Have you ever sit through a company meeting, hear the CFO speak, and think, “That should be me up there”? It’s not just about numbers anymore. Today’s CFOs are strategic, influential, and right at the core of business decisions.

But making that jump from finance manager to the corner office? That’s where the challenge lies. And that’s what we’re breaking down here: how to become a CFO.

The Real Deal Behind the CFO Career Path

Let’s not sugar-coat this: reaching the CFO role takes years of layered experience. It’s not just about moving up the finance ladder. You need to understand business strategy, risk, operations, and people. Those who aim to become CFOs must grow beyond spreadsheets and quarterly reports.

A Deloitte survey found 67% of Indian CFOs prioritise revenue growth ahead of cost reduction. Most CFOs start in roles like accounting, auditing, or business analysis. Then comes exposure to budgeting, financial forecasting, and risk management.

But the real leap happens when you start speaking the language of business, not just finance. That’s the switch from a support role to leadership. That’s when the board starts noticing you.

You must earn trust not just through technical ability, but by contributing to growth, stability, and business transformation. That’s the CFO career path. It’s demanding, but doable. You just need the right tools, mindset, and guidance.

How to Become a CFO Who Gets Noticed

In a recent Pulse Survey, 57% of CFOs said they have started reshaping their short-term strategies in response to changes in US economic policy. Meanwhile, 58% are investing in AI to support real-time forecasting and smarter planning.

Here’s where most ambitious finance professionals get stuck. They focus so much on technical knowledge that they ignore leadership skills. But if you’re asking how to become a CFO, understand this: leadership, vision, and communication matter just as much as finance.

You must focus on the core skills needed to become a CFO: strategic thinking, risk management, stakeholder communication, and team leadership.

You need to:

- Understand capital structure and investor relations

- Build strong teams and mentor future leaders

- Communicate effectively with board members and CEOs

- Take strategic risks and forecast long-term impact

- Shape company policy and handle crises with clarity

Another key part of the skills needed to become a CFO is learning to align finance with broader business objectives, not just track performance.

You also need to stay curious. Today’s CFOs deal with digital transformation, ESG mandates, data analytics, and AI tools. So if you’re still stuck in Excel, you’re behind.

That’s why modern finance leadership development focuses on both hard and soft skills. And that’s exactly what prepares you for the long haul.

Finance Leadership Development Is the Game Changer

Many professionals ask why they’re not advancing, even after years of experience. The answer?

They haven’t invested in the kind of leadership development that aligns with C-Suite demands.

You can’t wing it anymore. CFO think big, drive performance, and lead change. They must manage across teams, geographies, and disruptions. That’s why programmes focused on finance leadership development exist.

They help you:

- Learn strategy, governance, and digital finance

- Solve real business cases alongside peers

- Work with mentors who’ve been there, done that

- Network with future CEOs and board members

This is where your journey accelerates. You stop being someone who executes plans. You become the person who shapes them.

What Executive Finance Programmes Actually Offer

If you want to be CFO-ready, it helps to learn from institutions that understand business at scale. The Chief Financial Officer Programme from ISB, offered through Imarticus Learning, is one such course.

It goes beyond classroom learning. You experience:

- Blended modules with self-paced videos and live sessions

- Access to world-class faculty and industry CXOs

- Personalised leadership coaching

- Case studies from real-world scenarios

- Capstone projects with international exposure

Let’s compare its features in a simple table:

| Feature | What It Means for You |

| Blended Learning | Learn flexibly with a mix of online and live content |

| CXO Masterclasses | Gain insights directly from senior industry leaders |

| Leadership Coaching | Receive tailored feedback and executive mentoring |

| Global Capstone Project | Work on actual business problems with global relevance |

| ISB Faculty and Certification | Learn from India’s top business school and earn recognition |

This kind of structure isn’t just for your resume. It shapes how you lead. It shows stakeholders you’re not only trained, you’re ready.

Your CFO Responsibilities Start Long Before You Get the Title

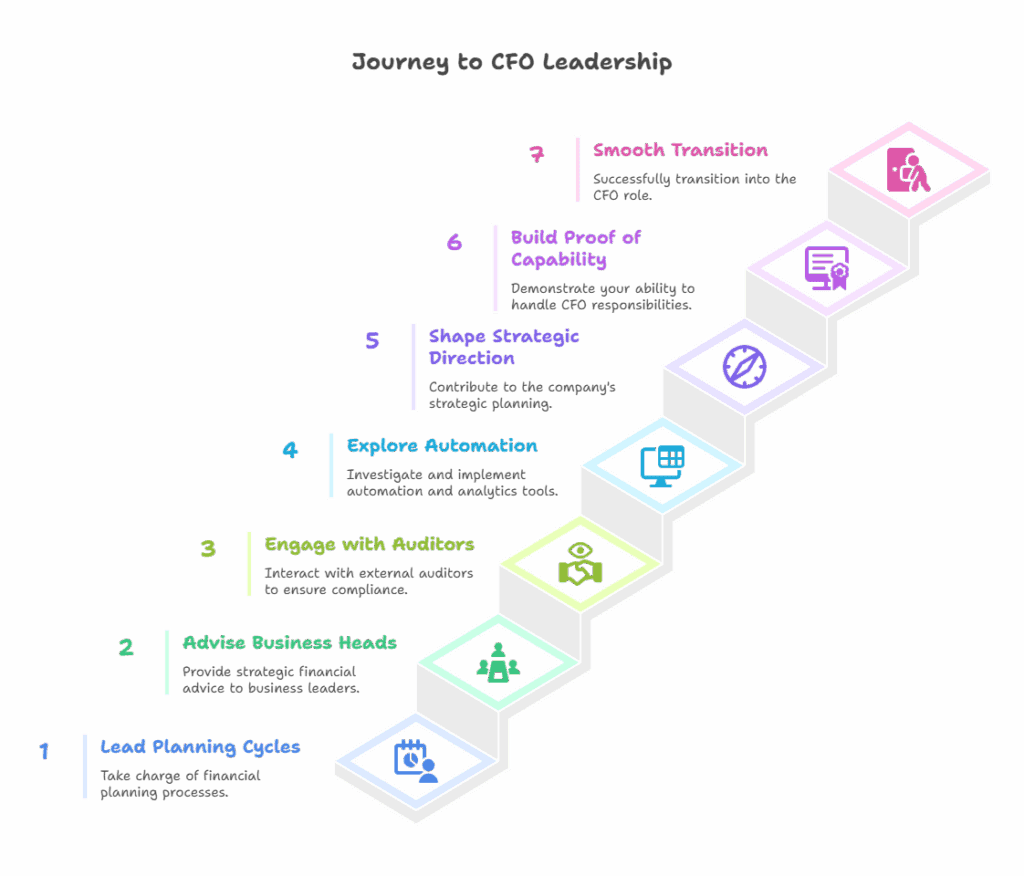

People often assume that CFO responsibilities and growth begin the day the offer letter arrives. But no. You start acting like a CFO before you become one.

You should already be:

- Leading planning cycles

- Advising business heads

- Engaging with external auditors

- Exploring automation and analytics

- Helping shape the company’s strategic direction

When you step into these CFO responsibilities and growth, you build proof of capability. The board sees it. The CEO remembers it. That’s how succession happens.

The sooner you align your thinking with CFO responsibilities, the smoother your transition becomes. You’re not a back-office finance manager anymore. You’re becoming the voice that influences decisions at the highest level.

The Right Mindset for CFO Growth and Visibility

Many qualified professionals miss out on promotions not because they lack skill, but because they don’t show up with the right mindset. Growth doesn’t come only from knowledge. It comes from visibility, initiative, and influence.

You need to:

- Speak up in cross-functional meetings

- Contribute beyond finance

- Offer solutions, not just analysis

- Take ownership when outcomes go sideways

The CFO role blends hard logic with human leadership. It’s about inspiring trust. That’s the kind of growth that boards reward.

That’s why executive finance programmes give you those experiential tools. They simulate boardroom environments, strategic scenarios, and transformation agendas, so you’re not blindsided when it’s real.

Step Into Financial Leadership with Imarticus Learning and ISB’s CFO Programme

Imarticus Learning, in collaboration with the Indian School of Business (ISB), brings you the Chief Financial Officer Programme. This isn’t just another finance course. It’s a career-defining opportunity to build the confidence, capability, and connections you need to become a CFO.

With over 150 senior executives already trained, the programme focuses on:

- Real-world decision-making

- Business model innovation

- Leadership transformation

It offers 8 months of structured learning that fits around your schedule. Whether you’re an existing CXO or an ambitious finance head, this programme gives you the clarity and confidence to lead.

Enrol in the CFO Programme by Imarticus Learning and ISB today. Shape your journey to the top.

Know Chetan Purohit’s review on the ISB CFO Program from Imarticus Learning in this video and how it transformed his career journey.

FAQ

1. How to become a CFO in India?

The initial steps are by doing core finance jobs and acquiring experience in strategy and leadership, and going through executive finance programmes.

2. What do I need to do to be a CFO?

In addition to technical expertise in the finance profession, you will need leadership and communication capabilities, strategic abilities, and experience working with cross-functional teams.

3. Does it have a distinct career path for CFO?

Yes. The majority of CFOs originate in finance, accounting, or analysis and grow to strategic leadership through their development programmes and executive training.

4. What are the usual CFO duties?

CFOs drive financial planning, and budgeting, risk, compliance and, in many cases, define company direction, culture and digitalisation.

5. Are executive finance programmes of any help?

Most definitely. They narrow the distance between middle level financial jobs and senior management with a concentration on real world leadership issues and strategic competencies.

6. Which is the top executive finance programme for becoming a CFO in India?

One of the most reliable executive finance programmes in the world is the Chief Financial Officer Programme organised by ISB together with Imarticus Learning. The subjects it teaches in a hybrid model, appropriate to people in the workforce, include leadership, strategy, and finance.

7. Is there a possibility of an individual who is neither a CA nor an MBA to take the CFO career path?

Right, it is true that a lot of CFOs have varied degrees of education in finance & analytics. Provided you have developed good financial skills and invest in leadership, you can definitely develop into the CFO position without CA or MBA.

The Final Words

You don’t become a CFO by accident. It takes intent, strategy, and training. If you’ve ever wondered how to become a CFO who leads with impact, now you have a path. Don’t just follow someone else’s career. Build your own.

Every future boardroom needs a voice like yours. Start shaping that voice today!

Take your seat at the table. Enrol in the Chief Financial Officer Programme now.