Ever wondered what it’s really like to step into the world of a Financial Analyst? Whether you’re just starting out, considering a switch, or simply curious, this role is more than just crunching numbers & preparing reports…

It’s a high-stakes, fast-paced career that blends technical expertise with strategic decision-making. In this blog… we’ll pull back the curtain on the Financial Analyst job role, exploring what the daily grind looks like, the highs that come with it, and the challenges that professionals face head-on.

So, let’s break it down – the reality, the rewards & yes… even the pressure.

Who is a Financial Analyst?

At its core, a Financial Analyst evaluates financial data, market trends, and economic indicators to provide insights that influence business decisions. From helping companies optimise investments to preparing budget forecasts, they act as the financial compass guiding leadership teams toward profitability & growth.

But let’s be honest… it’s not just about being good with spreadsheets.

This career demands a combination of analytical rigour, business acumen & strong communication skills. A day might begin with analysing stock trends and end with advising a CEO on acquisition decisions.

A Day in the Life of a Financial Analyst

Let’s start by visualising a typical day in the life of a financial analyst.

| Time | Task |

| 8:00 AM | Market opening updates & reviewing overnight global trends |

| 9:30 AM | Internal meetings to discuss ongoing projects |

| 11:00 AM | Financial modelling & forecasting |

| 1:00 PM | Lunch break (usually quick & at the desk) |

| 2:00 PM | Client or stakeholder presentations |

| 3:30 PM | Updating reports & reviewing KPIs |

| 5:00 PM | Strategising with investment teams or senior leadership |

| 6:30 PM | Wrapping up emails or prepping for the next day |

While the rhythm might vary, most financial analyst challenges revolve around tight deadlines, managing large datasets, & communicating complex findings clearly.

Curious what a career path looks like? Here’s a deep dive into the financial analyst career path.

The Financial Analyst Job Role: More Than Just Numbers

There’s often a misconception that the financial analyst job role is just about number crunching. But the reality is, it’s highly collaborative & involves:

- Evaluating investment opportunities

- Building financial models

- Forecasting revenue & expenditure

- Recommending strategies to increase profitability

- Working with cross-functional teams like marketing, operations & sales

If you’re leaning toward a career in financial analysis, you’ll need more than just finance knowledge. Strong communication, curiosity & a keen eye for trends are just as vital.

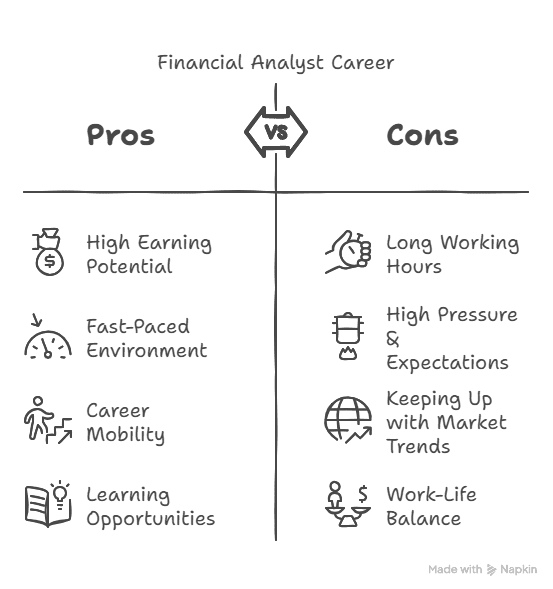

Pros of Being a Financial Analyst

Let’s talk perks… Because there are quite a few that make the job exciting.

1. High Earning Potential

A career in financial analysis often comes with competitive salaries. With experience & upskilling, professionals can reach top-tier compensation.

2. Fast-Paced Environment

If you love challenges & constant learning, this role offers both in abundance.

3. Career Mobility

The skillset is highly transferable across industries – from tech to healthcare to banking. You can even explore lateral shifts, like moving from corporate finance to an investment banking analyst life.

4. Learning Opportunities

From mergers to acquisitions to portfolio strategies – you get to learn it all. If you’re curious about specialisation, check out M&A careers for CA graduates.

Challenges of Being a Financial Analyst

But let’s not sugar-coat it. There are hurdles too… and knowing them upfront helps you prepare better.

1. Long Working Hours

The investment banking analyst life can mean 12-14 hour workdays. While not all roles are this intense, many require extended hours during financial closes or reporting seasons.

2. High Pressure & Expectations

Senior leadership depends on your insights. One error in a model? It could lead to major strategic missteps. That’s why financial analyst challenges include maintaining accuracy while working fast.

3. Keeping Up with Market Trends

This industry never sleeps. Whether it’s global markets or domestic policy changes – staying informed is a must.

4. Work-Life Balance

Especially in early roles, the balance can tip towards work. But with experience & the right environment, this improves.

These are the real pros and cons of being a financial analyst – and knowing both sides helps you decide if this path is right for you.

So… Is It Worth It?

In a word? Absolutely.

If you’re passionate about finance, strategy & solving real-world business problems, this career can be incredibly rewarding. The financial analyst job role evolves constantly – meaning you’ll rarely be bored. Plus, with proper training & guidance, you can carve out a niche that aligns with your interests.

For those curious about jumping in, here’s a great place to start:

👉 Postgraduate Financial Analysis Program by Imarticus – ideal for those looking to kickstart or elevate their finance career growth.

Financial Analyst Career Growth: What’s the Path Ahead?

Let’s talk about finance career growth… because where you begin isn’t where you’ll stay.

Entry-Level:

- Junior Analyst

- Financial Associate

- Business Analyst

Mid-Level:

- Senior Financial Analyst

- Strategy Manager

- Investment Banking Analyst

Senior-Level:

- VP of Finance

- CFO

- Portfolio Manager

Many professionals also transition into consulting, private equity, or even entrepreneurship. You can read about equity research roles after MBA if that’s your area of interest.

The bottom line? Growth is abundant if you stay curious, adaptable & open to continuous learning.

Let’s Talk About Work Culture…

A big part of a day in the life of a financial analyst revolves around collaboration – you’ll be interacting with everyone from accountants to marketing heads. While it’s dynamic, it also requires managing multiple stakeholders, deadlines & data simultaneously.

The team environment often plays a big role in whether your experience is high-stress or highly rewarding.

Want to hear it directly from industry experts?

📹 Watch this video on becoming a Financial Analyst – it’s packed with insights.

Tips for Thriving in Financial Analysis

Whether you’re already in or planning a move, here are some tried & tested ways to thrive:

✅ Master Excel & financial modelling – This is your toolkit

✅ Stay updated – Read financial news, follow market trends

✅ Network – Peers, mentors & professional communities can offer huge value

✅ Upskill continuously – Courses like financial analysis can give you that competitive edge

✅ Work on communication – Your insights are only valuable if understood

Final Thoughts

Being a Financial Analyst isn’t just about reports or balance sheets. It’s about becoming a trusted advisor – someone who sees the patterns, anticipates challenges & drives decision-making.

Sure, there are downsides. The financial analyst challenges are real – from long hours to high-pressure deliverables. But if you love problem-solving, navigating uncertainty & making sense of complex data… the pros definitely outweigh the cons.

This role is a launchpad. Whether you aspire to enter the world of investment banking, corporate strategy, or even entrepreneurship – it sets you up with skills that are valuable across the board.

So, if you’re serious about building a strong career in financial analysis, now is the time to act. Check out the Postgraduate Financial Analysis Program by Imarticus – your future self will thank you.