Last updated on September 1st, 2025 at 05:37 am

New comers in finance across the globe always want to know something: how to be an investment banker in India. It is one of the most coveted finance professions with the possibility of trading on billion-dollar deals, mergers and acquisitions, and capital market transactions. Indian investment banking is growing along with corporate growth, increased activity in IPOs, and money inflows from abroad.

It is not so easy to become an investment banker. It requires good investment banking education in India, well-established investment banking skill sets, industry-recognized certifications, and genuine SEBI and NSE-approved certificates. We will walk you through every step of professional growth, from being qualified to training and capabilities, and show how the CIBOP investment banking course by Imarticus Learning can assist you in reaching sooner.

Understanding the Role of an Investment Banker

You must know what the profession is all about to be able to learn how to become an Indian investment banker. Investment bankers are seasoned experts who facilitate governments, corporations, and institutions to raise capital, intricate financial transactions and mergers and acquisitions are negotiated. Some of their responsibilities are:

Advising corporations to raise equity, issue bonds, and list on the stock exchange.

- Mergers, acquisitions, and restructurings.

- Valuation, risk analysis, and financial modeling.

- Processing SEBI- and NSE-approved certification and regulation processes.

- Preparing high-net-worth clients with strategic advice.

Investment banking is a stressful but very fulfilling experience, with remuneration and professional development much better than most other finance professionals.

Eligibility for Investment Banking in India

In becoming an investment banker in India, acquiring experience is the key. As long as there is no master plan, higher academic and professional qualifications are highly preferred by organizations.

Educational Requirements

- Bcom, finance, economics, business administration, or accounting bachelor’s degree.

- Engineers can comfortably switch to MBA finance specialization.

- Postgraduate MBA (Finance) or finance certification also contributes a long way in improving possibilities.

Professional Eligibility

- Analytical and problem-solving skills.

- Good market knowledge, and compliance with the regulation.

- CIBOP investment banking course or CFA finance course is what is respectable.

SEBI and NSE-approved certificate for Indian experts is the certificate to be employed by top ranked companies.

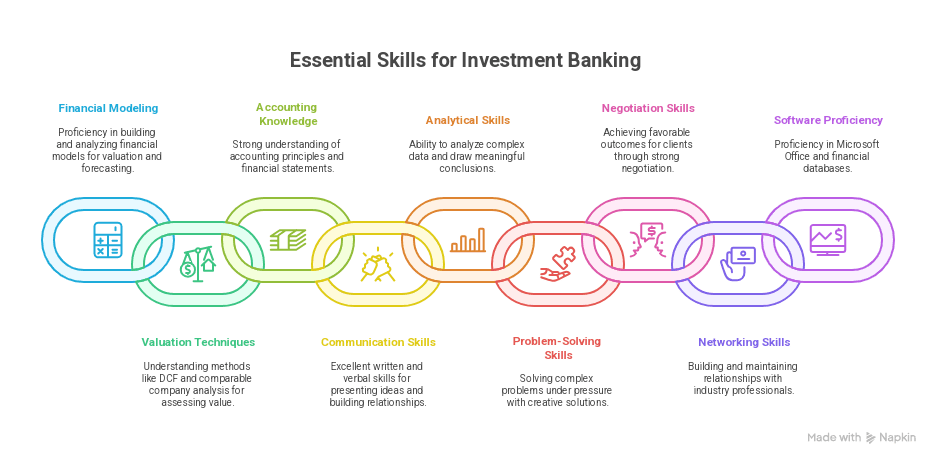

Skills Required for Investment Bankers

There is more to investment banker than academic qualifications. The companies require the conjunction of candidates’ hard skills and soft skills in order to be of some use in client dealing, stress careers.

Technical Skills

- Financial model and valuation.

- Merger and acquisition advisory.

- Risk management and compliance.

- SEBI and NSE guideline awareness.

- Capital market operations.

Soft Skills

- For delivering in communication and presentation with elan.

- Negotiating and networked skills.

- Deadlines and punctuality to deliver.

- Leadership skills to head employees.

Above-mentioned skills to be acquired by investment bankers are primarily offered by programmatic ones such as the CIBOP course in investment banking through experiential training through live case study.

Investment Banking Courses in India

If keenly interested in becoming an investment banker in India, the best investment banking courses in India are in the pipeline. They connect theoretical knowledge with market demand.

Popular Options Include:

- MBA in Finance: Provided by IIMs and other premium B-schools, an MBA is the proven path to an investment banking profession.

- Chartered Financial Analyst (CFA): Globally accepted certification for investment banking and research experts.

- CIBOP Investment Banking Course: Career-defining certification for Indian postgraduates with work experience 0–3 years.

- Postgraduate Finance Courses: Career-oriented, short-duration certification in securities, wealth management, and corporate finance.

They all, CIBOP investment banking course is a winner in India as it is job assured, industry-focused, and placement oriented.

CIBOP Investment Banking Program – A Career Gamechanger

Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) program has been producing India’s investment banking professionals for over ten years. The most realistic way of being an investment banker.

Key Highlights

- 100% Job Guarantee: 7 guaranteed meetings with the top investment banking companies.

- Placement Ratio: 85% best offer ratio of top 9 LPA.

- Flexible Timeline: 2.5 months (workdays) or 5 months (weekends).

- Industry Award: Best Finance Education Provider of the 30th Elets World Education Summit 2024.

- Best Placement Record: 1200+ batches placed, 50,000+ certified and trained, and 1000+ hiring partners.

CIBOP’s investment banking course is experiential learning, sector-specific case studies, and SEBI and NSE-approved compliance-driven mechanisms.

Step-by-Step: How to Become an Investment Banker in India

If still today you are thinking about how to be an investment banker in India, the following given is the step-by-step process:

- Complete Your Education: Take admission in courses of finance, commerce, economics, or business administration.

- Build Good Foundations: Study accounting, valuation, and capital markets.

- Select Appropriate Course: Study higher investment banking courses in India, e.g., CIBOP course.

- Gain Practical Experience: Do internships, case studies, and industry projects.

- Gain Correct Skills: Develop technical skills (financial modeling) and soft skills (networking, negotiation).

- Gain Certifications: Get globally and regionally recognized certifications, i.e., SEBI and NSE-approved certifications.

- Make Correct Applications: Apply for international, boutique, and mid-cap investment banks.

- Ace Interviews: Highlight technical skills, communication skills, and industry experience.

Career Growth in Investment Banking

Investment banking leads to career advancement with special titles

- Analyst: Junior role, finance modeling, analysis, and pitch books.

- Associate: Mid-level designation involving analyst management, client negotiation, and deal closure.

- Vice President: Client management and recruitment of staff.

- Director/Executive Director: Straight strategic negotiation and deal management.

- Managing Director (MD): Highest designation, cross-border deals, and business development management.

CIBOP investment banking course-students enjoy the privilege of stepping up a little earlier to associate- and analyst-grade positions.

Importance of SEBI and NSE-approved Certifications

Indian applicants must possess an in-depth knowledge of SEBI- and NSE-approved qualifications. The qualification equips the experts:

- With capital market regulation.

- To perform IPOs, M&As, and security trades ethically.

- Build employer and customer trust.

- Improve placement opportunities with stable banks.

Study material under investment banking in CIBOP is composed in such a manner that it incorporates such rules as part of it so that the graduates become so strong that they can come out and strike the markets.

Challenges in Becoming an Investment Banker

Despite being as old as the benefits, a career path of becoming an investment banker in India is not complaint-free.

- Tough Competition: Scores of candidates for limited jobs.

- Long Hours of Work: Investment bankers work 80–100 working hours a week on average.

- Pressure of Regulation: SEBI and NSE reforms are regular enough to keep feet on ground but compliance is maintained in hand.

- Sophisticated Clients: Sophisticated clients require accuracy and punctuality.

Conditions to be above calls will include willpower, constant learning, and mandatory certificates. You can also check the experience of a CIBOP learner here From Learner to Morgan Stanley | Shruti’s ₹4.5 LPA CIBOP Journey | Imarticus Learning Reviews

FAQs

Q1. How to become an investment banker in India after graduation?

Do a finance or commerce degree, do the tests like CIBOP investment banking course and get employed as an analyst.

Q2. What are the eligibility requirements for investment banking?

Finance degree, commerce degree, or allied stream degree and analytical skills and industry-related qualification.

Q3. Which are the best investment banking courses in India?

MBA (Finance), CFA, and CIBOP’s investment banking course for job security.

Q4. What are the skills required for investment bankers?

Financial modeling and valuation, and risk management technical skills, communication, negotiation, and competencies.

Q5. Is CIBOP an SEBI and NSE-approved certification?

Yes, the course is structured and intended for SEBI and NSE-approved certification and thus the graduates are regulatory compliant.

Q6. What salary can freshers expect in investment banking?

Freshers’ salary ₹6–9 LPA, additional hike in the long run.

Q7. Can non-finance graduates become investment bankers?

Yes, science. Graduate engineers or students can even become investment bankers after professional training like CIBOP.

Q8. What is the duration of the CIBOP investment banking program?

It can be completed in two ways: 2.5 months (working days) or 5 months (weekends).

Q9. Is investment banking a good career in India?

Yes, due to high IPOs, cross-border transactions, and foreign funding, it is one of the most rewarding finance professions.

Q10. How competitive is investment banking in India?

Very competitive, but with proper skills, certification, and networking, the right people can have good careers.

Conclusion

So then how to become an investment banker in India? The answer is step by step: acquire proper education background, become technical as well as soft skill-rich, and acquire industry-approved certifications. With growing activity in IPOs, corporate expansion, and foreign investment, India never needed professional investment bankers more.

Imarticus Learning’s CIBOP investment banking course is the best option with 100% placement guarantee, live training, and SEBI-approved courseware. It offers theory-practice gap for finance pass outs with placements in top investment banks.

Investment banking is more than just a job—it’s a high-stakes, high-reward career that shapes the future of companies and economies. If you’re ready to step into this world, start your journey today with the right investment banking courses in India and certifications.