Introduction

Knowing your numbers is no longer enough in today’s fast-paced finance world. If you are an aspiring financial analyst or even a finance professional looking to advance your career, knowing the right Financial Analysis Tools can give you that winning edge. Financial Analysis Tools allow you to work smarter and not harder, enabling you to make data-driven decisions, develop thoughtful reports, and still allow you to create market-case scenarios. This post dives deep into the top three Financial Analysis Tools that every analyst should be familiar with—and why they are more important than ever.

Table of Contents

- Excel for Financial Analysis

- Power BI: Essential Tool for Data Analysis in Finance

- Tableau: Visualizing Financial Insights

- Comparison Table: Top Tools for Finance Professionals

- Why These Tools Matter in Investment Banking

- FAQs

- Key Takeaways

- Conclusion

Excel for Financial Analysis

Excel is the foundation of all financial modelling and analysis. Whether you’re projecting revenue or creating dashboards, this tool remains a non-negotiable in your finance toolkit. For students and professionals starting out in financial roles, learning Excel for financial analysis can set the stage for a solid and scalable career in finance.

Why Excel Stands Out

It is widely accepted and applied in almost every finance job, so it is a core skill that employers in all industries, such as investment banking, corporate finance, and consulting, require.

Provides robust formulas, pivot tables, and financial functions, which can be manipulated to analyse information, execute complicated computations, and create automated procedures for repetitive work.

Simple to audit and review models constructed upon Excel, offering traceability and transparency that is paramount at the time of financial reporting and in the instance where models require validation by teams or clients.

Key Features

- Financial modeling

- Scenario and sensitivity analysis

- Budgeting and forecasting templates

Excel Tips for Financial Analysts

- Use INDEX-MATCH instead of VLOOKUP for better flexibility and faster lookups, especially when working with large datasets where performance is critical.

- Master conditional formatting for dynamic dashboards that visually highlight trends, anomalies, or thresholds, making data interpretation quicker and more intuitive.

- Use Data Tables for quick scenario analysis, enabling you to test multiple assumptions or inputs and instantly see how changes impact your key financial metrics.

External Link:

Power BI: Essential Tool for Data Analysis in Finance

Power BI is more than just a data visualization tool. For finance professionals- it brings large, scattered data into a centralised, easy-to-read format. As one of the most essential tools for financial analysts, Power BI is used extensively in reporting, dashboarding & real-time data analytics.

How Power BI Elevates Analysis

- Connects to various data sources like SQL, Excel, and cloud-based platforms

- Interactive dashboards that update in real-time

- Enables decision-making with advanced analytics

Use Cases in Finance

- Budget variance analysis

- Real-time tracking of KPIs

- Automated report generation

Table: Power BI vs Excel

| Feature | Excel | Power BI |

| Real-time Dashboard | Limited | Yes |

| Data Volume Handling | Moderate | High |

| Advanced Visualization | Basic Charts | Interactive Visuals |

External Link:

Microsoft Case Studies: Power BI in Financial Services

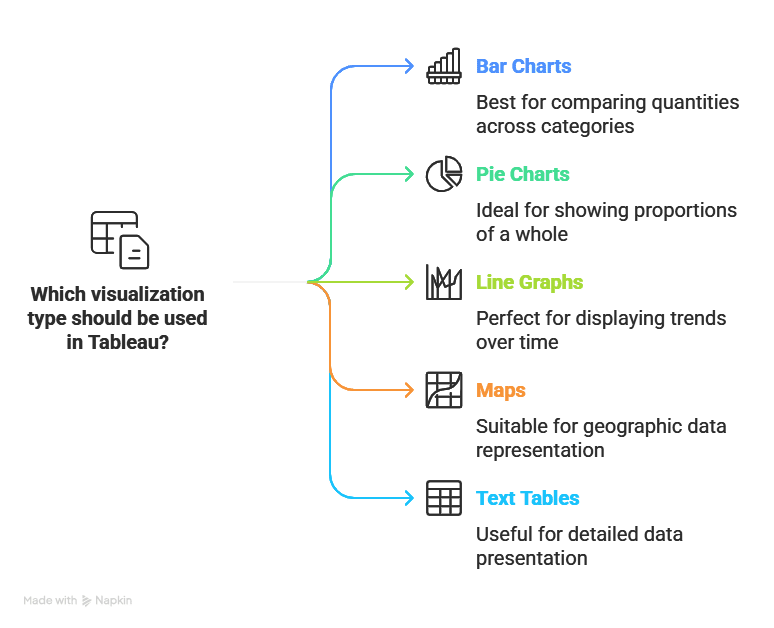

Tableau: Visualizing Financial Insights

Tableau is all about transforming data into appealing stories. With Tableau, finance professionals can demonstrate insight in such a way that stakeholders quickly understand and act upon it. It is one of the best-used tools for finance professionals involved with communicating data to leadership or clients.

Why Use Tableau in Finance

- Offers intuitive drag-and-drop features for visualization

- Works well with large datasets

- Ideal for building dashboards for top management

Use Cases in Finance

- Revenue trend visualization

- Profitability analysis by product or segment

- Risk heatmaps and forecasting

Tableau Skills to Master

- Building interactive dashboards

- Creating calculated fields for financial ratios

- Using storyboards for presenting investment insights

External Link:

Gartner Magic Quadrant: Tableau’s Leadership in Analytics

Comparison Table: Top Tools for Finance Professionals

| Tool | Best For | Ease of Use | Cost | Learning Curve |

| Excel | Financial Modeling, Forecasting | High | Low (Free in many cases) | Low |

| Power BI | Dashboards, Reporting | Moderate | Free to Moderate | Moderate |

| Tableau | Visual Analytics | High | Moderate to High | Moderate |

These tools are often used in tandem for a complete financial analysis ecosystem. For instance, analysts often start in Excel, move the data to Power BI for dashboarding, and then use Tableau for executive-level visual storytelling.

Why These Tools Matter in Investment Banking

In the high-stakes world of investment banking, precision, clarity, and speed are non-negotiable. The use of investment banking software has evolved, and professionals must now go beyond traditional spreadsheets.

You know well how investment banking relies on precise valuation and strategic reporting for scenario-testing capabilities. The financial analysts who are astute with Financial Analysis Tools like Excel, Power BI, or Tableau can give faster, deeper, and more accurate insights and edge their competition. Mastering these tools has become an unfortunate necessity toward building a career. Today’s analysts are not just number crunchers—they’re storytellers, strategists, and data interpreters.

What Investment Bankers Use These Tools For

- Equity research modeling

- IPO valuation

- Pitch book creation

- Real-time performance dashboards

FAQs

1. What are Financial Analysis Tools?

Financial Analysis Tools are software or platforms that help finance professionals- analyze, interpret, and present financial data for decision-making.

2. Why are these tools important for finance professionals?

They help professionals gain insights quickly, present clear dashboards to leadership, and make decisions based on real-time data.

3. Can beginners learn these tools easily?

Yes, platforms like Excel and Power BI offer tutorials, and popular edtech platforms like Imarticus Learning provide structured training courses on financial analysis.

4. Is Excel still relevant in modern finance roles?

Absolutely, Excel remains the base for all financial modelling and is widely used in banks and finance firms.

5. How does Power BI differ from Excel?

Power BI handles large data sets & creates dynamic, real-time dashboards, unlike Excel, which is best for modelling and static analysis.

6. What’s the cost of using Tableau in finance?

While Tableau Public is free, enterprise versions can be moderately priced, depending on user count & features required.

7. Which tool is best for investment banking?

Excel is the foundation, but Power BI and Tableau are excellent for reporting and visualization, respectively.

8. Do companies use these tools?

Yes, most top finance firms and investment banks use a combination of these tools for robust analysis.

9. Can I get certified in these tools?

Yes, certifications are available for all three tools and are often valued by employers.

10. How do these tools help in job interviews?

Proficiency in these tools can help you demonstrate practical skills, especially when given case study-based interview rounds.

Key Takeaways

- Excel, Power BI, and Tableau are the top 3 Financial Analysis Tools for every analyst.

- Each tool has unique strengths—from modelling and dashboards to interactive visuals.

- Mastering these tools opens doors in investment banking, corporate finance, and consulting.

- Financial Analysis Certification and hands-on practice improve employability for students and finance professionals.

Conclusion

In today’s cut-throat finance industry- mastering Financial Analysis Tools is not just “nice to have” skill but rather a necessity. Be it for an investment banking role, or climbing the corporate finance ladder, the tools: Excel, Power BI and Tableau, offer the insight and edge you need. After all, tools are as effective as the person wielding them. So start learning, start applying, and watch your financial career soar.