Last updated on December 9th, 2022 at 06:16 am

Technology and Finance have gone together for time immemorial. Initially, it was about making and maintaining records of financial transactions and later the introduction of coins, paper currency and promissory notes in the early 19th century. In modern times and about a decade ago Fin and Tech have got amalgamated into the era of fintech.

The early internet age:

Did you know that Fintech Courses teach you that the past 5 years cable under the seas far exceeds the cable network over the last 150 years since data and volumes of traffic have increased immensely? The first under-sea trans-Atlantic telegraphic cable fondly called Victorian internet-connected North America to West Europe and was in use since 1867. Financial markets at New York could connect to London, Asian markets, Europe, etc with its expansion. Forex references to GBPUSD also call this the cable-pair as most transactions were between the USD and GBP.

The laying of cabling infrastructure helped globalization and financial interactions between the period from inception in 1867 to 1914. The outbreak of WWI, the 1929 stock market crash and the Great Depression led to the slowing of the markets for over 25 years. During WWII codes and code-breakers were developed by the Germans and Britishers respectively. Communications in those days were through codes and set the initial foundation stone for coding. Just look at the German encoder shown below! It was the ability to build the decoders that leaked the German communications that led to an inversion of fates and an early end to WWII.

The ATM and calculator era:

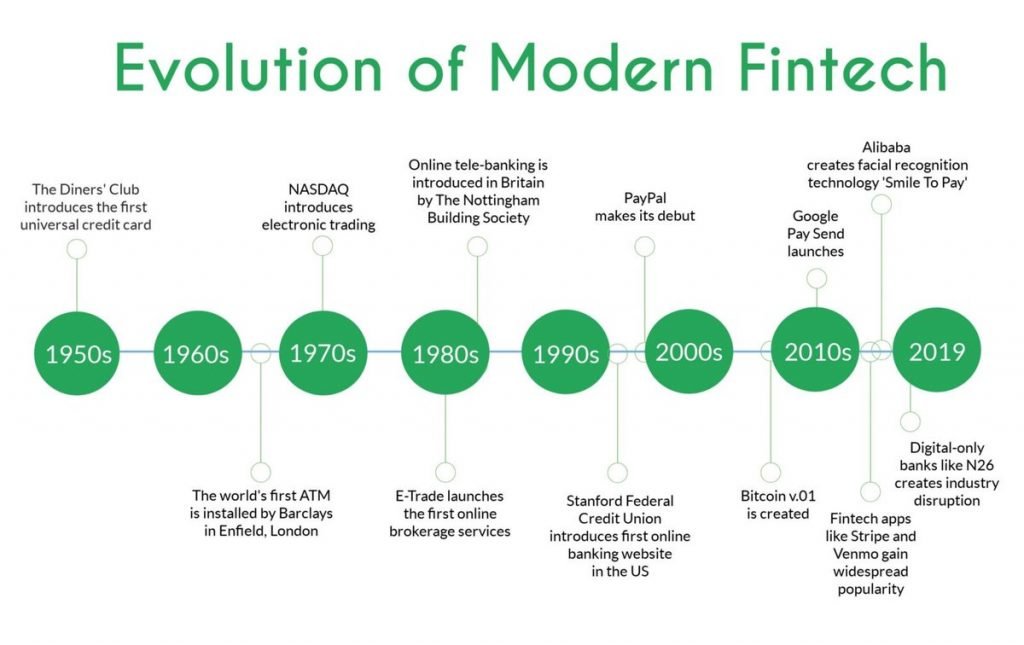

The second phase of fintech began in 1967 with the digitization of analog to digital systems. It was also the beginning of RegTEch and early use of Fintech in development. The first ATM machine placed in the UK in Barclay’s Bank was the introduction and initiation of fintech. With more machines being made available the way people transacted and their relations with technology and finance changes irreversibly. Soon we saw the introduction of computing power in the TT 2500 DataMath hand-held calculator from Texas Instruments. This slowly evolved into today’s smartphones.

The electronic age:

The period between1970-80 saw the introduction of banking SWIFT codes and payment systems both international and domestic in 1973. SWIFT-(Society For Worldwide Interbank Financial Telecommunications) with its HQ in Belgium covered over 15 major countries and 239 banks. Today it is a portal for financial communication with 11,000 institutions and is the global payment system portal for financial communications. Between the ’70s and ’80s emerged NASDAQ the stock exchange with almost no human interference. The launch of the internet in the late ’80s saw internet banking and brought smart mobile phones into the hands of the common man.

Stock markets and payment systems:

1999 saw .coms start and soon end. The 2008 financial crash brought into the limelight the distrust of customers and the start of the blockchain technology and cryptocurrencies. It also saw Siri, Google, Amazon, etc enter the digital assistant and payments platforms to revolutionize the financial scenario. Alongside e-commerce platforms emerged like TenCents, Alibaba and many others who all cashed in on the immense benefits of being early fintech players who have nearly replaced the way we shop, transact and buy things.

The present scenario:

With the advent of smartphones, data analytics and the startup revolution Fintech post the 2008 financial meltdown emerged with blockchain technology being touted as the next big technological breakthrough. Blockchains have the potential to transform and disrupt the industrial scenario with cryptos, eCommerce platforms and digital currencies taking over. P2P lending, crowd-funding, angel investors and a complete transparent digital financial world is where we definitely are headed to.

Conclusion:

The evolution of fintech has been gradual and over the last decade, fintech is set to transform and disrupt many an industry. This makes the demand for personnel high and scope for jobs huge. Payments are also good and it makes a wise choice as a career. The fintech industry needs a large number of qualified personnel and is set to grow rapidly with even governmental policies promoting its growth. Incubators, startup hubs and integration of technology into all streams of life is the new mantra.

Do your Fintech courses at Imarticus Learning to get the ideal launch with assured placements. For more details, you can also contact us through the Live Chat Support system or can even visit one of our training centers based in – Mumbai, Thane, Pune, Chennai, Hyderabad, Delhi, Banglore, Gurgaon, and Ahmedabad.