When people search for Investment Banking Exams, they are rarely asking for a single test name. What they are trying to decode is whether investment banking follows a structured examination route like CA, CFA, or the civil services. This confusion exists because investment banking operates at the intersection of finance knowledge, deal execution skills, and regulatory awareness.

Exams in Investment Banking refer to a group of certifications, professional exams, and regulatory assessments that support entry, credibility, or progression in investment banking roles. These exams differ by geography, career stage, and role focus. Some validate technical finance skills. Others exist to meet market or compliance requirements. None of them functions as a single gateway exam.

Before anyone starts comparing Investment Banking Exams, there is usually a quiet moment of confusion.

You hear that investment banking pays well.

You hear that it is competitive.

You hear that people from many backgrounds enter it.

And then the obvious question follows.

If this is a serious profession, where is the exam?

That question makes sense. Most finance career people grow up knowing they have a defined test at the centre of them. Investment banking certification feels different because it is.

This distinction matters because many aspirants plan their preparation incorrectly. They spend years chasing the wrong qualification while ignoring the exam or skill that hiring teams actually value at that stage.

What is Investment Banking

Before diving deeper into Investment Banking Exams, it helps to pause and clearly understand what investment banking actually is. Many misconceptions around exams come from an incomplete picture of the role itself.

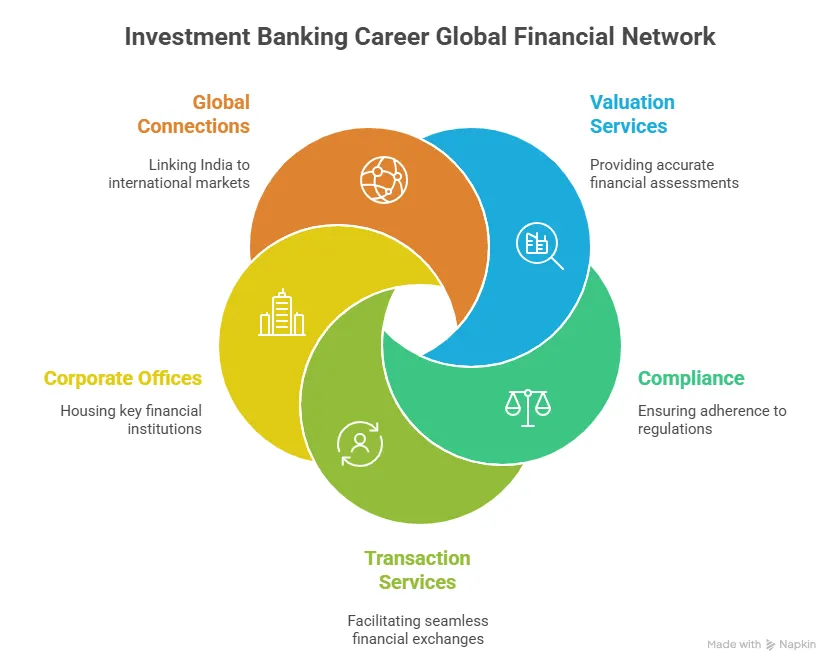

At its core, investment banking is a financial advisory and execution driven function. Investment bankers help companies, governments, and institutions raise capital, restructure businesses, execute mergers and acquisitions, and navigate complex financial decisions.

If you are new to the field, a detailed explanation of what is investment banking helps set the right foundation before evaluating exams, certifications, or career paths.

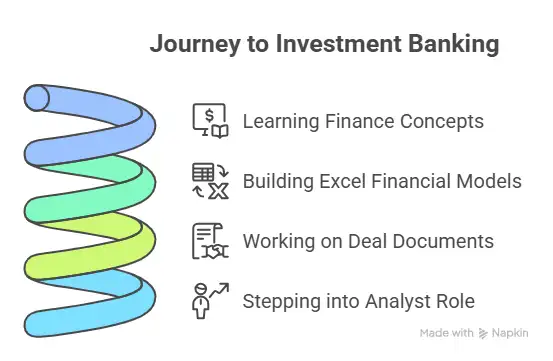

What Investment Bankers Actually Do

Investment banking work revolves around transactions rather than routine finance operations. The role is project-based, deadline-driven, and heavily analytical.

Some of the most common responsibilities include:

- Advising companies on mergers, acquisitions, and divestments

- Helping firms raise capital through equity or debt markets

- Valuing businesses, assets, and investment opportunities

- Preparing financial models, pitch decks, and transaction documents

- Coordinating between legal teams, clients, and investors during deals

This transactional nature explains why employers focus heavily on clarity of thinking, financial judgment, and execution skills rather than just academic credentials.

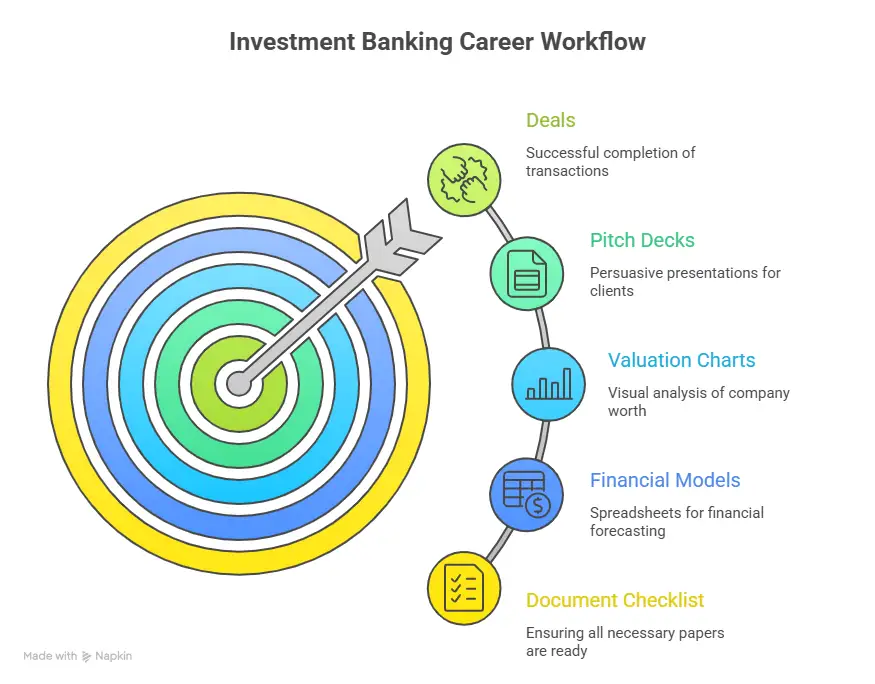

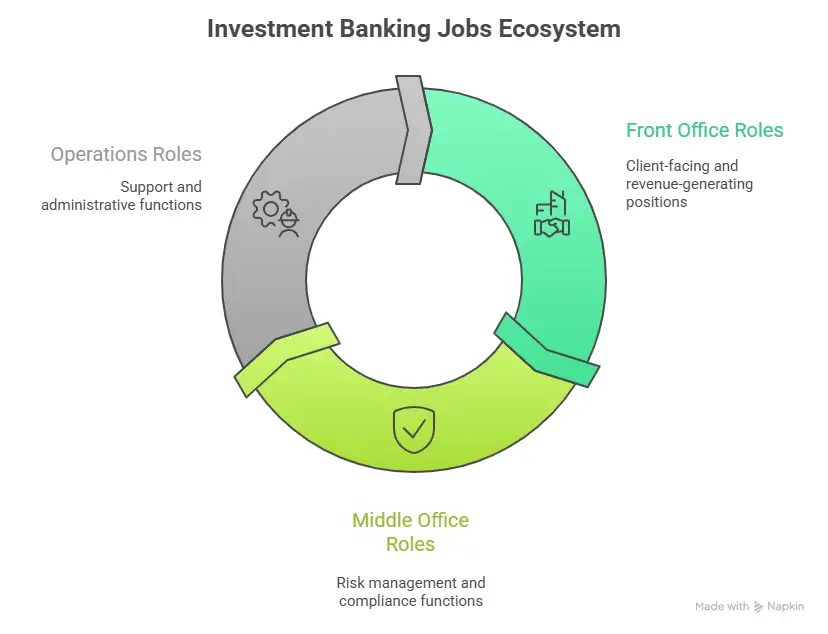

Core Functions Within Investment Banking

To understand where exams fit, it helps to look at how the functions of investment banking work.

| Function | What It Focuses On |

| Mergers and Acquisitions | Buying, selling, and restructuring businesses |

| Capital Markets | Raising funds through equity and debt |

| Valuation and Financial Modelling | Pricing businesses and investments |

| Transaction Advisory | Due diligence, structuring, and deal support |

Each of these functions uses finance concepts differently. This is why there is no single investment banking examination that covers all roles equally.

Why Investment Banking Does Not Follow a Single Exam Path

Unlike professions such as chartered accountancy or law, investment banking does not operate under one licensing authority worldwide. Banks hire based on capability, readiness, and fit, not exam completion alone.

This structure explains why Investment Banking Exams exist as support mechanisms, not entry gates. Exams help candidates build relevant knowledge, signal seriousness, and reduce skill gaps, but they do not replace hiring processes.

Understanding this point early prevents a common mistake where aspirants assume that clearing one exam guarantees entry into investment banking.

Understanding what investment banking is all about and what investment bankers actually do on a day-to-day basis, how their work connects to deals, and why the role demands strong financial judgment helps place later discussions around skills, preparation, and exams in the right perspective:

Is There an Exam for Investment Banking?

This question appears frequently because finance careers usually follow a defined exam structure. Investment banking does not work that way.

There is no single global investment banking examination that guarantees entry into front-end roles. Banks recruit based on a combination of academic background, technical skill tests, internships, and deal readiness. Exams act as signal builders rather than entry tickets.

That said, Investment Banking Exams still play an important role. They help candidates demonstrate seriousness, foundational competence, and long-term alignment with finance careers. This is why certifications like the CFA course, regulatory exams like NISM, and professional qualifications like CA appear repeatedly in investment banking profiles.

The absence of one mandatory exam does not reduce the importance of exams. It simply means the responsibility of choosing the right exam shifts falls to the candidate.

Why Exams Still Matter in Investment Banking Hiring

Banks operate under intense time pressure. Recruiters need filters. Exams provide structured signals that help narrow large applicant pools.

Investment Banking Exams serve three practical purposes:

- They standardise finance knowledge across candidates from different academic backgrounds.

- They signal discipline, consistency, and long-term commitment.

- They reduce onboarding risk for employers.

For example, valuation concepts, accounting treatment, and financial analysis appear repeatedly in interviews. Candidates who have prepared for recognised exams are more likely to perform confidently in these areas.

This is why exams for investment banking continue to influence hiring outcomes, even though none of them function as a legal requirement.

Categories of Investment Banking Exams by Purpose

To make sense of the landscape, it helps to group Investment Banking Exams based on what they actually help with. This framework is missing from most existing content.

Before reviewing the table below, it is important to understand that no candidate needs every exam listed. The value lies in alignment, not accumulation.

Purpose-Based Classification of Investment Banking Exams

| Exam Category | What It Supports | Typical Use Case |

| Core Finance Certifications | Valuation, financial analysis, ethics | Students and early career professionals |

| Regulatory Exams | Market access and compliance | India-specific roles |

| Professional Qualifications | Accounting depth and credibility | Audit, advisory, transaction roles |

| Academic Entrance Exams | Campus recruiting access | MBA-driven investment banking tracks |

This structure allows aspirants to choose exams based on role intent rather than reputation alone.

Core Finance Certifications Relevant to Investment Banking

Among all exams for investment banking, core finance certifications carry the widest recognition. They build strong conceptual grounding and signal analytical readiness.

Chartered Financial Analyst Program

The CFA Program is often associated with investment banking because of its coverage of valuation, financial reporting, corporate finance, and ethics.

Did you know?

According to the CFA Institute, over 190,000 professionals globally hold the charter, and many work in investment banking, asset management, and corporate finance roles.

CFA does not train candidates in deal execution. It strengthens thinking, valuation logic, and financial judgment. This is why it is commonly pursued alongside internships and modelling practice.

Financial Modelling and Valuation Certifications

Short-term certifications in financial modelling focus on practical execution. These are not regulatory exams. They exist to bridge the gap between theory and applied work. Banks value these skills during interviews and case discussions.

While these certifications do not replace formal Investment Banking Exams, they improve readiness and interview performance.

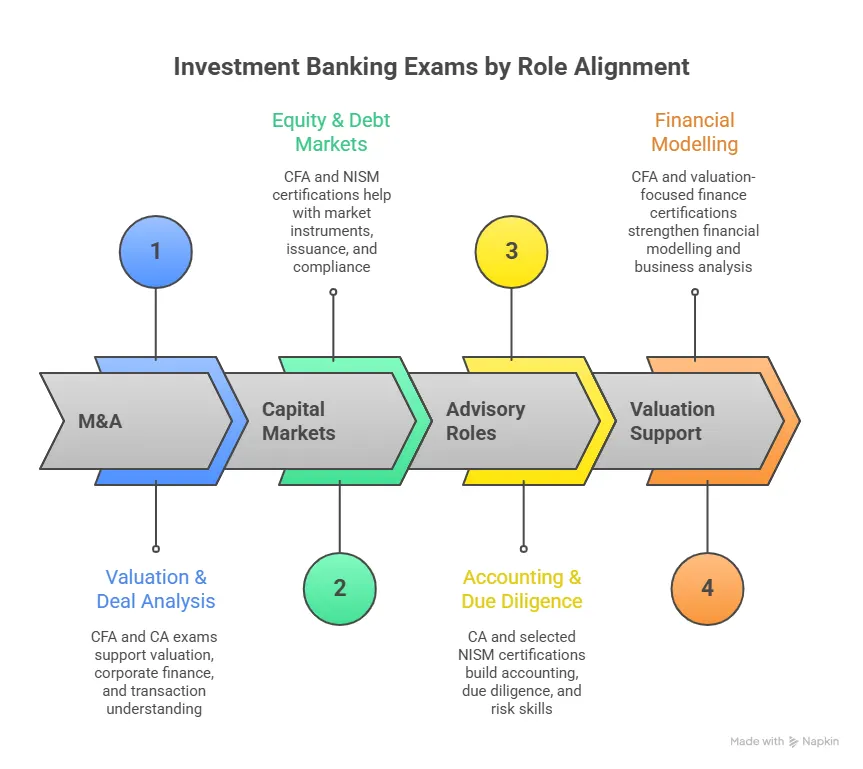

Different investment banking roles draw on different areas of finance knowledge. Understanding how exams align with specific functions helps candidates choose preparation paths that support the type of work they aim to do:

Investment Banking Exams in India: Regulatory and Market Context

The Indian investment banking landscape operates under a regulated securities framework. This is where investment banking exams in India differ from global markets.

Before exploring specific exams, it helps to understand why regulation matters. Deal execution, advisory services, and capital market activities fall under SEBI oversight. Certain roles require compliance certification.

NISM Certifications

The National Institute of Securities Markets conducts regulatory exams aligned with SEBI requirements. NISM certifications are relevant for roles involving capital markets, merchant banking, and advisory functions.

These exams do not test valuation depth. They test regulatory understanding, market operations, and compliance awareness. This makes them practical additions for candidates targeting India-based investment banking roles.

Why NISM Matters in India

- It aligns professionals with SEBI regulations.

- It improves employability for capital market-facing roles.

- It supports compliance readiness in investment banking operations.

This relevance is often underplayed in generic investment banking content, even though investment banking exams in India operate within this regulatory ecosystem.

Professional Qualifications and Investment Banking Relevance

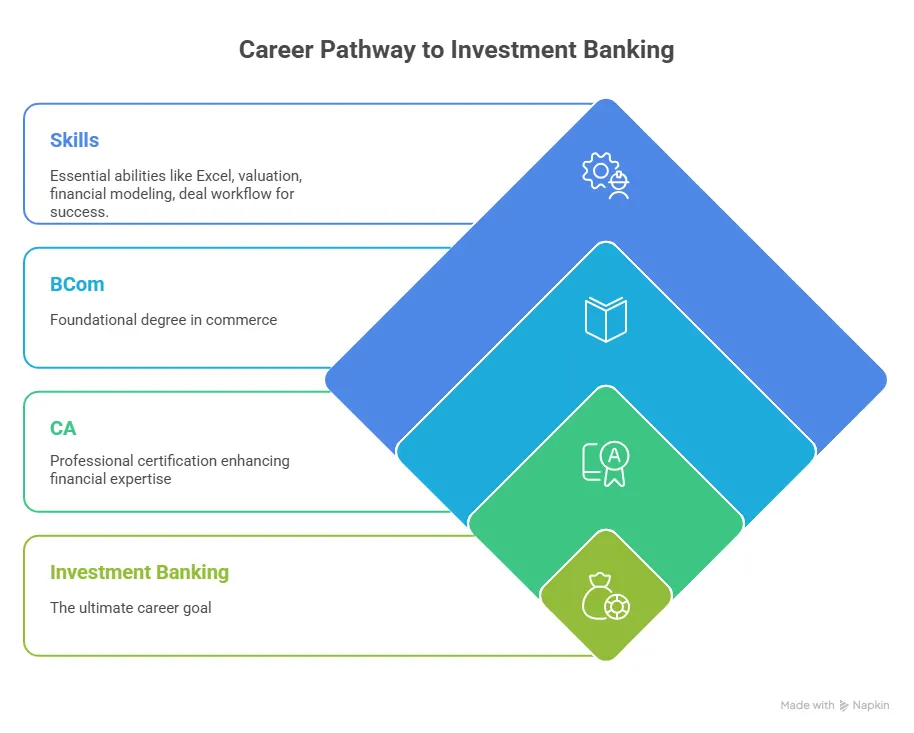

Professional qualifications like CA appear frequently in Indian investment banking teams, especially in transaction advisory, valuation support, and restructuring roles.

CA builds deep financial accounting, tax, and audit knowledge. This strength becomes valuable in due diligence, deal structuring, and financial analysis. While CA is not designed as an investment banking examination, its relevance emerges through application.

This explains why many investment banker exam discussions include CA, even though it was never designed for investment banking alone.

Did you know? The Institute of Chartered Accountants of India reports over 3.5 lakh members as of recent years, many of whom work in finance and advisory roles.

How Candidates Misinterpret Investment Banking Exams

One recurring issue is exam stacking. Candidates attempt multiple exams without a clear role strategy. This leads to fatigue and diluted focus.

Investment Banking Exams work best when chosen with clarity around:

- Geography

- Target role

- Career stage

- Time availability

A first-year student does not need the same exam as a working professional planning a lateral switch. Treating all exams as equal often delays outcomes rather than accelerating them.

Investment banking roles are shaped by the functions professionals support across transactions, capital raising, and advisory work. Looking at how these roles differ in responsibility and focus helps clarify why preparation paths, skill requirements, and exam relevance vary across investment banking careers.

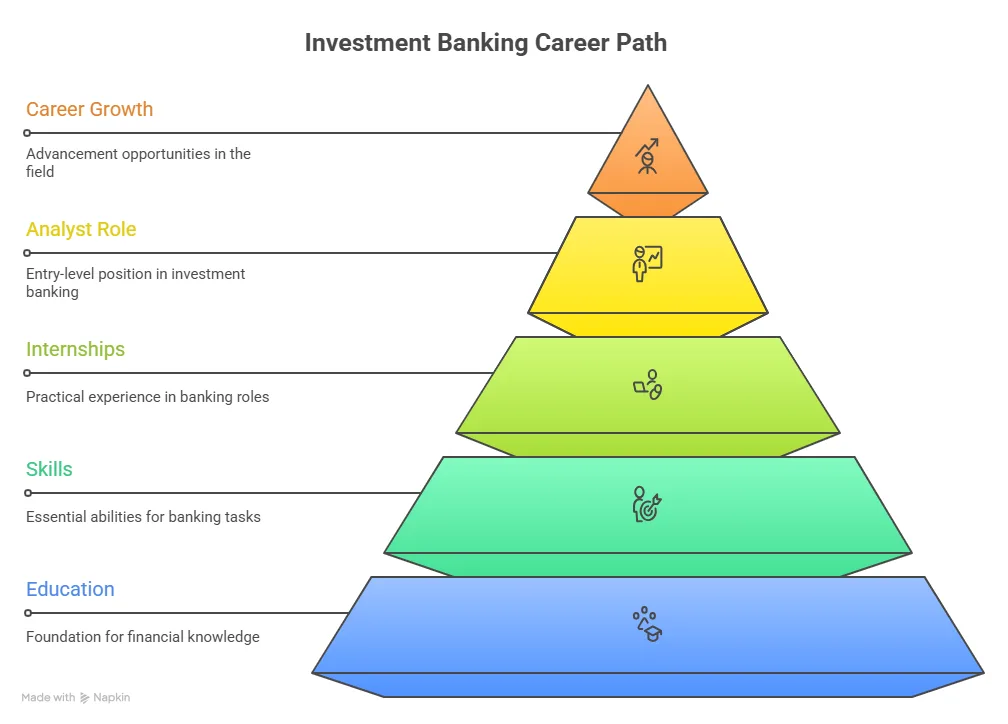

How Investment Banking Exams Align With Career Stages

Investment banking careers do not progress in straight lines. Responsibilities change fast, and the value of exams shifts with experience. Understanding this timing is critical because the same exam can help one candidate while adding no value to another.

Investment Banking Exams work best when matched to the stage at which a candidate is trying to enter or reposition within the industry.

Career Stage-Based Relevance of Investment Banking Exams

Before reviewing the table, it helps to remember that banks hire for readiness, not certificates. Exams support readiness differently at each stage.

| Career Stage | Typical Profile | How Exams Help |

| Undergraduate or Final Year Student | Limited exposure, academic focus | Build credibility and baseline finance knowledge |

| Early Career Professional | 1 to 3 years of work experience | Signal seriousness and technical depth |

| Lateral Switcher | Non-IB finance or consulting background | Bridge skill gaps and improve interview confidence |

| Mid-Career Banker | Deal exposure and execution experience | Exams become optional and role-specific |

This framework explains why many senior bankers hold no additional certifications beyond their academic qualifications, while entry-level candidates often rely heavily on exams for investment banking.

A Practical Way to Think About Exams for Investment Banker Roles

Instead of asking which exam guarantees entry, a better question is which exam improves readiness for the next hiring filter.

Investment banker exams function as preparation tools you must master. They sharpen thinking, build credibility, and reduce interview friction. When combined with internships, live projects, and technical preparation, they create a stronger hiring profile.

This mindset shift alone helps candidates avoid the trap of chasing labels and start building competence.

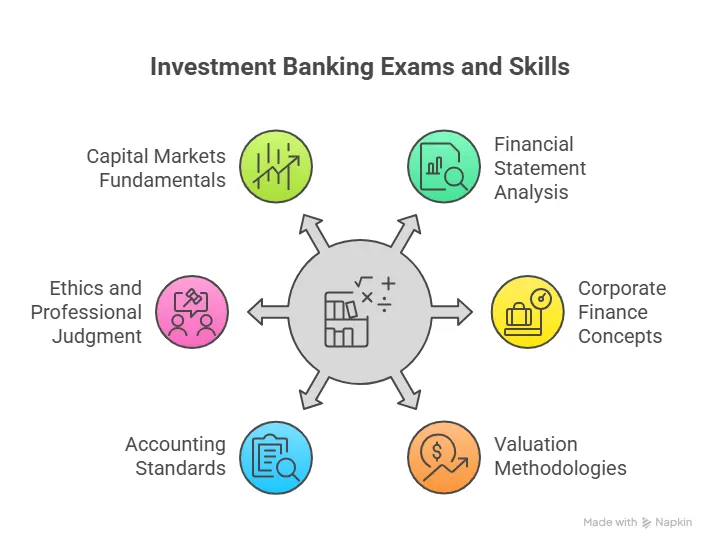

Investment banking preparation is not only about clearing exams but also about developing the skills required to apply financial concepts under real-world conditions. Looking at how exam knowledge connects with analytical, communication, and execution skills helps explain why some candidates transition more smoothly into investment banking roles than others:

Investment Banking Exams for Students and Fresh Graduates

Students often search for Investment Banking Exams because they want structure. At this stage, exams serve as learning frameworks rather than hiring guarantees.

What Exams Help at This Stage

- Core finance certifications that teach valuation and financial analysis

- Regulatory exams that explain market structure

- Academic entrance exams that open campus hiring routes

Investment banking exams in India at the student stage often include CFA Level I and select NISM modules. These exams provide early exposure to concepts that later appear in interviews and case discussions.

A useful way to judge value here is simple. If an exam improves clarity while studying balance sheets, income statements, and valuation models, it is doing its job.

Early Career Professionals and Exam Signalling

Once someone has work experience, the role of exams shifts. Hiring managers no longer look for academic promise. They look for applied thinking.

Investment Banking Exams at this stage act as reinforcement tools. They strengthen weak areas and validate technical conversations during interviews.

For professionals working in audit, accounting, or finance operations, exams like CFA or CA help reposition profiles closer to front office or advisory roles. This is also where targeted financial modelling certifications add disproportionate value.

Many exams for investment banker roles become relevant here because candidates are evaluated on how well they connect theory with real business scenarios.

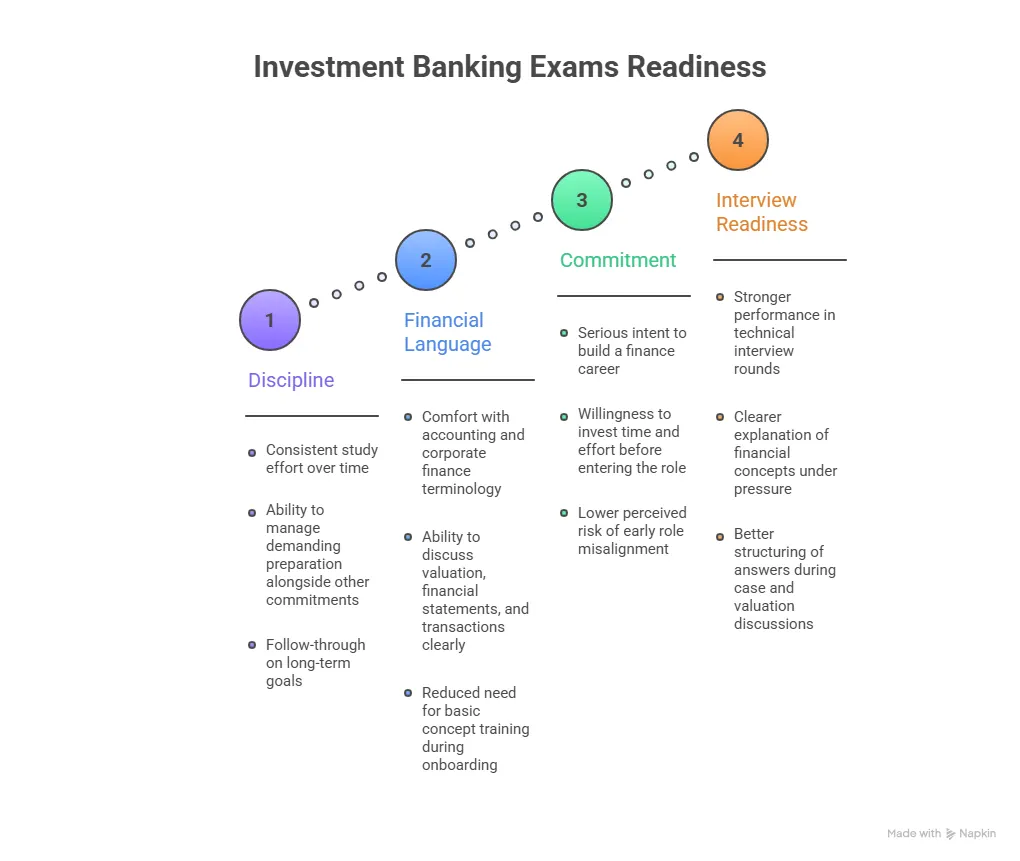

Readiness for investment banking goes beyond exam completion. Understanding how exam knowledge translates into practical confidence, interview performance, and day-to-day execution helps explain why some candidates feel prepared on paper but struggle in real hiring scenarios:

Lateral Switchers and Exam Strategy

Lateral movement into investment banking is common. Consultants, corporate finance professionals, and even engineers make this transition.

For lateral switchers, Investment Banking Exams act as translators. They help candidates speak the language of bankers.

The most useful exams at this stage are those that:

- Strengthen valuation logic

- Improve understanding of deal structures

- Build comfort with financial statements

This is also where preparation becomes selective. Attempting too many exams creates confusion. One well-chosen exam aligned with role goals is more effective than multiple loosely connected certifications.

Breaking into investment banking requires more than ambition. Understanding how hiring decisions are made, what firms look for at different stages, and how candidates can position themselves effectively to land their dream job in IB helps bring structure to an otherwise competitive and opaque recruitment process:

Global Perspective on Investment Banking Exams

Many aspirants assume global investment banking follows a universal exam system. This assumption creates unnecessary confusion.

Globally, banks focus on:

- Academic pedigree

- Technical interviews

- Deal exposure

- Cultural fit

Exams complement these filters but do not replace them.

CFA and Global Investment Banking

The CFA Program remains the most recognised global certification associated with investment banking. According to CFA Institute data, charterholders work across investment banking, asset management, and corporate finance.

However, CFA is not region-specific. It supports global mobility and conceptual depth rather than local regulatory access.

FINRA and Other Market Exams

In markets like the US, FINRA exams exist for licensing purposes. These exams are role-dependent and employer-sponsored. They are not entry-level investment banking examinations in the traditional sense.

Understanding this distinction helps candidates avoid assuming that passing a licensing exam alone improves hiring chances.

Choosing Between Multiple Exams Without Overloading

A common mistake is chasing every available option. Investment Banking Exams are not cumulative in value.

A simple decision filter helps:

- Choose one core finance exam

- Add one skill-based certification if required

- Avoid overlapping syllabi

This approach keeps preparation focused and sustainable.

Why Academic Exams Still Matter in Investment Banking Hiring

Entrance exams like CAT and GMAT appear frequently in investment banking career paths because top MBA programs act as recruiting hubs.

These exams do not test investment banking skills. They test aptitude, reasoning, and discipline. Banks value these traits because they predict performance under pressure.

Investment Banking Exams at the academic level, therefore, operate one step removed from technical finance. They open doors where technical learning happens later.

This layered hiring logic explains why MBA-driven investment banking roles remain common in India and globally.

The Long-Term Value of Investment Banking Exams

Beyond hiring, exams influence how professionals think. They improve financial judgment, ethical reasoning, and decision clarity. These qualities compound over time.

Investment Banking Exams, therefore, act as career accelerators when chosen with intent, and you can also compare the investment banking pay over other finance certifications. Their real value emerges through application, not certificates.

This perspective helps aspirants move from exam chasing to skill building.

A Clear Decision Framework for Choosing Investment Banking Exams

Choosing between multiple Investment Banking Exams becomes easier when decisions are grounded in context rather than popularity. Most confusion comes from copying someone else’s path without checking if the same conditions apply.

Before looking at the framework below, it helps to pause and answer three questions honestly:

- Where do I want to work geographically?

- Which role am I targeting in investment banking?

- What is my current level of exposure to finance?

Decision Matrix for Investment Banking Exams

| Situation | Exam Direction That Makes Sense |

| Student with no finance background | Entry-level finance certification plus skill training |

| Commerce or accounting graduate | CA or CFA Level I, depending on role intent |

| Working professional in audit or finance | CFA or valuation-focused certifications |

| India’s focused capital markets role | NISM certifications plus finance foundation |

| Global mobility-focused aspirant | CFA Program-aligned preparation |

This framework avoids over-preparation and keeps effort proportional to outcome.

How to Prepare for Investment Banking Exams Without Burning Out

Preparation fatigue is common among aspirants preparing for investment banking exams in India. This happens when preparation becomes exam-centric rather than skill-centric.

A more sustainable approach focuses on three layers.

Layer One: Concept Clarity

This includes accounting principles in investment banking basics, corporate finance, and valuation. Most Investment Banking Exams test these areas directly or indirectly.

Layer Two: Application Practice

This involves financial statement analysis, valuation case studies, and deal scenarios. Exams improve retention when concepts are applied repeatedly.

Layer Three: Interview Translation

Every exam topic should be convertible into interview answers. If a concept cannot be explained simply, it is not yet ready.

This layered approach reduces stress and improves outcomes across exams for investment banking and investment banking interview questions alike.

Common Misconceptions Around Investment Banking Exams

Many candidates approach investment banking examination planning with assumptions that sound logical but fail in practice.

One common belief is that passing more exams increases hiring probability. In reality, overlapping exams often repeat the same content and delay practical exposure.

Another misconception is that exams replace internships or deal exposure. Exams support readiness. They do not substitute execution.

A third misunderstanding is that only top-tier exams matter. In practice, relevance matters more than reputation. A well-chosen exam aligned with role goals delivers better results than a popular but misaligned one.

How Investment Banking Exams Influence Long-Term Careers

The long-term impact of Investment Banking Exams appears gradually. Professionals who build strong foundations early adapt faster to complex transactions later.

Exams improve:

- Financial judgment

- Structured thinking

- Comfort with ambiguity

These traits matter at senior levels where decisions influence large transactions. This is why many professionals value exams long after hiring outcomes are settled.

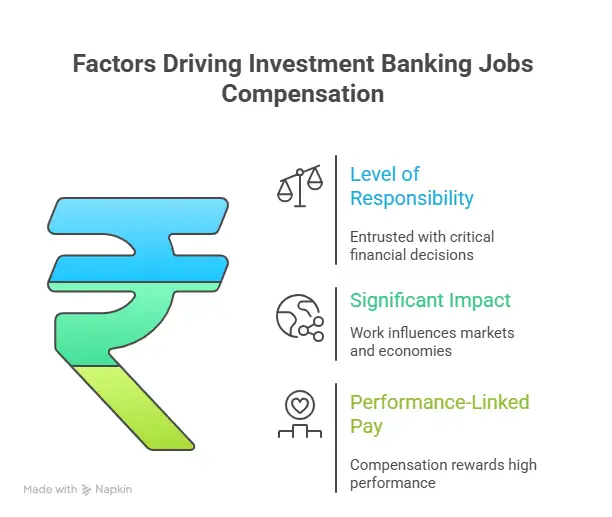

Salary Expectations and the Role of Exams

Discussions often surface alongside Investment Banking Salary because aspirants expect direct financial returns from certifications.

In reality, exams influence salary indirectly.

Investment Banking Salaries in India by Role (Approximate Annual Compensation)

| Role | Average Salary Range (₹) | Notes |

| Analyst (Entry Level) | ₹8-₹18 LPA | Most freshers start here; boutique vs large bank ranges vary. |

| Associate | ₹12.5-₹30 LPA | Mid-level, some firms reach higher ranges with bonuses. |

| Vice President (VP) | ₹30-₹70 LPA | Senior mid-level role, leadership & client engagement. |

| Director / Executive Director | ₹60L-₹1Cr+ | Senior role across strategy and major deal execution. |

| Managing Director | ₹1-2 Cr+ | Top leadership role, performance heavily bonus-linked. |

According to publicly available compensation surveys, entry-level investment banking roles in India can range widely based on firm type, deal exposure, and city.

Exams improve salary outcomes by:

- Improving interview performance

- Supporting entry into higher-quality roles

- Enabling faster responsibility growth

They do not create salary jumps on their own. This is a critical nuance missing from most content around exams for investment banking.

Choosing the Right Preparation Path for Investment Banking with Imarticus Learning

When thinking about how to strengthen your readiness beyond theoretical study and Investment Banking Exams, structured preparation that mirrors real industry expectations becomes important. The finance industry places a premium on skills that go beyond textbooks, such as understanding processes within banks, trade life cycles, and operational workflows that underpin deal execution and market functioning.

One program that aligns well with these needs is the Investment Banking Certification from Imarticus Learning. This is a professional certification designed for careers in investment banking operations, treasury, clearing services, and related financial functions. It has been built with input from industry experts and reflects real expectations from banks and financial institutions.

What Makes This Certification Relevant

- Industry-Aligned Curriculum: The program covers essential topics such as securities operations, trade life cycle, fixed income and derivatives, risk management, AML/KYC frameworks, and wealth & asset management operations, giving learners grounding in the way investment banks actually operate.

- Multiple Pathways: It offers specialised pathways such as Securities Operations and Wealth & Asset Management Operations, allowing learners to focus on areas that align with their longer-term career interests.

- Flexible Format: The course is available in different formats, including a compact 3-month weekday option and a part-time weekend option, which helps learners balance preparation with other commitments.

- Career Support Features: Beyond technical training, the program includes interview readiness, resume support, and career services designed to help candidates present themselves effectively to employers.

- Industry Recognition and Legacy: CIBOP has been offered for over a decade and has evolved with market needs, with many hiring partners across banks and financial institutions recognising its value.

FAQs on Investment Banking Exams

Below are detailed answers to the most frequently asked questions on investment banking exams. Each answer explains the topic through the lens of Investment Banking Exams and the current industry structure.

Which exam is for an investment banker?

Investment Banking Exams do not include a single exam designed exclusively for investment bankers. Instead, exams such as CFA, CA, and regulatory certifications support entry into investment banking roles by building finance knowledge and credibility. The exam that works best depends on geography, role intent, and career stage. Many candidates combine one core finance exam with practical training to strengthen readiness.

What exams are needed for investment banking?

Investment Banking Exams vary based on the market and role. In India, candidates often pursue CFA, CA, or NISM certifications depending on whether the focus is advisory, valuation, or capital markets. Globally, exams support knowledge building rather than acting as mandatory requirements. The need is not for multiple exams but for the right exam aligned with hiring expectations.

Is CFA or CA better for investment banking?

CFA and CA serve different purposes. CFA focuses on valuation, corporate finance, and investment analysis, which aligns well with front-end and advisory roles. CA builds strong accounting and audit depth, which supports transaction advisory and due diligence roles. The better choice depends on the type of investment banking role targeted, rather than overall difficulty. Structured learning pathways offered by Imarticus Learning help candidates strengthen CFA-linked skills and translate them into practical deal readiness.

Who earns more, CA or IB?

Investment Banking Exams do not determine earnings on their own. Compensation in investment banking depends on role, firm, deal exposure, and performance. Investment bankers in front-end roles often earn more due to variable pay and bonuses. CAs in senior advisory or leadership roles can also reach comparable compensation levels. The exam supports entry, but career trajectory drives earnings.

Is CFA only for investment banking?

CFA is not limited to investment banking. While CFA appears frequently in discussions around Investment Banking Exams, it is also widely used in asset management, equity research, portfolio management, and corporate finance. Its value lies in financial thinking rather than role restriction, which is why it supports multiple finance careers. Imarticus Learning helps candidates apply CFA concepts to real-world finance roles, including but not limited to investment banking.

What is the IB salary?

In India, entry-level investment banking roles typically pay ₹8-15 LPA, with bonuses adding 20-60% to base pay. Associate-level compensation usually ranges from ₹18-35 LPA, while experienced professionals with strong deal exposure can earn ₹50 LPA or more. Investment Banking Exams help with early role access, but long-term salary growth depends mainly on performance and deal execution.

Is 25 too old for investment banking?

Age does not disqualify candidates from investment banking. Investment Banking Exams help candidates reposition at different stages. At 25, candidates often bring maturity and work experience that banks value. Exams and structured programs help bridge skill gaps and improve interview readiness, making age a minor factor compared to capability. Imarticus Learning supports this transition by aligning exam preparation with interview expectations and practical finance work. As a result, age becomes far less relevant than demonstrated capability and readiness.

Which is better, CA or an investment banker?

CA is a qualification, while an investment banker is a role. Investment Banking Exams, like CA, support entry into finance careers but do not define job titles. Many CAs work as investment bankers, advisors, or finance leaders. The better option depends on whether someone wants a professional qualification or a specific role outcome.

Is JP Morgan an investment banker?

JP Morgan is a global financial institution with a strong investment banking division. Investment Banking Exams are not mandatory for working at such firms, but strong finance foundations, academic credentials, and technical readiness are essential. Many professionals at such firms hold finance certifications alongside practical experience.

Is a 3.6 GPA bad for investment banking?

A 3.6 GPA is generally competitive for investment banking roles. Investment Banking Exams help strengthen profiles where candidates want to add finance credibility. Hiring decisions consider GPA, internships, technical skills, and interviews together. Structured preparation pathways offered by Imarticus Learning help candidates translate exam knowledge into practical finance skills that interviewers actually test.

Arriving at Clarity on Investment Banking Exams

By the time someone reaches the end of a discussion on Investment Banking Exams, one thing usually becomes clear. The confusion was never really about exams. It was about direction.

Investment banking does not reward people who collect credentials. It rewards people who can think clearly under pressure, understand businesses beyond numbers, and support decisions that carry real financial weight. Exams exist in this ecosystem because they help build that thinking. They are reference points, not finish lines.

Seen this way, the role of exams becomes easier to place. CFA strengthens valuation and financial judgment. CA deepens accounting and transaction understanding. NISM aligns professionals with market structure and regulation. Each exam has a purpose when chosen with intent. None of them works in isolation.

The strongest outcomes come when exam preparation is paired with practical exposure. Concepts make sense faster when they are applied. Interviews become less intimidating when preparation mirrors real work. This is where structured learning environments add quiet value. Programs that blend technical finance, exam alignment, and real-world application help candidates move from preparation to readiness without unnecessary detours.

For students and professionals who want to approach investment banking preparation with clarity rather than guesswork, the Investment Banking Certification offered by Imarticus Learning can help bridge the gap between exams and execution.