Most people land on a page about CFA careers with a quiet question in mind. They are not looking for definitions. They are trying to see themselves somewhere in the picture. They want to know if the effort will change how their working life feels five or ten years from now.

I think about CFA careers as a shift in how you look at money and decisions. Before CFA, many roles ask you to follow instructions. After the CFA Certification, roles slowly ask you to form opinions. That shift matters more than any job title. It changes the kind of conversations you are part of at work.

Picture a simple situation. Two people look at the same company results. One reports the numbers. The other explains what those numbers mean for the next three years. Career options for CFA train you to become the second person. That difference is subtle at first. Over time, it becomes your entire value.

I often notice that people underestimate how everyday this transformation feels. It is not dramatic. It shows up when a manager asks for your view. It shows up when a client listens instead of interrupting. It shows up when your work moves from execution to influence.

CFA career options are not limited to one industry or one country. They travel well because the thinking behind them is universal. Risk exists everywhere. Capital allocation exists everywhere. So does uncertainty. The CFA framework prepares you to work with all three without panic.

If you are wondering whether CFA career options are only for investment banking or fund management, the answer becomes clearer once you look closer. The qualification does not teach you where to work. It teaches you how to think when money, risk, and time collide.

This guide looks at career options for CFA from that lens. Not as a list of jobs. Not as a promise of salary. It looks at how careers actually unfold when CFA knowledge meets real work.

What CFA Careers Actually Entail?

CFA is best understood by looking at how decisions are made in finance when there is no perfect answer. Markets move. Information arrives late. Numbers often contradict each other. The CFA program exists to train people to operate calmly inside that uncertainty. That ability is what gives CFA careers their long-term value.

When people ask what is CFA, they often expect a technical definition. In practical terms, CFA is a professional qualification that teaches how to evaluate businesses, assess risk, and allocate capital with discipline. It is designed for roles where opinions carry weight and mistakes have consequences. This is why CFA careers tend to sit close to decision-making rather than routine execution.

The CFA program is structured around investment analysis, portfolio management, and ethics. These areas form the core skill set used across most CFA career paths. Whether someone works in research, asset management, risk, or corporate finance, the underlying thinking remains consistent. You learn how to ask the right questions when the data is incomplete.

A useful way to think about CFA is to compare it to navigation. Anyone can read a map. CFA trains you to navigate when the road changes. That distinction explains why CFA careers remain relevant across industries and geographies.

How the CFA Program Is Structured

The CFA levels are divided into three parts. Each level builds a different layer of capability that supports CFA careers at various stages.

| CFA Level | Primary Focus | Role in CFA Careers |

| Level 1 | Financial tools and concepts | Entry-level readiness |

| Level 2 | Valuation and analysis | Analyst responsibility |

| Level 3 | Portfolio and strategy | Leadership decisions |

This progression mirrors how CFA careers develop in the real world. Early roles focus on understanding numbers. Mid-level roles focus on interpreting them. Senior roles focus on using them to guide outcomes.

The program is governed by the CFA Institute, which sets global standards for curriculum and ethics. This consistency is why CFA career options are recognised across markets. Employers know what the designation represents regardless of location.

Also Read: Why CFA is the Gold Standard for Finance Professionals?

Ethics and Trust in CFA Careers

Ethics is not a side topic in the CFA program. It is woven into every level. Candidates commit to a professional code that prioritises integrity and transparency. In practice, this creates trust. CFA career opportunities often involve managing other people’s money or advising on high-impact decisions. Trust becomes a career asset.

What CFA Is Not

Understanding what CFA is also means knowing what it is not. CFA is not a shortcut to a job. It does not guarantee placement or instant seniority. CFA careers develop through experience layered on top of the qualification. This clarity matters. Many people enter the program expecting immediate results. Those who benefit most from CFA career options are the ones who see the program as a long-term investment in thinking skills.

How Does CFA Help in Career Decisions

People often ask how CFA helps in career choices. I see it as a filter. The CFA curriculum forces clarity. You learn what kind of financial work suits your thinking style.

For example, some people enjoy building models and testing assumptions. They lean toward valuation roles. Others like understanding capital markets as a system. They move toward portfolio roles. CFA careers allow both paths. The program does not lock you into one outcome.

It is like learning how a car works instead of only learning how to drive. Once you understand the engine, you can choose whether you want to race, travel long distances, or maintain vehicles.

Choosing CFA is often driven by a desire for depth and long-term relevance in finance roles. This segment reflects on why CFA careers continue to appeal to professionals who want stronger decision-making skills, global recognition, and steady career progression across market cycles.

CFA Careers Path From Entry Level Onward

The CFA career path usually unfolds in layers. Each layer adds responsibility rather than replacing the previous one. At the early stage, CFA Level 1 career opportunities focus on support and execution. Roles often involve data handling, financial modelling support, and report preparation.

These tasks may feel routine, but they build muscle memory.

You learn accuracy. You learn discipline.

As candidates progress, the work shifts. At the middle stage, the focus moves to interpretation. You start explaining numbers. You defend assumptions. You make recommendations. This is where a career after CFA Level 2 progression becomes visible. At senior stages, CFA careers revolve around judgment. Decisions affect portfolios, businesses, and client outcomes. The work becomes less about calculations and more about responsibility.

Below is a simple progression map.

Typical CFA Careers Path Progression

| Career Stage | Nature of Work | Skill Focus |

| Entry Level | Data and analysis support | Accuracy and basics |

| Mid Level | Valuation and recommendations | Interpretation |

| Senior Level | Strategy and oversight | Judgment |

This progression explains why CFA career prospects improve with experience rather than with exam completion alone.

Also Read: How to Become CFA in India and Build a Global Finance Career?

Career Options After CFA Level 1

Career options after CFA Level 1 often confuse candidates. Passing Level 1 signals commitment and foundational knowledge. Employers see it as readiness to learn.

Common career options after CFA Level 1 include:

- Research assistant roles

- Junior analyst positions

- Investment operations roles

- Risk and compliance support roles

These roles may not sound glamorous. They serve a clear purpose. They place candidates close to decision-makers and help build the skills for CFA Level 3. That proximity matters.

CFA careers rarely reward shortcuts. They reward exposure and consistency.

Clearing CFA Level 1 is often the first real test of discipline and planning in CFA careers. This segment breaks down how candidates typically approach the exam, manage the syllabus, and structure their preparation in a way that fits alongside work or college. It offers a practical perspective on what helps build a strong foundation for the levels that follow and for the broader CFA career path.

CFA Career Opportunities in India

CFA career opportunities in India have expanded over the last decade. The growth of asset management firms, global capability centres, and investment research hubs has created demand.

Cities like Mumbai, Bengaluru, and Gurugram host many CFA careers India opportunities. These roles often connect Indian teams with global markets. This global linkage explains why CFA India careers continue to grow.

In India, a CFA career scope often includes:

- Equity research for global banks

- Portfolio analytics for asset managers

- Risk analytics for financial institutions

- Corporate finance roles in large firms

These roles value the structured thinking that CFA careers promote.

CFA Careers and the Role of Professional Ecosystems

Beyond employers, CFA career options benefit from professional networks. CFA Society careers provide learning, events, and peer exposure. These societies act like informal classrooms. Conversations here often shape long-term career direction.

Similarly, platforms like the CFA Career Center and the CFA Institute Career Center connect candidates with global roles. These tools support mobility across markets.

Also Read: From Aspiring Analyst to C-Suite: How a CFA Course Can Shape Your Financial Future

A Practical Way to Think About CFA Careers

I often explain CFA careers using a simple daily life idea. Imagine managing a household budget. Early on, you track expenses. Later, you plan savings. Eventually, you make long-term investment choices. Each stage builds on the last.

CFA career scope follows the same logic. The qualification teaches you to move from tracking numbers to shaping outcomes.

Role-Wise CFA Career Options and How Growth Actually Happens

As CFA careers move beyond the entry phase, roles start to look less uniform. This is where many people feel lost. Job titles sound similar, yet daily work feels very different. I find it useful to explain CFA career options by matching them with the kind of problems they solve.

How CFA Careers Split Into Role Families

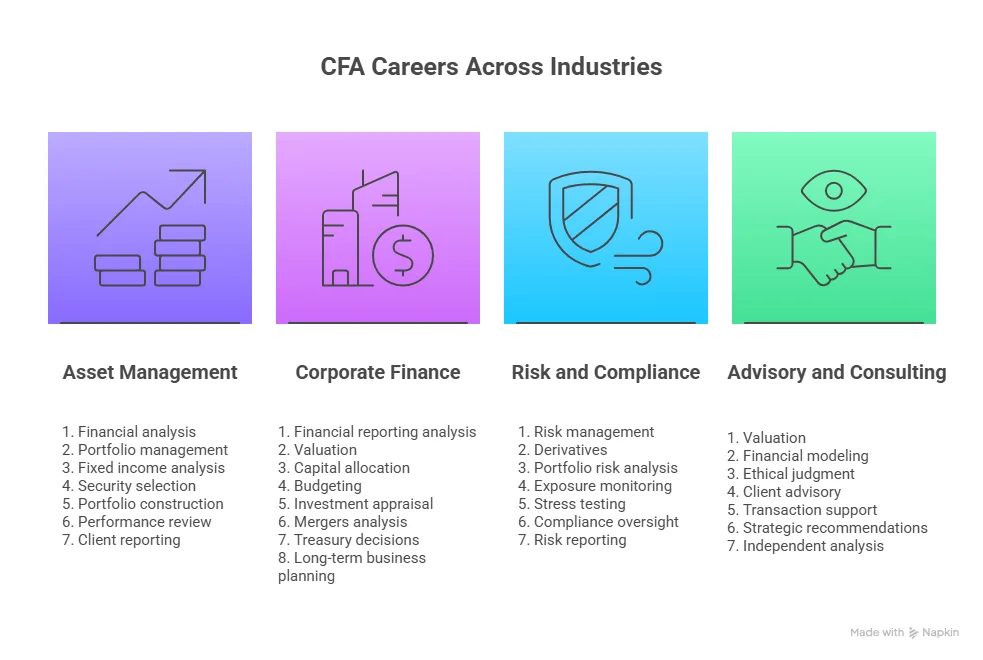

Most CFA careers fall into a few broad role families. Each family uses the same CFA knowledge differently. This is similar to how the same smartphone can be used for work, travel, or entertainment, depending on the user.

The major roles include:

- Investment research and valuation

- Portfolio and asset management

- Risk and performance analysis

- Corporate finance and strategy

- Investment operations and controls

Each of these supports long-term CFA career prospects in a different manner.

Also Read: Top 10 Reasons Why You Should Pursue the Chartered Financial Analyst (CFA) Designation

Investment Research and Valuation Roles

Research roles are often the most visible CFA career options. These roles focus on understanding businesses, industries, and markets. The work involves reading financial statements, building valuation models, and writing clear opinions. This is like comparing homes before buying one. You check location, price, future value, and risks. CFA careers in research train you to do this with companies.

Common roles include:

- Equity research analyst

- Credit analyst

- Investment research associate

These roles suit people who enjoy deep focus and structured thinking. A career after CFA in these roles often leads to senior analyst or sector specialist positions.

Portfolio and Asset Management Roles

Portfolio roles use research outputs to make allocation decisions. This is where CFA careers connects analysis with action. Decisions here impact real money. Think of this role like planning meals for a month with a fixed budget. You balance nutrition, cost, and preferences. Portfolio managers balance risk, return, and client goals.

Typical CFA career options here include:

- Portfolio analyst

- Assistant portfolio manager

- Fund manager

Careers for CFA charterholders often peak in this family. These roles value experience more than speed.

Risk, Performance, and Analytics Roles

Not all CFA careers involve choosing investments. Some focus on measuring and risk management. These roles gained importance after the global financial crisis. In simple terms, this work resembles checking road conditions before a long drive.You may not drive the car, but you reduce the chances of accidents.

Roles include:

- Risk analyst

- Performance analyst

- Investment compliance analyst

CFA career scope here is stable and growing. These roles suit people who enjoy precision and structure.

Corporate Finance and Strategy Roles

CFA careers also extend into corporate settings. Here, the focus shifts from markets to business decisions. Budgeting, capital allocation, and mergers become core tasks. This is like running a shop. You decide how much inventory to hold, when to expand, and how to fund growth.

Common career options after CFA in this area include:

- Corporate finance analyst

- Strategy analyst

- Treasury roles

CFA career opportunities in India have grown here as large firms value global finance skills.

Investment Operations and Control Roles

Operations roles support investment decisions. They ensure trades settle, data flows correctly, and reports remain accurate. This work is similar to logistics management in a warehouse. When systems run well, problems stay invisible.

Roles include:

- Investment operations analyst

- Fund accounting specialist

- Reporting analyst

CFA careers in operations often offer a strong work-life balance.

Also Read: Top CFA Job Roles: What Employers Look for in Finance Professionals

Career After CFA for Charterholders

Career after CFA completion changes the conversation. Employers shift focus from exams to impact. Careers for CFA charterholders emphasise leadership, trust, and responsibility.

Charterholders often move into:

- Team leadership roles

- Client advisory roles

- Investment committee positions

CFA career prospects improve when professionals show consistency rather than job hopping.

CFA Career Opportunities in India Versus Global Markets

CFA careers India often begin with global exposure through offshore teams. Over time, professionals move closer to decision-making roles. CFA UK careers and Middle East roles value Indian CFA talent due to strong analytical skills. Mobility improves after charter completion. The CFA Institute careers ecosystem supports this mobility through standardised ethics and employer trust. Tools like the CFA Institute career guide and CFA career portal help professionals explore global roles.

CFA Careers and Global Mobility

One advantage of CFA careers is portability. CFA UK careers, Middle East roles, and Asia Pacific markets recognise the qualification. This portability comes from shared standards. Professionals often move after building experience in India. CFA career opportunities expand when global exposure is added.

Also Read: Top Career Opportunities after CFA Certification Explained

A Practical Lens on Role Selection

I often suggest choosing CFA career options based on comfort with uncertainty. Research roles deal with unknowns. Operations roles value predictability. Portfolio roles balance both.

CFA careers reward self-awareness. The program gives tools. The direction comes from personal fit.

Balancing CFA preparation with a full-time job is a common challenge within CFA careers. This segment explores how candidates structure their study time around a busy workday. It reflects a practical two-hour daily approach that many working professionals use to stay on track without disrupting their professional responsibilities.

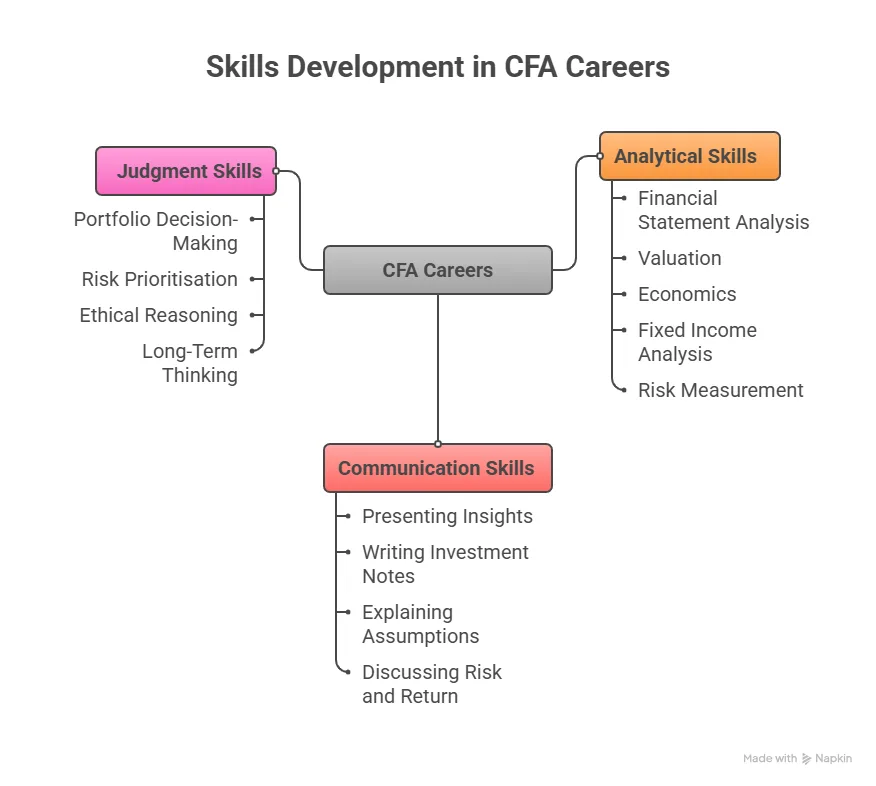

Skills That Actually Drive CFA Careers Forward

CFA careers do not grow on theory alone. Growth comes from how skills are applied. Over time, three skill layers become clear.

- The first layer is analytical skill. This includes valuation, financial statement reading, and risk assessment. These skills help answer simple questions like whether a business can survive a bad year.

- The second layer is communication skills. This means explaining numbers in plain language. A good analyst can explain a balance sheet to a non-finance colleague. CFA careers reward those who translate complexity into clarity.

- The third layer is judgment. This develops slowly. Judgment shows when data is incomplete. It is the ability to act without perfect information. This is where CFA career scope separates experienced professionals from beginners.

Top Skills for Financial Analysts

Before looking at numbers or salaries, it helps to understand the skills employers value most in CFA careers. Below is a simple breakdown.

| Skill | What the Skill Involves | Why It Matters in CFA Careers |

| Financial Analysis | Reading financial statements, understanding cash flows, and evaluating profitability | Forms the analytical base required across most CFA careers |

| Business Understanding | Understanding how companies make money and manage costs | Helps analysts move beyond formulas to insight |

| Risk Assessment | Identifying financial, market, and operational risks | Essential for sustainable decision-making in CFA careers |

| Data Interpretation | Making sense of large datasets and trends | Improves clarity and confidence in analysis |

| Communication | Explaining analysis clearly in writing and discussion | Builds trust and credibility over time |

| Ethical Judgment | Applying professional and ethical standards | Central to long-term growth and responsibility in CFA careers |

| Attention to Detail | Ensuring accuracy in numbers and assumptions | Prevents costly mistakes in financial decisions |

| Time Management | Prioritising tasks and meeting deadlines | Supports consistency and reliability in analyst roles |

| Learning Agility | Updating skills and knowledge continuously | Keeps CFA careers relevant as finance evolves |

These skills shape long-term CFA career prospects more than exam scores.

Also Read: Skills That Every Chartered Financial Analyst Should Have

Work Hours and Lifestyle in CFA Careers

Work hours in CFA careers vary by role and market. Research and portfolio roles often have longer hours during earnings seasons. Operations and risk roles follow steadier schedules. This is like running a store versus managing inventory. One reacts to customers. The other plans systems.

Most financial analysts work between 45 to 60 hours per week. Senior roles may demand more during high-pressure periods. This varies by firm and geography. Data from global finance surveys such as those published by investment banks and industry bodies suggest this range remains common across markets.

Salary Dynamics in CFA Careers

Salary is a frequent question. CFA careers do not offer a single number. For example, CFA Salary in India depends on role, experience, and geography. In India, early roles may start modestly. As experience grows, salaries rise steadily. Mid-career professionals often see strong jumps when responsibility increases.

| Region | Role / Career Stage | Typical Salary Range | Notes |

| India | Entry Level (CFA Level 1 / 2) | ₹6 L – ₹12 LPA | Starting roles like financial analyst, research associate, vary by city and firm size. |

| Mid Level (3 – 7 yrs) | ₹12 L – ₹25 LPA | Includes portfolio analyst, senior analyst, risk or credit analyst roles with experience. | |

| Senior Level / CFA Charterholder | ₹25 L – ₹50+ LPA | Senior roles such as portfolio manager, investment banker, risk manager; top firms may exceed this. | |

| Average Chartered Salary | ~₹28.6 LPA | Based on the India career impact survey of CFA charterholders. | |

| Global | Average CFA Charterholder | ~$180,000 per year (~₹1.5 Cr) | General global average reported by CFA Institute; may vary by region. |

| Entry Level (US / UK / Int’l) | ~$60,000 – $95,000 | Typical starting offers in international finance hubs; depends on the role. | |

| Mid Level (Standard) | ~$100,000 – $200,000 | Mid-career analyst or portfolio roles in major markets. | |

| Senior / Portfolio Manager | $200,000 + (plus bonuses) | Senior portfolio manager and leadership positions, especially in asset management or hedge funds. |

Global salary surveys published by the CFA Institute consistently show that charterholders earn higher median compensation compared to non-chartered peers. These surveys highlight how CFA careers reward experience and leadership rather than exam completion alone.

Coding and Technology in CFA Careers

Many ask if coding is required. Coding is not mandatory for all CFA careers. Basic tools like Excel remain core. Some roles benefit from Python or SQL. These tools help automate analysis. Think of coding like learning shortcuts on a calculator. It saves time but does not replace thinking.

Roles in decision analysis or risk modelling benefit most from coding. Traditional research and portfolio roles value logic and reasoning more.

Also Read: The Growth of CFA Courses and 2020-2027’s Outlook

Why the Right CFA Careers Preparation Matters with Imarticus Learning

Preparing for the CFA Program is not only about clearing exams. It is about how well that preparation translates into CFA careers over time. The gap between passing an exam and performing at work is where many candidates struggle. The right preparation approach reduces that gap.

What matters is learning how things work in real jobs, having clear help, and getting support that fits how CFA careers grow over time. This is where the learning model and ecosystem around the program start to matter as much as the curriculum itself.

Imarticus Learning positions its CFA program around this exact idea. The focus stays on exam readiness while keeping career application and employability in view.

Key USPs That Strengthen CFA Careers With Imarticus Learning

- Program designed in collaboration with KPMG in India, bringing industry-reviewed content, case studies, and evaluation aligned with real finance roles.

- Access to Kaplan Schweser learning resources, including globally trusted CFA study notes, question banks, and mock exams mapped to the current curriculum.

- Dual-teacher support model, where live faculty handle concept delivery and dedicated mentors provide continuous doubt resolution and guidance.

- Structured internship opportunities with KPMG in India for top performers, helping bridge academic preparation and workplace exposure early in CFA career options.

- Placement and career support after CFA Level 1, including resume preparation, interview readiness, and access to interview opportunities.

- Money-back assurance for eligible candidates, reflecting confidence in training quality and learner outcomes.

- Practical case studies across core finance domains, evaluated by industry professionals to strengthen application skills.

- Flexible learning formats, with options for live online and offline modes to suit working professionals and full-time students.

- Regular industry webinars and live sessions, offering exposure to current market practices and evolving expectations in CFA career opportunities.

- Preparation ecosystem covering multiple global finance certifications, allowing learners to build complementary skills alongside CFA.

FAQs on CFA Careers

People searching for clarity around CFA careers often reach this point with specific questions in mind. These frequently asked questions usually come from real concerns about effort, outcomes, and long-term direction. The answers below draw from how the qualification works in practice and how careers typically evolve after entering the CFA pathway.

Is CFA a good career option?

CFA careers offer strong long-term value for those interested in finance decision-making. The qualification builds analytical depth and ethical grounding. CFA career prospects suit people who enjoy structured thinking and continuous learning. In India and globally, CFA career options remain relevant across market cycles. Many learners enhance outcomes through Imarticus Learning, which focuses on applied skills alongside exams.

What careers is CFA good for?

CFA careers align well with investment research, portfolio management, risk analysis, and corporate finance roles. CFA career scope also supports advisory and leadership positions over time. The qualification prepares professionals for roles where financial judgment matters. This flexibility explains why CFA career prospects span multiple industries and markets.

Is CFA harder than IIT?

CFA careers require a different kind of effort compared to engineering paths. The CFA program tests application and consistency over several years. Difficulty depends on learning style and discipline. CFA career opportunities reward patience and structured study rather than speed.

Is 67% enough to pass CFA?

CFA careers does not publish fixed passing percentages. Passing depends on meeting the minimum passing score set by exam standards. Many candidates pass without high raw scores. Career options after CFA value concept clarity and application over numerical targets.

What are the top 3 skills for a financial analyst?

For CFA careers, the top skills are financial analysis, business understanding, and communication. These skills allow professionals to move from data to decisions. Career options for CFA grow fastest when these skills develop together.

How much is a CFA salary?

CFA careers offer salaries that rise with experience and responsibility. Entry roles may offer moderate pay. Mid and senior roles show strong growth. According to the global CFA Institute compensation surveys, charterholders earn higher median salaries over time. CFA career scope rewards sustained performance rather than quick gains.

How many hours do financial analysts work?

In CFA careers, financial analysts usually work between 45 and 60 hours per week. Workload varies by role and season. Research and portfolio roles may see spikes during reporting periods. Operations roles tend to be steadier.

Is coding needed for financial analysis?

Coding is optional for many CFA careers. Basic automation skills help efficiency. Advanced coding benefits specialised roles. CFA primarily value reasoning and judgment over technical programming.

How many hours of study are required for CFA?

CFA requires disciplined preparation. Candidates typically study around 300 hours per level as suggested by the CFA Institute. Actual hours vary by background. Consistent study supports long-term success in CFA career prospects.

Shaping the Next Phase of Your CFA Careers

CFA careers do not arrive all at once. They take shape quietly through choices made over time. The roles discussed in this guide, the skills that compound, and the salary growth that follows all point to the same idea. The CFA program works best when it is treated as a long-term framework rather than a short-term milestone.

What stays consistent across CFA careers is the nature of the work. You are trusted with judgment. You are expected to think ahead. You are asked to explain not just what the numbers show, but what they imply. That responsibility grows gradually, and so does the value you bring to an organisation.

The path looks different for everyone. Some find their place in research. Others move toward portfolio roles, risk, or corporate finance. What connects these outcomes is the way CFA thinking reshapes how decisions are made. Over time, this way of thinking becomes your professional identity.

Preparation plays a quiet but important role in this journey. Strong preparation builds confidence early. It reduces friction when theory meets real work. This is where structured learning environments, industry-aligned case exposure, and guided support can make the transition into CFA career options smoother. Many learners choose to align their CFA Course preparation with Imarticus Learning because the focus stays on both exam readiness and career application.

In the end, CFA career opportunities reward patience and clarity. The effort you put in today shows up later as credibility, responsibility, and choice. When preparation and intent align, the career outcomes tend to follow naturally.