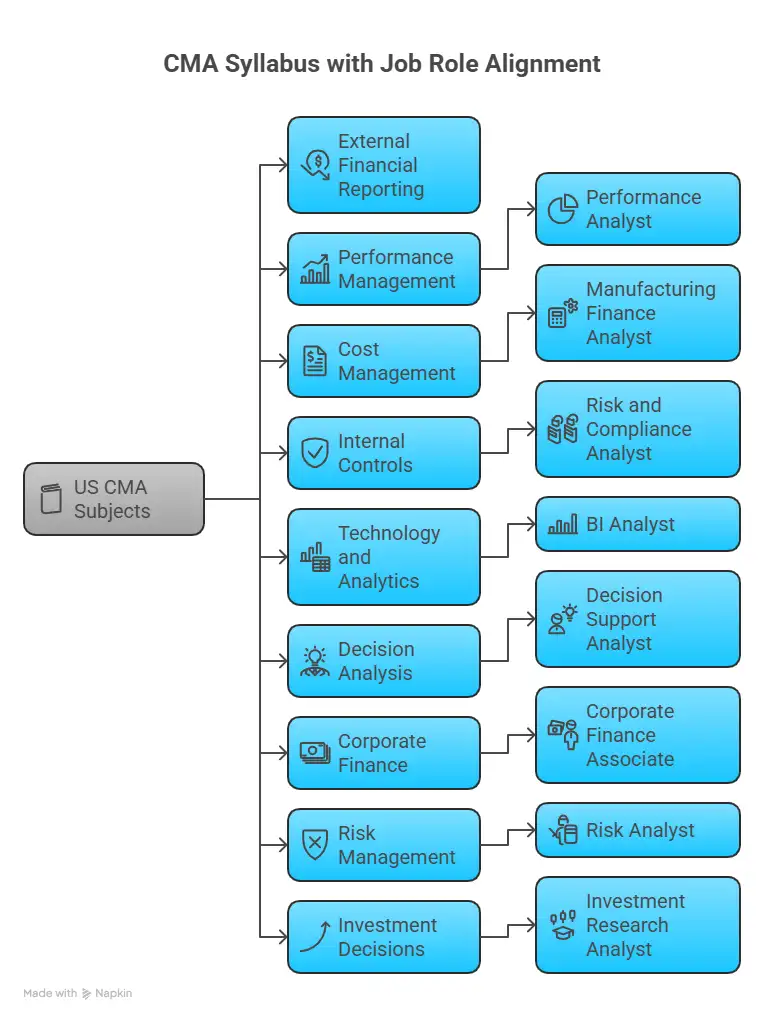

Here is a visual that shows a relation between the focus subjects of the US CMA and what job roles or skills it prepares you for:

Turning the CMA Syllabus Into a Career Advantage

This section covers how you can convert your understanding of the CMA syllabus into career capital. You will read about the CMA course benefits and what recruiters value in candidates who understand the logic behind the subjects.

Why Employers Value CMA Candidates

- They have strong cost control discipline.

- They understand regulatory boundaries.

- They can analyse financial statements with an integrated perspective.

- They know how to build budgets and forecast business scenarios.

- They think like problem-solvers, which senior finance roles require.

According to a salary survey by IMA in 2023, US CMA professionals reported a median global salary that was approximately 21% higher than non-CMA peers. (Source)

This is why many students eventually combine both the Indian CMA and US CMA credentials. Mastery of the CMA Syllabus across both pathways builds the confidence to handle complex roles in FP&A, audit, taxation, analytics, and financial leadership.

And if you’re still wondering if CMA is worth a bet, the time, money, and resources, here is a video that explains this in detail:

How to Use Mock Tests and Analytics to Track Syllabus Mastery

Mock tests become valuable only if you know how to interpret them. A low score is not a failure. It is a data point. This section explains how to track your improvement scientifically.

Five-Step Analysis Routine

- Identify topics with recurring mistakes.

- Compare mistakes with your topic clusters.

- Review conceptual gaps using short notes.

- Redo the same questions after seven days.

- Use a score tracker to monitor your improvement every week.

Sample Performance Tracker

This table helps you observe patterns in your own progress without needing any special software.

| Week | Percentage Scored | Topics Paused | Topics mastered | Notes |

| 1 | 42 percent | Accounting Standards, Budgeting | Basic Maths | Increase revision frequency. |

| 2 | 57 percent | GST, Variance Analysis | Budgeting | Needs more problem-solving. |

| 3 | 64 percent | Financial Reporting | Variance Analysis | Better conceptual clarity. |

| 4 | 72 percent | Transfer Pricing | Taxation | Close to exam-ready. |

With this system, students feel in control of their preparation. Smart tracking gives more peace of mind than blind revision cycles.

Anchor Points for High-Retention Revision

Use these anchor methods across the CMA syllabus.

- Flashcards for definitions and formula-heavy chapters

- Flow diagrams for tax and audit subjects

- Mini case studies for costing and strategic management

- One-page summaries for economic laws and company law

- Weekly 60-question drill from mixed subjects

These small steps create a strong revision culture that helps you stay grounded through the preparation journey.

A Revision Map for US CMA Attempts

This part gives you a combined map to revise the CMA USA syllabus, especially for students who plan to take both pathways over their career.

US CMA Revision Map

Use a 30-day block for each part of the US CMA exam.

- For the US CMA Part 1 syllabus, rotate between performance management, external reporting, and internal controls.

- For the US CMA Part 2 syllabus, assign longer blocks for decision analysis and financial statement interpretation because these topics influence essay-type scenarios.

- Keep 20 per cent of your time for pure question solving and mock exams.

When you combine these two revision maps, your conceptual clarity strengthens across both qualifications.

Career Pathways That Open Up Through the CMA Syllabus

This section outlines the career opportunities that align with the CMA syllabus. These roles may vary across sectors, but they share one common thread. Employers trust CMA candidates because they understand both financial logic and managerial reasoning.

Popular Job Roles After CMA

- Cost Accountant

- Business Analyst

- FP&A Analyst

- Internal Auditor

- Tax Associate

- Financial Reporting Specialist

- Investment Analyst

- Risk Analyst

- Strategy Consultant

- Operations Finance Specialist

Industries That Actively Hire CMA Candidates

- Manufacturing

- FMCG

- Consulting

- Banking and financial services

- Energy and infrastructure

- Technology and IT services

- Pharma and healthcare

- Logistics and supply chain

The CMA syllabus builds a combination of cost analytics, corporate reporting, taxation, business strategy, and financial interpretation. This multi-disciplinary exposure makes candidates useful across industries and functions.

How Imarticus Learning Supports Students Through the CMA Syllabus

This part explains how structured mentorship helps you navigate the CMA syllabus more confidently. Imarticus Learning provides a blend of instructor-led sessions, practical case studies, and exam-focused problem-solving workshops that align perfectly with the CMA course design.

How Mentorship Improves Exam Readiness

- You gain access to structured notes that reduce reading time.

- Expert faculty help simplify difficult chapters like decision analysis, audit, and taxation.

- Live doubt-solving sessions speed up your learning significantly.

- Mock exams are designed using the latest pattern across both the Indian CMA and the CMA USA course syllabi.

- Placement assistance and soft-skill training help you transition smoothly into finance roles.

For many learners, the biggest advantage is the accountability created through continuous guidance and personalised study plans.

FAQs on CMA Syllabus

This section brings together the most frequently asked questions students have while navigating the CMA Syllabus. Each answer is designed to give you clarity on the qualification, the learning journey, the exam structure and the career outcomes connected to it.

What is the syllabus for CMA?

The syllabus for CMA is a structured framework that develops your accounting, costing, taxation, strategic management, and financial decision-making skills. It has two parts in the US CMA pathway. When students study CMA with the right sequence and revision cycles, they gain a strong command over financial reporting, cost optimisation, tax compliance, and business strategy. Many candidates rely on structured coaching through Imarticus Learning to navigate the entire CMA syllabus efficiently using curated notes, mock tests, and faculty-led guidance.

Is the CMA exam difficult?

The CMA exam is considered challenging because the syllabus is broad and blends theory with numerical application. The syllabus is designed to test your ability to interpret business data and make financial decisions, which is why regular revision and conceptual understanding matter more than memorisation. Students who follow a structured plan, especially under mentors at Imarticus Learning, often find the CMA exam manageable because they learn how to study CMA in smart phases.

Is CMA hard or CS?

CMA focuses heavily on costing, finance, taxation, analytics, and strategic decision-making. CS revolves more around corporate laws, compliance frameworks, corporate secretarial work, and governance. Students who enjoy numbers, analytics, budgeting, and financial interpretation often find CMA more intuitive. On the other hand, learners who prefer detailed legal reading might find CS suitable. Ultimately, choosing between the two depends on your interest areas.

Is CMA difficult than CA?

CA has a wider academic depth and a larger number of papers, while CMA is built around cost analytics, corporate finance, taxation, and strategic decision-making. Students who enjoy practical financial reasoning generally find the CMA syllabus comparatively accessible because the exam pattern focuses on applied understanding. Difficulty also depends on your preparation strategy. With structured coaching from Imarticus Learning, many students find that CMA becomes manageable through guided practice.

What is the CMA salary?

CMA professionals earn attractive salaries because companies value analytical skills, cost optimisation expertise, and strong financial judgment. According to the IMA Global Salary Survey 2023, the global median total compensation for CMAs is about $86,955, while professionals in the Americas region report a median total compensation of $163,932. In regions like India, the Middle East and Africa, CMA professionals earn an average total compensation of around $39,583.

What are the 4 types of accountants?

Across the industry, the four major types of accountants include financial accountants, cost accountants, management accountants, and tax accountants. Each type corresponds to a particular set of functions within the CMA. For example, cost accountants work with costing principles, budgeting, and variance analysis, which are important parts of the CMA syllabus at intermediate and final levels. Management accountants apply decision-making tools and analytics. Tax accountants work with direct and indirect taxes. Financial accountants apply corporate reporting concepts.

What are 5 careers in accounting?

There are many career paths available once you complete the CMA. Five popular roles include FP&A analyst, cost accountant, internal auditor, corporate reporting specialist, and financial analyst. Each of these roles uses a different segment of CMA. With structured training from Imarticus Learning, students transition smoothly into these finance careers.

Shaping the Road Ahead for Your CMA Goals

As you reach the end of this guide, take a moment to recognise how much clarity you now hold about the CMA pathway. The CMA syllabus is not just a set of papers and chapters. It is a professional development structure that sharpens your financial judgment, builds your analytical stamina, and prepares you for the kind of decisions that shape real organisations. Every topic you cover strengthens a different part of your thinking. Every revision cycle you complete makes you more confident in handling complex financial situations.

Preparing for CMA is a long-distance effort, and the learners who thrive are the ones who approach the syllabus with a calm structure rather than pressure. You now understand how each level fits into your growth, how topic clusters interact, how the Indian and US CMA pathways open doors across industries, and evaluate the CMA course duration to plan your study timelines realistically and balance work, education, and personal commitments. With the right support system, consistent practice, and the study methods outlined across this three-part guide, you can turn this preparation phase into a rewarding journey.

If you ever feel the need for structured guidance, industry-aligned training, or curated learning support, Imarticus Learning offers a supportive environment where mentors walk with you through every stage of the CMA course.

Use everything you have learned here to move confidently toward your CMA goals. Your skill set is already taking shape. All that remains is steady progress and the commitment to keep showing up for yourself every day.