Breaking into investment banking is no longer just for students from top colleges or those who can afford a costly MBA. The entry barriers have come down, and today, what really matters is your skills and how job-ready you are. With the right investment banking placement-focused course, you can go from learning in a classroom to working in a real finance role in just a few months.

Whether you’re a BCom graduate trying to find a strong career direction, a working professional who wants to move into core finance, or someone planning a complete career shift, these programmes make the journey simpler and more practical. Instead of spending years on theory, you learn exactly what the industry expects from day one.

You don’t just study concepts. You learn how investment deals actually happen, how companies are valued, how financial models are built, and how investment bankers work behind the scenes using all of these. It feels less like you’re studying and more like getting trained for a real job.

What really sets these courses that offer investment banking placement apart is the way they blend learning with experience:

→ Skills that companies are hiring for right now.

→ Live projects that feel like real client work.

→ Internships that give you genuine industry exposure.

→ Placement support that helps you move from training to employment.

That’s why investment banking certification is now seen as one of the best placement courses in India. It gives you a faster, more direct, and more realistic path into high-paying finance roles, without needing an elite degree or years of additional study.

In this blog, I’ll walk you through everything you need to know about investment banking placement, from how these courses work and what skills you’ll build, to how placements actually happen and what recruiters look for. By the end, you’ll have a clear picture of whether this path is right for you and how you can prepare yourself to step confidently into an investment banking career.

Did you know?

For students who want more certainty along with strong skills, an investment banking course with a job guarantee becomes a smart choice. These programmes are designed to make you fully job-ready while offering structured placement support, reducing the risk and uncertainty that usually comes with entering high-finance roles for the first time.

What is Investment Banking

Before we talk about investment banking placements, there’s one question I get asked all the time: “What exactly is investment banking?”

Most students hear the term and immediately think of big salaries, suits, and stock markets, but they’re not always sure what the work actually involves. And honestly, that’s completely normal. Investment banking sounds complicated until you see it in simple, real-world terms.

I usually tell them this: Investment banking is about helping companies make their biggest financial decisions. So before you think about placements, packages, or job titles, it’s important to first understand what is investment banking and what kind of work you’ll be doing. Once that becomes clear, everything else – the course, the training, and the placement process starts to make a lot more sense.

Investment banking is the side of finance where the biggest business decisions take shape. It’s where companies come when they want to grow, raise capital, enter new markets, or completely transform their future. Instead of just managing money, investment bankers work on deals that can change the direction of entire organisations.

This includes work like:

- Mergers & acquisitions (M&A)

- IPOs and fundraising

- Valuation and financial modelling

- Corporate restructuring

- Capital market advisory

In simple terms, investment bankers sit at the centre of strategy, numbers, and real business growth by helping companies make smart, high-impact financial moves. It’s a fast-paced, demanding, and highly rewarding role because your work directly influences major outcomes.

The roles you step into reflect this real responsibility:

- Financial Analyst

- Investment Banking Analyst

- Valuation Analyst

- M&A Associate

- Equity Research Analyst

These are not entry-level jobs in the traditional sense. They put you directly into the heart of real finance work from day one, and that’s reflected in the investment banking salary in India, which typically starts between ₹4-8 LPA for freshers and can rise quickly with experience and performance.

That’s exactly why a course offering investment banking placement is so powerful. It doesn’t just teach theory. It trains you for these exact roles. You learn the same tools, techniques, and workflows that professionals use on the job. By the time you finish, you’re not just qualified, you’re prepared to step into real-world finance roles with confidence and clarity.

This video breaks down the role of an investment banker and how investment banking functions in real life, from advising companies on raising capital to executing mergers and acquisitions, giving you practical insight into the profession before diving deeper into courses, eligibility, and placement paths.

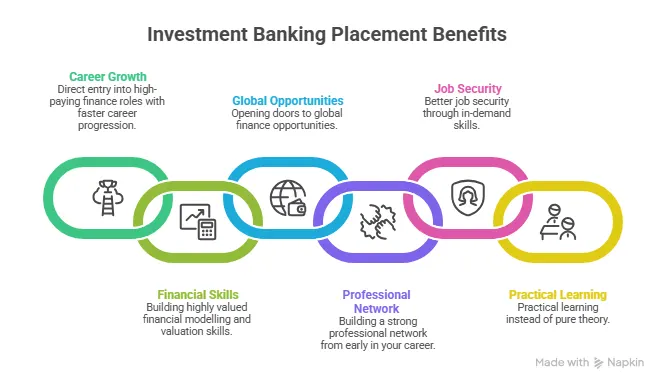

Why Investment Banking Placement Matters

A placement course is only as good as the outcome it delivers, and when it helps you earn an investment banking degree or certification that employers actually value, it turns learning into a real career opportunity.

Investment banking placement matters because:

- It reduces job-search uncertainty.

- It connects you directly with recruiters.

- It saves months of random applications.

- It increases salary potential.

- It builds real industry credibility.

Today, students don’t just want education. They want results. That’s why placement courses, placement guarantee courses online, and investment banking courses with a job guarantee are in massive demand.

Did you know?

A financial modelling and valuation course with placement is ideal for those who want to build deep technical expertise while also securing job opportunities.

How Investment Banking Placement Works in India

Most investment banking placement programs follow a structured model:

| Stage | What Happens |

| Skill Training | Financial modelling, valuation, Excel, PowerPoint |

| Practical Exposure | Live projects, case studies |

| Resume Building | Finance-specific CV and profile |

| Internship Support | Short-term internships |

| Placement Drive | Interviews with hiring partners |

| Offer Rollout | Analyst/associate roles |

Investment Banking Course in India offers placement assistance for freshers, while others provide investment banking placement guarantees under conditions like attendance, performance, and interview readiness.

This video walks through practical steps, interview expectations, and real strategies top candidates use to land investment banking roles, from analyst positions to deal support teams and helps you clearly see what recruiters look for when hiring.

Best Investment Banking Courses with Placement in India

The best investment banking courses with placement don’t try to teach you everything. They focus on what actually gets you hired. The skills that recruiters expect you to already know when you walk into an interview.

That’s why their core training usually revolves around:

- Financial modelling: So you can build models the way professionals do, not just understand formulas.

- Valuation: To confidently answer the big question, What is this company really worth?

- M&A: Because mergers and acquisitions are at the heart of investment banking work.

- Capital markets: To understand how companies raise money and how markets function.

Practical tools like Excel, Power BI, and Pitchbooks: Since most of your real work will happen on these, not in textbooks. These courses are called the best placement courses for a reason. They don’t stop at teaching concepts. They are built around outcomes. Their entire structure is designed to move you from learning to employment.

They usually offer things like:

- Recruiter tie-ups: So your profile reaches companies that are actively hiring.

- Internships: Giving you hands-on experience and something solid to add to your CV.

- Job-ready skills training: Making sure you’re confident with tools, models, and interview expectations.

This is what makes them different from traditional finance courses. You’re not just studying finance. You’re preparing for a job in finance where performance-based roles and bonuses can significantly boost your overall investment banking salary. That’s why many students look for options such as investment banking courses with placement in India, where placement support is a key part of the programme.

Short-term courses with investment banking placement are perfect for those who want quick career movement. Financial modelling and valuation courses with placement are ideal if you want strong technical skills with job support. These options are popular because they save time, reduce uncertainty, and give you a clear, practical path into the investment banking world.

Did you know?

Courses after BCom with placement are ideal for commerce graduates who want to move directly into investment banking and core finance roles with structured training and assured job support.

Investment Banking Placement After BCom and Graduation

If you’ve ever wondered how to become an investment banker, Investment Banking Placement after BCom is one of the strongest career upgrades a commerce graduate can make, because it gives you the skills, experience, and placement support needed to move directly into core finance roles.

| Degree | Best Investment Banking Career Path |

| BCom | Investment banking course with placement |

| BBA | Finance course with placement |

| MBA | Specialised Investment Banking placement programs |

| Engineering | Financial modelling course with placement |

A BCom gives you the foundation in accounting, finance, and business, but on its own, it often isn’t enough to land high-impact, high-paying finance roles. That’s where an investment banking placement-focused course completely changes the game.

That’s why these programmes are considered some of the best courses. They offer a clear direction, a shorter learning curve, and a much quicker entry into the finance industry. If your goal is to move into high-paying, high-growth finance roles without spending years on additional degrees, this is one of the fastest and most effective paths you can take.

Another reason why this path works so well is that the investment banking eligibility criteria are quite flexible. This makes investment banking placement after BCom especially attractive, because you don’t need a long list of qualifications, just the right training and preparation to enter the industry confidently.

You might have thought about what investment bankers do, what to do for investment banking, and whether investment banking is a good career. From advising companies on raising capital to structuring mergers and acquisitions, and what to expect in the real world, this short guide is just what you need.

Finance Courses That Support Strong Investment Banking Placement

Not every finance course will take you into investment banking. This is something many students realise a little late. Just because a course has finance in its name doesn’t mean it prepares you for deal-making, modelling, or core investment banking roles.

Skills required in investment banking are very specific, and only certain types of courses actually train you for that world. The right courses are the ones that are practical, technical, and placement-focused, not just theory-based.

The courses that truly open doors to investment banking usually include:

Investment Banking courses with placement are designed exactly for this career path.

| Investment Banking Course Type | Key Skills Covered | Job Roles After Course |

| Investment Banking Courses with Placement | Financial modelling, valuation, M&A, deal structuring, pitch books | Investment Banking Analyst, Corporate Finance Analyst |

| M&A-Focused Courses | Mergers & acquisitions, due diligence, transaction advisory, deal execution | M&A Analyst, Corporate Development Analyst |

| Capital Markets Courses | Fundraising, IPO process, equity markets, capital raising strategies | Capital Markets Analyst, Equity Analyst |

Investment Banking PlacementSo when choosing a course, the question shouldn’t be Is this a finance course?

It should be: Will this course make me ready for an investment banking job?

Did you know?

A short-term course with placement is perfect if you want quick, job-ready skills and faster entry into investment banking without long academic commitments.

Online Investment Banking Placement Programs

Online learning has completely changed how students enter finance careers. Earlier, you had to move to big cities, attend full-time classes, and spend a lot of money just to access good training. Today, you can build the same career path sitting at home.

You can now easily find online placement courses that offer structured training with job support, online courses with placement guarantee that focus strongly on outcomes, or even placement guarantee courses online that make career entry more predictable. This has made investment banking far more accessible than ever before.

The biggest advantages of investment banking courses are simple and practical:

- Learn from anywhere – Whether you live in a metro city or a small town, your location no longer limits your opportunities.

- Lower cost – Online courses are usually much more affordable than offline institutes, MBAs, or long-term degrees.

- Flexible schedule – Perfect for students, working professionals, and career switchers who can’t pause their lives for full-time study.

- Same investment banking placement opportunities – What really matters is your skill set and project experience, not whether you learned online or offline. Many recruiters now treat both equally.

For many students, online learning is no longer a second option. It’s the smarter option. You get quality training, placement support, and flexibility all at once, without sacrificing career outcomes. Around 50,000+ learners opted for the CIBOP course by Imarticus Learning!

Here’s a concise overview of how online learning is beneficial:

| Investment Banking Course Feature | Learning Investment Banking Online | Learning Investment Banking Offline |

| Flexibility | ✅ | ❌ |

| Cost-effective | ✅ | ❌ |

| Learn from anywhere | ✅ | ❌ |

| Recorded + live sessions | ✅ | ❌ |

| Easy revision access | ✅ | ❌ |

| Access to faculty | ✅ | ✅ |

| Placement support | ✅ | ✅ |

| Same recruiters | ✅ | ✅ |

| Commute time saved | ✅ | ❌ |

| Suitable for working professionals | ✅ | ❌ |

Along with practical training, many of these programmes also help you prepare for important investment banking exams that strengthen your profile and credibility. Certifications in financial modelling, valuation, capital markets, or global exams like CFA or NISM modules are often aligned with the curriculum. This means you’re not just learning skills, you’re also building recognised qualifications that recruiters value.

Smart Insight:

Choosing investment banking courses with placement is a smart option for students who want strong technical training along with structured job support. These programmes focus on financial modelling, valuation, and capital markets while connecting you with hiring firms, making the transition from learning to employment much smoother.

Investment Banking Placement for Freshers

Freshers often worry that it is impossible to get into investment banking without experience. In reality, most investment banking placement programs are designed especially for fresh graduates. While experience is essential, what recruiters really look for is strong fundamentals in finance, financial modelling and valuation skills, proficiency in Excel and PowerPoint, good communication skills, and a structured mindset.

That’s why investment banking placement assistance for freshers focuses heavily on:

- Resume building

- Mock interviews

- Case study preparation

- Internship exposure

For freshers, an investment banking course with placement becomes a launchpad rather than just a learning program.

Role of Investment Banking Internships in Placement

Internships play a huge role in strengthening your profile. They add real experience to your resume, build confidence for interviews, and show recruiters you can handle real finance work. Internships are often the easiest and smartest way to enter investment banking because they give you real industry exposure before you step into a full-time role. They help you understand how the work actually happens, improve your chances of placement, and put you in a stronger position when it comes to salary and career growth.

Investment banking internship in Bangalore

Many students use an investment banking internship in Bangalore as their entry point, and later strengthen their profiles through investment banking courses with placement in Bangalore, because the city has a strong ecosystem of investment banks, KPOs, Valuation firms, and consulting companies.

Benefits of internships:

- Practical exposure

- Higher placement success

- Better salary negotiation

- Stronger professional network

Worried about how you will clear your first investment banking job interview? Keep these 13 essential investment banking interview questions and structured answers in mind and watch the magic unfold. Save this video to boost your confidence and performance when you’re preparing for placement interviews after completing your course.

Investment Banking Placement in Bangalore

Bangalore is one of the strongest cities for finance careers. It has a large presence of investment banks, global KPOs, and valuation firms. Students find great opportunities in financial modelling, M&A support, and core analyst roles here.

Investment Banking Placement in Hyderabad

Hyderabad is quickly becoming a preferred city for freshers in finance, with growing opportunities in investment banking jobs in Hyderabad for freshers. It offers strong roles in financial analytics, capital market services, and back-office investment banking. The lower cost of living also makes it a practical choice for students starting their careers.

Investment Banking Placement in Pune

Pune is gaining popularity for investment banking and valuation roles. It is known for good training institutes and a growing demand in financial modelling and research. Many students choose investment banking jobs in Pune to build a finance career without the high expenses of metro cities.

Investment Banking Placement in Chennai

Chennai has a steady presence of global finance and consulting companies, including several investment banking companies in Chennai that support core finance operations. Hiring is consistent in equity research, corporate finance, and valuation roles. It is a reliable city for long-term finance career growth.

Investment Banking Placement in Coimbatore

Coimbatore is emerging as a strong Tier-2 finance city. Investment banking companies in Coimbatore offer entry-level roles in research and analytics. It is a great option for students who want a cost-effective start in finance outside major metros.

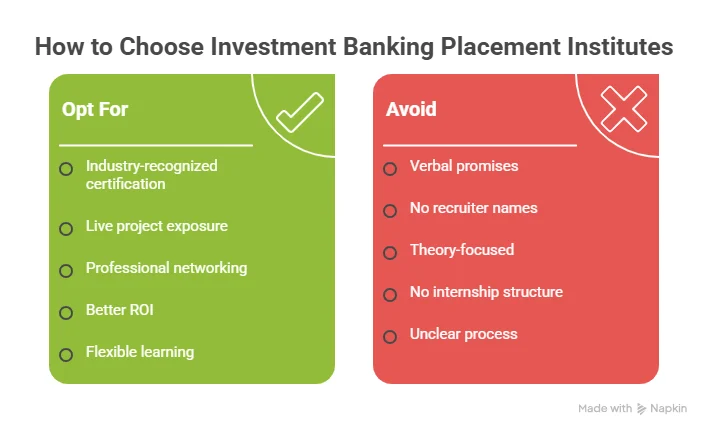

How to Choose the Best Institute for Investment Banking Placement

Before you choose an investment banking institute, make sure it offers:

- A strong recruiter network with multiple hiring companies.

- Internship support or guaranteed internships.

- Real placement track record with past student results.

- The syllabus is updated with topics like financial modelling and valuation.

- Clearly written placement guarantee policy.

If most of your answers are Yes, you’re on the right track. This checklist helps you quickly filter the best institutes for investment banking placement without confusion.

Why Imarticus Is a Trusted Choice for Investment Banking Placement in India

What people really trust about Imarticus is that it feels practical from day one. It’s not just about completing the investment banking course; it’s about actually becoming employable. Everything is designed with one question in mind: Will this help the student get hired?

The learning is very industry-focused. You’re not buried under heavy theory. You’re trained in skills that finance companies genuinely use, like financial modelling, valuation, and deal analysis. So instead of feeling like a student, you start thinking like an investment banking professional. The recruiter network is another big plus. Students don’t have to randomly apply everywhere and hope for the best. There are real company connections, which make the placement process more structured and realistic.

Internships make a huge difference, too. Investment banking internships give you your first taste of real finance work and add solid experience to your CV. For many students, this is where confidence really builds. And you’re not alone in the placement journey. There’s a dedicated team that helps with resumes, investment banking interviews, and guidance at every stage. That support matters, especially if you’re new to the finance world.

Which makes investment banking a great fit for:

- Freshers starting their careers

- BCom graduates upgrading their profiles

- Career switchers moving into finance.

- Working professionals aiming for better roles

Overall, Imarticus feels less like an institute and more like a launchpad into a real investment banking career.

FAQs About Investment Banking Placement

If you’re thinking about getting into investment banking, it’s normal to have a lot of questions. From investment banking placements and salaries to eligibility and course choices, these frequently asked questions clear up the most common doubts, so you can move forward with more clarity and confidence.

What is a placement in investment banking?

A placement in investment banking means getting a job through a structured hiring process supported by an institute or training provider. It includes resume building, interview preparation, recruiter connections, internships, and direct interview opportunities with hiring firms.

Can freshers really get placed in investment banking?

Yes, freshers do get placements in investment banking. Most investment banking placement programs are designed keeping freshers in mind. What matters more than experience is your command over financial modelling, valuation, Excel, and your interview readiness.

Do I need an MBA to enter investment banking?

No. An MBA is not compulsory. Many students enter through an investment banking course with placement, which is faster, more practical, and directly aligned with hiring needs.

What is the typical investment banking salary for freshers in India?

Investment banking freshers usually start earning around ₹4-8 LPA. The pay can vary depending on skills, institute, city, and company. The investment salary of professionals varies with company, geography, expertise and designation. With experience and performance, growth is very quick in this field. With Imarticus Learning, many students secure placement up to ₹9 LPA.

Is online learning accepted for investment banking placement?

Absolutely yes. One can pursue online investment banking courses and get placements. Recruiters usually focus on your skills and projects, not on the mode of study. The investment banking course by Imarticus Learning has 1000+ hiring partners, offers 100% job assurance and has an 85% Placement Rate.

Is investment banking placement a safe career option?

If you are serious about finance, willing to work hard, and choose the right course, it is one of the strongest long-term career paths in the industry.

Which degree is best for investment banking placement?

BCom, BBA, MBA, CA, CFA, and even Engineering backgrounds work well. What matters most is your specialised training after graduation.

Do placement courses really reduce job search time?

Yes, some Investment banking courses connect you directly with hiring companies instead of random job applications – like the CIBOP course by Imarticus Learning, where the placement process is built into the course itself. From resume building and profile optimisation to mock interviews and recruiter introductions, everything is planned step by step.

Grab That Investment Banking Placement Role

Investment banking placement is not magic or luck, but it is really about being intentional with your career. It’s about knowing what you want and giving yourself the right chances to get there. Most students don’t lack ability. They just lack a clear path.

It always begins with choosing the right investment banking course with placement. Once that is sorted, half the confusion disappears. You know what you’re working towards and why. Your effort suddenly has direction. Then you start building your core skills, especially financial modelling and valuation. In the beginning, it can feel difficult and overwhelming. But slowly, as you practice, things start to make sense. And when that happens, your confidence changes. You stop doubting yourself and start trusting your ability.

Internships are where everything becomes real. This is the moment when you move from “learning finance” to “working in finance.” You understand how offices function, how deadlines matter, and how your skills are actually used. Your CV starts to look stronger and more professional. Interview preparation is what brings calm. With mock interviews and guidance, fear reduces. You walk into interviews knowing you’ve prepared properly, not just hoping for the best.

Placement support is what ties it all together. It gives your hard work a platform. Applying through structured channels, attending drives, and staying consistent is what finally turns effort into offers.

And when you look at the bigger picture, investment banking placement gives you a strong start in terms of salary, fast growth in your career, exposure to real global finance work, and a career that remains valuable for the long run. So if you’re serious about building a future in finance, an investment banking course is not just another option to consider. It’s a smart decision that can change the direction of your entire career.