Investment banking is not an overnight thing. The interviewees would undergo a rigorous selection process wherein they would be tested for technical as well as interpersonal abilities. For overcoming it, you would have to professionally frame interview questions for investment banking that would tend to focus on finance, valuation, accounting, and behavioral issues.

Here, in this complete guide, we are going to discuss the best investment banking interview preparation methods, discuss technical IB interview questions, discuss IBHR interview questions and answers, discuss investment banking behavior interview questions, and tell you how a mock interview for banking professionals can make you confident. We will also indicate how Certified Investment Banking Operations Professional (CIBOP) certification will set you apart from the rest of applicants by providing you with the same attributes interviewers want.

Why Investment Banking Interviews Are Challenging?

Invest banking positions are where the best graduates from across the world are drawn, and thus competition is tough. The interviews will try to assess your knowledge alongside your ability to solve problems under pressure. The tests comprise generally:

- Technical Knowledge: Accountancy, valuation, mergers & acquisitions, capital markets.

- Analytical Skills: Speed and accuracy.

- Behavioural Traits: Communication, resilience, leadership, and cultural fit.

- Practical Exposure: Practical exposure to real finance situations.

Memorising basic investment banking interview questions is the secret to the candidates so that they make a studying impression.

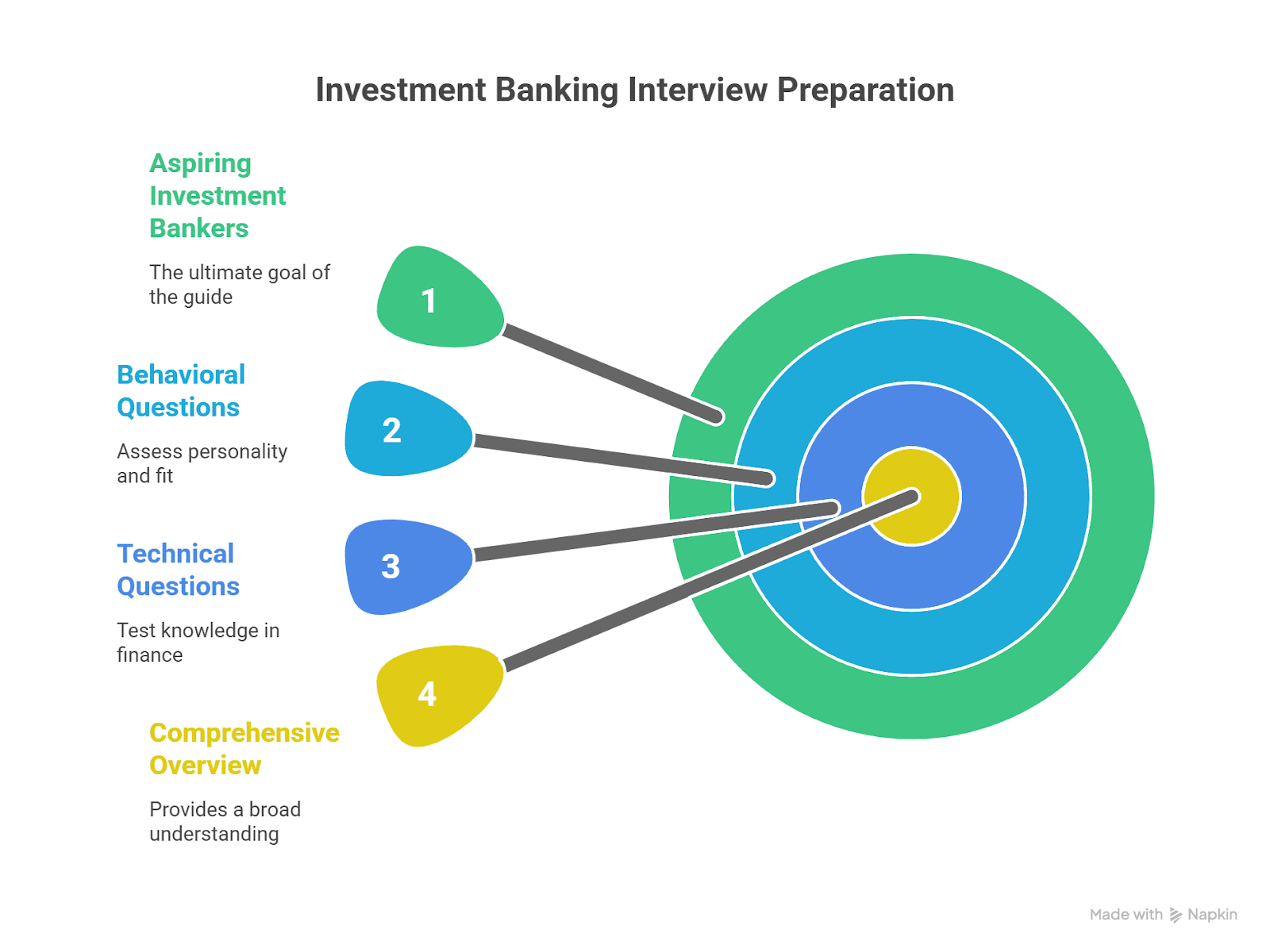

Categories of Investment Banking Interview Questions

In the unlikely event that you are successful, you should equip yourself to handle the many forms of questions that you are most likely to be asked.

1. Technical Questions for IB Roles

They test your fundamental finance abilities:

- Describe DCF valuation.

- What is WACC and how do you compute it?

- Take me through a merger model.

What are the three financial statements and how do they tie in with each other?

2. Investment Banking Behavioural Questions

These examine culture fit and soft skills:

- Why do you want to work for investment banking?

- Tell me about a time when you worked under high pressure.

- How do you handle conflict in the team?

3. IBHR Interview Questions and Answers

These are HR-driven, examining motivation and personality:

- Why should we hire you over someone else?

- What are your greatest strengths and weaknesses?

- Where would you like to be in 5 years’ time?

4. Mock Interview for Banking Jobs

Mock interviews are used in order to reveal gaps and drill answers, more effectively preparing candidates in real interviews.

Technical Questions for IB Roles: How to Answer

Since technical expertise is of top priority, let us find out how to respond to some of the most widely encountered technical IB interview questions:

Q1. Walk me through a DCF valuation.

Answer Strategy:

- Step 1: Estimate free cash flows.

- Step 2: Determine discount rate (WACC).

- Step 3: Calculate present value of the cash flows.

- Step 4: Add terminal value.

- Step 5: Calculate enterprise value.

Q2. How are the three financial statements connected?

Answer Strategy:

- Retained earnings of the balance sheet are added to net income of the income statement.

- Depreciation is deducted on the income statement but added on the cash flow statement.

- Asset/liability change on the balance sheet affects cash flow.

Q3. What happens when a company issues debt?

Answer Strategy:

- Balance sheet: Liabilities increase, cash increases.

- Income statement: Decreases net income by interest charge.

- Cash flow: Financing cash inflow.

Practice with these investment banking technical interview questions and you’re ready for interviews.

Investment Banking Behavioural Questions: What Recruiters Seek

Your behaviour working under pressure is what your investment banking behavioural questions answers reveal.

Q1. Why investment banking?

Show enthusiasm for finance, highlight analytical ability, and talk about long-term career ambition.

Q2. Tell me about a time when you were a team leader.

Highlight leadership, teamwork, and quantifiable results.

Q3. How do you manage stress?

Show resilience, time management, and planning.

The mix is to apply the use of the STAR method (Situation, Task, Action, Result) when answering.

IBHR Interview Questions and Answers

The HR here will be concise but will require depth and truthfulness.

Q1. What sets you apart from other candidates?

Highlight technical skills, training sessions, internships, and some soft skills.

Q2. What’s your greatest weakness?

Choose a real weakness but show that you are making a genuine effort to enhance it.

Q3. Where do you see yourself in 5 years?

Provide your ambitions in addition to the career of investment banking, showing initiative and dedication.

IBHR interview questions and answers practice never trails behind basics.

Investment Banking Interview Prep Strategies

It takes excellent investment banking interview preparation. Do so by following these steps:

- Master the Technicals: Learn valuation, financial modelling, and capital markets.

- Stay Current on Markets: Stay updated on global economic news.

- Practice Behavioural Questions: Practice mock interviews to build good communication.

- Review Your Resume: Be extremely conversant to elaborate on every point extensively.

- Use Case Studies: Practice actual cases to demonstrate analytical mind.

Courses such as CIBOP provide interview preparation tips and training.

Mock Interview for Banking Jobs: Why It Matters

Among the best performance-improvement ways is practicing via a mock interview for banking careers.

- Simulates Real Pressure: Do time-pressured questioning.

- Feedback and Correction: Fill gaps and improve.

- Increases Confidence: Eliminates nervousness in the actual interview.

- Brings Out Hard Questions: Prepare for surprises.

Mock interviews form part of career guidance services by CIBOP, bringing the candidate the added benefit.

How CIBOP Helps in Interview Success?

CIBOP certification is suited for those who are ready to solve investment banking interview questions and land good-paying positions.

Key Benefits:

- Job Guarantee of 100% with 7 sure-shot interviews.

- Placement Achievement: 85% placement record, topmost 9 LPA salaries.

- Comprehensive Curriculum: Securities business, wealth management, risk management, AML.

- Industry Recognition: Best Education Provider in Finance, Elets World’s Education Summit 2024.

- Proven Success: 50,000+ students, 1200+ batches cleared.

CIBOP not only gives you the investment banking education but also gives you the interview practice as well as soft skills training, resume building, and bank hiring mock interview.

FAQs

Q1. What is the most common interview question in investment banking?

Valuation technique, DCF model, relationship accounting, and behavior situational interview.

Q2. How important are technical interview questions for IB roles?

Very much so — they test your experience with finance principles and quantitative skill.

Q3. How do you answer investment banking behaviourals?

Practice with the STAR method, do practice interviews, and focus on real experience.

Q4. IBHR interview questions and answers, how are they distinct from technical ones?

Yes, HR on fit, motivation, and personality, technical on finance acumen.

Q5. Do I need to practice a mock interview for bank vacancies?

Yes, it detects weakness areas and enhances confidence levels prior to actual interview.

Q6. Do you offer interview preparation support?

Yes, it provides placement support, soft skill training, and assured interviews.

Q7. Why investment banking?

Show finance enthusiasm, problem-solving interest, and long-term career alignment.

Q8. What if you answer technical questions incorrectly?

Stay calm, explain your approach, and concede knowledge limitations modestly.

Q9. Are investment banking interview questions tougher than consulting interviews?

Yes, they tend to have more accounting and finance specifics in models.

Q10. How soon after CIBOP can I expect interviews?

Within completion of the course — with interview commitments.

Watch a CIBOP student speaking about his experience Unlock Your Career In Investment Banking with Assured Placements | Student Speaks Imarticus Learning

Conclusion

Overcoming investment banking interview questions is a matter of technical skills, behavioral skills, and practice in order. Practice and preparation are the answer, whether IB career role technical interview practice, or investment banking behavioral interview questions, or IBHR interview questions and answers.

Mock interview practice for investment banking roles prepares you to fight. And with such targeted CIBOP Course, not just do you get technical exposure but interview preparation in full and placement guarantee too.

As 2025 and the future play out, the battle to land a job at an investment bank will be tougher — but with proper mentorship, you’ll be ahead of the pack, land your dream job, and craft a rewarding career.