Last updated on November 3rd, 2025 at 05:35 pm

Have you ever wondered what kind of salary a Financial Risk Manager earns? If you’re eyeing a career in risk management or finance, that’s probably one of the first questions that comes to mind. And rightly so – after all, your job should reward both your skills and the time you invest in building them.

If you’ve ever found yourself wondering, “How much can I really earn with an FRM certification?” – you’re asking a very practical question. Now more than ever, risk management isn’t just a buzzword. It’s where careers are not only built but accelerated, in India and around the world.

The FRM certification, offered by GARP, has become one of the most prestigious global designations in finance. Employers across banking, consulting, and fintech respect it. But how much can you earn with an FRM under your belt in India? Let’s break it down.

What is FRM?

If you’re wondering what is FRM, think of the FRM (Financial Risk Manager) credential as a global passport in finance. Offered by GARP (Global Association of Risk Professionals), it proves your ability to handle the toughest challenges in modern finance, from market volatility and credit risk to regulatory compliance.

It’s not just another qualification on your résumé; it’s a recognition that you can help companies plan confidently through uncertainty. That’s why leading banks, investment firms, consulting companies, and fintechs actively seek FRM-certified professionals. With the demand for skilled risk managers rising, the FRM salary in India continues to reflect the value of this globally respected certification.

What Does an FRM Professional Actually Do?

FRMs are the financial risk experts who keep organisations safe when markets get unpredictable. They work behind the scenes, analysing data, building risk models, and designing strategies to minimise potential losses.

In simple terms, FRMs don’t just crunch numbers – they help businesses make smarter, safer decisions.

You’ll find them in:

- Banks that manage credit or market risk.

- Hedge funds and asset management firms, optimising portfolios.

- Fintech companies, strengthening digital risk frameworks.

- Regulatory bodies like the RBI or SEBI ensure compliance and stability.

Their expertise makes them essential to the financial ecosystem, and that’s exactly why FRM-certified professionals are among the most sought-after in today’s finance world.

Which Industries Hire FRMs?

From banks to startups, FRMs are found anywhere money meets uncertainty:

| Industry | Top Employers |

| Banking & Financial Services | HDFC, ICICI, Axis, SBI, Barclays |

| Consulting & Big 4 | Deloitte, KPMG, PwC, EY |

| Insurance & Actuaries | LIC, HDFC Life, SBI Life |

| Fintech & Startups | Paytm, Razorpay, Cred |

| Asset Management & Hedge Funds | BlackRock, Franklin Templeton |

| Corporate Risk (Non-financial firms) | Tata, Reliance, Mahindra |

If you land an offer at Nomura, expect Analyst salaries to average ₹16-40 LPA, driven by location and market division.

Confused about what to do after BCom? This video cuts through the noise – no hype, no fluff – just clear guidance on the best certification that can fast-track your career, boost your earning potential, and help you stand out in today’s finance job market.

FRM Salary in India: A Closer Look

The FRM salary in India can vary depending on your experience, industry, and location. According to a recent salary research by QuintEdge, FRM-certified professionals in India earn between ₹6.7 LPA to ₹50 LPA.

Here’s a quick breakdown:

| Experience Level | Average Salary (INR) |

| FRM Fresher | ₹6-8 LPA |

| 2-5 Years Experience | ₹10-18 LPA |

| 5-10 Years Experience | ₹20-30 LPA |

| 10+ Years / Leadership | ₹40-50 LPA |

What’s driving these numbers? Companies have been facing growing regulatory pressures from the RBI and SEBI. Add the rise of digital banking and market volatility, and suddenly, risk experts are more important than ever. This demand is directly boosting FRM salary packages, especially in 2025 and beyond.

Most recent surveys show FRM-certified professionals in India earn well above average finance roles. Jobted pegs the average around ₹12 LPA, whereas 6Figr reports experienced FRMs earning nearly ₹22 LPA annually.

The FRM Salary Ladder in India

Salary isn’t just about digits; it’s about growth and the kind of career arc you can expect. The journey starts at the fresher stage, moves quickly through specialist roles and then peaks with strategic leadership.

| Experience Level | Typical Salary (INR) | Common Roles |

| 0-2 Years | ₹4-7 LPA | Risk Analyst, Junior Risk Consultant |

| 3-7 Years | ₹8-15 LPA | Risk Manager, Senior Risk Analyst |

| 8+ Years | ₹20-35+ LPA | Head of Risk, CRO, Director of Risk |

In fact, veterans with global experience and broader portfolios can cross ₹1 crore per annum, especially at multinational banks or consulting houses.

Even entry-level roles such as Risk Analyst or Credit Risk Associate average ₹6-8 LPA on AmbitionBox, which is notably higher than most finance graduate salaries.

FRM Salary City-wise

Location plays a big role in salary potential – metros dominate the charts.

| City | Average Salary |

| Mumbai | ₹8-25 LPA |

| Bengaluru | ₹7-22 LPA |

| Delhi NCR | ₹6-20 LPA |

| Pune | ₹5-15 LPA |

| Tier-2 Cities | ₹4-12 LPA |

Metro cities also offer faster career acceleration due to the concentration of multinational banks, consulting firms, and fintech startups.

Did You Know?

Mumbai-based FRMs at J.P. Morgan can earn ₹18-30 LPA+, boosted by annual bonuses.

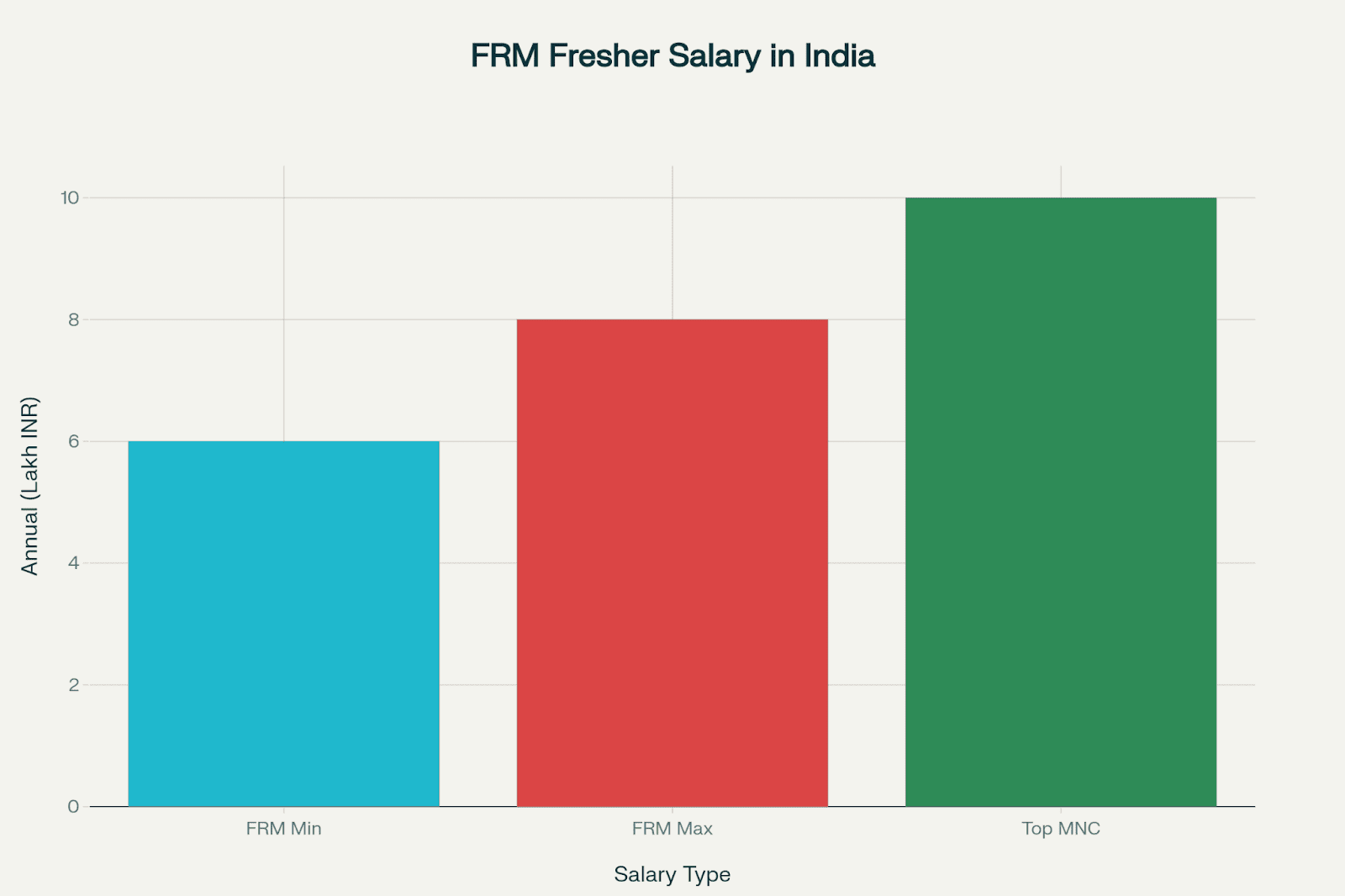

FRM Fresher Salary in India: Is It Worth It?

The short answer – yes, absolutely. An FRM fresher in India can expect to earn between ₹6 LPA and ₹8 LPA, depending on where they work. That’s already higher than most other finance graduates starting.

Common entry-level jobs for FRM-Certified Professionals include:

These are strong starting points that often lead to mid-level roles within a few years, which come with substantial pay hikes.

Interesting Fact!

Top-tier employers (J.P. Morgan, Morgan Stanley, BlackRock, Nomura) pay above market – entry roles starting at ₹16-19 LPA, with senior managers crossing ₹31-75 LPA, including bonuses. – 6 Figr & Levels.FYI.

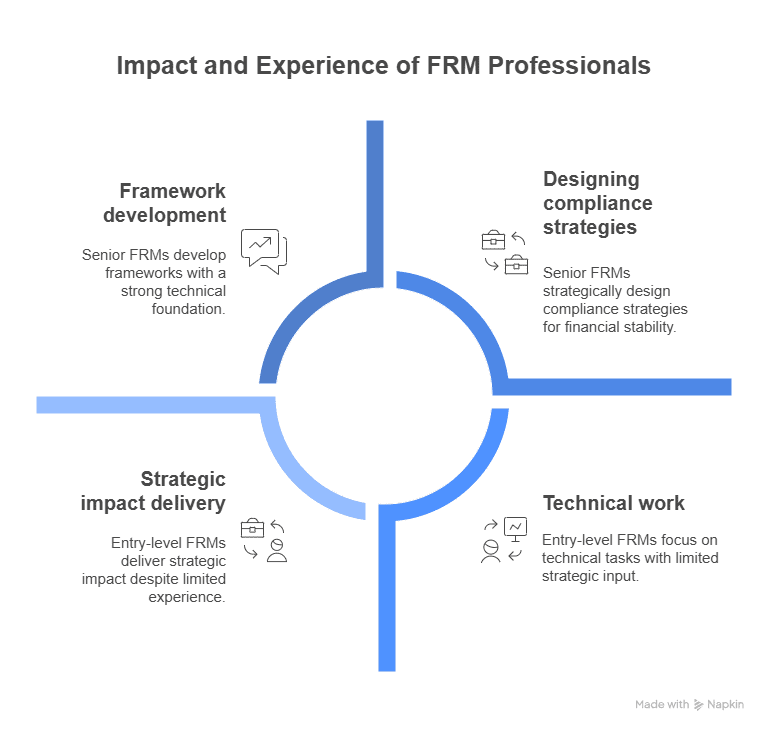

Why FRM Professionals are Paid Well

Ask any recruiter: the right risk expert doesn’t just spot issues; they prevent millions in losses. FRM-certified professionals earn more because:

- They deliver strategic impact, not just technical work.

- Freshers enjoy a 20-30% premium over generalist finance grads, especially in metros like Mumbai, Bengaluru, and Delhi.

- Mid-level and senior FRMs design frameworks and compliance strategies that save money and keep companies afloat during downturns.

Did you know?

Naukri and Glassdoor listings for FRM roles often show salaries 20-30% higher than comparable non-certified finance positions, especially in metro cities like Mumbai and Bengaluru. This difference is visible across platforms.

FRM Jobs and Pay Scale: Roles You Can Target

Earning your FRM qualification doesn’t box you into one type of job – in fact, it opens up multiple career paths.

| Role | Salary Range (INR) |

| Risk Analyst | ₹6-12 LPA |

| Credit Risk Manager | ₹10-18 LPA |

| Market Risk Analyst | ₹8-15 LPA |

| Portfolio Risk Manager | ₹18-25 LPA |

| Treasury Manager | ₹15-22 LPA |

| Regulatory Compliance Lead | ₹20-35 LPA |

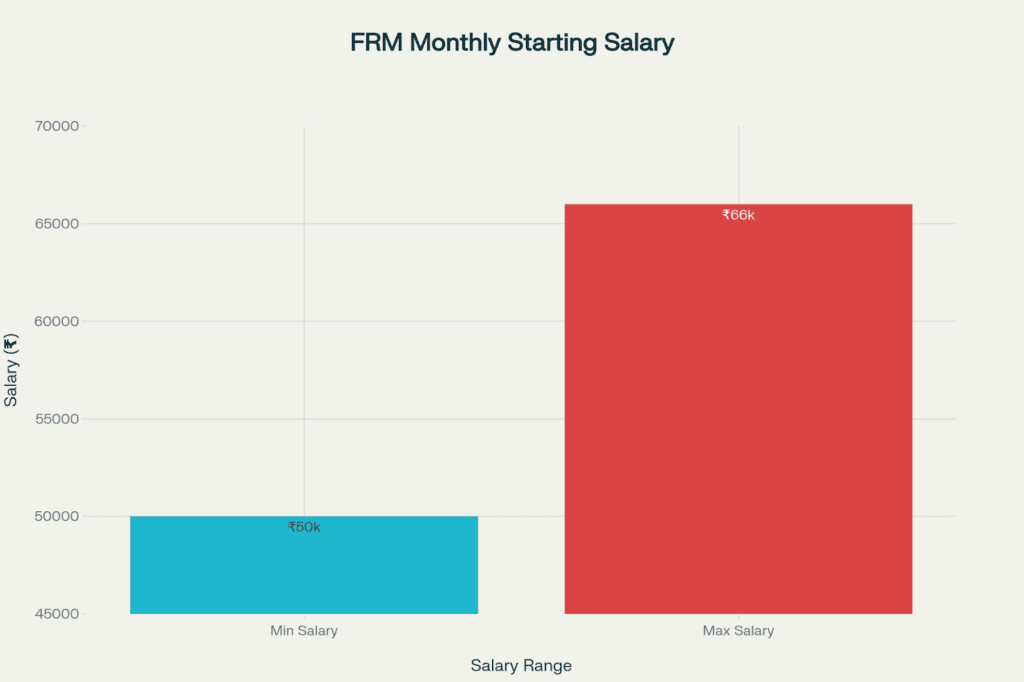

FRM Salary in India Per Month

To get a clearer picture of earning potential, it helps to see how these annual figures translate into monthly pay. Here’s what FRM professionals in India typically earn per month.

| Level | Average Monthly Salary (INR) |

| Fresher | ₹50,000 – ₹66,000 |

| Average (All) | ₹64,000 – ₹1,60,000 |

| Senior | ₹1,30,000 – ₹2,80,000+ |

Entry-level FRMs usually start around ₹50K/month in top cities.

Senior FRMs (10+ years or leadership roles) can cross ₹2 lakhs/month in MNCs and large banks.

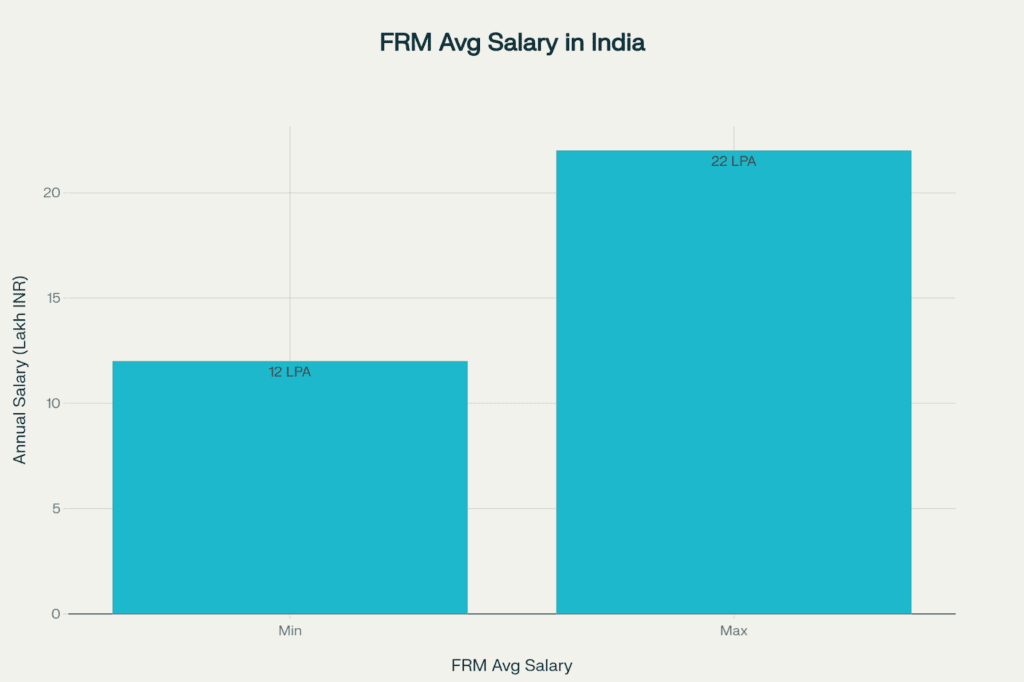

FRM Average Salary in India

According to the latest 2025 reports, the average FRM salary in India varies across sources.

- Jobted estimates it at around ₹11.9 LPA

- 6Figr places it closer to ₹21.9 LPA,

- while Glassdoor reports an average of about ₹10 LPA.

Together, these figures highlight how FRM-certified professionals in India typically earn between ₹10-22 LPA, depending on experience, role, and organisation.

These numbers reflect the rising appetite for certified risk professionals, especially as Indian banks and fintechs ramp up regulatory compliance teams in 2025.

The typical FRM-certified professional rolls in at ₹12-23 LPA on average, with mid-career specialists trending closer to ₹20 LPA.

FRM Starting Salary in India

When you’re just starting in risk management, the FRM fresher salary in India typically ranges from ₹6-8 LPA, but those landing analyst roles in top MNCs can see their starting package bumped up to ₹10 LPA, setting a solid financial foundation right from day one.

The fresher’s salary is significantly higher than most non-certified finance roles. The starting package is driven up for those placed in Mumbai/Delhi with Big 4 or top banks.

FRM Fresher Salary in India

If you’re just starting and wondering what your first paycheck as an FRM might look like, here’s a quick snapshot of what freshers typically earn in India.

- Typical range: ₹6-8 LPA for Risk Analysts, Credit Risk Associates, or Jr. Market Risk roles.

- Large consulting firms/US banks may pay close to ₹10 LPA for well-qualified starters.

- Most freshers get their first hike within 2-3 years as they build practical risk and analytics experience.

You’ve finished your BCom, landed your first job, but somewhere deep down, you’re wondering – is this it? Or can a commerce graduate like you really break into the seven-digit salary club? This video will guide you through the best certification options after a BCom degree that can turn that question into reality.

CA FRM Salary in India

Those holding both CA and FRM certifications are paid premium salaries in risk, treasury, and strategic finance roles, quickly reaching mid- to senior-level pay bands.

| Profile | Average Salary |

| CA | ₹7-12 LPA (Freshers to 3 yrs) |

| CA at Top MNC | ₹13-23 LPA (with 5-8 yrs) |

| CA + FRM | ₹12-20 LPA (3-5 yrs), ₹30+ LPA (Sr) |

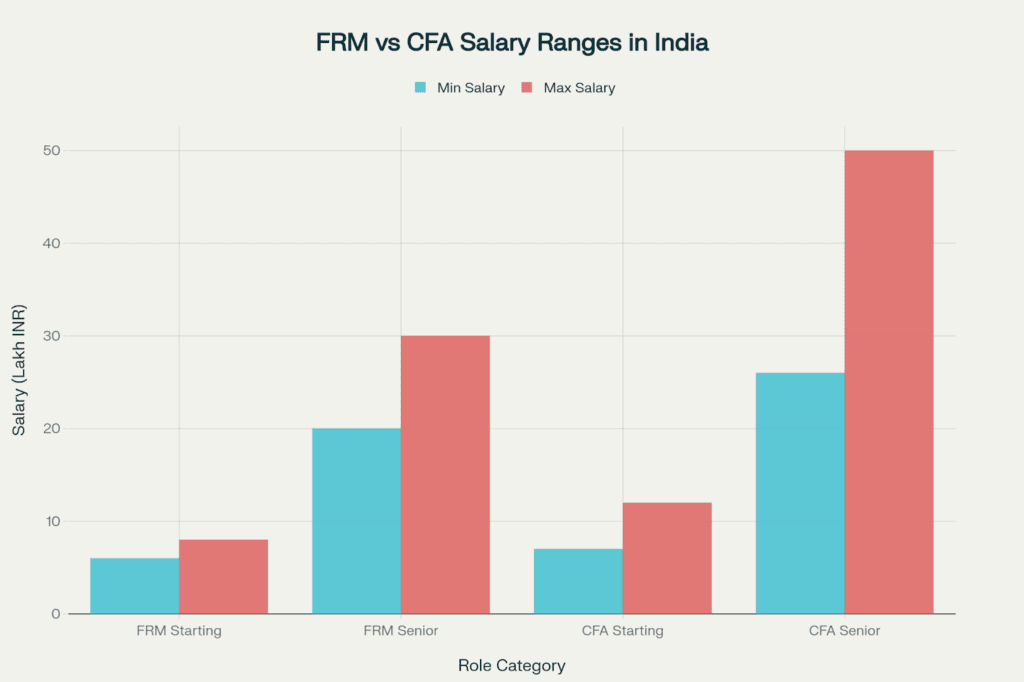

FRM vs CFA Salary in India

Both FRM and CFA are globally respected designations. Now that we know FRMs earn handsomely, the next big question is- how do they stack up against CFAs? Let’s break down the salary face-off between these two finance powerhouses.

| Experience Level | CFA Salary | FRM Salary |

| Entry (0-3 yrs) | ₹7-12 LPA | ₹6-9 LPA |

| Mid (4-7 yrs) | ₹13-25 LPA | ₹10-15 LPA |

| Senior (8+ yrs) | ₹26-50+ LPA | ₹20-30+ LPA |

CFA is preferred in investment/portfolio roles, while FRM is preferred for risk, compliance, and treasury.

Both see rapid jumps post 5 years, but CFA may command the highest peaks in portfolio mgmt/banking, while FRM leads in risk-intensive domains.

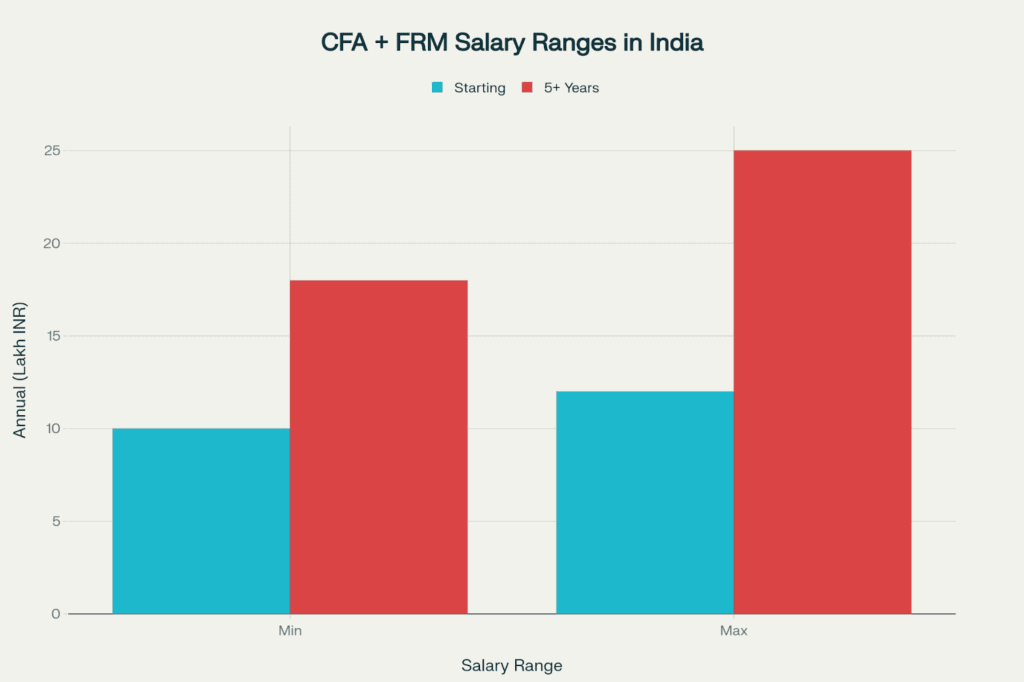

CFA FRM Salary in India

- Salary for professionals holding both CFA and FRM ranges from ₹8-15 LPA for 1-4 years of experience, quickly rising to ₹18-30+ LPA with 5-8 years, especially in investment banks, asset management, and risk strategy.

- Dual-certified specialists are sought after for hybrid roles – investment risk, risk analytics, and portfolio risk consulting.

Did you know?

Picking up Python or R can instantly add ₹2-3 lakhs to your annual offer, as risk analytics is a premium skill.

FRM vs Other Certifications: Salary & Value

FRM isn’t alone; CMA and CFA also give a clear career boost.

| Certification | Typical Indian Salary | Main Roles | Skills That Boost Pay |

| FRM | ₹4-7 LPA Fresher, up to ₹35+ LPA Senior | Risk Management, Analytics | Data modelling, Python, Regulatory expertise |

| CMA | ₹3-5 LPA Fresher, up to ₹30 LPA Senior | Management Accounting, Costing | Power BI, SAP, Strategy, Communication |

Why FRM sometimes edges ahead: Risk roles now attract huge demand, faster salary hikes, and job security, even during downturns.

Salary by Job Roles in Financial Risk Management

When you begin your journey as an FRM-certified professional, the title on your business card isn’t just a designation; it’s a reflection of the value you bring to the financial ecosystem.

From entry-level analysts crunching market data to directors shaping risk strategies at multinational banks, every role tells a story of growth, expertise, and reward.

Picture this-

You begin as a Risk Analyst, working behind the screens to identify early warning signs in portfolios – earning around ₹6-8 LPA. As you sharpen your understanding of credit exposure and regulatory metrics, that number begins to climb.

Soon, you might step into the shoes of a Credit Risk Manager, balancing decisions worth crores – salaries here often reach ₹15-25 LPA depending on the organisation and city.

Move a few years ahead – you’re no longer just assessing risks; you’re defining frameworks. As a Market Risk Specialist or Operational Risk Manager, your expertise becomes pivotal to every trade and compliance decision, fetching ₹20-35 LPA or more in global banks.

And for those who keep climbing, to Senior Risk Leaders, VPs, or CROs – the story turns exponential. Strategic decision-making, cross-border exposure, and advanced analytics can push annual compensation well above ₹50 LPA in top-tier firms.

FRM Salary in India: What’s the Future?

The outlook for FRM salaries in 2025 is bright. Experts predict an average 12-18% salary hike across all levels. So what makes the FRM certification a smart financial move? Let’s summarise.

- Faster Salary Growth: FRM-certified professionals often get promoted faster because they bring proven credibility to risk roles.

- Job Security: Risk management remains a top hiring priority even during recessions.

- Global Mobility: The FRM credential makes it easier to transition into international finance jobs.

- Career Diversity: From banking to fintech, every financial institution needs risk experts.

This growth is mainly driven by:

- Stricter regulations by the RBI and SEBI

- Expansion of GIFT City in Gujarat

- Rising ESG and compliance mandates

In short, risk management is becoming the backbone of modern finance, and FRM-certified professionals are leading that change.

The demand for certified risk managers is set to grow sharply with India’s expanding financial sector and regulatory oversight.

According to Naukri and LinkedIn hiring insights, FRM-related job postings have increased by nearly 35% YoY since 2023.

By 2030, salaries in advanced risk roles are expected to rise by another 20-25%, especially in fintech and global investment banking domains.

Factors Impacting FRM Salaries

Several things move the needle for better or worse on your pay:

- Industry: Banking, investment, and insurance top the charts; consulting and fintech are strong challenger sectors.

- Company Size: Large MNCs and global banks pay far more than regional outfits.

- Location: Mumbai is king, followed by Bengaluru and Delhi NCR for top packages.

- Skill Set: Knowing Python, R, Power BI, or Tableau? Expect a 20-30% lift.

- Certifications: Adding CFA, CPA, or an MBA to FRM multiplies the value.

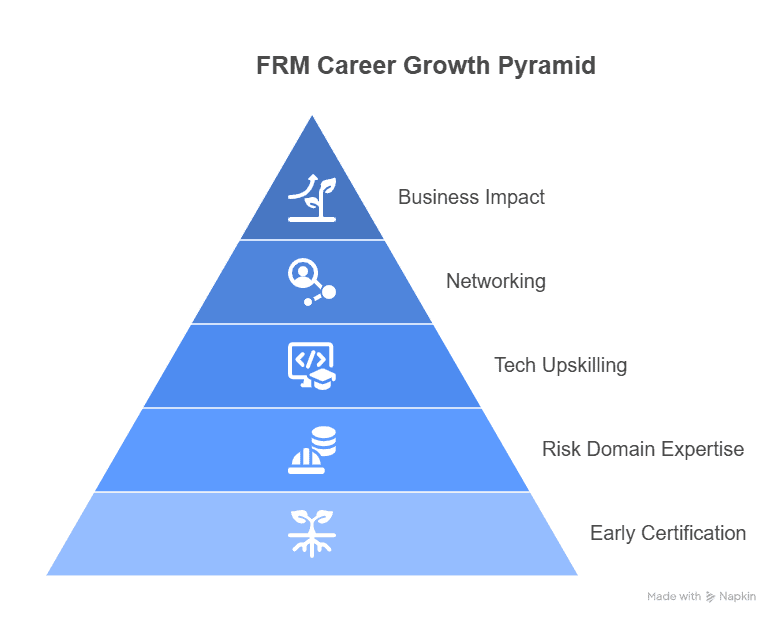

How to Boost Your FRM Salary

Earning your FRM is just the first milestone – how you build on it determines how fast your salary grows. Here are a few proven ways to stay ahead of the curve and maximise your earning potential:

- Get certified early, start compounding your growth.

- Work across risk domains: credit, market, liquidity.

- Upskill in data analytics, AI, and fintech regulation.

- Stay networked: GARP members, LinkedIn, webinars.

- Always show business impact in appraisals.

Where to Start: Preparing for the FRM Journey

If you’re inspired to pursue your FRM journey, preparation is the key. Look for learning programs that provide:

- GARP-approved study materials

- Mock exams and classroom support

- 1:1 career mentorship

- Placement guidance

India’s only GARP-authorised provider, the Imarticus FRM Certification Program, offers a structured path to earning your FRM credential and accelerating your risk career.

FAQs about FRM Salary in India

Here are a few frequently asked questions about FRM Salary in India to understand advanced career opportunities and salary growth for professionals aiming to master risk management in the finance industry.

Who earns more, FRM or CFA?

While both CFA and FRM professionals enjoy competitive pay, FRMs often earn slightly higher in specialised risk management roles due to their niche expertise in managing financial uncertainty. On the other hand, CFAs earn more in investment and portfolio management roles. Ultimately, the better-paying path depends on your interest in domain – risk or investments.

What is the salary of an FRM in Deloitte India?

At Deloitte India, FRM-certified professionals typically earn between ₹5-12 LPA for freshers; the pay range increases depending on experience and role. Mid-senior professionals in risk consulting or financial advisory can see packages crossing ₹25 LPA. FRM certification adds a strong edge in global risk and compliance projects.

What is the salary of ACCA vs FRM in India?

Both ACCA and FRM offer global finance careers, but their pay scales differ by role. FRMs specialise in risk management and usually earn around ₹10-20 LPA, while ACCAs specialise in accounting and audit roles, earning an average of ₹6-15 LPA. The FRM salary in India tends to rise faster due to their demand in banking and fintech risk functions.

Is FRM in demand in India?

Absolutely. FRM-certified professionals are increasingly sought after as Indian banks, NBFCs, and fintech firms strengthen their risk and compliance frameworks. With the RBI tightening regulatory norms, FRMs are now among the most in-demand finance specialists in 2025.

What is the expected FRM salary in India in 2025?

In 2025, the FRM salary in India is projected to range between ₹10-30 LPA depending on experience, role, and sector. Senior professionals in banking and treasury roles often command packages above ₹25 LPA.

What is the average Financial Risk Manager salary in India?

The average FRM salary in India stands around ₹12-18 LPA for mid-level professionals, according to AmbitionBox and Glassdoor data. This number continues to climb as more firms recognise the value of certified risk talent.

What is the FRM fresher’s salary in India?

Fresh FRM-certified professionals typically start between ₹6-8 LPA. Companies like Deloitte, KPMG, and fintech startups actively hire FRM freshers for entry-level risk and analytics roles, offering a solid launchpad for career growth.

How are FRM jobs and pay scale structured?

FRM salaries scale quickly with experience and role complexity. Risk analysts and associates earn mid-level pay, while risk managers, treasury heads, and credit risk specialists earn significantly more due to higher responsibility and exposure.

What is the average FRM salary in India for freshers?

For FRM-certified freshers, salaries usually fall in the ₹6-8 LPA range, depending on the company, role, and city. Tier-1 firms and global banks may offer slightly higher packages to those with additional finance or analytics skills.

Which companies hire FRM-certified professionals in India?

Top recruiters include Deloitte, KPMG, PwC, Barclays, and various fintech startups.

What roles can I get after FRM certification?

Common roles include Risk Analyst, Credit Risk Manager, Market Risk Analyst, and Treasury Manager.

Transform Your Finance Career With FRM

Choosing a career is never just about passion; it’s also about potential. And when it comes to both, the FRM certification delivers on every front.

FRM salary in India ranges from ₹4 LPA as a fresher to ₹35 LPA+ at leadership/strategy roles, with global salaries crossing $100K for experienced pros. Major cities and global firms offer the best packages and now often match international pay for Indian talent. Salary is just the start – risk management means you’re helping shape finance and business strategy, both locally and worldwide.

From strong starting salaries to international opportunities, the FRM opens doors to some of the most dynamic and secure roles in finance. Whether you’re a fresh graduate or a mid-career analyst, earning your FRM could be the smartest investment you make this year.

If you love analytics, strategy and want a career with impact and global recognition, FRM is more than an exam. It’s the next leap in finance – backed by salary, security, and story. So if you’ve been thinking about it, now’s the time to leap. The world needs skilled risk managers, and your next big opportunity could be just one FRM exam away. Enrol Now!