Last updated on March 21st, 2024 at 10:58 am

Last Updated on 2 years ago by Imarticus Learning

Banking is not the same as it was before 2008. If you are pursuing a banking career, you need to be accustomed to how new age banking works. When we are talking about new-age banking, inevitably the concept of sustainable finance comes into the picture.

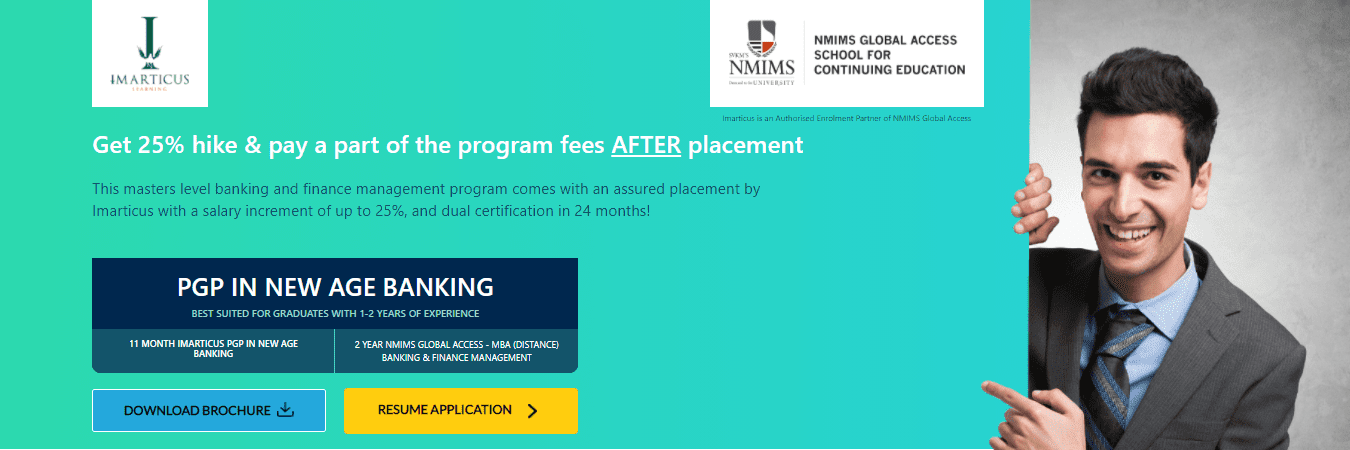

A post-graduate diploma in new-age banking and finance or at least a certificate course in banking and finance from a reputable institution should give you the edge to make you the right candidate in the era of new-age banking.

A post-graduate diploma in new-age banking and finance or at least a certificate course in banking and finance from a reputable institution should give you the edge to make you the right candidate in the era of new-age banking.

The infamous 2008 financial crisis along with various setbacks in the banking sector put a major dent in trust. Reliability in the banking industry was completely shaken and an overall change and restructuring became inevitable.

More people were looking for alternate financial solutions. Since then, along with traditional banking, the investment finance sector started investing towards environmental causes like clean energy projects. Moreover, they focused on alternative business models that benefited the local economy.

With the growth of mistrust towards traditional banking, consumers wanted a reform subjected to more ethical and responsible banking. With demand, transparency, diversification, and sustainability have become the heart of new-age banking. Many new banking institutes originated from this demand, with these three core values rooted in their operational framework.

As part of value-driven meaningful investments, new-age investors are looking for comprehensive reporting services with the hope of more transparency. Attitude has shifted from earning money to gaining people and their trust. The current generation believes financial services business has more to offer towards the world’s biggest issues. As a result, causes like climate change, clean energy, education, and community development started to gain capital, unlike the traditional banking era.

Profit, people, and the planet are equally prioritized by new-age banking systems. They channel investors’ money towards creating cultural values and benefiting people and the planet in exchange for a consistent positive return.

Investors are keen to see the evidence of responsible utilization of their funds. With this philanthropic utilization of capital, the term “impact investing” is becoming more relevant. Capital management strategies are based on diversification, transparency, sustainability, and keeping a social conscience for every investment made.

Currently, there are three main drivers of impact investing. And, these include the ability to quantify the social and environmental impact, change in stakeholders’ mindset, and better risk-reward ratio on the invested funds.

The financial return is understandably still the main focal point of the banking industry. All investors prioritize a risk-weighted return and sustainable banking moderates a lot of risks traditionally sneaking from unethical actions and decision making.

Notably, sustainable banking demands and offers transparent quantitative reporting data on every investment. With multiple reporting standards in place, creating and measuring objective data become a priority. Providing evidence of responsible business activities becomes fundamental to establish and maintain fruitful commercial relationships.

Enhanced governance is the driving force to sustainable banking. Previously, when unethical banking made headlines for all wrong reasons, the call for ethical banking became louder than ever. Consequently, ethical financial decision-making becomes institutionalized. Integrated reporting, strict regulatory supervision, and restrictive listing were implemented to increase the bank’s accountability.

New-age banking employed the necessary mechanism of traditional banking and combined new-age reform and approaches. These changes brought in by sustainable finance through new-age banking are slowly recovering the lost confidence in the banking industry and gradually reconstructing trust in financial services. Besides, momentum in sustainable banking has gathered pace since 2013 and is likely to continue.

As a banking profession aspirant, you may want to build your career towards new-age banking and wish to opt for a tailor-made post-graduate diploma in new-age banking and finance. Alternatively, you can also go for a certificate course in banking and finance.

As a banking profession aspirant, you may want to build your career towards new-age banking and wish to opt for a tailor-made post-graduate diploma in new-age banking and finance. Alternatively, you can also go for a certificate course in banking and finance.