Mergers and Acquisitions are among the most important events in the corporate sector. And, obviously, with such an important event comes a position of equal importance. Mergers and Acquisitions analysis is a high demanding job that leaves no place for error. And, because as long as the corporate sector as a whole remains, it is a surety that mergers and acquisitions will keep on happening, it is also a guarantee that a mergers and acquisitions analyst will be needed no matter the time.

So, if you want to pursue a fruitful career in this sector and give your future the flourish it deserves, then the best option for you would be to do a proper merger and acquisition analyst course, chartered financial analyst course, or SWOT analysis course.

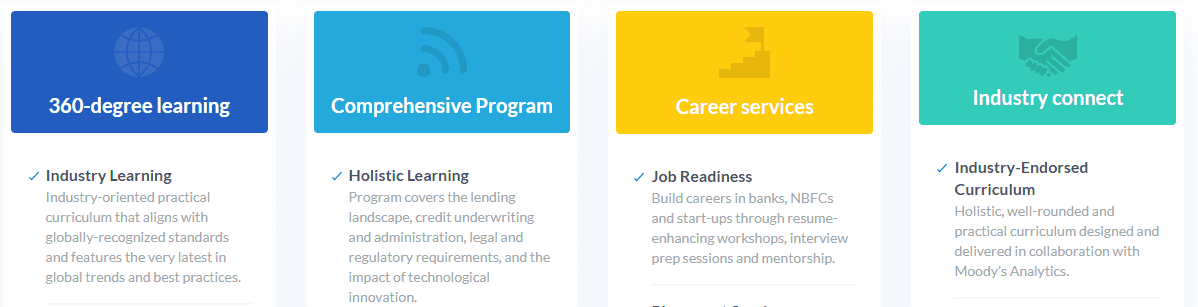

A lot of institutions offer a solid merger and acquisition analyst course in India. Such an institute is Imarticus Learnings.

A lot of institutions offer a solid merger and acquisition analyst course in India. Such an institute is Imarticus Learnings.

It not only provides a compact financial analysis prodegree but also comes with placement opportunities that give you the chance to land your dream job right from the get-go.

However, there are a few skills that M&A analysts must possess. Here, we are going to talk about them.

Finance Modelling and Valuation Techniques

The job of M&A analysts is to assess prospective companies in the field to acquire or merge with. They need to evaluate both profits and losses of a merger for all the parties included. So, obviously, they need high-level skills of financial modeling course helps them chalk out the goals and the means to achieve them.

Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

Another important skill analysts should have is to be able to put the correct value to each aspect of a merger. They need to determine as precisely as possible the appropriate premiums needed for acquisition.

This is why they must always stay ahead of industrial knowledge and analyze all the recent value reports of events.

This is one of the reasons why students with a degree in chartered financial analyst course or SWOT analysis course get high preference in this field.

Flawless Pitch Books

Another skill analysts must have is making flawless pitch books. It is important to present all the information and stats regarding the merger to all the parties involved appealingly.

Accounting Prowess and Industrial Knowledge

As these deals often tend to cost millions, the analysts must have accounting prowess so that they can keep a check on all the transactions made. Analysts also need core industrial knowledge as all mergers and acquisitions made are very industry-specific.

Staying up to date with International Corporate Scenarios

A good analyst should always stay up to date with international corporate scenarios. As mergers are a common event for businesses both local and global, a deep understanding of the function and process goes a long way to help clients.

In-depth Knowledge of Industrial Law

This is possibly one of the most important skills needed in an analyst. A good analyst should be acquainted with all the laws that need to be regarded during a merger and acquisitions process as any error can lead to serious legal trouble for everyone involved.

Conclusion

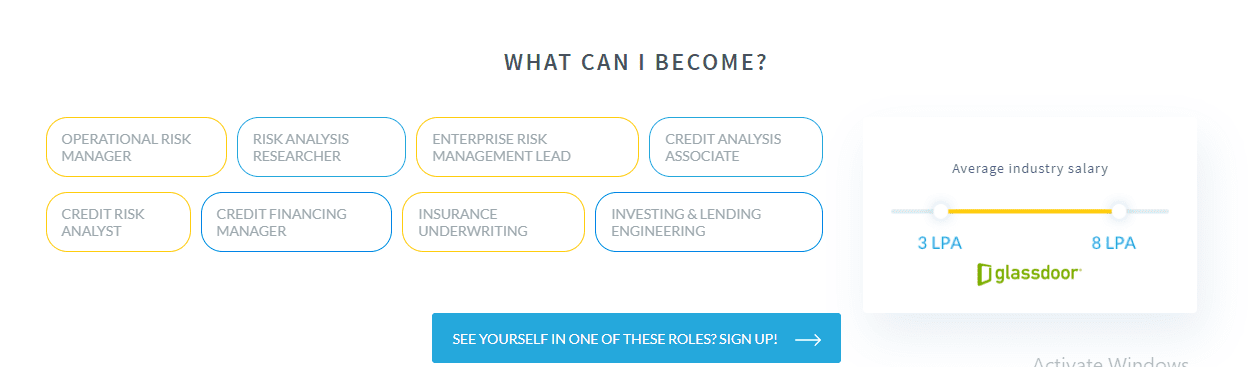

A merger and acquisitions analyst has no room for error and should always be at least two steps ahead of everyone to guide them properly. And, the only way to do that is by learning the process completely. Imarticus Learnings brings to you a great opportunity with its financial analysis prodegree that will help you get the boost you need in your career.

On the other hand, if a digital ledger is created through

On the other hand, if a digital ledger is created through

Let us understand why credit underwriting is such a fascinating career option.

Let us understand why credit underwriting is such a fascinating career option. You get to work with the latest technology:

You get to work with the latest technology:  Conclusion:

Conclusion:

The upward mobility is quite high in the field of financial analysis and one can build a good career with his/her performance and results. One can work hard and can rise to good positions like the fund manager, chartered financial analyst, etc. which have high salaries.

The upward mobility is quite high in the field of financial analysis and one can build a good career with his/her performance and results. One can work hard and can rise to good positions like the fund manager, chartered financial analyst, etc. which have high salaries.