In the ongoing age-old game of global finance, investment banking is the driving force, pushing the growth of capital, building economies, and showmen to the unlimited horizon of global financial markets. Investment banking, with its constant drive, not only facilitates the growth and development of companies but is also an essential ingredient in ensuring that the world of finance stays in check.

The Pivotal Role of Investment Banking in Global Finance

Investment banking is a funding-raising mechanism and, besides that, an economic leverage and fiscal stability between nations. From underwriting to merger and strategic consulting, investment banking activities are the hub to productive intermediation of international finance.

Investment banks act as intermediaries between fund seekers and providers. Whether it is taking a start-up public through an IPO or arranging a multinational’s with expensive mergers and acquisitions, investment bankers are the primary drivers in structuring and putting together deals that reshape the world of finance.

Understanding the Role of Investment Bankers

Investment bankers’ work is not all about pitchbook development and figures. It is controlling the market, getting companies to access capital, and putting dollar amounts on risk exposure. Investment bankers are middlemen who connect investors with firms and make money move freely where it is most needed.

In addition to the conventional advisory services, investment bankers themselves are directly involved in asset re-engineering, private placements, and managing innovative derivative products. Their technical expertise offers fine financial options appropriate to long-term business needs.

How Investment Banking Services Drive Market Liquidity?

Investment banking activities cover all types of financial activities ranging from fund raising to risk management. More significant, investment banking activities enhance the liquidity of financial markets. Investment banks enable transactions that are less risky because of their trading and underwriting facilities in financial markets.

These services provide diversification of financial instruments on and for the investors. Investment banks create appropriate financial instruments that cater to different risk appetites and thereby increase access in the marketplace and stability within the financial system.

Economic Impact of Banking on Global Markets

The economic contribution of banking—albeit through investment banking—is direct and far-reaching. Investment banks make business expansion, employment, and technological innovation possible by investing money into productive avenues.

In periods of recession, investment banks have assisted in taking them out by providing liquidity, refinancing arrears assets, and guiding the government through fiscal policy. Their work thereby is not restricted to booms but is equally vital during a recession.

The international presence of investment banks today also implies that their decisions spread throughout the global economy, affecting such disparate things as local levels of employment and trade balances internationally.

A Career in Global Finance: Opportunities and Challenges

Careerglobally financing in investment banking is not easy but very rewarding. The fast-paced work environment ensures two days would never be identical, with endless opportunities for learning and exposure to senior-level decision-making.

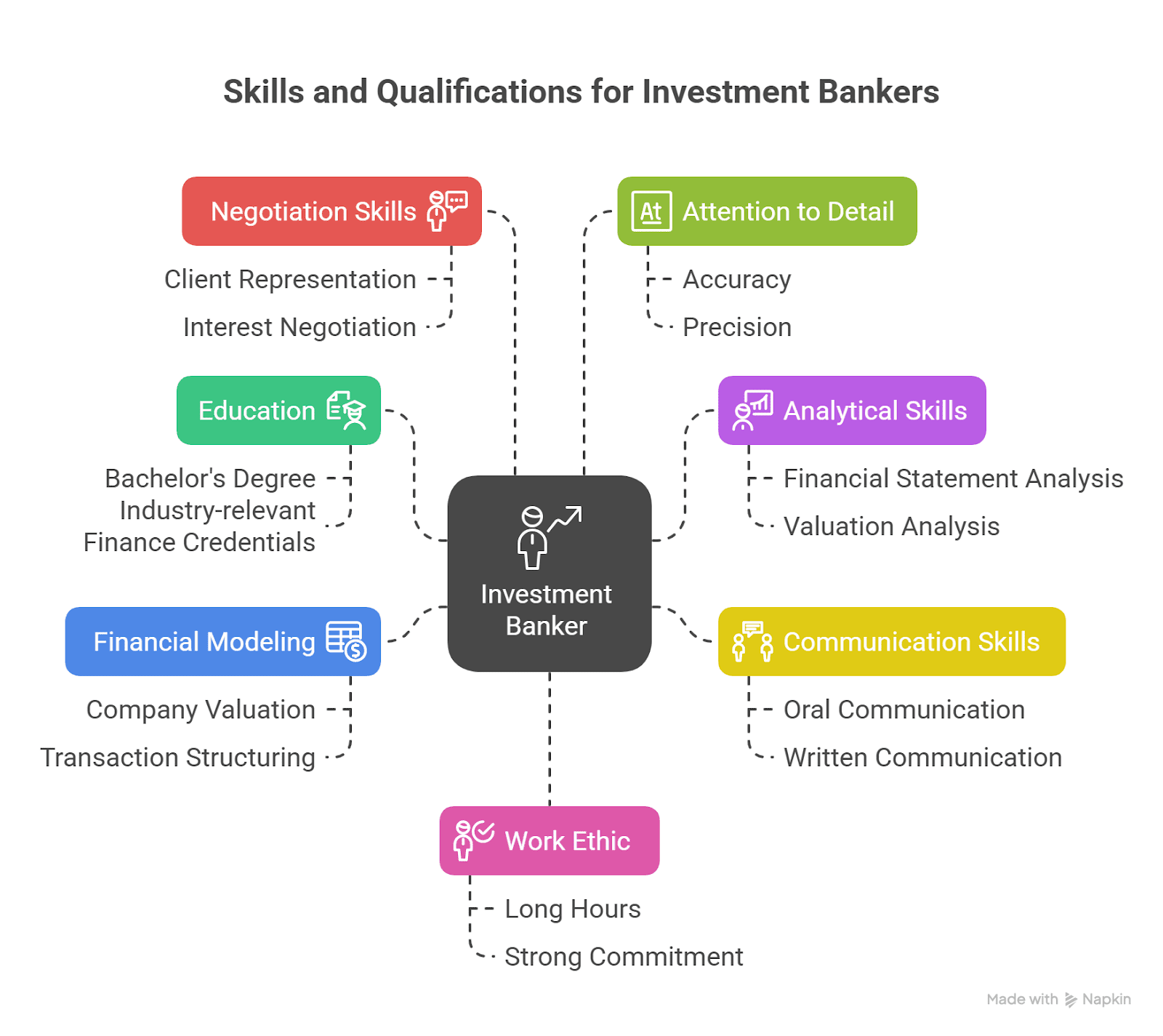

With career tracks from equity research to risk management and operations, the career has endless career opportunities. International finance career also demands great analytical skill, resilience, and regulator negotiating geographically.

Limitations notwithstanding—long working hours, stunning pressure, and ever-shifting market situations—the payoff is unrivaled industry glory, enormous compensation, and skewed professional career graph.

Investment Banking and Global Financial Markets: A Symbiotic Relationship

Offshore financial markets rely to a small extent upon the infrastructure and innovation of investment banks. Investment banks give depth and stability to the market through efficient price discovery, market intelligence, and developing customized investment concepts.

They also encourage corporate governance and disclosure since listed companies are forced to disclose more information, thus making investors able to have faith in them.

Generally, the international financial markets would not almost be as efficient without the foundations established by sound investment banking activities.

The Future of Investment Banking

While fintech is trending more than ever, banking models of business and environmental, social, and governance factors are gaining center stage in investment choices. Hence, investment banking needs to undergo several transformations. Technologies that are emerging, such as AI, blockchain, and data analytics, already are transforming due diligence, risk, and client engagement.

Sustainable investing and impact lending are also generating new verticals, challenging bankers to be ahead of ethics in the endeavor of maximizing returns. The future investment banker will require technical competencies, interpersonal abilities, and a firm commitment to world best practice if he or she is to thrive.

CIBOP: Launch Your Investment Banking Career with Confidence

For everyone who is interested in entering this high-risk, high-reward sector, Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) is the way to go. CIBOP is exclusively designed for 0–3 years finance pass-outs. Live simulations coupled with trainer-led training are employed to create industry-ready professionals.

The course comprises:

- 100% Job Guarantee with 7 sure-shot interviews

- Placement of up to 9 LPA with an average of 4 LPA

- More than 50,000 students trained in 1,200+ batches

- Flexible tenure choice: 3 months or 6 months

CIBOP course comprises securities operations, financial markets, risk management, and anti-money laundering.

You’ll also be working on live projects in:

- Money Laundering Schemes

- Ethical Banking

- Trade-Based Money Laundering

The CIBOP program, with more than 1,000 recruiting partners and its robust industry network, offers comprehensive guidance to the candidates in aptitude training, profile building, and mock interviews for sure success.

Conclusion: Shaping the Global Financial Landscape

From enabling the billion-dollar initial public offering to assisting economic recovery from a crisis, investment banking creates worldwide effects in the space of global affairs. In its increasing battle against adversity in the face of technology and ethics-driven finance needs, its worth cannot but continue to increase. If you are a career-oriented banker or finance professional simply fascinated by the intrigue of it all, understanding how investment banking drives markets can assist in bringing to light the economic heartbeat of the world.

If you’re willing to take the jump, Imarticus Learning’s CIBOP™ certification has everything to guide a path in this high-impact, career-cutting route.

FAQs: Investment Banking and Its Global Relevance

1. What is the role of investment bankers in economic development?

Investment bankers create capital flow to top industries, shed light on fiscal policy, and create financial strength in their era of economic devastation and thereby cause national and international economic growth.

2. How do investment banking services benefit corporations?

They offer professional training in fundraising, mergers, acquisitions, risk management, and expansion so that the companies are able to make extraordinary financial choices.

3. Why is investment banking important to global financial markets?

Investment banking introduces liquidity, ingenuity, and stability in finance to make the markets anywhere in the world more effective and strong.

4. What skills are important for a career in global finance?

Analytical abilities, communication, adaptability, and structured financial knowledge are the pillars of success in the global finance industry.

5. Can investment banking affect everyday life?

Indirectly. By contributing to economic prosperity, employment, and market stability, investment banking indirectly benefits society as a whole and overall welfare.

6. How does the economic impact of banking influence global trade?

Banking decision regulates exchange rates of currencies, interest rates, and streams of investments, all of which play an important role in power drives commerce currents across the globe.

7. What makes investment banking a perfect career choice?

High-paying salaries, quick career advancement, and the fact that one gets to be part of the significant financial decisions are what make it such a desirable profession.