Last updated on November 12th, 2025 at 02:27 pm

Tired of seeing your career and your paycheck stay stuck at the same level? You might have the string foundation, but what’s missing is the global edge. That’s exactly where the Certified Public Accountant (CPA) license comes in.

This isn’t just an “American” qualification. The CPA is the gold standard in global accounting and finance. For ambitious professionals in India, it’s one of the most powerful credentials you can add to your résumé if you’re aiming for:

- Rapid salary growth

- Leadership and decision-making roles

- Opportunities with the Big 4 and top MNCs

- International career mobility

The CPA salary in India varies based on experience, industry, and location, but CPAs consistently earn higher pay packages than non-certified finance professionals in similar roles.

When it comes to unlocking real career growth, one phrase on your profile changes everything:

“CPA Certified.” That’s why the CPA is recognised worldwide in the finance and accounting community.

Curious about how this translates into real earning potential?

Let’s break down what the CPA salary in India looks like across experience levels and job roles, and why it’s considered a career-defining qualification.

“CPAs are trusted financial advisors who help individuals, businesses and other organisations plan and reach their financial goals.” – AICPA

What is CPA?

The CPA isn’t just a certification; it’s a lens into the global finance ecosystem that transforms how you understand and influence business.

So, what is CPA, really? It’s the industry’s way of measuring whether you understand how money actually moves, not just in theory, but in real-world businesses under pressure.

Here’s a simple way to see it: If a CA gives you a panoramic view of Indian accounting, the CPA hands you the lens that lets you zoom into global standards; the mechanics of auditing, regulation, and financial reporting. It’s like learning to read the financial “DNA” of a company rather than just its headlines.

It’s more than a title. It signals credibility, deep expertise, and global trust. Employers know that a CPA professional has mastered:

- Advanced accounting principles

- Auditing standards

- Taxation and regulatory frameworks

- Ethical and analytical decision-making at a leadership level

The CPA exam assesses your grasp of accounting, auditing, taxation, regulation, and business concepts through four parts, each structured to build a different layer of expertise.

“Analysis shows that passing the CPA exam leads to rewards in small, medium, and large companies. Accountants who pass the CPA exam receive a measurable earnings premium.” – Journal of Accountancy article (AICPA‑affiliated).

Understanding the CPA Certification

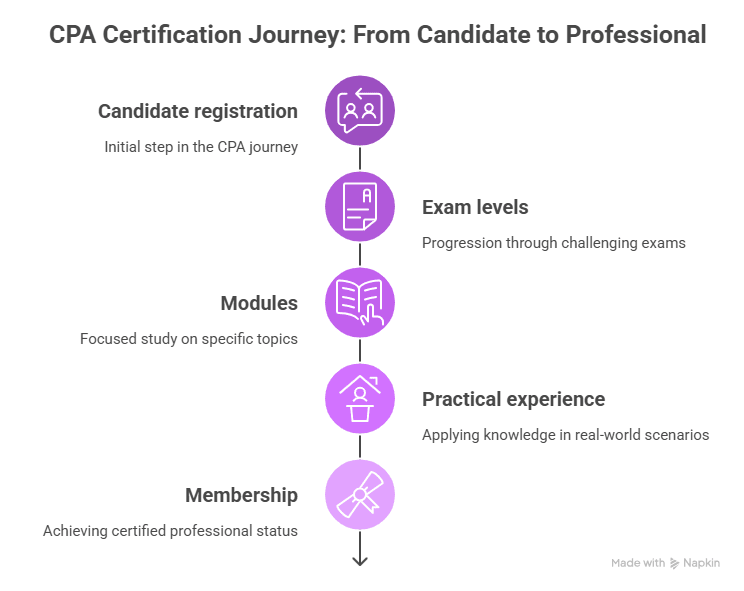

The CPA program is a structured pipeline that transforms you from a candidate into a respected CPA professional honoured worldwide.

When people talk about the “CPA certification,” they’re talking about a comprehensive journey – from registering with the exam board, passing four challenging exam sections, fulfilling professional experience requirements, to becoming a licensed CPA and maintaining your credentials through continuous education.

The CPA course duration typically ranges from 12-18 months, depending on how consistently you prepare and balance your schedule.

In an increasingly global market, specialised expertise like CPA certification translates directly into premium pay and unparalleled career mobility.

Is the CPA Salary in India Worth the Investment?

This is the moment every aspirant waits for – the real ROI on CPA certification. CPAs earn higher salaries compared to their non-certified peers, and the credential itself opens doors to lucrative career options globally.

The CPA credential signals your mastery of accounting principles, auditing rigour, tax expertise, and most importantly, professional ethics. These skills are indispensable for companies that handle complex financial data or navigate multifaceted compliance landscapes.

Real growth is not just about the numbers – it’s the expanded career access, the trust clients and employers place in you, and your ability to step confidently into decision-making roles.

- Entry-Level CPA Salary in India: ₹6-9 LPA, providing a 15-20% premium over non-CPAs.

- Mid-Level Professionals CPA Salary in India: ₹12-20 LPA, roughly 20-30% higher than peers without certification.

- Senior and Leadership Roles CPA Salary in India: ₹20-70 LPA+, a 40%+ premium difference that can translate into an extra ₹1 crore or more over a lifetime.

Multinational Finance & Consulting Firms: Salaries are often premium to domestic averages due to the high value placed on CPA expertise. Indian organisations, especially multinational corporations and Big 4 accounting firms, prize CPA holders for roles in financial reporting, internal controls, tax strategy, risk management, and executive leadership positions.

Starting salaries for new hires with master’s degrees rose about 17% to a median of $67,750, compared to the last survey.

Want to know what US CPA-qualified professionals really earn, both in India and abroad? You’ll get a practical breakdown of the top CPA roles, actual salary ranges at every career stage, and global opportunities open to CPA holders in this video.

Why the CPA Salary in India is Surging?

The most compelling reason to invest in the CPA is simple: Money. The return on investment (ROI) is staggering, particularly in the Indian market, where expertise in US GAAP and international taxation commands a hefty premium.

Think of your career like travelling from a busy airport. Without the right credentials, your options are limited. But with a CPA, it’s like having priority access – more routes open up, and you move ahead faster.

That’s why CPA professionals often earn higher salaries – it shows you have the expertise and credibility to take on roles that really impact financial decisions.

Non-CPA vs CPA Salary

Forget incremental raises. The CPA license provides an immediate, structural bump to your earning potential that only widens over time. This difference can be summarised as mentioned below:

| Experience Level | CPA Salary in India (Range) | Non-CPA Salary | Salary Differential |

| Entry-Level (0-3 yrs) | ₹6-8.5 LPA | ₹5-6 LPA | 15-20% Premium |

| Mid-Career (3-7 yrs) | ₹9-28 LPA | ₹7-20 LPA | 20-30% Premium |

| Senior (7+ yrs) | ₹20-70+ LPA | ₹15-40 LPA | 40%+ Premium |

The Takeaway: At the senior/managerial level, a CPA can earn 40% or more than a non-certified peer. This difference can easily translate into an extra ₹1 Crore+ in lifetime earnings.

Deep Dive: CPA Salary in India by Experience & Role

The term “CPA salary in India” is too broad. Compensation depends heavily on where you work and the nature of your job. Here are a few key job roles and their salary:

| Role/Experience Tier | Typical CPA Salary in India | Key Responsibilities |

| Audit/Tax Associate (Entry-Level) | ₹6-9 LPA | Bookkeeping, journal entries, tax return preparation, and basic auditing. |

| Senior Financial Analyst (2-4 Yrs) | ₹10-18 LPA | Financial modelling, budgeting, forecasting, and reporting for global clients. |

| Audit/Tax Manager (5-8 Yrs) | ₹18-35 LPA | Leading client engagements, managing teams, risk assessment, and complex compliance. |

| Financial Controller/Director (8+ Yrs) | ₹35-70 LPA+ | Overseeing all accounting/finance functions, strategic planning, and internal controls. |

| CFO/Partner-Track (Top Tier) | ₹80 LPA – ₹1 Crore+ | Ultimate financial authority, board-level strategy, M&A guidance, and global risk management. |

The Big 4 & MNC Advantage

Where you work can completely change your career trajectory. CPAs often find themselves fast-tracked in workplaces that value global standards, and that’s exactly why the Big 4 and top MNCs prefer hiring them.

These environments reward skill, expertise, and international-level financial knowledge, which is why CPA professionals see faster growth and higher starting packages.

Location Matters: Where you are in India matters. Companies allocate higher budgets in metropolitan areas to attract top-tier global talent. Metro hubs like Mumbai, Delhi-NCR, and Bengaluru offer higher salaries due to the concentration of industries in these areas. For instance, senior CPAs in Mumbai and Delhi often reach ₹20-38 LPA+ swiftly.

Big 4 (Deloitte, EY, KPMG, PwC): These firms offer structured progression paths and often start CPAs at ₹12-25 LPA (depending on experience). They are the largest recruiters because they handle clients that adhere to the standards of the US SEC and the US GAAP.

Top Metros (Mumbai, Delhi-NCR, Bengaluru): These cities command the highest salaries due to a concentration of Global Capability Centres (GCCs) and MNC headquarters. For instance, senior CPAs in Mumbai and Delhi often reach ₹20-38 LPA+ quickly.

Industries that Pay the Most: Financial Services (BFSI), Consulting/Big 4, and Global Technology/GCCs are consistently the highest payers due to their direct revenue impact and the complexities of compliance.

“Big 4 firms and MNCs don’t just hire CPAs – they fast-track them into leadership roles because CPA expertise drives their business success.”

CPA Salary in India: City-wise Breakdown

If you’re planning your career move, knowing how CPA salaries differ by city can help you decide where to work. Some cities offer higher pay because they have more multinational companies and Big 4 offices. Here’s how salaries compare.

Tier 1 Cities – These metro-cities offer the highest CPA salaries because of strong finance and consulting ecosystems.

- Mumbai: ₹9.3-20.5 LPA (Avg. ₹1.24L/month)

- Delhi NCR: ₹14-20 LPA (Avg. ₹1.41L/month)

- Bengaluru: ₹13.5-25 LPA (Avg. ₹1.60L/month)

- Hyderabad: ₹8.7-15 LPA (Avg. ₹98K/month)

- Chennai: ₹9.5-15 LPA (Avg. ₹1.02L/month)

If you want Big 4, corporate finance roles, or global accounting exposure, these cities are your best bet.

Tier 2 Cities – These are good for stability and balanced work-life, though salary ranges start lower.

- Kolkata: ₹3.8-12 LPA (Avg. ₹66K/month)

- Ahmedabad: ₹5.5-13 LPA (Avg. ₹77K/month)

Growth is steady, especially as more companies expand outside metros. The CPA credential amplifies growth anywhere – but in Tier 1 hubs, it accelerates it faster.

Where you work matters. The right city can amplify not just your salary but your exposure to cutting-edge finance roles.

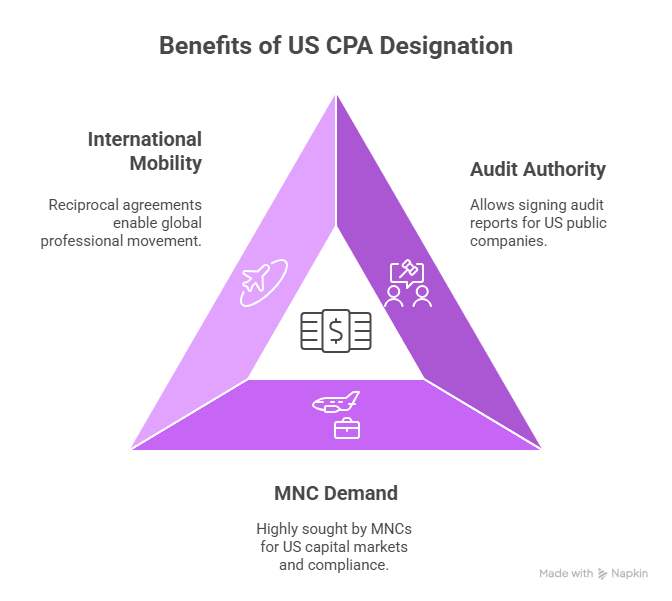

What Makes CPA Globally Valuable?

The CPA’s value extends far beyond salary; it’s about access, authority, and global relevance.

The Gold Standard: The CPA is granted by the AICPA (American Institute of Certified Public Accountants) and governed by State Boards, thereby granting legal authority. It is the only accounting designation that allows you to sign audit reports for US public companies.

MNC Requirement: Any company that deals with US capital markets, adheres to US GAAP (Generally Accepted Accounting Principles), or faces US federal taxes requires a CPA on staff. In today’s global economy, nearly every major company operating in India is involved.

International Mobility: The CPA has reciprocal agreements with other top global bodies (like CPA Canada and CA Australia/New Zealand), making it easier to migrate or work internationally without needing to re-qualify fully.

“CPAs play a critical role in protecting the public interest by ensuring the reliability of financial information.” – AICPA

What Makes the CPA Salary in India So Competitive?

When you look at the CPA salary in India and why it stands out, it’s not just about earning more money – it’s about what those earnings say about your skills, credibility, and value in the industry. The CPA is a badge of global expertise, legal authority, and deep technical proficiency that the market highly values.

Here’s the real deal: Indian companies increasingly operate on a global scale and need professionals who can navigate international accounting rules and compliance seamlessly.

CPAs are legally authorised to sign audit reports for US public companies, which is a key responsibility and an enormous indicator of trust. Not every finance professional can do that, and companies are willing to pay a premium for those who can.

Then there’s the international mobility factor. CPA certification opens doors across markets by removing geographical barriers and puts you in the running for high-paying roles worldwide.

Put it all together – the technical mastery, legal standing, and global relevance, and you see why CPA salaries in India are not just competitive but command a serious premium. It’s more than a salary: it’s professional validation, career flexibility, and long-term financial growth, all rolled into one powerful package.

Curious about where your CPA certification can take you? This video shows how CPA can help you land in finance leadership role as a CFO.

Earning a CPA license can potentially increase your earning potential by hundreds of thousands of dollars over the course of your career.” – AICPA article.

How to Maximise Your CPA Value?

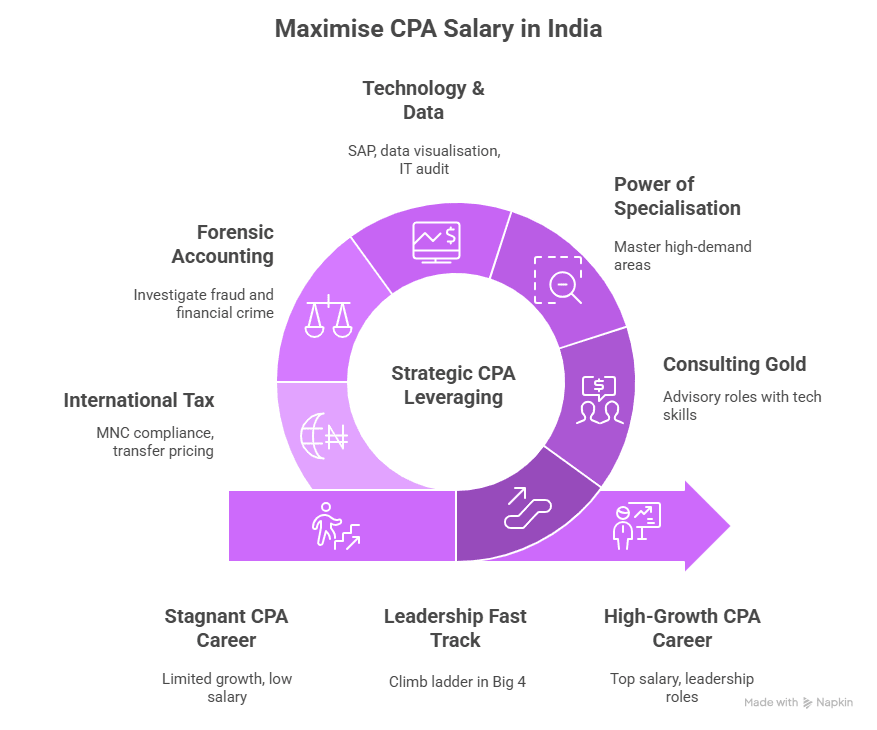

Earning the CPA is step one. Leveraging it for maximum CPA salary in India and the US, and career growth is the next step.

The Leadership Fast Track

The CPA qualification is a mandatory requirement for climbing the ladder in Big 4 and MNCs:

From Associate to Manager: The CPA is often a prerequisite for promotion to Manager roles (3-5 years), where salaries jump well above ₹20 LPA.

The CFO Pipeline: Most senior finance leadership roles (Controller, VP of Finance, CFO) are filled by CPAs because of their comprehensive, legally-backed expertise.

Consulting Gold: Advisory roles in Risk Management, Transaction Services, and IT Advisory highly value the CPA combined with tech skills, leading to some of the highest packages in India.

The Power of Specialisation (Post-CPA): Once certified, don’t stop. Specialising in high-demand areas pushes your CPA salary in India to the top of the range.

Technology & Data Analytics: CPAs who master tools like SAP, Power BI, data visualisation, and IT audit are in incredibly high demand in Bangalore/Hyderabad’s tech hubs (GCCs).

Forensic Accounting: Investigating fraud and financial crime – a high-stakes, high-pay niche.

International Tax & Transfer Pricing: Highly complex and highly compensated, essential for MNC compliance.

Final Action Steps: Your 18-Month Plan

Embarking on the CPA journey is a significant professional commitment, but with the right roadmap, it becomes an achievable and rewarding goal. Here’s a concise plan to navigate the CPA certification efficiently:

- Evaluate Eligibility: Consult an expert to map your Indian education to the 150-credit-hour rule for CPA Eligibility in the US.

- Select a State: Choose a US state board with favourable requirements for your background.

- Find a Learning Partner: Enrol in a high-quality CPA review course that understands the Indian context (e.g., provides exam centre guidance).

- Commit to the Preparation: Dedicate 400+ hours of focused time to study all four parts within the 18-month window.

- Get Licensed: Pass the exam and complete the work experience requirement (typically 1-2 years under a licensed CPA) to obtain your final license.

Is CPA Worth It for Indian Professionals?

Absolutely. It’s an investment that pays off not just at the start of your job search but continues to deliver through accelerated promotions, broader job opportunities, and leadership roles with attractive compensation.

With India’s financial services sector expanding rapidly and multinational companies deepening their presence, accounting professionals with a CPA license find themselves in high demand.

The credential’s reciprocity with other top accounting bodies means you don’t have to start over when moving between countries; your skills and licensure travel with you. Beyond salary, CPAs benefit from access to global networks, continuing education, and lifelong career support.

To explore course details and career guidance on CPA certification, turn your ambitions into achievements with Imarticus Learning and unlock your salary potential in India’s competitive finance landscape.

CPA vs Other Certifications

In the fast-evolving world of finance, whether you’re deciding between CPA, CFA, CA, or CMA. It’s essential to understand how each certification aligns with your career goals, industry demands, and growth timelines to make an informed choice.

| Credential | Focus | Duration | Global Recognition | Ideal Roles | ROI Timeline |

| CPA | Auditing, Accounting, Tax | 1.5 – 3 years | Very High | Audit, Tax, Financial Leadership | Medium term (2+ years) |

| CFA | Investment Management | 3 – 4 years | High | Asset Management, Equity Research | Longer term (3-4 years) |

| CA (India) | Indian Tax, Accounting | 4 – 5 years | Moderate (India) | Public Accounting, Tax Compliance | Long term |

| CMA | Managerial & Cost Accounting | ~2 years | Moderate | Corporate Finance, Cost Control | Medium term |

Salary Potential Comparison in India

When you’re choosing between CPA, CA, CFA, or CMA, the real question is simple: which one actually takes your salary to the next level? Each certification opens different doors, leads to different roles, and builds different types of expertise – so understanding their earning potential makes your decision much clearer.

Let us look at how top finance certification holders’ pay scales progress across experience levels, making the decision clearer and way more practical.

| Certification | Entry Level | Mid-Level | Senior / Leadership |

| CPA | ₹6-9 LPA | ₹12-28 LPA | ₹35 LPA – ₹1 Crore+ |

| CA | ₹6-10 LPA | ₹10-25 LPA | ₹28 LPA – ₹80 LPA+ |

| CFA | ₹7-12 LPA | ₹15-35 LPA | ₹40 LPA – ₹1.3 Crore+ (markets-dependent) |

| CMA (USA) | ₹5-9 LPA | ₹10-22 LPA | ₹25 LPA – ₹60 LPA+ |

Confused between pursuing a CPA or a CA in India? This video breaks down the key differences that matter – career progression, global recognition, salary comparisons, and which qualification Indian MNCs prefer for top finance roles like CFO and Finance Director.

Benefits of a Comprehensive CPA Preparation Program

Starting the CPA journey is easier when you have guidance that fits your reality – balancing work, study, and U.S. requirements. Instead of generic study materials, you get a clear plan: live online sessions, simplified explanations, and mentors who actually support you through doubts and exam strategy.

But the goal isn’t just clearing exams—it’s what happens after. The right training helps you present your CPA confidently in interviews, understand licensing requirements, and position yourself for roles that pay more and carry greater responsibility, especially in Big 4 firms and global companies.

The right support doesn’t just help you earn the CPA. It helps you use the CPA to accelerate your career and salary growth.

Imarticus Learning’s CPA certification program is designed exactly for that: efficient exam preparation backed by real career outcomes—so your qualification becomes a catalyst for real advancement, not just another line on your resume.

FAQs About CPA Salary in India

Looking into the landscape of CPA salary in India and what it means for your career? These frequently asked questions will help you understand earning potential, growth opportunities, demand, and how the CPA compares to other finance qualifications – so you can decide if it’s the right move for you.

What is the salary of a CPA in India?

CPA salaries typically start around ₹6-9 LPA at the entry level. With a few years of experience, CPAs move into the ₹12-28 LPA range, and senior roles such as Controller, Finance Director, or CFO can go ₹35 LPA to ₹1 crore+, depending on the company, sector, and city.

Who earns more, CA or CPA?

It depends on where you want to work. In India-focused roles, CAs and CPAs can earn similarly. In Big 4 firms, MNCs, and companies working with US GAAP, CPAs often earn more because of their global reporting and compliance expertise. If your goal is global mobility or US-based roles, CPA has the advantage.

What is the salary of a CPA in the Big 4 in India?

Big 4 firms offer some of the strongest salary progression for CPAs:

- Entry-level: ~₹8-14 LPA

- Mid-level (2-5 yrs): ₹15-28 LPA

- Manager/Lead roles: ₹28-45 LPA+

- Senior leadership / Partner-track: ₹50 LPA – ₹1 crore+

Because the Big 4 handle US clients, having a CPA often fast-tracks promotions.

What is the CPA salary in India for freshers?

Freshers with a CPA typically earn around ₹6-9 LPA, which is noticeably higher than the packages offered for standard accounting or finance roles. Companies, especially the Big 4 and top MNCs, are willing to pay more because the CPA signals strong technical knowledge, global accounting standards expertise, and readiness for client-facing work.

Does having a CPA increase salary?

Yes. The CPA credential has a direct impact on salary growth. CPAs earn 20-40% higher salaries across most experience levels because employers value their expertise in global accounting standards, auditing, taxation, and compliance.

Will a CPA help me work abroad?

Yes, and that’s one of the biggest reasons professionals choose the CPA. Since the CPA is recognised globally, it gives you the flexibility to explore jobs in countries such as the US, Canada, Australia, the Middle East, and Singapore. Many CPAs start their careers in India and then move abroad through internal company transfers or client-based onsite opportunities. The qualification simply makes it much easier for employers to trust your expertise, no matter where you go.

Is the CPA difficult to pass?

The CPA exam is known to be rigorous, with global pass rates averaging around 45-55% across the four sections. The challenge isn’t just memorising concepts – the exam tests your ability to apply accounting, audit, tax, and regulatory knowledge in real business situations.

Is CPA a tough course?

Yes, it’s challenging, but manageable with the right preparation strategy and learning partners like Imarticus Learning. The concepts are professional and practical, and candidates who follow a structured study plan often clear all parts within 12-18 months.

Is CA or CPA better?

It depends on your career goal: Choose CA if you want to build your career strongly within India (audit, taxation, compliance). Choose CPA if you want global roles, Big 4 exposure, or work with US/International accounting standards.

Is CPA in demand in India?

Yes. The demand is rising fast due to the growth of MNCs, Big 4 firms, Global Capability Centres (GCCs), and companies working with US GAAP and international reporting. CPAs are especially valued in audit, financial reporting, controls, and tax strategy roles.

Build a Global Finance Career with CPA

With India’s financial services sector rapidly expanding and multinational firms deepening their footprint, CPA-certified professionals are increasingly sought after. CPA certification is not just an investment in certification – it’s an investment in your career future and earning potential.

Whether you’re aiming for Big 4 firms, MNC leadership, or strategic finance roles, earning the CPA with a partner like Imarticus Learning unlocks your full salary potential in India’s competitive market.

By choosing the right preparation route with expert guidance, you can navigate the CPA journey efficiently, accelerating your path to higher salary bands and leadership roles.

Start your CPA certification journey today to transform your career and earnings because every professional deserves the global edge that CPA provides. Partner with Imarticus Learning and take the definitive step towards becoming a globally recognised accounting expert.