Last updated on November 13th, 2025 at 05:29 pm

Thinking about stepping into the world of finance, whether you’re a fresh grad, a working professional itching for the next leap, or someone simply curious about the inner workings of money and markets? Then the CFA Course might be your ticket.

Let’s be honest: pulling off a serious credential like the CFA isn’t just about collecting letters after your name. It’s about rewiring how you think: not only what the numbers show, but why they matter, how they drive decisions, and what they reveal about the financial world around you. The journey is more than exams and textbooks – it’s about cultivating a mindset that speaks the language of global finance, one that hiring managers and investment teams recognise and value.

I’ll give you a look at what the journey actually involves, the skills you’ll pick up, the doors it can open for your career, and some tips to tackle it without feeling burned out. By the end of this guide, you’ll have a clear roadmap for your CFA course journey – so you can step in confident, focused, and ready to take your place in the world of finance. Let’s dive in and explore what makes this credential a game-changer.

Interesting Fact: The CFA Program is recognised in 160+ markets around the world.

What is the CFA Course?

So you might be wondering – what is CFA, really?

What does a CFA charterholder actually do?

To me, the CFA course isn’t just another finance qualification – it’s a shift in the way you see the world of investing. It’s what happens when you stop just reacting to market changes and start anticipating them with insight.

The Chartered Financial Analyst (CFA) program, offered by the CFA Institute, is one of the most respected credentials in global finance. It’s not a quick shortcut or a simple course to boost your career – think of it more like a marathon one that builds lasting expertise and prepares you for the long game in investment and financial management. Each level challenges you to dig deeper into how money flows – through markets, portfolios, and entire economies, and trains you to make smarter, more informed decisions along the way.

Think of it as your complete financial toolkit. You don’t just learn how to analyse a balance sheet; you learn how to connect numbers to narratives – to understand why a company’s valuation changes, how macroeconomic shifts affect portfolios, and what ethical choices define great investors.

When someone earns the CFA charter, it signals more than knowledge. It shows discipline, judgment, and a long-term view – the exact traits that employers and clients look for in investment professionals from Mumbai to London to New York.

In short: the CFA course isn’t just about mastering finance – it’s about learning to think like the people who shape it.

If you’re still exploring whether the CFA course is right for you, our CFA course details section breaks down everything from how the program works to what skills you’ll build and how to prepare for success.

The fundamental purpose of finance is to contribute to society through increases in societal wealth and well‑being. We need more people in our professional ranks who have clear ethics and a sense of commitment. – Paul Smith, CEO of CFA Institute

Why Choose the CFA Course for Your Finance Career?

Why would anyone willingly invest hundreds of hours in this demanding course? For me, it’s simple: it prepares you to be the professional people turn to when markets move, when portfolios need insight, or when critical financial decisions are on the line.

Imagine being the go-to professional when your company needs insight into market trends, portfolio risks, or asset valuations. The CFA charter doesn’t just open doors; it unlocks them widely across investment management firms, hedge funds, and corporate finance departments worldwide.

When employers seek trusted experts, having a CFA course credential on your resume sets you distinctly apart. And more importantly, it gives you the confidence to make decisions that others might hesitate to take.

The CFA program is experiencing significant growth in India, with candidate numbers increasing by almost 25% annually since 2019, highlighting its growing importance in emerging markets.

Curious why the CFA is hailed as the gold standard in finance? This video breaks down what makes the CFA so valuable for your career – from global recognition to high-paying roles.

CFA Course Levels and Curriculum

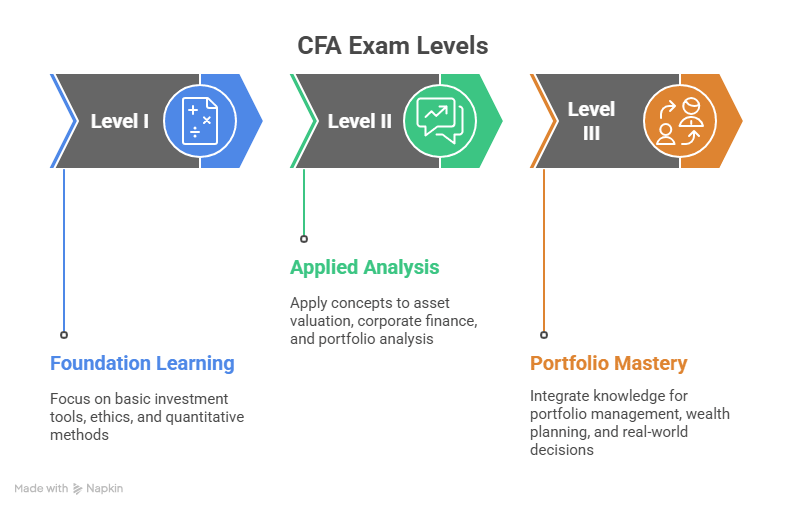

The CFA course is similar to climbing a mountain – each level builds on the last; it is structured in three progressive levels:

Level 1 – Building Fundamentals: It’s like learning to read the language of the financial world. This level assesses your understanding of the basics, such as ethics, quantitative methods, economics, and financial reporting, with multiple-choice questions. It’s the foundation every apprentice investor needs.

Level 2 – Application of Concepts: Now, envision stepping into the shoes of a financial analyst who must apply knowledge to real-world cases. Level 2 examines your ability to analyse complex equity valuations, fixed income, corporate finance, and risk. At this level, the questions are scenario-based, mirroring actual market challenges.

Level 3 – Mastering Portfolio Management: At this stage, the questions are scenario-based, reflecting real-world market challenges and opportunities. The focus is on advanced portfolio management and wealth planning, with essay-style and case study questions that test your ability to think critically, apply sound judgment, and communicate your investment rationale effectively – just as you would in actual client situations.

Each step builds on the last, requiring around 300 study hours per level – so perseverance counts as much as intelligence.

You can hire people with an MBA, but you don’t necessarily know that one MBA is the same as another MBA. If you hire investment professionals with a CFA designation, you absolutely have confidence at the level of qualification.” – CFA Institute.

The CFA Course Eligibility

When aspiring CFA candidates or current professionals inquire about the program, their uncertainties often stem not from the official structure, exam format, different levels, potential salary, fees, or diverse career paths, but rather from their personal perceptions and assumptions about these aspects.

Finance credentials today aren’t just certificates; they’re global passports. The CFA designation is one such credential, well-respected across continents and industries. But with all the buzz around this top-tier finance credential, many wonder –

Who exactly is eligible to take the CFA course?

Is it only for finance graduates?

Is there an age bar?

Do you need years of experience before applying?

This is one of those common misconceptions about the CFA program, and I always enjoy clearing up that confusion as soon as possible. Whenever someone asks me about the CFA’s prerequisites, they expect a long list of rigid financial experience, like needing five years as a junior analyst or something equally intimidating.

The truth might surprise you: the CFA program is actually designed to be incredibly inclusive and accessible to a broad range of candidates, particularly for the first hurdle, Level I. For me, that’s the beauty of it. They’re looking for potential and commitment, not just a CV. You essentially have three pathways to apply for the Level I exam:

Educational Background: A Bachelor’s Degree (or an equivalent qualification) is the standard route. You don’t even have to have completed it yet – you can register if you are in the final year of your program.

Professional Experience – if you’ve clocked 4,000 hours of work experience and higher education, that adds up to three years. Critically, this experience doesn’t even have to be investment-related – it just needs to be relevant to business.

So, in short, you don’t need years of dedicated investment-banking experience to start. You are required to have one of those solid foundations in place, and then, most importantly, the discipline to study. The real experience begins when you start tackling the curriculum!

CFA Exam

The CFA program has three levels, each testing different skills. The program’s three levels take you from foundational knowledge to advanced portfolio management:

- Level I: Focus on basic concepts – ethics, quantitative methods, and financial reporting.

- Level II: Dive deeper into asset valuation and investment tools.

- Level III: Master portfolio management and wealth planning.

| Level | Focus | Exam Format | Duration |

| Level 1 | Basic knowledge and comprehension of investment tools, ethics, and financial reporting | Multiple-choice questions | 2 sessions × 2 hours 15 mins each |

| Level 2 | Application of concepts to analyse and value investments | Item set questions (mini case studies) | 2 sessions × 2 hours 12 mins each |

| Level 3 | Portfolio management, wealth planning, and integrating concepts with decision-making | Constructed response (essay) + item sets | 2 sessions × 2 hours 12 mins each |

Key Points:

- All exams are offered in English.

- Ethics is emphasised at every level.

- Passing requires both knowledge and the ability to apply concepts to real-world scenarios.

Want a clear snapshot of what the CFA course journey looks like and why it’s worth it? This video covers the essentials for anyone curious about starting their CFA path.

CFA Course Preparation

Let’s be honest – preparing for the CFA exams is tough. You can’t just cram formulas or skim through notes and expect to ace it. It’s about really understanding the material and being able to use it when it counts. I like to think of it as training for a marathon; you don’t run 42 km on day one. You start small, stay consistent, and slowly build the endurance to cross that finish line.

From what I’ve seen and heard from people who’ve actually done it, here’s what really helps:

Start early and stay consistent.

One of my friends, Rohan, began his CFA Level I exam preparation four months in advance. Every night after work, he’d put in just 90 minutes. No all-nighters, no panic. By the time exam week came around, he was calm, and he passed on the first try. That’s the power of steady effort.

Practice like it’s the real thing.

A candidate once told me she treated her mock exams like the real deal – no breaks, no distractions, just her and the timer. By exam day, she wasn’t nervous; it just felt like another practice session. Mock tests aren’t just practice – they build confidence.

Don’t skip ethics.

I get it, ethics doesn’t sound exciting. But a lot of people miss their passing mark because they underestimate it. One person I know actually turned his borderline fail into a pass because he reviewed ethics carefully in the last week – it really can make that much difference.

Find your tribe.

Studying alone can feel isolating. I remember a small online group that met every Sunday evening – half the time they were just complaining about how hard derivatives were, but that sense of community kept everyone motivated. You learn faster when you’re not alone in it.

Take care of yourself.

Burnout is real. I’ve seen people try to power through on four hours of sleep and crash halfway. One candidate I spoke to started taking short walks after study sessions – it helped clear his head and made a huge difference in his focus.

The CFA exams are challenging – no sugar-coating that, and pass rates often sit below 50%. But it’s not about being a genius. It’s about showing up, being consistent, and believing in the process. When you finally see that “pass” on your result, all those late nights and weekends suddenly feel worth it.

Did you know that Global pass rates hover around 40-50% per level, highlighting the rigour and value of the program.

CFA Course Fees

Investing in CFA Certification is an investment in your career; the return often outweighs the cost many times over. From my experience, understanding the CFA course fees upfront helps you plan better. Here’s a breakdown:

| Level | Program Fee (INR) | Registration Fee (INR) |

| Level 1 | ₹ 60,000 (all‑inclusive) | ₹ 10,000 |

| Level 2 | ₹ 60,000 (all‑inclusive) | – |

| Level 3 | ₹ 60,000 (all‑inclusive) | – |

Note – The program fee at Imarticus covers the program, including both training and study materials.

Career Opportunities After Completing the CFA Course

Earning your CFA charter opens doors to a wide array of finance career paths – both in India and globally. CFAs are highly sought after because they bring a strong mix of analytical skills, ethical standards, and practical market knowledge. Some of the key career opportunities include:

CFAs thrive in roles like:

- Portfolio Managers who decide how to allocate assets for investment funds.

- Research Analysts digging into company fundamentals and market trends with analytical skills.

- Investment Bankers advising on mergers, acquisitions, and capital raising.

- Risk Managers assessing exposure and mitigating financial threats.

- Wealth Managers guide wealthy clients through investment decisions.

- Corporate Finance Analysts who support companies with budgeting, financial planning, and strategic thinking and decision-making.

- Equity / Fixed Income Analysts specialise in analysing stocks, bonds, and other securities to make informed investment recommendations.

- Fund Managers / Hedge Fund Analysts manage mutual funds or alternative investment funds, balancing growth and risk.

- Financial Consultants / Advisors provide strategic advice to businesses and individuals on financial planning, investments, and retirement strategies.

Employers worldwide trust CFAs to make crucial financial decisions. Your salary potential grows alongside this trust, with entry-level CFAs in India averaging ₹8-10 LPA and seasoned professionals earning well into the ₹40 LPA+ range.

If you’re curious about how the CFA designation can shape your professional journey, check out our detailed guide on the career options after CFA certification.

Interesting Fact: According to the CFA Institute, 91% of charterholders report that their designation has enhanced career opportunities.

Salary After Completing CFA

Now, onto the part that really catches everyone’s attention – the salary. Earning your CFA charter definitely opens the door to better paychecks, but it’s also about the career growth and opportunities that come with it.

Entry-level CFAs in India can usually expect salaries around ₹8-12 lakhs per annum, which is generally higher than non-certified peers in finance roles. And experience makes a significant difference. Mid-career professionals with a CFA often reach ₹20-40 lakhs or more, especially in multinational companies or investment firms.

CFA Level 1 – Entry-Level Roles & Salary Growth

CFA Level 1 candidates often start in analyst or support roles; salary growth accelerates with experience or after clearing Level 2.

| Job Role | Entry-Level (0-2 yrs) | Mid-Level (3-5 yrs) | Senior-Level (6-10 yrs) |

| Research Analyst (Intern/Junior) | ₹4-6 LPA | ₹7-10 LPA | ₹12-15 LPA |

| Financial Analyst | ₹5-8 LPA | ₹9-12 LPA | ₹14-18 LPA |

| Equity Research Associate | ₹6-9 LPA | ₹10-14 LPA | ₹15-20 LPA |

| Data/Valuation Analyst | ₹4-7 LPA | ₹8-11 LPA | ₹12-16 LPA |

| Investment Banking Support Analyst | ₹6-10 LPA | ₹12-16 LPA | ₹18-25 LPA |

CFA Level 2 – Intermediate Roles & Salary Growth

After Level 2, professionals often move into front-office or client-facing roles with noticeable pay jumps.

| Job Role | Entry-Level (0-2 yrs) | Mid-Level (3-5 yrs) | Senior-Level (6-10 yrs) |

| Equity Research Analyst | ₹8-12 LPA | ₹14-20 LPA | ₹20-28 LPA |

| Investment Banking Associate | ₹10-15 LPA | ₹18-25 LPA | ₹28-35 LPA |

| Portfolio Analyst | ₹9-13 LPA | ₹15-22 LPA | ₹22-30 LPA |

| Credit/Risk Analyst | ₹8-12 LPA | ₹14-20 LPA | ₹20-26 LPA |

| Corporate Finance Analyst | ₹7-11 LPA | ₹12-18 LPA | ₹18-25 LPA |

CFA Level 3 – Charterholder/Advanced Roles & Salary Growth

CFA Level 3 pass-outs and charterholders are eligible for senior, leadership, and client advisory roles. Compensation includes bonuses and performance-linked pay.

| Job Role | Entry-Level (0-2 yrs) | Mid-Level (3-5 yrs) | Senior-Level (6-10+ yrs) |

| Portfolio Manager | ₹12-18 LPA | ₹20-35 LPA | ₹40-60 LPA+ |

| Investment Manager | ₹14-20 LPA | ₹25-40 LPA | ₹45-70 LPA+ |

| Equity/Research Head | ₹10-16 LPA | ₹20-30 LPA | ₹35-50 LPA+ |

| Risk/Strategy Consultant | ₹12-18 LPA | ₹22-32 LPA | ₹35-55 LPA+ |

| Wealth/Asset Manager | ₹10-15 LPA | ₹18-28 LPA | ₹30-45 LPA+ |

Globally, the story looks even more impressive. Fresh CFAs can start at $70,000+ annually in countries like the US, UK, or Singapore. Senior CFAs, especially portfolio managers or executives, easily pull in six-figure salaries – sometimes well over $200,000. If you’re curious about how these numbers compare closer to home, check out our detailed breakdown of CFA salary in India to see how earning potential grows with experience and role.

But here’s a little secret: the salary is more than just your base pay. CFA holders often get bonuses, stock options, and profit-sharing opportunities that can multiply their total income. Plus, the global nature of the CFA means you can explore career avenues around the world – and that international edge can be a game-changer.

Of course, the CFA alone isn’t an instant ticket to a massive paycheck. It’s a respected credential that, combined with real-world experience, networking, and continuous learning, propels your career forward steadily but surely.

CFA Course vs. Other Finance Certifications

If you’ve met professionals with CPA, FRM, or CA certifications, you might wonder how the CFA course compares. Think of it as choosing between various vehicles for a financial career journey – the CFA course is particularly tailored to investment and portfolio management, while the CPA focuses more on accounting and auditing, and the FRM zeroes in on risk analysis. The CFA charter’s global recognition and emphasis on ethics make it especially coveted in asset management circles, offering a unique blend of depth and applicability. Here’s a concise overview of the CFA course with other popular finance certifications to help you get a better understanding.

| Aspect | CFA | CPA | FRM | CA |

| Eligibility | Bachelor’s or final year | Bachelor’s + accounting credits | Bachelor’s degree | 10+2 or graduation |

| Levels | 3 | 4 | 2 | 3 |

| Exam Style | MCQs + case studies | MCQs + simulations | MCQs | Descriptive + objective |

| Pass Rate | ~40–45% | ~50% | ~45–50% | ~10–15% |

| Focus | Investments & finance | Accounting & auditing | Risk management | Accounting & taxation |

| Job Roles | Analyst, PM, Strategist | Auditor, CFO, Controller | Risk Analyst, Risk Manager | Auditor, Finance Manager |

| Salary Range | ₹8-25 LPA | ₹7-20 LPA | ₹8-22 LPA | ₹6-18 LPA |

| Global Recognition | Very high | High (esp. U.S.) | High | Strong in the Commonwealth |

Why Choose Imarticus for Your CFA Course Journey?

Having a CFA program on your resume is one thing; mastering it is another. Here’s why I feel Imarticus Learning is a great learning partner for your CFA course preparation:

- Structured Learning & Mentorship: Every student gets one-on-one guidance from industry experts to help understand tough concepts and stay on track.

- Global Curriculum Standards: Imarticus is aligned with CFA Institute guidelines, ensuring you’re prepared for exam rigour worldwide.

- Practical Exposure: Through case studies, simulations, and workshops, you learn to connect theory with real-world decision-making.

- Career Support: Resume-building, interview preparation, and access to global networks help you transition from certification to career.

With this kind of backing, I always tell you’re not just studying for the CFA course; you’re preparing to step into a role where your decisions matter.

FAQs About the CFA Course

If you’ve made it this far, you probably still have a few questions swirling in your mind. These frequently asked questions break down everything you need to know about the CFA course.

What is a CFA course?

The CFA course is a globally respected program that trains you in investment management, financial analysis, and ethical decision-making. It’s way more than just studying numbers – it’s about learning to see what those numbers mean, how they influence markets, and how to make smart, confident financial decisions that matter. Think of it as a deep dive into the language and mindset of the world’s top investment pros.

Is CFA harder than CA?

It depends on your strengths. CA is more technical and accounting-heavy, with tough exams and lots of memorisation. CFA, meanwhile, focuses on investment analysis, markets, and decision-making – it’s about applying concepts, not just recalling them. Both are challenging, but in different ways. If you love finance and markets, the CFA course might feel more your style.

What is a CFA salary?

CFA charterholders usually see a strong boost in earnings. In India, fresh CFAs earn around ₹8-12 LPA, while experienced professionals can make ₹20-40 LPA or more, especially at top firms. Globally, salaries often start above $70,000 and rise quickly with experience. It’s not instant – but it’s a steady, rewarding climb. With Imarticus Learning’s comprehensive CFA training programs, you can strengthen your conceptual foundation, gain industry insights, and position yourself for these high-growth career opportunities.

How many years is the CFA course?

On average, it takes about 2.5 to 4 years to complete all three levels of the CFA course, considering you pass each on your first try and accumulate necessary work experience. With structured guidance and expert mentorship from Imarticus Learning, you can streamline your CFA journey and stay on track to achieve your certification efficiently.

Who is eligible for the CFA course?

You need a bachelor’s degree or equivalent, or be in your final year of studies. Alternatively, if you have a combination of work experience and education equaling four years, you can apply for the CFA course. You don’t need prior investment experience to start; it’s designed to welcome diverse backgrounds. With Imarticus Learning’s CFA prep program, you can get personalised guidance and structured study support to confidently meet eligibility requirements and excel in your exams.

Is CFA higher than MBA?

They serve different purposes. CFA is a deep specialisation in investment and finance, focusing on technical expertise and ethical practice. MBA covers broader business management topics like strategy, marketing, leadership, and operations. Many professionals actually complement their MBA with CFA to get both breadth and depth.

What is the CFA course pass rate?

Historically, pass rates for the CFA course hover below 50%. The exams are tough and designed to be challenging – they filter out those who aren’t fully prepared. With the right preparation and mindset, you can absolutely ace it. At Imarticus Learning, you’ll get guidance from expert mentors, a hands-on, industry-focused curriculum, and continuous support throughout your journey.

Is 27 too late for pursuing the CFA course?

Absolutely not! The CFA program has no age limit. Whether you’re 22 or 40, if you have the drive to learn and grow in finance, this credential is for you. Many people pursue the CFA mid-career to switch tracks or boost their credentials.

How many papers are in the CFA course?

Instead of ‘papers,’ the CFA program has three levels – Level 1, 2, and 3. Each level has a unique exam format covering core finance topics, increasingly testing your analytical and portfolio management skills as you progress.

Is the CFA course in demand?

Yes! CFA charterholders are highly sought after in investment banking, asset management, equity research, risk management, and wealth planning. The global finance industry values CFA expertise, and demand continues to grow alongside complex financial markets.

Which degree is better with the CFA Course?

CFA course pairs well with degrees in finance, economics, accounting, business, or even engineering and math. If you want a smooth learning curve, a finance or commerce background helps, but CFA’s design welcomes all analytical minds ready to dive deep into investments.

Can CFA earn 1 crore?

Yes, senior CFAs in leadership roles like Chief Investment Officers or Fund Managers in top firms can earn ₹1 crore or more annually, counting bonuses and profit shares. It’s not guaranteed overnight, but it is attainable with experience, skill, and the right opportunities.

Elevate Your Finance Career with the CFA Course

Completing the CFA Course isn’t just a qualification – it’s a transformation. It represents the shift from knowing what happens in finance to understanding why it matters, and having the confidence to act on that knowledge.

As the CFA Institute puts it: For many of us, ‘CFA charterholder’ is a defining attribute. It means you have made a significant commitment to your practice, putting investors first, and maintaining the highest ethical and professional standards.

Earning this credential isn’t just about a certificate or clearing the levels – it’s a key that opens doors to careers in investment management, wealth advisory, risk strategy, and beyond. It tells employers around the world that you’re not just qualified – you’re ready to lead.

CFA Course is more than a certificate – it’s your chance to think, decide, and lead like a finance pro. When you finish, you’ll stand out, make an impact, and speak the language of global finance. Ready to begin your career as a CFA Charter?