Last updated on August 24th, 2024 at 12:11 pm

Preparing for a finance interview can be very challenging, but with the right guidance, one can ace the toughest of finance interview questions. With the following guide, we will help you tackle the most common finance interview questions as well as other finance related questions.

This guide will also provide knowledge about various other aspects such as expectations, how to prepare, what kind of finance questions can be asked and the necessary concepts you must know of. Whether you are a fresher or even a working professional, this guide will help you prepare for the finance interview.

What To Expect In a Finance Interview

Before preparing for the finance interview questions it is very important to know what the interviewers expect from the candidates. The interviewees are not only expected to have good financial knowledge but also how to apply the financial knowledge. The candidates can expect the following types of questions while preparing for the finance interview questions-

- Technical questions: In finance interview questions these questions are meant to test the financial concepts of the candidate and to find out how well they can perform the financial tasks

- Behavioral questions: In finance interview questions these questions are asked to find out how the candidates have handled their work in the past jobs because finance requires experience.

- Situational questions: In such types of questions, the candidates are given some situations or scenarios and they are required to answer how they would react in that situation. These are very important kinds of questions and are asked in finance interview questions.

Preparation For The Interview

Preparation is the key thing that candidates need to do in order to ace the finance interview questions. Here are some of the points that should be kept in mind in order to prepare for finance interview questions:

- Research the company: Before going for an interview in a company, it is necessary to research the company in detail such as current news, the founders and their achievements, etc.

- Review common 1uestions: The candidates can look into some sample interviews of the company and prepare some finance interview questions to gain confidence.

- Brushing up the basics: While preparing for the finance interview questions, the candidates must know the basic concepts that they have learned in the past.

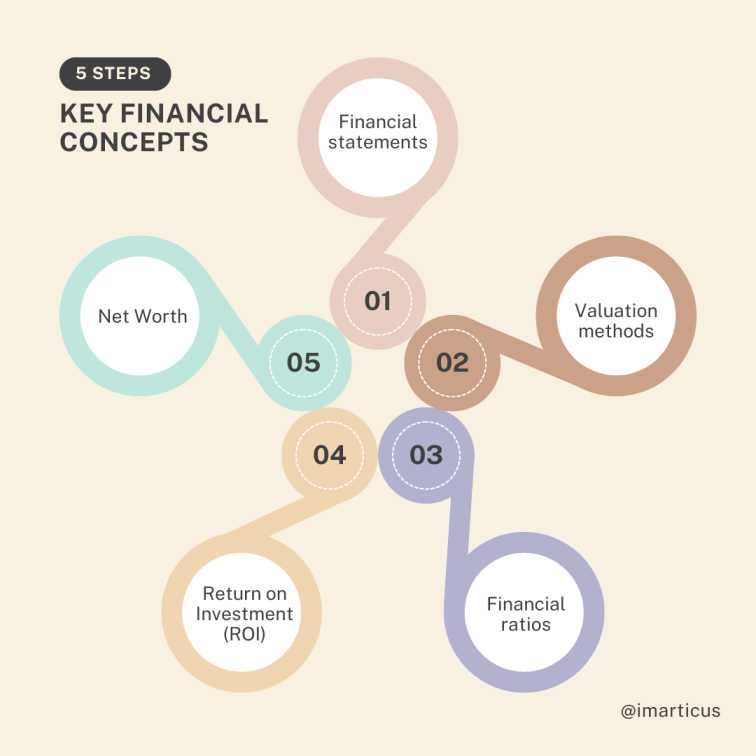

Key Financial Concepts

Before preparing for the finance interview questions, the candidates must go through the basic finance questions and concepts to prepare for finance interview questions which are provided below:

- Financial statements: This includes understanding the income statement, balance sheet, and cash flow statement of the company.

- Valuation methods: Candidates must be aware of the different valuation methods such as the Discounted Cash Flow (DCF), Comparable Company analysis, etc.

- Financial ratios: These ratios tell about the liquidity, profitability, and leverage of the company.

- Return on Investment (ROI): The return on Investment tells about the return a company can expect from the investments they have made.

- Net Worth: The net worth tells about the financial health of the company. It is measured as the difference between the total assets and the total liabilities.

Common Finance Interview Questions and Sample Answers

Tell me about yourself.I graduated with a degree in finance from the following xyz university which helped me gain a deeper and complete knowledge of financial concepts and also helped forge a strong foundation in financial analysis and corporate finance. After completing graduation, I worked as an intern at ABS Ltd. to apply my knowledge in practical life. I wish to pursue a career in the finance field as it is quite challenging as well as exciting for me.

Why do you want to work in finance?I feel comfortable working with numbers and I like to analyse data, learn the trends and help businesses in making financial decisions. I have good analytical skills and also they have always had an interest in business and so they think they can combine both skills and have a good career in the finance field.

Explain a financial model you have built.I developed a discounted cash flow (DCF) model to assess a possible acquisition in their previous position. Forecasts for capital expenditures, cost estimates, and revenue were all incorporated into the model. I decided to move forward with the purchase after calculating the acquisition’s possible return on investment by discounting future cash flows.

How do you value a company?There are many ways in which we can value a company such as by the DCF analysis, Comparable analysis and precedent transactions. The DCF involves determining future cash inflows and discounting them in present value, comparable analysis basically chooses companies from the same sector and makes comparisons, precedent transactions look at recent sales of companies and analyzes the current market trends.”

What is EBITDA and why is it important?EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. It’s a measure of a company’s operating performance and is often used to compare profitability. EBITDA helps to assess a company’s operational efficiency by excluding the effects of capital structure and non-cash items..

Describe a time you worked in a team to achieve a common goal?In the university, I worked as the head of the finance club where they had a case study competition. There were several teams and each team was given a case study on any one company and they were required to solve it within a certain time limit. My team efficiently worked towards solving the case, with good teamwork and communication, the team won a second prize in the competition.

How do you stay updated on financial news and trends?I invest in stocks so it is necessary to be updated on financial news and current trends. The candidate reads the news every day from the Economic Times, The Wall street Journal, etc. They also follow various news channels on Twitter and LinkedIn.

What do you think is the biggest challenge facing the finance Industry today?The rapid development of technology and the widespread use of artificial intelligence (AI) in financial services pose major risks. Although these technologies are innovative and efficient, they also come with risks. like the need for updated legal frameworks and cybersecurity threats. It’s critical to remain adaptable and keep up with technological advancements.

How do you handle stressful situations?I focus on work and maintain discipline to help them cope with stress. For example, I efficiently interacted with the team and divided the work into manageable portions throughout a high-stakes project with short time frames. I was able to stay focused by taking regular rests and keeping an optimistic attitude.

Give an example of a financial analysis you have done and its impact.I prepared a profitability study for product lines at their prior position. They determined which goods were underperforming by analyzing the margins and sales figures of each product. Over the following two quarters, their suggested withdrawal of these products and emphasis on high-margin items resulted in a 15% rise in profit margin.

Conclusion

Acing finance interview questions will not be possible with just memorising the answers. Cracking interviews is also about understanding the concepts properly and having knowledge of how to apply those concepts. Whether you are preparing for finance related questions and finance interview questions for freshers, or even if you are preparing for tougher finance executive questions, the advice in this guide should help you out in all cases.

Good luck with the interview and do not forget to prepare because preparation is the key in preparing for finance interview questions. To learn advanced concepts of financial accounting and financial management, you can check out the Financial Accounting and Management course by Imarticus.

FAQ’s

Preparing finance interview questions for freshers includes knowing about financial terms and how to value a company. The candidate must be aware of the key concepts.

Finance executive interview questions include questions like, “Have you handled any market downturns? How do you deal with technology to stay ahead in your career?”, “What kind of strategies do you adopt in order to maintain the financial stability of your company?”, etc.

It is important to be well acquainted with concepts like financial statements and valuation models, to know about current market trends and news and have knowledge about financial modeling, etc. Knowing about these types of concepts for finance questions is enough for the interview.

To prepare for basic finance questions it is important to go through the basic financial concepts and terms. You will have to know finance from the base and how to apply them and also analyse it in real life. This can be done by preparing some finance basics for interview.

There are many online websites and online videos and articles that help candidates prepare for the finance interview questions. Youcan also go for mock interviews to prepare for the interview. This will help you in getting an idea as to how you can prepare for finance interview questions and know which finance related questions are being asked by the interviewers.