Last Updated on 7 months ago by Imarticus Learning

Earning your US CPA Certification is a career-defining move. It’s not just a credential—it’s a symbol of expertise, global credibility, and access to top-tier finance and accounting roles. Whether… you’re aiming to work at a Big Four firm or lead a finance division in a multinational, the CPA designation can take you there.

Let’s explore the top job roles, the industries that value CPAs the most, & what kind of salaries you can expect. If you’re planning your journey or looking to make the most of your credential, this guide is for you.

Why the US CPA Certification Is a Game-Changer

The US CPA Certification (Certified Public Accountant) is globally recognised, especially valued in the fields of accounting, audit, taxation, and finance. It opens the door to:

- Global career mobility

- Higher earning potential

- Job roles that blend strategy, compliance, and financial leadership

- Immediate recognition among employers and recruiters

If you’re still wondering how the course works, we recommend reading our full breakdown:

👉 CPA Course Explained

Top CPA Job Roles You Can Explore

1. Public Accountant

A classic and respected path. Public accountants handle:

- Audits and attestation

- Tax planning and filing

- Advisory services for individuals and firms

If you aspire to work at a Big Four (Deloitte, PwC, EY, KPMG) or even launch your own practice, this is the place to start. It’s a cornerstone of many CPA designation career paths.

2. Internal Auditor

Companies need auditors to assess risk, ensure regulatory compliance, and evaluate internal controls. With the US CPA Certification, you can take up roles like:

- Internal Audit Manager

- Compliance Auditor

- Risk Consultant

It’s also a great fit for those seeking CPA jobs in multinational companies, where financial transparency is non-negotiable.

3. Corporate Controller

Controllers are the financial gatekeepers of an organisation. They’re responsible for:

- Budgeting

- Financial reporting

- Regulatory compliance

This role is one of the most sought-after high paying CPA jobs, especially in tech, banking, and manufacturing.

4. Financial Analyst

If you enjoy interpreting data to guide investment and business decisions, this is a great fit. CPA-qualified analysts are preferred because of their:

- Knowledge of accounting standards

- Analytical rigour

- Forecasting accuracy

Many accounting jobs for CPA holders include this title, especially in investment firms and corporate finance teams.

5. Tax Consultant

With global taxation laws becoming more complex, CPAs are in high demand for:

- International tax planning

- Transfer pricing

- Tax dispute resolution

If you want to specialise, this is a rewarding option among US CPA career opportunities.

6. Forensic Accountant

Want to combine accounting with investigation? Forensic accountants work on:

- Financial fraud detection

- Litigation support

- Insurance claims

This niche role is increasingly popular among those looking for distinct CPA designation career paths.

Top CPA Job Roles and Salaries (India-Based)

| Job Role | Entry-Level Salary (INR) | Mid-Level (INR) | Senior-Level (INR) |

| Public Accountant | ₹4 – ₹6 LPA | ₹7 – ₹12 LPA | ₹15 – ₹20+ LPA |

| Internal Auditor | ₹5 – ₹7 LPA | ₹10 – ₹14 LPA | ₹18 – ₹25 LPA |

| Financial Analyst | ₹6 – ₹9 LPA | ₹12 – ₹18 LPA | ₹20 – ₹28+ LPA |

| Corporate Controller | ₹8 – ₹12 LPA | ₹16 – ₹24 LPA | ₹30 LPA and above |

| Tax Consultant | ₹5 – ₹8 LPA | ₹10 – ₹15 LPA | ₹18 – ₹22 LPA |

| Forensic Accountant | ₹6 – ₹10 LPA | ₹12 – ₹18 LPA | ₹20 – ₹25+ LPA |

These ranges reflect average market trends and may vary based on your employer, location, & experience.

What Are the Best Jobs After CPA in India?

In India, the US CPA Certification is gaining traction among top employers, especially due to the globalisation of financial practices. Here are the most popular jobs after CPA in India:

- Statutory Auditor at MNCs

- Financial Planning & Analysis (FP&A) Specialist

- Global Taxation Consultant

- Management Accountant

- Finance Manager in Shared Service Centres

Many US-based firms have Indian operations and actively hire CPAs for core functions. If you’re wondering how to manage the CPA exam alongside a job, check this:

👉 Passing the CPA Exam While Working Full-Time

Your Future in a CPA Job in Multinational Companies

Top-tier companies with global operations value CPA professionals for their understanding of:

- US GAAP and IFRS

- SEC regulations

- Global tax and compliance frameworks

Some of the top MNCs hiring CPA-certified professionals in India include:

| Company | Common CPA Job Roles |

| Deloitte | Advisory Consultant, Audit Analyst |

| KPMG | Risk Assurance, Internal Auditor |

| EY | Tax Associate, Financial Analyst |

| Accenture | FP&A Lead, Financial Controller |

| Amazon | Global Finance Manager, Tax Analyst |

If your goal is to land one of these coveted CPA jobs in multinational companies, the credential sets you apart in a crowded job market.

The Rise of High Paying CPA Jobs

Let’s talk numbers. The CPA designation is often a fast-track ticket to the C-suite. Some of the high paying CPA jobs you should aim for include:

- Chief Financial Officer (CFO) – ₹40 LPA and above

- Director of Finance – ₹30 – ₹45 LPA

- M&A Consultant – ₹25 – ₹35 LPA

- Financial Controller – ₹18 – ₹30 LPA

These roles are not only financially rewarding but also come with leadership influence and decision-making power.

What Are the Most In-Demand US CPA Career Opportunities?

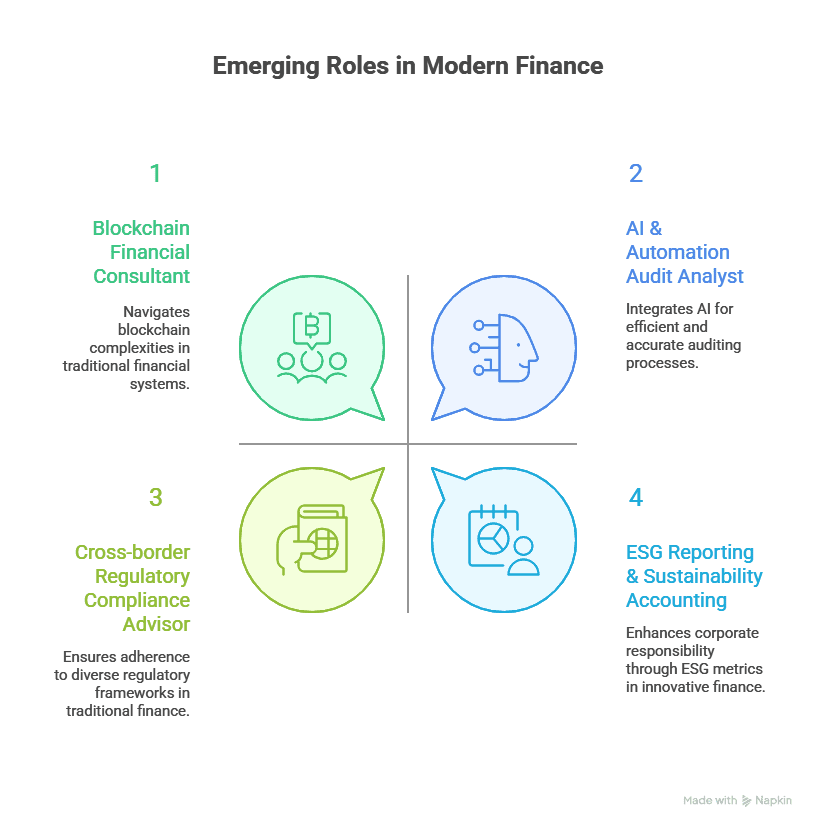

While many CPAs move into traditional finance roles, several emerging fields are booming for credential holders. Some of the top US CPA career opportunities right now include:

- ESG Reporting & Sustainability Accounting

- AI & Automation Audit Analyst

- Blockchain Financial Consultant

- Cross-border Regulatory Compliance Advisor

These new paths reflect how dynamic and future-focused a CPA designation career path can be.

Exploring Accounting Jobs for CPA Holders

You’re not limited to just one route. The beauty of the CPA certification is the variety of roles you can pursue. Some overlooked but promising accounting jobs for CPA holders include:

- Budget Analyst

- Treasury Specialist

- Accounting Policy Manager

- IFRS Reporting Analyst

These roles span across industries like healthcare, fintech, real estate, and even government finance.

Want to Start Your CPA Journey?

Get comprehensive training, mentorship, and placement assistance with the Certified Public Accountant Program by Imarticus. It’s designed for aspiring CPAs in India, with expert faculty and globally aligned curriculum.

Summary: Where Can the US CPA Certification Take You?

| Career Path | Industry | Average Salary (INR) | Work Environment |

| Public Accounting | Audit & Assurance Firms | ₹6 – ₹15 LPA | Client-Facing |

| Corporate Finance | IT, Manufacturing, FMCG | ₹8 – ₹20 LPA | In-House Finance Teams |

| Consulting | Advisory & Strategy Firms | ₹10 – ₹25 LPA | Cross-functional |

| Taxation | CA Firms, Corporates | ₹6 – ₹18 LPA | Domestic & Intl Clients |

| Government & Nonprofit | Regulatory Bodies, NGOs | ₹5 – ₹12 LPA | Public Sector |

Your journey as a CPA can be as broad or specialised as you want it to be.

Watch: What You Can Do After Becoming a CPA

🎥 Watch the Career Paths after CPA Certification

FAQs

1. What are the best US CPA career opportunities?

Top opportunities include roles in audit, tax, consulting, and financial analysis at global firms.

2. Are there good jobs after CPA in India?

Yes, roles like Financial Analyst, Tax Consultant, & Internal Auditor are in demand across Indian MNCs.

3. What are typical CPA job roles and salaries?

CPA job roles range from auditors to controllers… with salaries starting at ₹6 LPA and going up to ₹30+ LPA.

4. What CPA designation career paths can I explore?

You can work in public accounting, corporate finance, tax advisory… or forensic accounting.

Final Thoughts

Whether you’re aiming for senior finance roles, global mobility, or specialised consulting, the US CPA Certification can get you there. With the right training and dedication, it leads to CPA job roles and salaries that are unmatched in many other finance careers.

Explore your career path, plan your journey, and take the next step towards becoming a global accounting leader.