Artificial Intelligence (AI) and Machine Learning (ML) are now considered the next frontier of asset management. It has been under constant evolution and several technological innovations are made as per the changes posed by the asset owners.

Even though the traditional sources of differentiation in asset management are getting commoditised rapidly, it is not completely demolished from asset management. AI and ML are providing new opportunities to extend a company’s reach in the global market for cost reduction and efficient operations.

Many big corporate sectors are now leaning towards making AI and ML the next frontier of asset management. In this article, let’s learn in detail about the significance of AI and ML in asset management.

What is Artificial Intelligence (AI) and Machine Learning (ML)?

Artificial Intelligence is a branch of computer science that deals with building potent and smart machines that are capable of performing tasks like humans. It encompasses a wide range of techniques and methodologies to enable assets and machines to learn, reason and make informed decisions based on the data.

Machine Learning is one of the branches of Artificial Intelligence, which is now shifting paradigms of every sector in the tech industry. It primarily focuses on using varied data and algorithms to imitate human intelligence. Machine Learning or ML is now considered the future of the tech industry, which is trying to improve its accuracy gradually.

Trends of AI and ML

Artificial Intelligence and Machine Learning are transforming the society at large. Addressing the elephant in the room, ChatGPT is now the newest AI language model that has taken over the world. This has predominantly enhanced the course of modern search engines.

However, there are various trends AI and ML are working on, which would be a great asset when it comes to asset management. Let’s see what they are.

-

AutoML

AutoML or Automated Machine Learning, is one of the most promising aspects of AI branches. It helps improve construction reporting and automatically tunes the net architectures of a software industry.

AutoML is a neural network model that facilitates tuning and helps reach the market cost-efficiently. It is also a fast way that provides promising solutions and is the latest AI and ML trend in 2023.

-

AI-enabled Designs

AI is generally known to streamline procedures primarily related to data, image and linguistic analytics. Recently, OpenAI has developed new models combining languages and images to generate conceptually new designs using the prompts. The AI-enable conceptual designs are ideal for healthcare, IT, retail and finance industries.

-

AI-based Cybersecurity

With the emergence of new cyber threats every day, the development of cybersecurity has now become crucial to sustain in society. AI and ML are playing a growing role in determining and responding to the newest cybersecurity threats. Organisations are now integrating AI to proactively defend the security curve and not suffer a higher rate of negative impacts.

-

Bias Removal in ML

As enterprises are adopting AI gradually, the challenge of AI bias is now a genuine concern. It refers to refers to the potential for machine learning algorithms to produce discriminatory or unfair outcomes due to biased data or biased model training.

To address this concern, efforts are being made to remove AI bias. This will help in making objective predictions and people are not discriminated against on any grounds of medical treatment, product buying or applying for loans.

Role of AI and ML in Asset Management

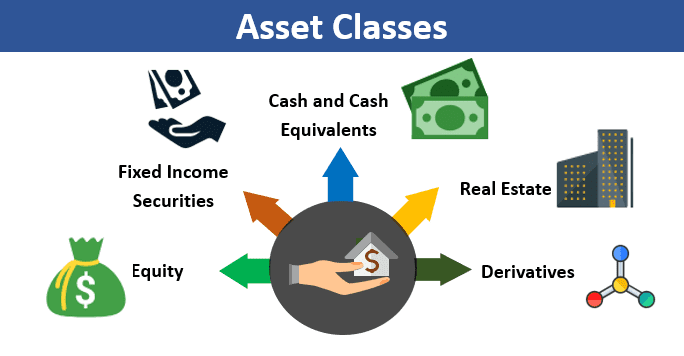

Asset management has been integrated with technology for decades and has come up with a variety of uses. As technology is revolutionising, the asset management sectors are now incorporating AI to upscale their business. Here are some ways one can identify the roles of AI and ML in asset management.

Improving UI

Companies involved with asset management are utilising UI or user interfaces at great lengths to gain a large number of audience. With the help of artificial intelligence, companies can enhance their connectivity and achieve goals. This also enhances their client service, data analytics, production and technology.

Operational efficiency

AI and ML enable predictive maintenance, identify maintenance needs, reduce asset downtime, and optimise maintenance activities. They also help in detecting potential issues, optimising asset allocation for better utilisation and improving demand forecasting for efficient company operations.

Investment procedures

Investment procedures also incorporate AI and ML for pre-trade analysis. These technologies are used to get data-driven insights for informed decision-making, assessing and managing investment risks effectively. AL and ML help asset managers to use advanced analytics and automation for improved investment performance.

Conclusion

Asset management has now become a crucial part of both business and personal purposes. Therefore, incorporating advanced technology to modulate assets has become vital.

If you are interested in learning about asset management and other aspects of financial markets, check out Imarticus Learning’s Certified Investment Banking Operations Professional course or CIBOP course. You can build a potent career with this course in investment banking.

To know more, check out the website right away.

This is because the company might have made many important investments on assets and it is important to have someone to represent the management.

This is because the company might have made many important investments on assets and it is important to have someone to represent the management. This requires a technology that could effectively capture the requisite data at every stage.

This requires a technology that could effectively capture the requisite data at every stage. Asset Management is a key focus area in business and is independent of industries. To be a successful asset manager, you need to acquire certain skills.

Asset Management is a key focus area in business and is independent of industries. To be a successful asset manager, you need to acquire certain skills.