Last updated on March 22nd, 2024 at 06:13 am

The main revenue for a bank always comes from the money they lend to different borrowers. The interest obtained on that lent money generates revenue for them. Now, this lending process exposes a bank to risks.

In this article, we will discuss various aspects of credit underwriting standards and the importance of a credit analyst course or a PG diploma in banking and finance.

What are Credit Underwriting Standards?

Underwriting standards are a set of guidelines defined by banks or lending institutes, to determine if a loan applicant is qualified for the loan or credit. Credit underwriting standards determine the loan amount, loan terms and tenures, rate of interest, etc. This credit underwriting standard works as a risk management process that helps minimize the risk factor from the lent loan.

Key factors of Credit Underwriting

There are some basic points a bank should consider before granting the loan.

- A common problem faced by credit approvers is that they often don’t get sufficient financial information from the applicant.

- An efficient cash-flow projection report can be prepared with enough historical data, balance sheet statements, and a financial analysis system. However, appropriate information needs to be obtained from borrowers regarding expected trends, upcoming capital structure and incorporated in cash-flow modeling for better prediction.

- Rating models can be efficiently predictive and render an effective early caution against credit deterioration only when the data fed to them are quality data.

- When the process is more manual and duplicate data is kept in multiple systems, it causes an increase in “time to cash”. The key factors that contribute to “time to cash” are the market environment, the efficiency of decision-makers, and system infrastructure.

- To understand the key performance indicators and meet the audit requirements, extracting the right data is essential. Also, a user-friendly way of capturing data and a strict well-defined process is essential to make sure the data is correctly apprehended and managed.

- Understanding the business model sustainability of the borrower is important. The borrower should have better alignment between business strategy and financially reliable sectors to recover the losses when one sector is underperforming.

Challenge for Smaller Banks

When it comes to smaller banks, they face few challenges while maintaining credit underwriting standards, which either cause problems for them in the present or might create in the future.

- Major small banks face significant challenges in terms of their ability to produce, manage and maintain sufficient data. This is a clear indication that small banks suffer due to a lack of IT infrastructure and strong risk governance policies.

- Another key trend among smaller banks is that because of the extremely competitive market, the interest rates that banks offer on loans are not calculated based on the underlying credit risk of those loans, but rather they are more intended towards capturing the market. This lack of risk-based pricing may cause a future inability to recover the money lent.

- The banks are launching new products, offers, expanding themselves into new markets, re-adjusting risk strategies because of intense market competition. There was a drop in average lending margins which basically reduced the overall profit margin for a bank.

Conclusion

Credit risk management comes with various challenges. Proper analysis of quantitative and qualitative data, decision-making ability, and mutual relationships can help to reduce the risk and only a properly trained professional can do that.

When you are looking for a career in the banking sector, deep knowledge of credit underwriting standards is essential.

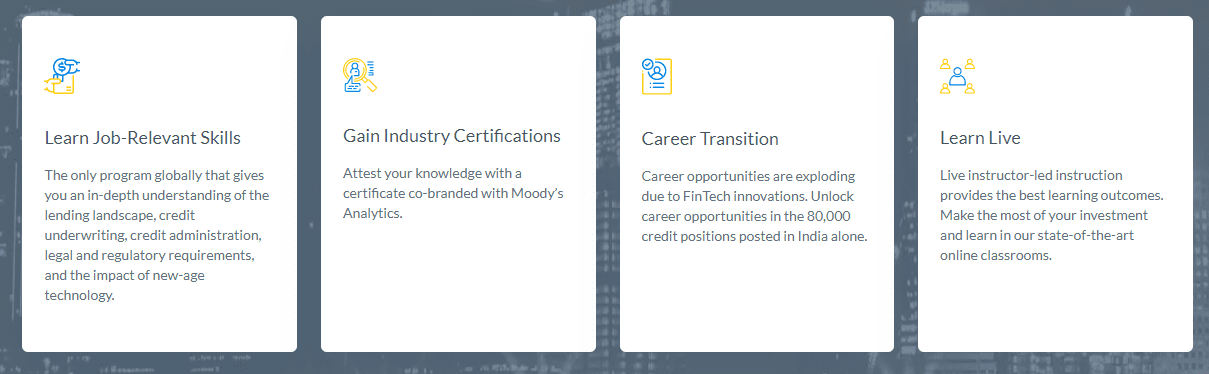

A credit analyst course or PG diploma in banking and finance may help you to achieve that. Credit Risk and Underwriting Prodegree In Collaboration with Moody’s Analytics is such a tailor-made course for you.

A credit analyst course or PG diploma in banking and finance may help you to achieve that. Credit Risk and Underwriting Prodegree In Collaboration with Moody’s Analytics is such a tailor-made course for you.