Last updated on July 23rd, 2025 at 11:46 am

The CFA certification fee in 2025 is a point of concern for finance professionals given the investment and the return. Being an internationally accepted certificate, the Chartered Financial Analyst (CFA) qualification can open up high-paying career prospects, but the cost of money has to be known. This piece delves deep into the pricing of CFA in India, provides you with a step-by-step cost break-up of how much it will cost to sit for the CFA exam, and talks about the return on investment of CFA. So, if you are curious, “Is CFA worth it in 2025?”, continue reading for an in-depth analysis.

What Is the CFA Certification and Why Pursue It?

CFA Charter is referred to as the gold standard certification for finance and investment professionals. Awarded by CFA Institute (USA), it demonstrates portfolio management, investment analysis, ethics, and financial reporting skills.

- Recognised in 170+ nations

- Most desirable qualification for a career in equity research, asset management, and investment banking

- Indian average salary of CFA is Rs. 7.5 LPA

- 192% average salary boost for CFA charterholders

In 2025, the certification is most relevant than ever, with more demand for best-in-class finance professionals globally.

CFA Course Fees 2025: Understanding the Full Cost

As you determine the cost of CFA certification, you have to include the three-tier program model. Here’s how it breaks down:

1. CFA Exam Registration Fees

There is a separate exam registration for each one of the three levels of CFA (I, II, III). Following are CFA course fees 2025 estimates:

- Early registration fee: USD 940 per level

- Normal registration fee: USD 1,250 per level

Based on provided early registration for all three levels, the least expensive option is:

- 940 x 3 = USD 2,820 (~INR 2.34 lakhs)

Missed early registration period:

- 1,250 x 3 = USD 3,750 (~INR 3.11 lakhs)

2. One-Time Enrollment Fee

First-timers need to pay an enrolment fee of USD 350 (~INR 29,000) one-time.

3. Learning Resources and Preparation Costs

Whereas some do individual study, most of the candidates utilize prep providers. Imarticus Learning possesses a strong program with:

- Kaplan Schweser content (globally trusted)

- Dual-teacher mode

- CFA Charterholders’ doubt-clearing

- Mock tests and sample papers

Premium course price ranges from INR 60,000 to INR 1.2 lakhs per level depending upon features.

4. Additional Expenses

- Study material, calculator, stationery: INR 10,000

- Internet fees (if preparation is being undertaken online)

- Re-attempts (if necessary)

Total Estimated CFA Certification Cost in India

| Cost Component | Estimated Cost (INR) |

| Enrollment Fee | 29,000 |

| Early Registration (all levels) | 2,34,000 |

| Prep Course (3 levels) | 1,80,000 |

| Miscellaneous | 10,000 |

| Total Estimated Cost | INR 4.5–5.0 lakhs |

CFA Return on Investment: What Are the Career Gains?

The CFA charter earns one eligibility for well-paying professional positions in India and globally. Let’s find out the career benefits of CFA worth the investment.

1. High Paying CFA Jobs in India

- Financial Analyst: INR 6–10 LPA

- Equity Research Analyst: INR 8–12 LPA

- Portfolio Manager: INR 12–25 LPA

- Investment Banker: INR 10–20 LPA

- Risk Analyst: INR 8–14 LPA

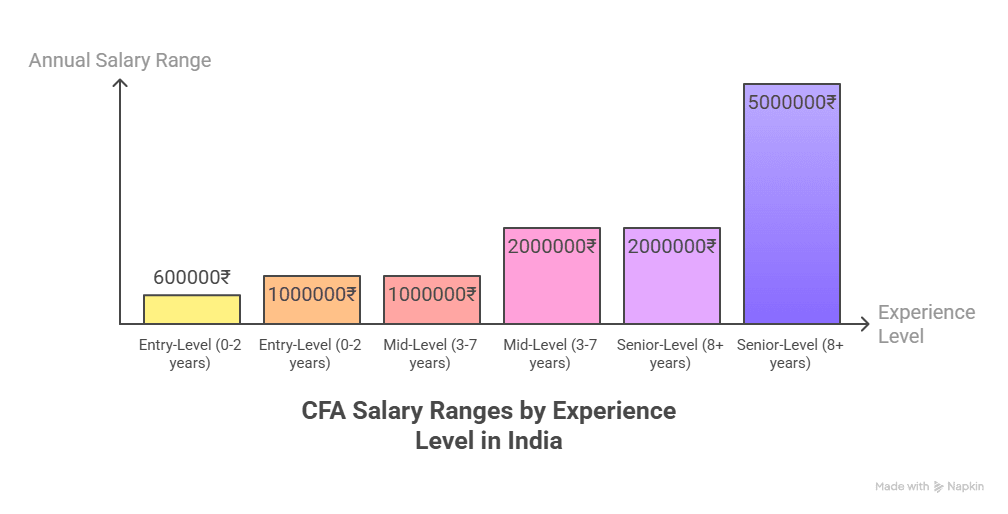

2. CFA Salary Growth in India

Charterholders show dramatic increase along the career path:

- Entry Level (cleared Level I): INR 5–8 LPA

- Post Level II: INR 8–12 LPA

- Post Level III (Charterholder): INR 15–30 LPA

Salaries increase aggressively with experience, and the certification remains extremely popular in capital markets, corporate finance, and buy-side careers.

3. CFA vs MBA Salary in India

| Criteria | CFA | MBA (Tier 2) |

| Avg. Cost | INR 4.5–5.0 lakhs | INR 10–25 lakhs |

| Avg. Starting Salary | INR 7.5 LPA | INR 6–8 LPA |

| Global Recognition | Very High | Moderate |

| ROI | Excellent | Varies by institute |

CFA Career Benefits: Global Opportunities

In addition to Indian opportunities, CFA charterholders can pursue careers in:

- UAE: AED 160,000 annually

- Singapore: SGD 80,000–120,000

- USA: USD 90,000–150,000

- UK: GBP 50,000–100,000

The CFA global career benefits are the power to move and access to lucrative investment banks, hedge funds, and private equity houses.

Is CFA Worth It in 2025?

Let us examine the value proposition:

- Cost: Around INR 5 lakhs

- Career Advancement: ₹7.5 LPA avg., max ₹30 LPA+ with experience

- Global Acceptance: Accepted in 170+ countries

- Career Roles: High-skill, high-growth career roles

With the hike in the salary for CFA salaries in India and worldwide, the return on investment of CFA is highly positive in 2025.

CFA Certification Cost vs Career Returns: Final Verdict

The CFA is a globally accepted qualification with actual career benefits. With relatively low CFA course fee 2025 and high career benefits, it has a fantastic ROI.

Frequently Asked Questions (FAQ)

Q1. What is the total CFA certification cost in India?

A: The total expense of CFA certification, i.e., exam fees, study guides, and prep courses, is INR 4.5–5.0 lakhs in 2025.

Q2. Is CFA a better investment than MBA?

A: Yes, from cost vs return on investment perspective. CFA program is cost-effective and provides global career opportunities, especially in investment frames.

Q3. How does CFA salary grow in India?

A: CFA salary in India starts from INR 5–8 LPA and goes up to ₹20–30 LPA depending on experience and clearing all three levels.

Q4. Are there high paying CFA jobs abroad?

A: Yes. CFA charter holders receive good pay in the USA, UK, UAE, and Singapore.

Q5. What if I fail the CFA exam?

A: You may re-appear by again paying registration fees. Money-back assurances are usually offered by majority of prep providers like Imarticus.

Q6. Can I do CFA while working?

A: Indeed. The CFA programme is flexible, and numerous professionals complete it while carrying out full-time work.

Q7. Is CFA worth it in 2025?

A: Without a doubt. Due to unmatched global demand, breathtaking salary hikes, and wide-ranging employment opportunities, CFA remains one of the greatest investment professions in 2025.

Conclusion

CFA is not only a certification in finance but rather the passport to entering the world of global finance. Although the fee of the CFA certification would seem to be an astronomically high amount at first sight, its benefit in the long term—career progression, income growth, and worldwide mobility—repays the investment. With a growing need for finance professionals and institutions such as Imarticus offering full-cycle training and placement support, CFA in 2025 is more valuable than ever.

Want to invest in yourself financially? The CFA track can be the greatest career option for you.