Did you know that 78 per cent of high-end banks include tool skills as a must-have capability for new recruits?

And in 2023, global investment banking fees totalled USD 94.7 billion, highlighting intense competition and the value placed on efficiency (Source).

To be great at Investment Banking, you need to dominate a set of specialised applications that drive every deal, pitch and valuation.

Why Tool Mastery Is Essential for a Career in Investment Banking

A successful investment banking career depends on swift analysis, airtight modelling and persuasive presentations. Firms seek candidates who can translate raw data into investment theses with precision.

By honing your banking skills on industry-standard platforms, you’ll stand out in a crowded graduate pool and deliver value from day one. If you also want to learn about a career in banking or an online finance course, read the full article for better understanding and clarity.

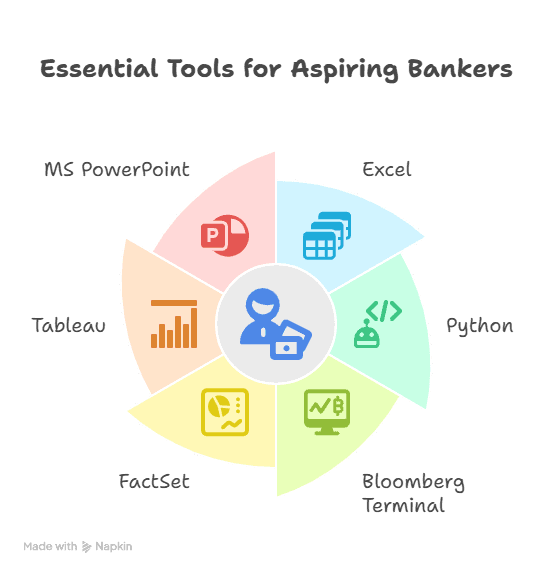

Top 6 Tools Every Aspiring Banker Must Learn

1. Microsoft Excel

Excel underpins virtually every aspect of deal analysis.

- Advanced formulas (INDEX–MATCH, OFFSET) facilitate dynamic modelling.

- PivotTables and Power Query simplify big data sets.

- VBA macros facilitate repetitive forecasting work.

Most bulge-bracket banks incorporate Excel tests into their hiring processes. Spending time creating custom add-ins or ChatGPT-driven formula builders offers a competitive advantage.

Link: https://www.microsoft.com/excel

2. Bloomberg Terminal

Bloomberg Terminal provides real-time market insight.

- Live quotes, news alerts and economic indicators.

- Proprietary analytics for credit risk, yield curves and relative valuation.

- Instant messaging and API access for retrieving data.

Link: https://www.bloomberg.com/professional

3. Python

Python is becoming increasingly pervasive in banking today.

- Pandas and NumPy for cleaning data and numerical analysis.

- matplotlib for creating complex charts.

- Jupyter notebooks to document code and outputs.

Automating end-of-day price pulls or recalibrating valuation models conserves hours a week. Incorporating Python scripts into your workflow raises your investment banking training.

Link: https://www.python.org

4. Microsoft PowerPoint

Pitch books and board presentations require clarity and design sensitivity.

- Brand-consistent custom slide masters.

- SmartArt and built-in charts bring data stories alive.

- Animations walk executives through intricate deal structures.

- Strong presentation skills complement your technical skills in an investment banking course or live deal environment.

Link: https://www.microsoft.com/powerpoint

5. FactSet {#factset}

FactSet gathers financial statements, consensus estimates and ownership data.

- Historical performance and forecast grids in a single interface.

- API integration with Excel and Python for effortless data pipelines.

- Watchlists and alerts are customisable for sector-specific surveillance.

Manual imports save reduces you to tackle strategic insights a core banking certification competency.

Link: https://www.factset.com

6. Tableau

Tableau transforms spreadsheets into interactive dashboards.

- Drag-and-drop interface uncovers hidden correlations.

- Story points sequence insights for stakeholder buy-in.

- Live database connections support real-time dashboards.

Visualisation skills are more highly priced in online finance programs and live deal rooms to convey major metrics at a glance.

Link: https://www.tableau.com

Comparison Table of Leading Tools

| Tool | Central Function | Top Feature | Approx. Cost |

| Excel | Financial modelling & analysis | VBA macros & Power Query | £100/year (Office 365 licence) |

| Bloomberg Terminal | Market data, news & messaging | Proprietary analytics | $2,000–$2,500/month (subscription) |

| Python | Automation & quantitative research | pandas & Jupyter support | Free (open-source) |

| PowerPoint | Investor presentations | Custom slide masters | £100/year (Office 365 licence) |

| FactSet | Financial database & API | Consensus & ownership data | Subscription-based |

| Tableau | Interactive data visualisation | Live database connections | $70/user/month |

Frequently Asked Questions

What’s the single most important tool for investment bankers?

Microsoft Excel is still essential for modelling and analysis.

How crucial is Bloomberg proficiency?

Very, most jobs need daily use of Bloomberg for market data.

Can I substitute Python with R?

R is better in statistical analysis, but Python is more widely used and hence more desirable.

Which certification provides the best ROI?

The CFA certification and specialised courses, such as CIBOP, provide high salary increases.

How long to learn Tableau effectively?

Elementary dashboards in 2–3 weeks; advanced skills could take 2–3 months.

What banking skills does CIBOP cover?

Excel modelling, Bloomberg navigation, Python automation are much more.

Is VBA relevant?

Yes—VBA is still essential for old systems and rapid automation tasks.

Do I require a proper finance course to break in?

Although not required, a reputable investment banking course shortens your learning curve.

How frequently should I update my skills?

Organise quarterly tool-specific upskilling sessions to keep yourself up-to-date with updates.

Conclusion

Mastery of these tools is your ticket to a successful investment banking career. These skills will take some time to build and master, but once you learn and get hands-on experience in these skills, you will have an exponential career growth.

Key Takeaways:

Excel & Bloomberg: The foundation for solid modelling and real-time market insight.

Python & Tableau: The backbones of automation and dynamic visualisation.

Structured training: Courses such as CIBOP close theory and practical application.

Call to Action:

Ready to accelerate your career? Sign up now for Imarticus Learning’s Certified Investment Banking Operations Professional Program and learn hands-on mastery of the tools that define contemporary banking.