In the fast pace of change in today’s financial landscape, leadership is not technical competence. Leadership requires vision, adaptability, and deep strategic ability to think. A CFO Program trains finance leaders in the competencies that they need to develop to move from functional specialists to enterprise-wide thought leaders. Committed to building the next-generation finance leaders, a CFO Program equips finance and technical professionals with enhanced leadership, strategy, and innovation skills.

Financial leadership is evolving at a more rapid rate globally. As per Deloitte CFO Insights 2024, 82% of Indian CFOs will lead the charge on driving AI and digital transformation. This calls for financial leaders to bridge numbers and adopt the bigger picture of business leadership. In CFO leadership development, the students are given confidence, competence, and networking to rise up into the C-suite and act as business transformers.

What Is a CFO Program and Why Does It Matter?

Understanding the Chief Financial Officer Course

A CFO program is a high-level course for chief financial officers and senior finance executives who wish to move a level. These courses combine leading-edge finance theory and in-job application with a focus on strategy, leadership, and innovation. London Business School’s CFO Program has some great strengths:

- Blend of global and India-centric strategies

- Alumni executive standing at a world-ranked school

- LBS London and Mumbai campus immersion sessions

This joint experience prepares finance leaders to be poised to tackle India’s fast-changing financial landscape and emerge tomorrow’s C-suite leaders.

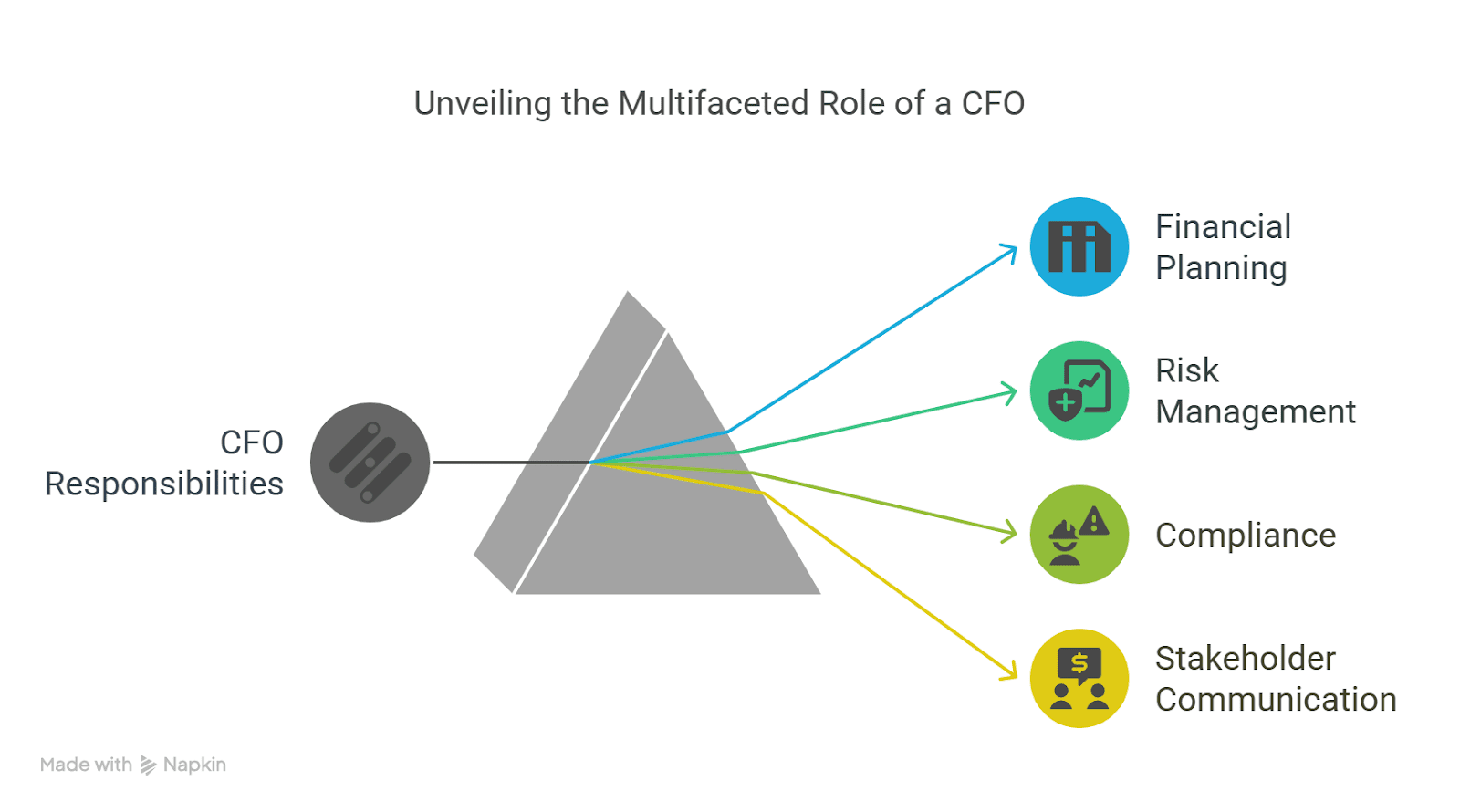

Why the CFO Role Is More Strategic Than Ever?

CFOs are no longer the guardians of finance. They are the masters of business transformation. 69% of Indian CFOs agree that by 2030 the CFO will play an even greater role in business transformation than the CEO (PwC CFO Study 2023). Development of CFOs as leaders is not an option, but a necessity. A world-class C-Suite executive program empowers CFOs to deliver higher-order capabilities in digital transformation, sustainability, risk, and organizational strategy.

Key Benefits of a CFO Program

Building Strategic Skills for CFOs

One of the primary benefits of a CFO program is learning to develop world-class strategic savvy. Through master-led bottom-up sessions and simulations, financial leaders can learn how to:

- Connect finance strategy to business goals

- Pulse cross-functional teams

- Overcome bureaucratic resistance

- Test and light digital acceptance

- Data-based decision-making

A guide such as this enables CFOs to become future-proofed leaders who can chart the company’s future.

Gaining Global and India-Specific Insights

One of the distinct advantages of London Business School’s Chief Financial Officer programme is that it blends global best practices with India-relevant content. The participants have access to:

- Global professionals as expert mentors, attuned to India’s market and regulatory environment

- India-specific case studies with financial themes

- India-specific modules on navigating India’s rapidly changing economy

By this dual emphasis, the attendees transfer state-of-the-art knowledge directly into their own market contexts.

Networking and Executive Education for Finance Leaders

Undoubtedly the most often under-leveraged CFO program benefit is the power of the peer network. As part of an executive alumni network worldwide, they have access to more than 55,000 global leaders. Through peer conversation, collective experience, and collaboration, CFOs gain a network exponentially stronger than would be achieved in the classroom.

Programme Highlights: What Sets This CFO Program Apart?

Immersive Campus Experiences

London Business School CFO Programme offers learners immersion sessions in Mumbai and London. Immersion sessions offer leaders a chance to:

- Meet global industry and faculty leaders

- Get accustomed to innovative workshops and simulations

- Develop solutions for real-life challenges

These interactions allow for accelerated learning and create space for transformational experiences that pinpoint milestone points of participants’ leadership journey.

Capstone Business Missions

Capstone projects in the program are geared to meet India’s economic and regulation-localised problems. Members:

- Develop new models applicable to actual business issues

- Develop solutions implementable with measurable impact

- Refine their problem-solving and leadership skills

Leadership Transformation

CFO Program is leadership transformation by definition. Members learn:

- Improved leadership mindset

- Improved executive presence

- Influencing and negotiating skills

- Structured process for transitioning successfully into C-suite roles

Why Indian CFOs Need Specialized Leadership Training?

Addressing India’s Financial Landscape

Indian CFOs have their own set of challenges ranging from rapid digitalization to complex regulatory regimes. Global finance insights and India expertise CFO training offers them the competitive advantage. They are able to benefit from:

- Crossing regulatory hurdles in India

- Picking up skills for managing digital disruption and innovation

- Approaches for sustainable growth

The Role of Digital Transformation

Since 75% of CFOs anticipate that AI and automation will redefine the finance leadership model in five years (Gartner Finance Research 2024), it is certain that the contemporary CFO must make technology a strategic enabler. A C-Suite executive program enables CFOs to drive digital transformation, benefit from data analysis, and roll out technology-based business models.

The Growing Importance of Cross-Functional Leadership

The modern CFO must span functions wider than finance to operations, marketing, HR, and IT. Strategic CFO competencies are needed to:

- Breaking organizational silos

- Building cross-functional alignment

- Influencing enterprise-wide innovation

And these empower CFOs to become best-in-class organizational success orchestrators.

How a CFO Program Shapes Future Leaders?

Developing Emotional Intelligence and Executive Presence

Emotional intelligence (EI) at a high level is required to make the transition from finance expert to C-suite leadership. CFO growth as a leader focuses on EI capability development so they can be in a position to:

- Build credibility and trust with stakeholders

- Manage complex relationships between individuals

- Lead with empathy and resilience

They are no less critical as technical knowledge in order to achieve a seat at the table to be a leader.

Strengthening Strategic Decision-Making

Effective CFOs walk the tight wire between short-term financial results and long-term planning. By using trainee experience, a Chief Financial Officer course instructs leaders to:

- Balance risk with uncertainty in multi-variable issues

- Make strategic, fact-based decisions under pressure

- Impose finance know-how on planning across the enterprise

Creating Lasting Impact

Lastly, the goal of any executive finance training for CFO leaders is to form leaders who have sustainable, impactful influence. Top CFO programs train alumni with:

- A leadership vision that is inspirational

- A capacity to drive transformative change

- A capacity to drive results at the most senior levels

FAQs: CFO Program Benefits and Insights

Q1: What is a CFO Program, and who should enroll?

A: A CFO Program is an incumbent CFO course designed for aspiring CFO, and senior finance leader executive education program that equips them to acquire leadership, strategy, and innovation skills.

Q2: How can CFO leadership development influence digital transformation?

A: It helps CFOs build AI, automation, and data analytics skills to drive digital projects and bridge finance projects with technology disruption.

Q3: What are the primary advantages of the CFO program?

A: Chief advantages include greater financial and strategic acumen, global network of executives to draw on, capstone projects utilized, and enhanced leadership profile.

Q4: How is the course structured for a Chief Financial Officer?

A: It is typically comprised of modules of experienced leadership, campus-based interactive learning, capstone projects, and networking among peers, all being planned with the focus on addressing real-world business finance leadership problems.

Q5: Why would a C-Suite executive program benefit a CFO?

A: It provides CFOs with the tools, templates, and self-belief to be company-wide leaders and drive organisational change.

Q6: How does finance leadership development address India-specific needs?

A: It merges global best practice with India-applicable content so that CFOs are able to meet regulation complexity, Indian growth and innovation at speed.

Q7: Why is today the right time for executive education in finance leadership?

A: As the business landscape keeps changing at breakneck speed day by day, relevance is a day-by-day by-product of learning. Executive education equips CFOs with the latest knowledge, strategic agility, and leadership potential to succeed.

Conclusion: Elevate Your Leadership with a CFO Program

In an era where the CFO mandate is widening, a CFO Program offers the special platform from which to rise to the occasion. By coalescing finance excellence, leadership, strategy, and innovation, CFOs are empowered to emerge as C-suite leaders of choice. Whether charting India’s regulatory labyrinth, driving digital reinvention, or triggering enterprise transformation, CFOs need to excel at more than technical skills – they need visionary leadership.

London Business School’s Chief Financial Officer programme builds finance leaders into the tools, knowledge, and networks they require to thrive. From hands-on learning on campus to international networking, from capstone strategy projects to building emotional intelligence, the programme builds leaders who will redefine the future of finance.

Want to set the future as a next-gen CFO? Invest in yourself today. Join a C-Suite executive program that will inspire, transform, and change you. Engage your leadership, extend your influence, and establish your company’s future with a world-class CFO Program.

Do you aspire to be an insider on the path to the C-suite? Begin today and redefine the word being a modern CFO.