You’ve just completed your B.Com or MBA, and now you’re stuck. You want a career in finance.

But where do you go next?

Job portals are full of openings that pay far less than what you expected. You dream of a solid job in investment banking or equity research, but something’s missing.

If you’re thinking about taking the CFA course, you’re on the right path. But here’s the question that most students keep asking: what is the real CFA salary in India?

Let’s break it down.

What Makes the CFA Course So Popular in India?

The Chartered Financial Analyst (CFA) programme is a postgraduate professional qualification presented worldwide by the CFA Institute. However, it has become even more applicable in India in the last ten years.

Why?

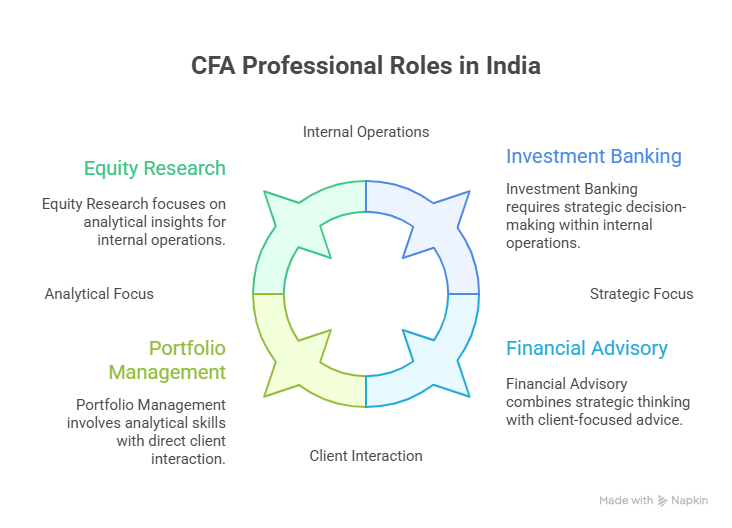

Since the finance sector in India has expanded at a rapid rate, there is an increased demand for well-trained professionals with each passing year. This certification will provide you access to lots of lucrative areas, including equity research, portfolio management, etc.

As more and more people try to pass through the programme every year, the programme is no longer restricted to investment bankers. Now CFA charter holders are offered even fintech jobs, as well as private equity and corporate finance.

The question that is always asked by students and professionals is whether the CFA salary is worth the effort, and will it be based in India. This will be answered depending on a lot of factors such as the experience, industry and the most importantly what level CFA you have passed.

CFA Salary in India: Level-Wise Earnings Breakdown

Here’s a quick look at the CFA level-wise salary in India based on career stage. Remember, the pay improves as you move forward in the course and gain work experience.

As of 25 December 2024, salaries reported by CFA professionals in India range from ₹1.2 lakh to ₹15 lakhs per year. This applies to those with experience between less than one year and up to 12 years.

| CFA Level | Average Salary (in ₹ LPA) | Role Type |

| Level 1 Cleared | Around ₹4–5 LPA | Analyst Intern, Research Assistant |

| Level 2 Cleared | Around ₹6–8 LPA | Equity Analyst, Junior Associate |

| CFA Charterholder | ₹10 LPA or higher | Investment Banker, Portfolio Manager |

These ranges may shift slightly depending on the city, company, and your work history. However, they reflect current finance jobs salary trends in India.

The CFA course is one part of the journey.

If you’re fresh out of college and have cleared just CFA Level 1, you’ll likely start with junior roles. But employers will see your effort and commitment. They know you’re investing in your career.

Once you clear Level 2, things get more serious. You now understand valuation, financial modelling, and investment tools better. This lets you apply for mid-level roles in equity research and risk management.

When you become a full CFA charterholder, your career options grow fast. This is where your CFA salary in India really starts reflecting your knowledge. You may lead teams or even head investment portfolios.

Top Industries Hiring CFA Professionals in India

Not every company hires CFA candidates. But those who do know exactly what they’re looking for.

A few sectors where CFA professionals work in India:

- Equity Research: Writing reports, forecasts, and company analysis

- Portfolio Management: Managing HNI clients or working for AMCs

- Risk Management: Working in banks or financial firms to assess and reduce risks

- Financial Advisory: Helping companies with strategic decisions

These roles come with different responsibilities, but the CFA salary in India is usually better than many other finance certifications.

CFA Career Prospects in India: What’s the Real Picture?

Let’s address the big one: CFA career prospects in India.

More Indian companies are hiring CFA-qualified candidates. From Axis Bank and HDFC to ICICI Prudential and CRISIL, all value the CFA programme. And the best part? Many of these companies also sponsor further training or allow study leave during exam months.

What’s even more encouraging is the growing demand in Tier 2 cities. Places like Pune, Ahmedabad, Jaipur, and Chandigarh are now seeing CFA demand grow.

Plus, companies in fintech and startups are not far behind. They look for professionals who can analyse data, forecast revenues, and manage investment strategy and the CFA course teaches all of this.

Chartered Financial Analyst Benefits That Matter

Choosing a professional course is not just about pay.

Let’s talk about the Chartered Financial Analyst benefits that truly matter.

- Strong Knowledge Base: It covers everything from economics to portfolio management

- Job Mobility: Switch between roles or even countries with ease

- Respect in the Industry: Hiring managers know the value of this qualification

- Global Recognition: The CFA charter is widely accepted across more than 160 countries

- Better Salary Negotiation: You walk into interviews with stronger leverage

Whether you’re working in Delhi, Bangalore, or Hyderabad, these benefits make you stand out in the competitive finance job market.

What Is the Scope of Investment Banking Salaries in India for CFA Professionals?

Automation and AI are changing the way finance works. However, the salary trends of finance jobs show that analytical and strategic roles are growing in demand.

That’s exactly where CFA-qualified professionals fit in.

Your ability to analyse data, understand risk, and manage investments sets you apart. You’ll make real decisions that shape business outcomes.

This is why many HR teams now list “CFA preferred” or “CFA-qualified” in their job descriptions.

Some ask, “Should I go for CFA or MBA?” Others compare it with CA, CPA, or even FRM.

Here’s the simple truth: CFA is best for investment-related roles. If you want to work in equity research, asset management, or risk, this course gives you focused skills. And in terms of CFA salary in India, it stands out when compared to many generalist certifications.

Also, the CFA programme is more affordable than most MBAs, especially those from top B-schools. Plus, it allows you to work and study at the same time.

Your Competitive Edge in the Finance Industry with Imarticus Learning

Imarticus Learning is the first authorised prep provider in India out of four of the most recognised certification programmes globally in the field of accounting and finance like the one that has world credibility, the Chartered Financial Analyst (CFA) programme.

CFA charter is a good credential of your profound knowledge in finance and investments. The qualification is global and opens doors of employment at leading financial institutions, banks, and investment houses.

- Recognised as the gold standard for finance professionals

- Includes digital, practical skill modules for hands-on learning

- Better career opportunities in India and abroad

- Connect with top industry experts through live sessions.

Career as a Chartered Financial Analyst

Wondering where a CFA qualification can take you?

Once you complete the programme, you can step into roles such as:

- Financial Analyst

- Credit Research Analyst

- Quantitative Analyst

- Investment Analyst

- Risk Analyst

- Equity Research Analyst

- Investment Banker

- Portfolio Manager

Salary Expectations

| Region | Average Salary |

| In India | ₹7.5 Lakhs per annum |

| International Roles | $79,000 per annum |

Senior CFA charterholders often report even higher figures, particularly in investment banking and portfolio management.

Start your CFA journey today with Imarticus Learning!

Know how to crack CFA Level 1 Exam in this video

FAQ

1. How does the CFA level-wise salary grow over time?

The CFA level-wise salary increases with each level passed. Level 2 offers mid-level roles, while charterholders earn the highest packages.

2. Which industries offer the best CFA salary in India?

Investment banking salaries in India are among the highest for CFA charterholders, followed by asset management and financial advisory roles.

3. Is CFA better than MBA for finance jobs in India?

For core investment roles, CFA often gives a deeper technical edge. Many recruiters prioritise CFA for specialised finance jobs and salary trends.

4. What are the benefits of being a chartered financial analyst in India?

Key Chartered Financial Analyst benefits include global recognition, better pay, strong finance knowledge, and access to top job roles.

5. Can I switch to investment banking with a CFA charter?

Yes, many CFA professionals transition into high-paying investment banking salaries in India, especially after Level 2 or Level 3.

6. Does CFA guarantee a job in finance after completion?

While no course can guarantee a job, the CFA boosts your chances significantly due to its relevance in finance jobs salary trends today.

Conclusion

Now you are aware of how CFA salary in India increases with time, the salary of the CFAs level wise, and how the CFA career opportunities in India are rising.

The Chartered Financial Analyst benefits are difficult to underestimate if you are serious about finance. Either through taking investment banking or the latest finance careers and wages, this qualification places you ahead of others.

Take the first step today. Start your CFA journey and shape your future in finance!