Last updated on March 26th, 2024 at 10:59 am

Last Updated on 2 years ago by Imarticus Learning

As technology continues to advance, new opportunities arise for insurance companies. Cloud computing is one of the most recent innovations that has changed how data is stored and accessed. With the rise of Blockchain technology, people wonder if this will change how insurers operate their businesses.

Finally, with the Internet of Things (IoT), insurers can collect more data than ever before about their customers and business practices. How will these three things impact insurance? Let’s explore!

The Rise of Cloud Computing for Insurance

Cloud computing is a great way to increase the speed at which insurers can access data. Instead of having their server or an extensive database that may be prone to hacking, businesses can use cloud-based services from Amazon and Google. It allows these companies to handle all the security measures so that insurers can focus on other things. Since insurers can work faster and more efficiently, they can reduce costs and potentially increase profits.

Is Blockchain Technology the Future of Insurance?

Blockchain technology is an excellent way for users to create secure transactions without relying on a third party. This type of digital ledger system ensures that records are accurate and transparent. In the insurance industry, there are a few different ways you can use this technology.

- You can pay out claims instantly without waiting for a third party to verify the payment.

- Users can track their policy history from one insurer to another. It would prevent people from double-paying or having overlapping insurance plans.

- Individuals can share their medical history with multiple companies to get better rates.

These are a few instances of how Blockchain can change how people do business in the insurance industry.

The Internet of Things Enhances Insurance Operations

With more devices connected to the internet, insurance companies can gather more data than ever before. This information can determine how likely people are to file claims or if their customers are at risk of accidents. It allows them to create better products that help people manage risks on their own. And when combined with cloud-based services and Blockchain technology, it is clear that IoT will be a critical part of the insurance industry in the future.

The advancement of technology is changing how people do business. From cloud computing to Blockchain, insurance companies can work faster and more efficiently than ever before. It may lead insurers to decrease their costs and increase profits in their businesses.

While this can be an advantage, it can also be a challenge for insurance companies. Since there is more competition, insurers must find new ways to stand out from their competitors and offer customers the best service possible.

Explore and Learn with Imarticus Learning

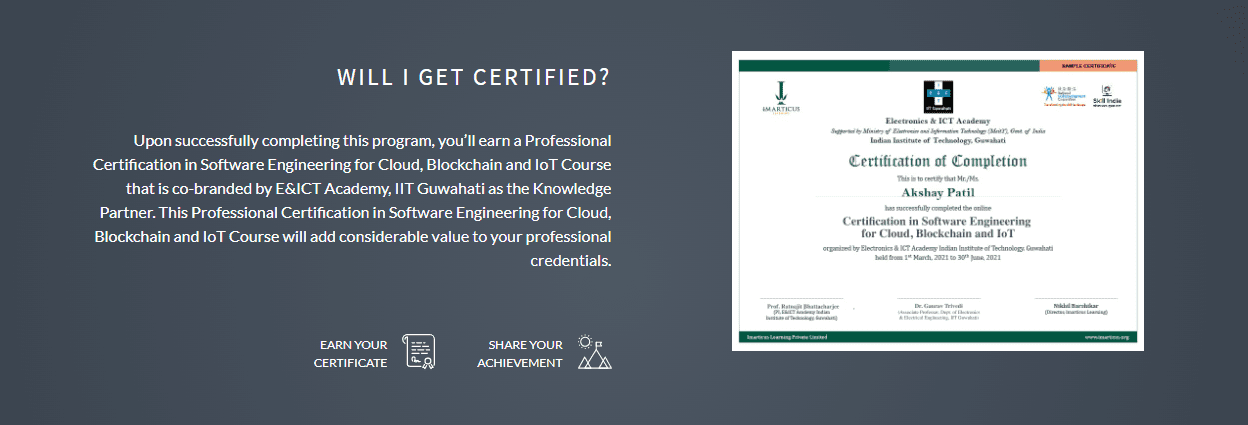

The Software Engineering certification online for Cloud, Blockchain, and IoT program collaborates with E&ICT Academy, IIT Guwahati, and industry experts to give aspiring Software Engineers the most pleasing learning experience possible. This intensive 9-month curriculum will prepare students for the new-age Software Engineer position, focusing on Cloud, Blockchain, and IoT.

Some course USP:

Some course USP:

- This cloud DevOps engineer course for students is with placement assurance aid the students to learn job-relevant skills.

- Impress employers & showcase skills with the certification in Software Engineering endorsed by India’s most prestigious academic collaborations.

- World-Class Academic Professors to learn from through live online sessions and discussions.