Last updated on July 23rd, 2025 at 12:54 pm

In the fast-paced world of finance today, being a financial analyst is no longer about working with spreadsheets and reporting.

Contemporary analysts must excel in a combination of technical tools, financial theory, valuation skills, and business insight. Whatever path you’re on, whether entering the world of finance or accelerating your own career, building the appropriate financial analyst skills is not up for debate.

In this exhaustive guide, we’ll take you through the most critical financial analyst skills you need to excel at, ranging from fundamental valuation methods to MS Excel mastery, and how they will ultimately make you an asset in your day-to-day work.

You’ll also get an insider’s view of tools analysts across the world use, core finance skills, sector-specific salary details, and how you can reskill with job-guaranteed certification courses like the Postgraduate Financial Analysis Program by Imarticus Learning.

What Are Financial Analyst Skills?

Financial analyst skills encompass a mix of analytical mindsets, technical software knowledge, industry expertise, and communication skills that enable professionals to translate financial data into meaningful conclusions and inform decision-making.

Financial analyst skills are way beyond textbooks. In practice, they enable professionals to:

- Predict the growth of the company

- Investment research

- Risk analysis and returns analysis

- Defend M&A and IPO analysis

- Develop business models that fuel strategic initiatives

Why Financial Analyst Skills Are in Demand

The demand for making decisions based on data has never been greater. Businesses across sectors—be they fintech firms or Fortune 500 conglomerates—rely upon qualified analysts to inform budgeting, forecasting, and strategic planning.

Additionally, demand for financial professionals who can effectively combine business acumen with data analysis has increased significantly.

According to Naukri.com and LinkedIn statistics, “financial analyst” remains one of the most sought-after and in-demand job roles in India and internationally.

With automation covering more of the heavy lifting, businesses now need analysts who bring insights, rather than information.

Top Financial Analyst Skills to Learn in 2025

Excel Skills for Analysts

Excel is still a non-negotiable skill in finance. Even with advanced tools available, Microsoft Excel is used to create pivot tables to model billion-dollar transactions.

Essential Excel functions all analysts must learn:

- VLOOKUP, INDEX-MATCH for relational data

- Pivot Tables and dynamic charts

- Conditional formatting for trend analysis

- Data validation for cleaner inputs

- What-If Analysis and Goal Seek

- Macros and VBA for task automation

Salary Insight: Based on industry reports, India-based professionals with advanced Excel and dashboarding expertise receive up to ₹21.8 LPA. Freshers typically begin between ₹1.8–3.6 LPA, with noticeable growth within 2–3 years.

Valuation Skills

Knowing how to estimate the value of a business is central to being a financial analyst. Analysts tend to apply valuation when evaluating investment opportunities, potential acquisitions, or budgeting internally.

Key valuation techniques:

- Discounted Cash Flow (DCF): Estimates value using estimated future cash flows.

- Comparable Company Analysis: Applies valuation multiples such as P/E, EV/EBITDA.

- Precedent Transactions: Examines past M&A transactions to use as a benchmark for value.

- LBO (Leveraged Buyout) Models: Frequently applied for private equity situations.

- Sum-of-the-Parts (SOTP): For conglomerates with diversified business segments.

Precision in valuation can directly impact investment choices and deal success.

Financial Modelling Tools

In addition to Excel, numerous analysts currently use specialist tools to develop more dynamic and scalable models.

| Tool | Functionality |

| Microsoft Excel | Basic modelling and scenario planning |

| Power BI / Tableau | Data visualisation for business intelligence |

| Python / R | Predictive modelling and handling of big data |

| SQL | Querying a database |

| Bloomberg Terminal | Live financial data, equity research, news |

| Capital IQ | Company-level research, benchmarking, analysis |

Learning a combination of these tools enables professionals to advance up the value chain, from data preparation to decision-making impact.

Analyst Technical Skills

Analysts need to bridge the gap between technology and business. Knowledge of tools such as SQL and Python enables analysts to work with and cleanse large datasets, automate reports, and uncover patterns that traditional methods may overlook.

Most sought-after technical tools:

- SQL: For querying databases, particularly for big-scale enterprise systems.

- Python: For financial modelling, automating dashboards, and executing analytics.

- Power BI/Tableau: For data storytelling via dashboards and reports.

- ERP Systems (SAP/Oracle): For accessing and processing firm-wide data.

Business Acumen and Domain Knowledge

You can’t just know the numbers—you must also understand what they mean.

Excellent analysts possess the capacity to:

- Interpret industry trends

- Forecast economic effects

- Understand supply chain implications

- Account for regulatory changes

- Analyse geopolitical risks

These observations not only make your analysis correct but also actionable for decision-makers.

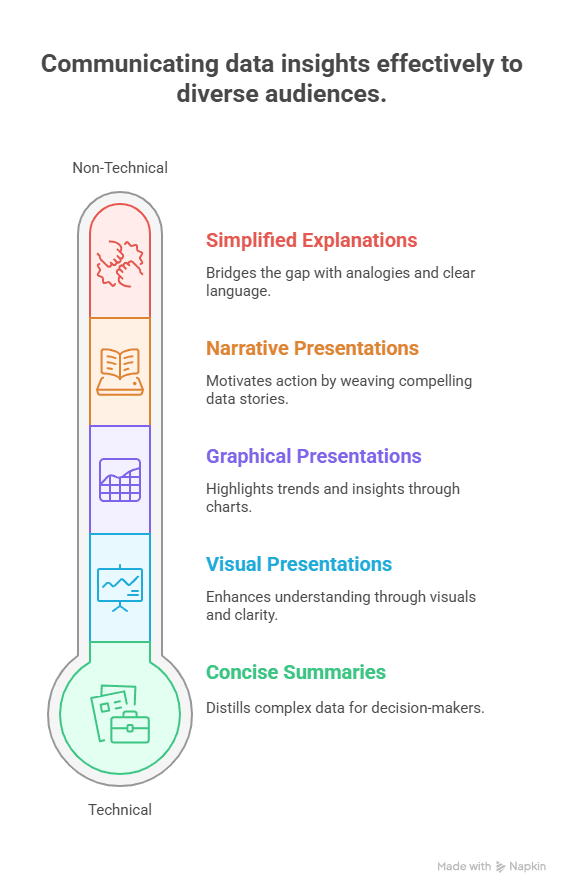

Communication and Presentation Skills

You may develop a good model, but if you are unable to present your results, it is of no use.

Most essential communication skills for analysts:

- Writing effective executive summaries

- Developing effective PowerPoint presentations

- Presenting data graphically (charts, graphs)

- Telling stories with numbers to motivate action

- Explaining data to non-finance stakeholders

Career Growth and Salary for Financial Analysts in India

Financial analysts in India typically start at ₹1.8–3.6 LPA, with mid-level professionals earning ₹6–10 LPA. Those with speciality skills in areas such as equity research, M&A, or strategic finance may earn ₹15 LPA and more.

Acquiring additional skills in valuation, financial modelling, and technical skills such as SQL and Python can help individuals achieve a 50–100% pay hike within a few years.

How to Become Financial Analyst | Financial Analyst – Skills , Salary and Job Opportunities

Who Should Take These Financial Analyst Skills?

This skill set is suitable for:

- Fresh graduates (B.Com, BBA, MBA)

- Engineers looking to switch to finance jobs

- Accounting, audit, or consulting professionals

- Anyone who is preparing for CFA, FRM, or investment jobs

- Entrepreneurs requiring finance proficiency

If you wish to transition into finance or want to develop faster in your existing position, these are the skills hiring managers seek.

Advantages of a Guided Learning Path

Though self-learning is feasible, guided programmes offer:

- Guidance from industry experts

- Live project mentoring

- Peer learning and case studies

- Placement assistance

FAQs On Financial Analyst Skills

1. Is learning financial analyst skills hard?

Not if you are trained and appropriately guided. Formal programs make the learning process easier and more real.

2. Do I need an MBA to be a financial analyst?

Not at all. Skills and hands-on experience are more important than degrees in today’s recruitment scenario.

3. How crucial is Excel in a finance role?

Very. It remains the most widely used tool in all financial functions.

4. What certifications should financial analysts have?

CFA, CPA, and institute certifications, such as those offered by Imarticus Learning, are in great demand.

5. Do non-investment functions have relevance for valuation?

Yes. In corporate finance as well as FP&A too, valuation knowledge informs strategic choice.

6. What programming language do I need to learn as an analyst?

Begin with SQL. Use Python if your function has data-intensive responsibilities.

7. How long does it take to get good?

Approximately 3–6 months with regular practice and project assignments.

8. Do companies really hire based on skill rather than education?

Increasingly, yes. Demonstrable skills and problem-solving ability are what set candidates apart.

9. Can financial analysts work in startups?

Yes, especially in fintech, e-commerce, and SaaS, where finance roles are highly data-driven.

10. What’s the best way to start building these skills?

Enrol in a job-assured, mentor-led program that focuses on practical application.

Conclusion: Building a Strong Foundation for Financial Success

Key Takeaways:

- Financial analyst skills extend beyond formulae—they encompass valuation, modelling, and business acumen.

- Developing skills in tools such as Excel, Power BI, SQL, and Python makes you a more competent and future-proof professional.

- Upskilling through systematic programs accelerates learning and leads to higher-paying, strategic job opportunities.

Now, take the next step: invest in your financial career. Want to develop job-ready financial analyst skills and get into elite firms?

Enrol in the Postgraduate Financial Analysis Program by Imarticus Learning