Most people do not start looking for CMA Classes with a clear plan in mind. The search usually begins with a quiet question. Is what I am doing right now enough for where I want to go?

For some, that question comes during a routine workday. Reports are prepared, numbers are reviewed, and meetings move on. The work is fine, but it feels limited. Decisions are taken elsewhere. For others, the question appears during college, when career options start to feel narrow or unclear.

CMA certification classes often come into the picture at this point. Not as a sudden ambition, but as a practical option worth understanding. The course promises structured learning in management accounting, finance, and decision-making. More importantly, it promises clarity around how businesses actually use numbers.

I see CMA learning as a way to make sense of financial information that already exists around us. A business budget is not very different from a household budget.

→ Income is planned.

→ Expenses are tracked.

→ Gaps are managed.

CMA course classes take this familiar logic and scale it to organisations, departments, and long-term strategy.

What makes CMA USA classes different from many other qualifications is the way concepts are applied. You are not asked to memorise accounting rules. You are asked to decide what those rules imply.

→ Should costs be controlled or redesigned?

→ Should profits be reinvested or protected?

→ Should risk be accepted or reduced?

These are the kinds of questions that appear in real workplaces.

The way people learn CMA has also changed. US CMA online classes have made the course accessible to those who are already working or studying full-time. Learning now fits into evenings, weekends, and quieter hours. This flexibility explains why many learners look for CMA classes near me or CMA USA classes near me, even when they plan to study online. Support and guidance still matter.

At its core, the best classes for CMA are about learning how to think through financial choices with structure and logic. The qualification does not change a career overnight. What it changes is how people approach problems, conversations, and responsibility at work.

This guide looks at CMA Classes from that practical angle. How does the learning work? How to choose the right format. What to expect from the syllabus. And how this path fits into real careers over time.

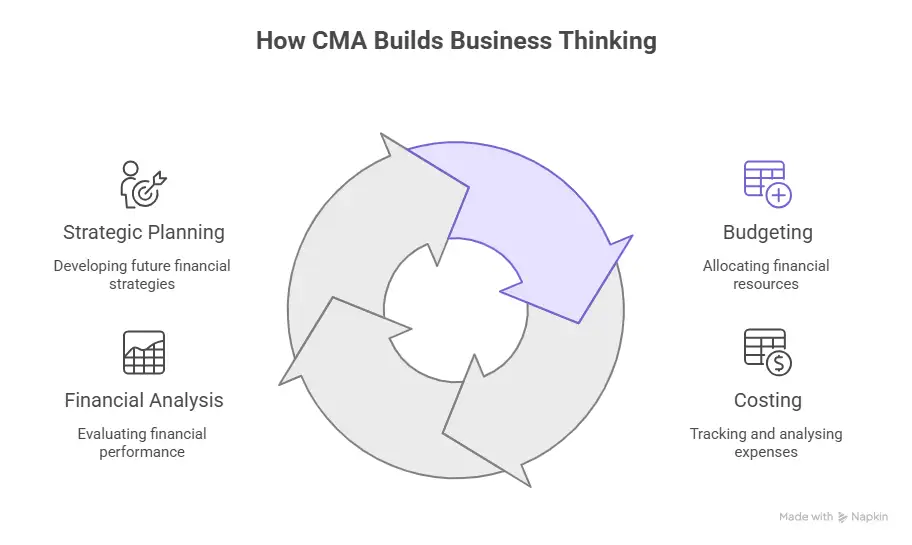

What Is CMA and How CMA Classes Shape Financial Thinking

Before understanding how CMA Classes work, it helps to pause and understand what is CMA at a fundamental level. CMA stands for Certified Management Accountant. It is a globally recognised professional qualification focused on management accounting, financial planning, analysis, control, and decision support.

CMA is designed for professionals who want to move beyond preparing numbers and into interpreting them. The qualification trains individuals to understand how financial information is used by managers to plan, evaluate performance, manage risk, and make long-term decisions.

This focus explains why CMA Classes are structured around real business situations rather than textbook accounting rules.

What CMA Is Focused On

CMA does not train you to record transactions. It trains you to evaluate outcomes.

At a practical level, CMA answers questions such as:

→ Is this business unit performing as expected?

→ Why are costs rising even when sales are stable?

→ Should the company expand now or conserve cash?

→ How do financial decisions affect long-term strategy?

CMA Classes teach learners how to approach these questions with structure and logic.

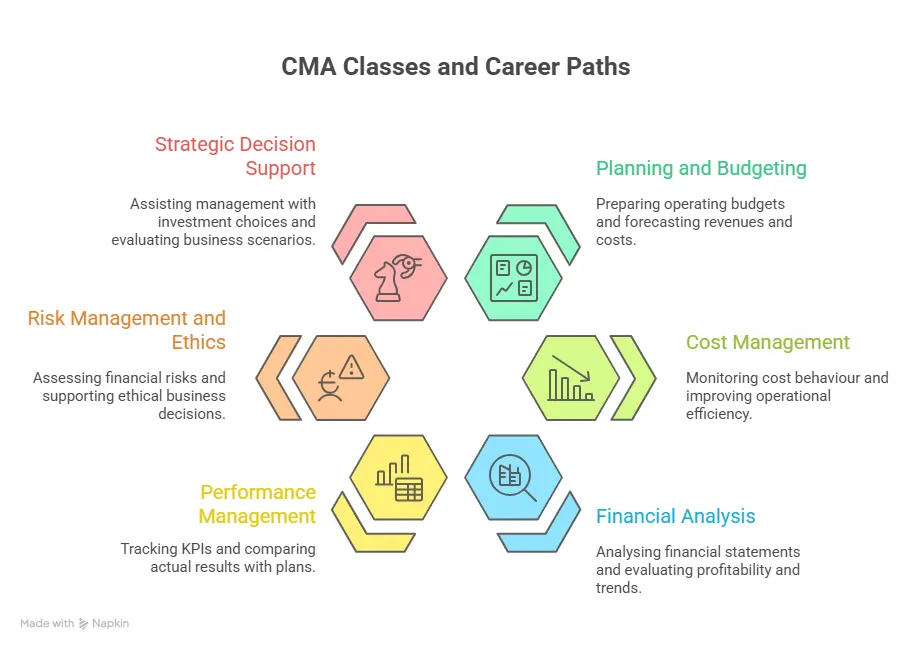

Core Areas Covered in CMA

The CMA syllabus is divided into two exam parts. Each part focuses on a different stage of business decision-making.

| CMA Part | What It Focuses On | Why It Matters |

| Part 1 | Planning, performance, and analytics | Helps understand how businesses plan and measure results |

| Part 2 | Financial management and strategy | Helps evaluate decisions, investments, and risks |

Together, these two parts explain why CMA USA classes are often described as decision-oriented rather than compliance-oriented.

How CMA Learning Connects to Real Life

The concepts taught in CMA Classes often feel familiar when explained correctly.

A budget works like a monthly household plan. Income is estimated. Expenses are planned. Variances appear. Decisions follow.

Cost management feels similar to running a small shop. If rent increases, you either adjust pricing, reduce waste, or rethink operations.

Investment decisions mirror personal choices, such as buying a home or delaying a purchase based on future cash flow.

CMA certification classes formalise this everyday thinking and apply it to organisations.

Why CMA Is Considered a Management Qualification

CMA is classified as a cost and management accounting qualification because it focuses on internal decision-making. This is different from qualifications that focus mainly on reporting past performance.

Certified management accountant classes train learners to:

- Analyse performance trends

- Support strategic planning

- Improve operational efficiency

- Communicate financial insights clearly

This is why CMA Classes are relevant across industries, not just accounting firms.

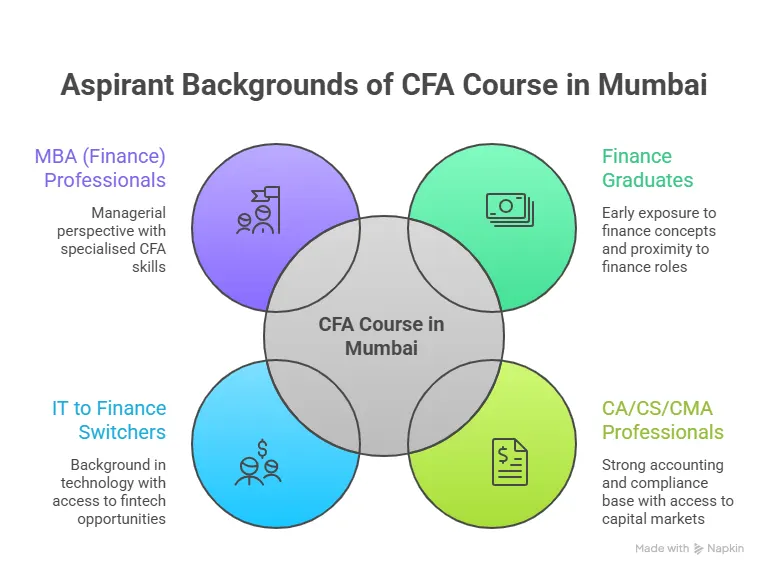

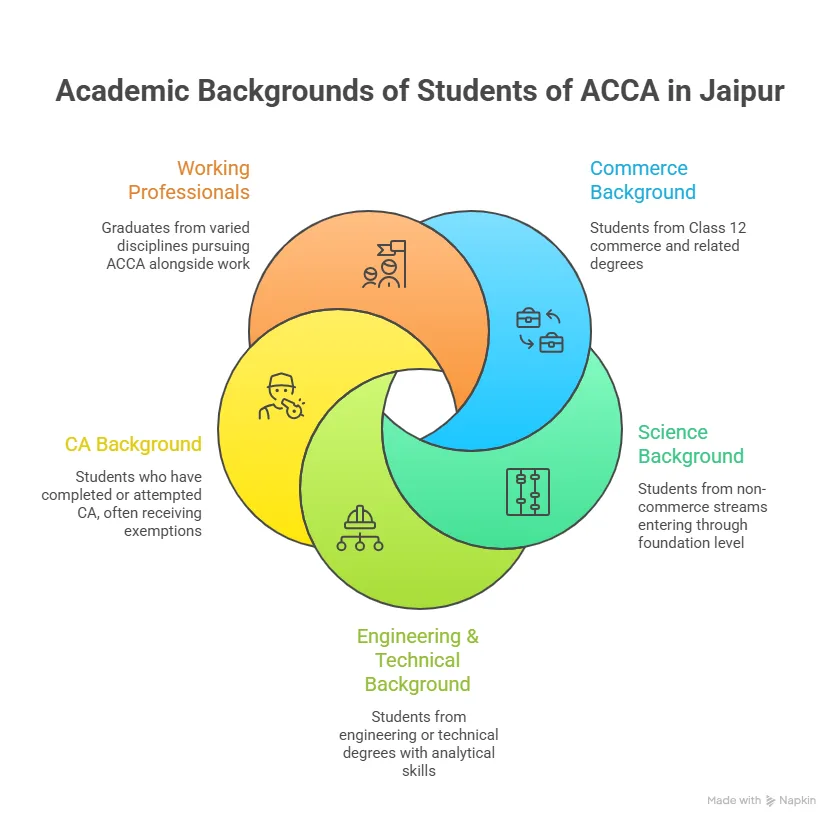

Who Typically Pursues CMA

CMA attracts a wide range of learners because of its flexible structure and global recognition.

Common profiles include:

- Commerce graduates seeking international credentials

- Working professionals in financial accounting roles

- Engineers and analysts moving into business roles

- Professionals aiming for leadership positions

US CMA online classes have made this path accessible even to those with full-time jobs.

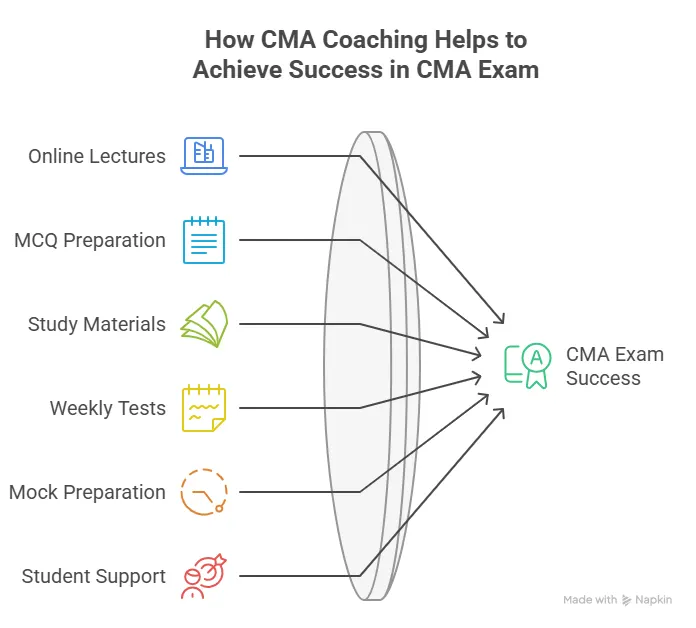

Formats of CMA Classes Available Today

This section explains how CMA classes are delivered. The learning format shapes how easily students stay consistent.

Classroom CMA USA Classes: Classroom CMA USA classes follow fixed schedules. Students attend live sessions at a centre. This format works well for those who need physical structure and peer presence.

US CMA Online Classes: US CMA online classes offer recorded lectures, live doubt sessions, and digital mock exams. This format suits working professionals and students in smaller cities. Many learners prefer it because they can pause and replay concepts.

Hybrid CMA Classes: Hybrid models combine classroom teaching with online revision. This approach helps students revise difficult areas without the travel.

Each format has the same syllabus. The difference lies in flexibility and support.

Also Read: Choose the Best CMA Review Course for Your Preparation

How to Identify the Right CMA Classes

The phrase best CMA classes gets used loosely. I define it through five clear lenses.

- Alignment with IMA syllabus updates

- Depth of question practice

- Faculty who explain concepts simply

- Structured revision cycles

- Career support beyond exam clearing

A CMA class that explains why formulas work always beats one that only teaches how to apply them. This difference becomes clear during case-based questions.

The question of whether CMA is worth the effort comes up naturally when professionals compare time, cost, and long-term career value. The answer often depends on how the qualification aligns with roles that involve decision-making, financial planning, and business strategy. Looking at outcomes such as role progression, skill relevance, and earning potential helps bring clarity to this.

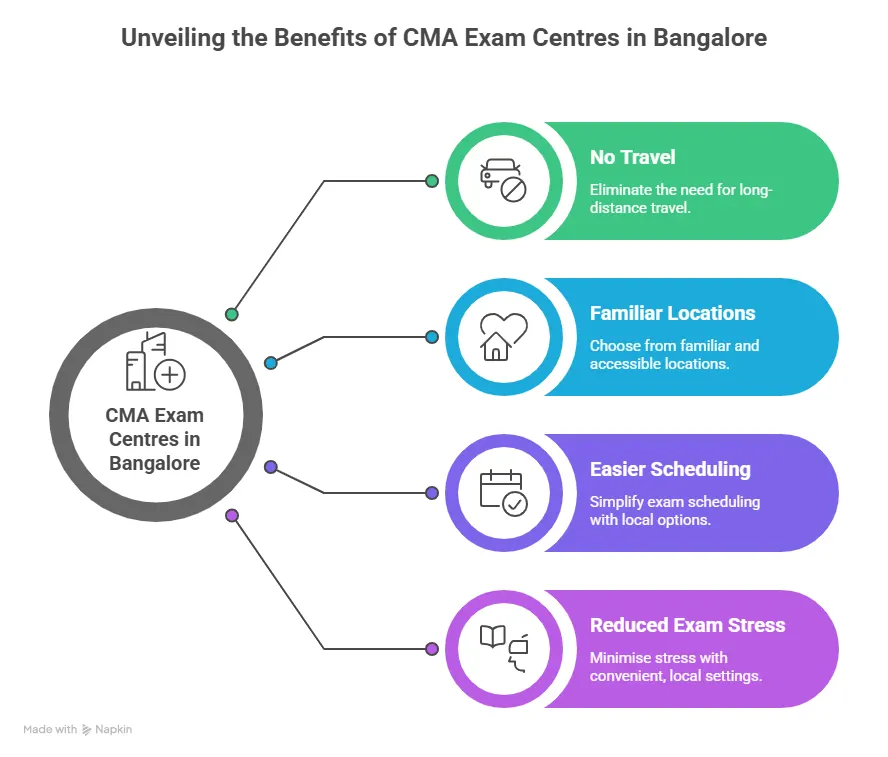

CMA Classes Near Me and How Location Still Matters

Even in a digital world, CMA classes near me remain a high-intent search. Location matters for two reasons.

- First, local centres help with CMA exam planning. Some centres guide students on exam windows and testing logistics.

- Second, time zones and live session timing work better with nearby institutes.

CMA USA classes near me also give learners the option to attend workshops or career events when available. That human connection still adds value.

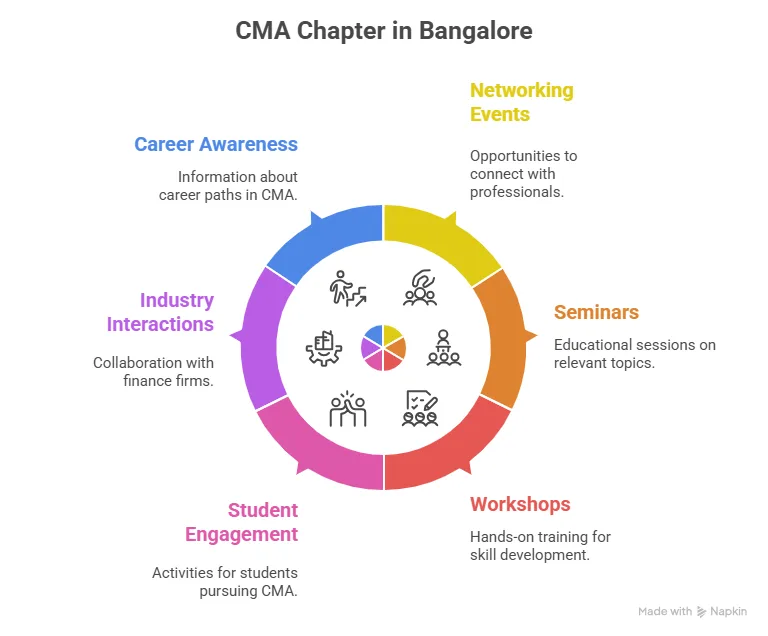

City-Wise Demand Patterns in India

This section explains why certain cities show stronger demand for CMA classes.

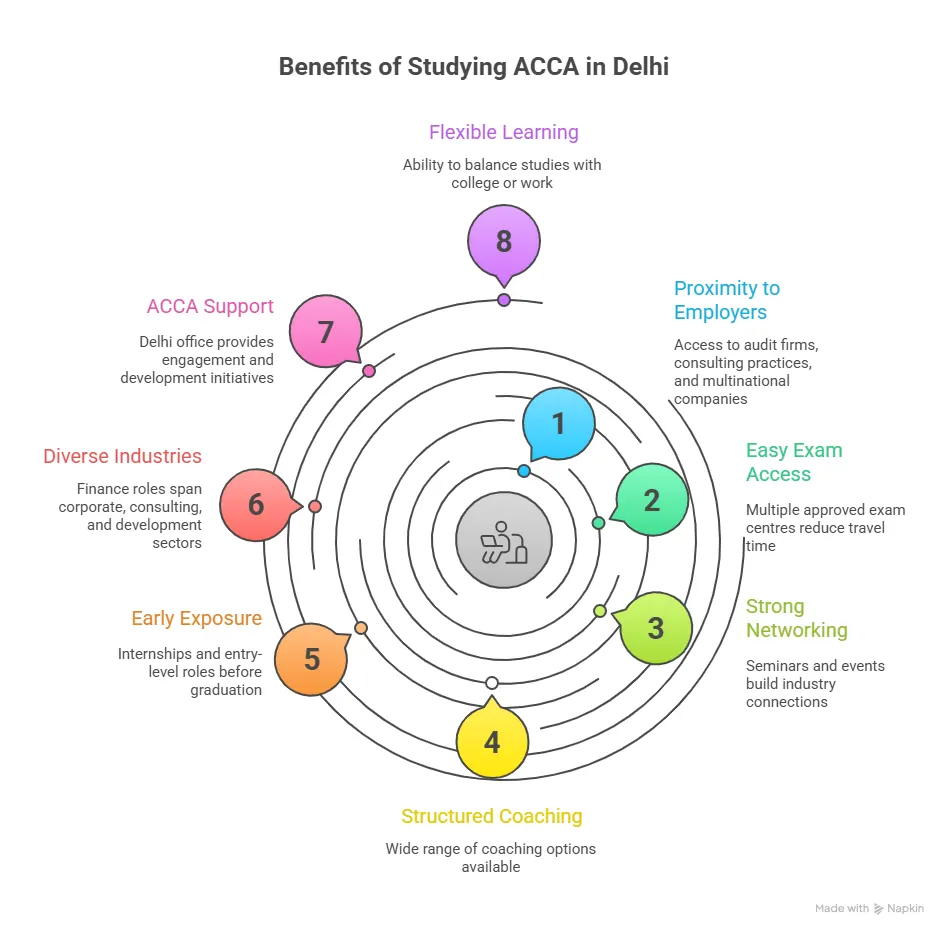

CMA Classes in Delhi: Delhi has a high concentration of commerce colleges and finance roles. Many students here pursue CMA classes alongside graduation. Classroom and hybrid formats remain popular.

CMA Classes in Kochi: Kochi has a growing finance and accounting talent pool. CMA classes in Kochi are often chosen by professionals working in shared service centres. Online formats dominate due to flexible work schedules.

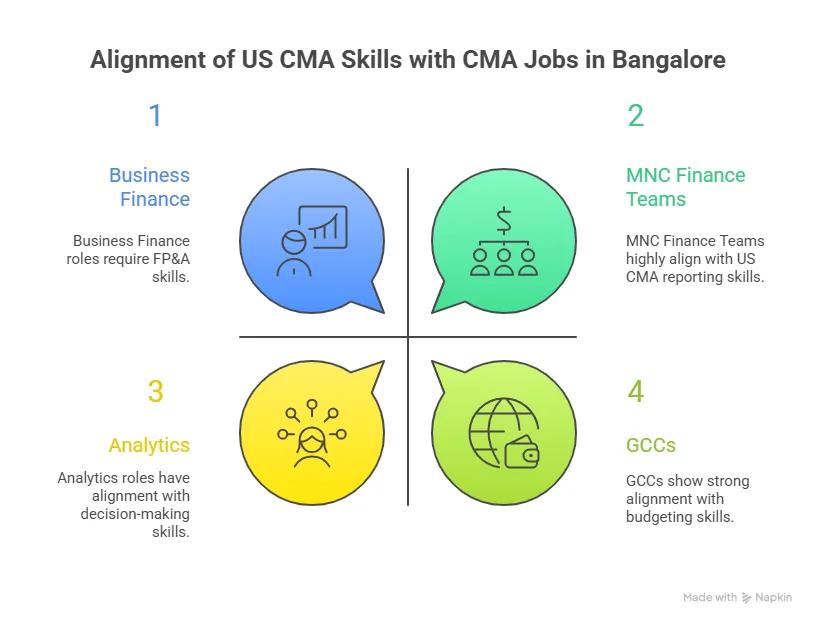

US CMA Classes in Mumbai: Mumbai remains a financial capital. US CMA classes in Mumbai attract investment banking, consulting, and corporate finance aspirants. Many learners prefer weekend batches or US CMA online classes to manage work hours.

These trends reflect career ecosystems rather than city size.

Also Read: 5 Reasons Why the US CMA Course is a Must-Have for Aspiring Management Accountants

Did You Know? According to the Institute of Management Accountants, CMA-certified professionals earn 21% higher median compensation globally compared to non-certified peers.

How CMA Classes Fit Into a Working Professional’s Life

One concern I often hear is time. CMA classes are designed for adults with jobs. Most US CMA online classes follow weekly study targets rather than daily rigid schedules.

A realistic study plan looks like this:

- 6 to 8 hours per week per subject

- Concept study on weekdays

- Practice questions on weekends

This rhythm feels similar to preparing for a fitness goal. Short daily effort matters more than long, irregular sessions.

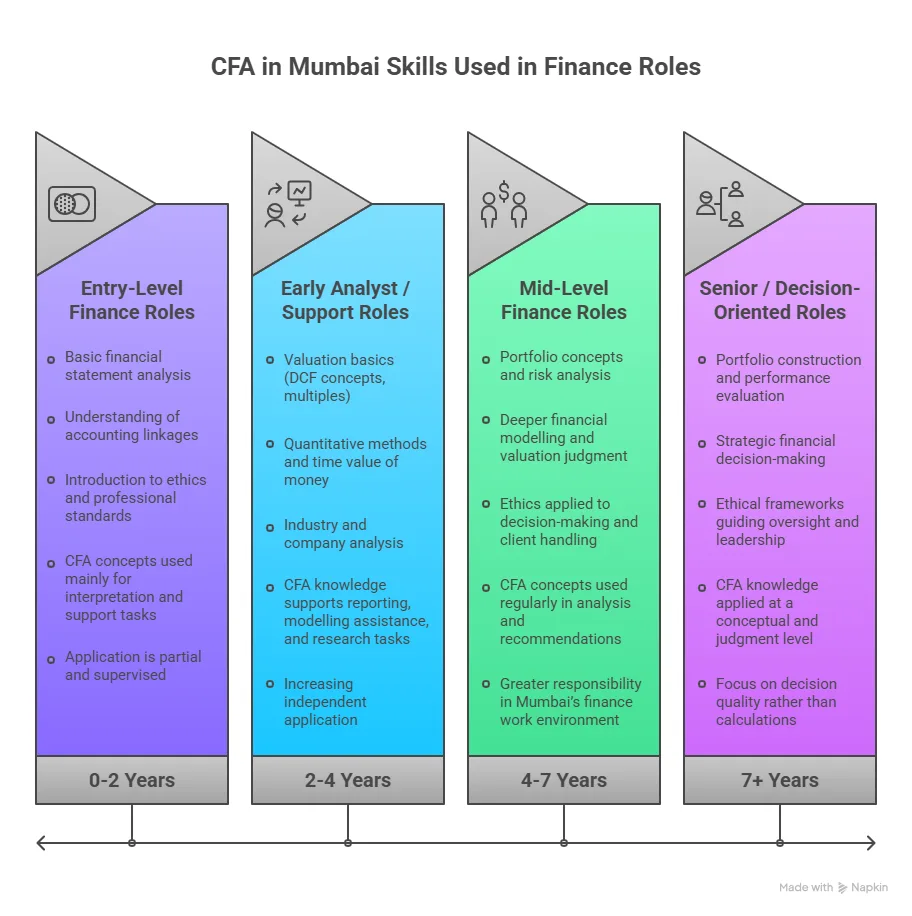

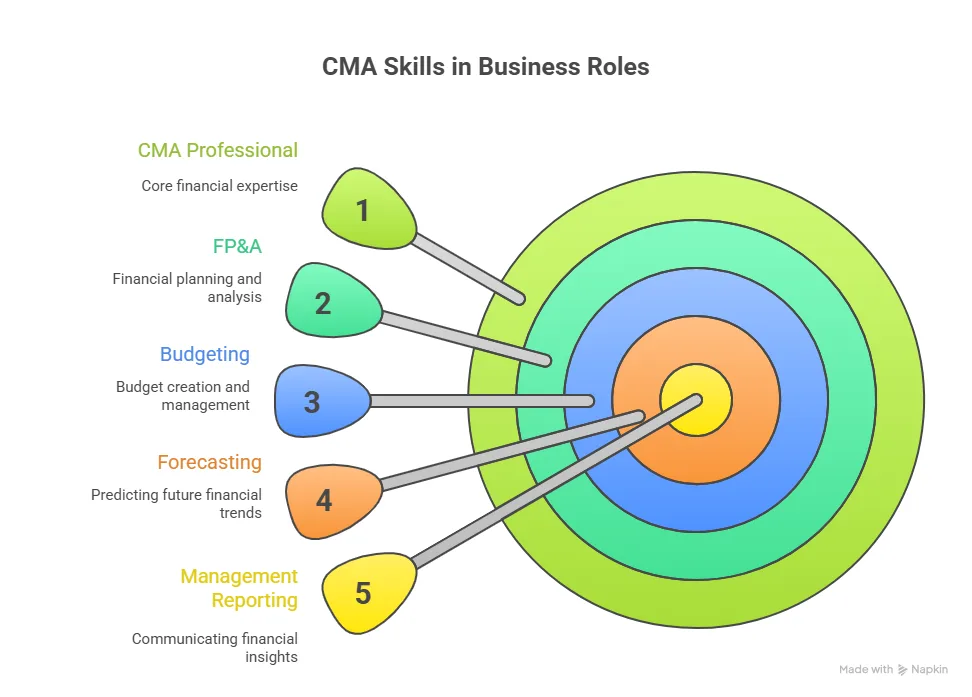

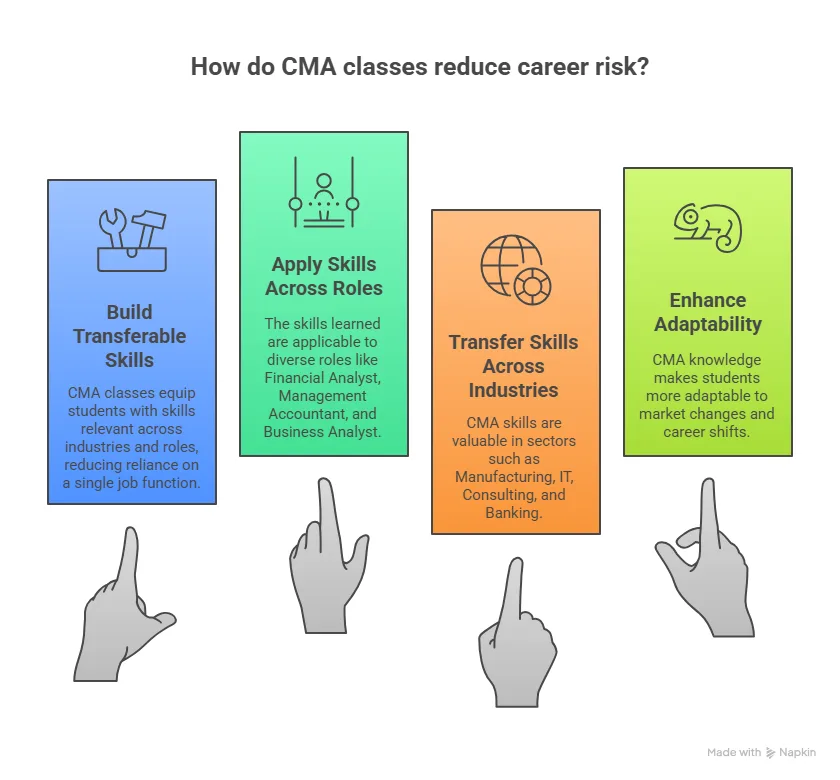

Career Roles CMA Classes Prepare You For

CMA career roles combine finance and strategy. These include:

- Management Accountant

- Financial Analyst

- Business Analyst

- FP&A Specialist

- Cost Controller

These roles exist across manufacturing, IT services, consulting, and startups.

Also Read: CMA After Graduation: The Real Timeline You Need to Know!

Why Global Recognition Matters

CMA USA classes follow a globally standardised exam. This means a CMA in India holds the same credential as a CMA in the US or Europe. This portability matters for professionals who plan global careers.

Certified management accountant classes also emphasise ethics. This builds trust with employers and clients.

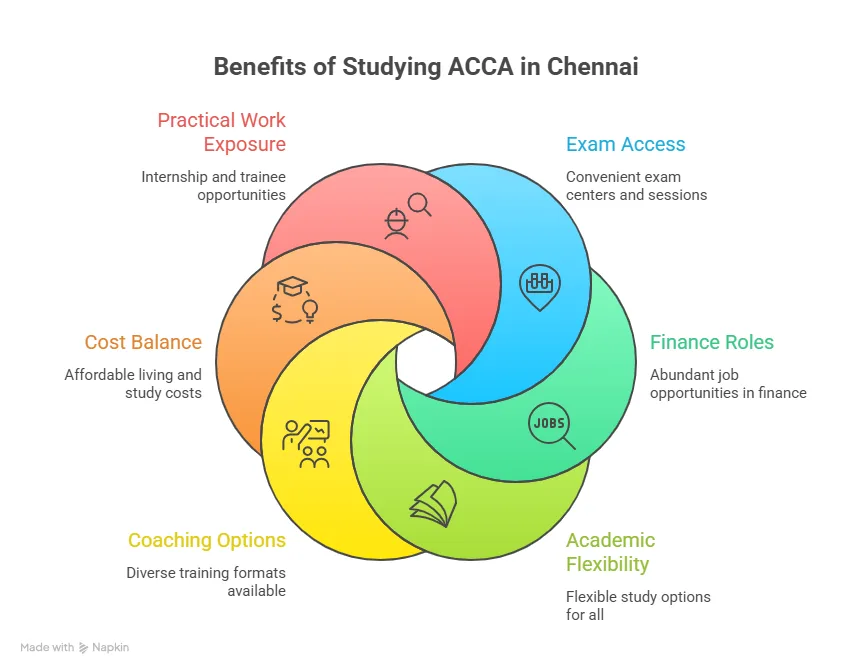

Many commerce graduates today explore multiple professional pathways before choosing a specialisation. Options like ACCA, FRM, CFA, and CMA often come up when the goal is to move into higher-value roles after BCom. Each path builds a different mix of skills, from financial analysis to risk management and strategic decision-making.

How Online CMA Classes Actually Work in Real Life

Many learners worry that the US CMA online classes feel distant. In practice, strong platforms feel very personal.

A typical online learning week looks like this:

- Two short concept videos

- One live or recorded example session

- Practice questions with explanations

- A short self-check quiz

This flow fits well into daily routines. Watching a video after dinner feels easier than opening a textbook. Solving questions during weekends creates confidence.

US CMA online classes also reduce travel fatigue. This matters in cities with long commute times.

Classroom Learning Still Has a Place

CMA classes near me often attract learners who value physical discipline. Walking into a classroom sets a mental switch. Distractions reduce. Peer energy builds consistency.

Classroom CMA USA classes work well for students who prefer asking questions in real time. Some learners process concepts faster when they hear others ask doubts.

Hybrid formats blend both worlds. Learners attend key sessions offline and revise online.

How Faculty Quality Shapes CMA Learning

Faculty quality decides how simple or complex topics feel. Good faculty explain ideas using daily life examples.

For instance, working capital management can be explained through monthly CMA salary cycles. Income arrives. Expenses follow. Savings bridge gaps. This makes cash flow logic intuitive.

Strong faculty also explain why wrong answers are wrong. This skill matters more than solving the correct answers.

Also Read: The advantages of having CMA certification: Courses, certifications and process

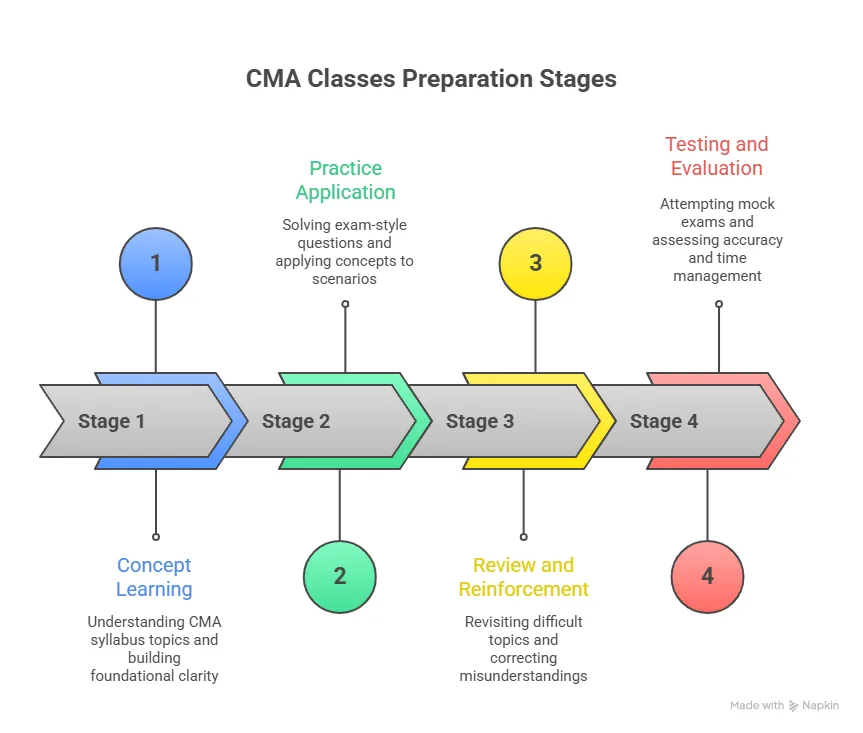

Why Mock Exams Matter More Than Notes

Notes feel comforting. Mock exams reveal reality.

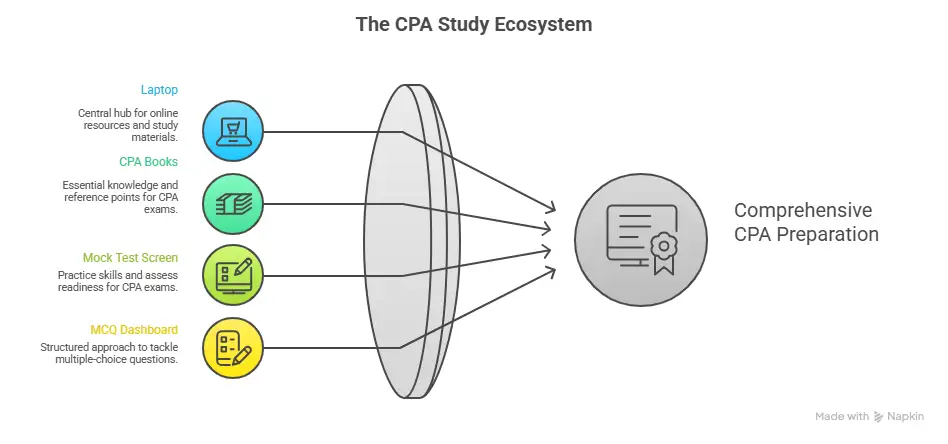

CMA Classes that schedule full-length mock exams along with CMA study materials train stamina. The CMA exam tests focus on over four hours. Mental fatigue affects accuracy.

Mock exams also train time management. Learners learn when to move on from tough questions. This skill directly improves scores.

Choosing Between Multiple CMA Classes Near Me

When several CMA classes near me appear similar, I suggest asking these questions:

- How many mock exams are included

- How often are syllabus updates reflected

- How doubts are handled during revision

- Whether career guidance is structured

Answers reveal seriousness.

Career Alignment Inside CMA Classes

Many learners ask how CMA certification classes connect to jobs. Good CMA Classes explain role alignment early.

For example, learners interested in FP&A receive deeper budgeting exposure. Those interested in consulting learn decision analysis frameworks.

This alignment helps learners stay motivated. Purpose fuels consistency.

Also Read: How to Prepare Yourself to be A Successful CMA

City Context and Learning Style

City culture influences learning style.

- CMA Classes in Delhi often attract full-time students. Structured timetables work well here.

- CMA Classes in Kochi see higher working professional participation. Flexibility matters more than speed.

- US CMA classes in Mumbai often cater to professionals in finance roles. Weekend batches and recorded backups matter most.

Understanding this context helps learners choose wisely.

Interesting Insight→ IMA reports that CMAs are employed across manufacturing, technology, consulting, and healthcare sectors. Sector diversity reduces career risk.

Career Support Inside CMA Classes

Career support varies widely. Some CMA USA classes offer resume workshops. Others offer interview prep. A few partner with recruiters.

Career support works best when it starts early. Learners align projects and examples with target roles.

Imarticus Learning integrates career orientation into several finance programs. When CMA aspirants already have industry exposure, such support becomes more meaningful.

Also Read: Can CMA Certification Lead to a High-Paying Finance Career?

Learning Pace and Burnout Prevention

CMA Classes should respect mental load. Overloading learners leads to burnout.

A balanced pace includes:

- One major concept per session

- Short practice bursts

- Weekly revision

This approach feels manageable.

Ethics and Professional Identity

Ethics is not just an exam topic. CMA certification classes that discuss real corporate dilemmas build professional confidence.

Understanding ethical consequences prepares learners for leadership roles.

How Salary Outcomes Connect With CMA Learning

Salary outcomes depend on how well learners apply CMA knowledge. Exams test application. Jobs reward application too.

CMA Salary in India by Role and Experience

Understanding the CMA Salary in India helps put the effort behind CMA preparation into perspective. Compensation for CMA professionals varies based on role, experience, and the level of decision-making responsibility involved. As professionals move from analytical roles to managerial and leadership positions, salary growth tends to reflect the increasing impact of their financial judgments.

The table below gives a realistic view of how CMA careers typically progress across different roles in the Indian market.

| Experience Level / Role | Average Salary Range | Notes |

| Entry Level CMA (0-2 yrs) | ₹6 – 10 LPA | Base roles like Financial Analyst, Cost Accountant, and Budget Analyst |

| Mid-Level (3-7 yrs) | ₹10 – 18 LPA | Senior Analyst, Management Accountant, Budget Manager |

| Senior Level (8+ yrs) | ₹18 – 25 LPA | Finance Manager, Financial Controller. |

| Leadership Roles | ₹25 – 30+ LPA | Senior Finance Leadership, CFO and Equivalent. |

| Average across All Levels | ~₹10 – 20 LPA | Reflects the overall range seen in India (freshers to experienced) |

CMA Classes that integrate case-based learning help learners explain decisions during interviews. This directly influences salary discussions.

How CMA Classes Fit Into a Long-Term Career Plan

Before moving into common questions, this section explains how CMA Classes align with real career timelines. Many learners expect fast results. CMA learning works better with patience and structure.

CMA classes usually fit into a one to two-year window. This window allows space for learning, revision, and exam attempts. People who rush often face burnout. People who pace themselves build a deeper understanding.

CMA USA classes support flexible planning. Learners can attempt one exam part at a time. This reduces pressure and improves focus. US CMA online classes make this flexibility easier.

Career planning also involves role clarity. CMA certification classes prepare learners for roles where financial insight guides decisions. These roles reward accuracy and judgment over speed.

Salary expectations for CMA professionals often vary by geography, especially when comparing opportunities in India and the US. Looking at CMA salary trends in India alongside the US helps professionals understand how global mobility, experience level, and role responsibility shape long-term earning potential.

Common Myths Around CMA Classes

Some myths create unnecessary fear. CMA classes do not demand advanced mathematics. They demand logical thinking. Calculations are simple. Interpretation matters more.

Another myth is age limitation. CMA certification classes welcome learners at different life stages.

| Common Myth | Reality |

| CMA Classes require advanced mathematics | CMA Classes focus on logical thinking and interpretation. Calculations are basic and manageable. |

| CMA is only for accounting graduates | CMA certification classes are open to graduates from different academic backgrounds. |

| CMA Classes are suitable only for freshers | CMA Classes welcome learners at different career stages, including working professionals. |

| CMA is limited to accounting jobs | CMA Classes prepare learners for roles in finance, analysis, and management. |

| CMA Classes demand full-time study | US CMA online classes allow flexible study alongside work or college. |

| CMA is only useful in the US | CMA USA classes are globally recognised and valued across countries. |

| CMA exams test memorisation | CMA Classes train application and decision-making rather than rote learning. |

| CMA is too technical for non-finance roles | CMA certification classes explain concepts in practical business terms. |

| CMA requires prior management experience | CMA Classes teach management concepts from the ground up. |

| CMA has an age restriction | CMA Classes are open to learners of all ages and career stages. |

Also Read: How tough is the CMA USA Exam for Self-Learners?

Why Learners Choose Imarticus Learning for CMA Classes

Deciding where to prepare for CMA Classes is an important step. Some learners prefer programs that simply cover the syllabus. Others want support that mirrors real industry expectations. The CMA program prep offered by Imarticus Learning focuses on both preparation for the US CMA exams and practical readiness for finance roles after certification.

- Industry-aligned training developed in collaboration with KPMG in India, bringing real business scenarios into CMA Classes.

- India’s first and only approved prep provider for top global finance certifications, including US CMA, recognised by the Institute of Management Accountants (IMA).

- Gold Learning Partner status with IMA, USA, which reflects recognised quality standards and globally benchmarked content.

- Access to practical case studies designed and evaluated by industry professionals, helping connect theory with real decisions.

- Opportunity for a KPMG in India internship for top performers, offering hands-on exposure to global accounting practices.

- Joint certification on completing the program, which enhances resume visibility with collaborative recognition from Imarticus and KPMG.

- AI-powered learning support, including comprehensive study material, mock exams, and 24×7 online tutor assistance to reinforce self-study.

- Money-back guarantee (subject to terms) offering a partial refund if exam success is not achieved, demonstrating confidence in the training process.

- A structured pre-placement bootcamp with resume support and interview preparation to help learners transition from preparation to career opportunities.

- Flexible delivery with both online and offline options, accommodating varied schedules and learning preferences.

These USPs reflect the unique features of the Imarticus Learning CMA Classes experience and help explain why some learners choose this path for their US CMA preparation.

FAQs About CMA Classes

This section answers the most frequently asked questions learners have when exploring CMA Classes. These questions usually come up while comparing study formats, understanding exam structure, and planning timelines.

How many years is a CMA course?

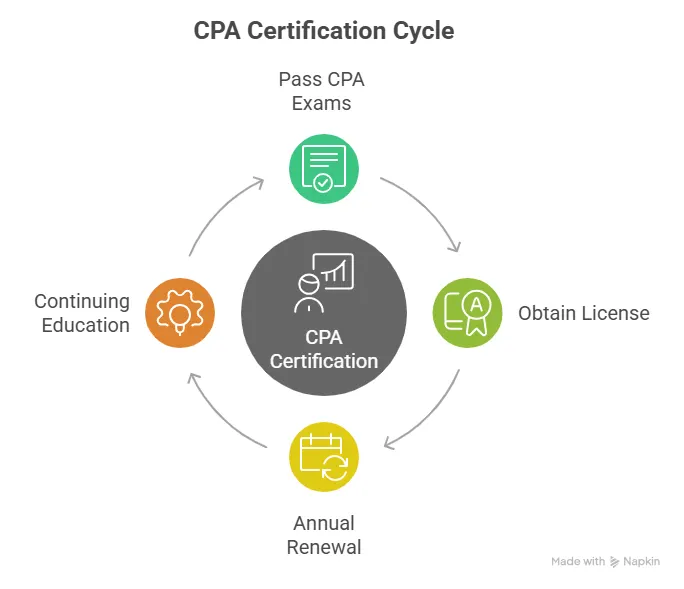

CMA classes usually span 12 to 24 months, depending on pace. Most learners complete both exam parts within two years while working. CMA course prep allows flexible scheduling. This helps learners balance studies with jobs or college. The timeline depends on study hours and exam attempts. CMA course classes with Imarticus Learning support one-part-at-a-time preparation, which suits busy professionals.

Is CMA full of maths?

CMA is not maths-heavy. The mathematics involved is basic. Additionally, subtraction, percentages, and ratios are common. The qualification focuses more on understanding results than calculating them. For example, learners interpret cost trends rather than solve complex equations. CMA classes train analytical thinking, not advanced mathematics.

Is CMA very difficult?

CMA can be challenging but manageable. Difficulty comes from application-based questions. CMA Classes teach how to apply concepts to scenarios. With regular practice, concepts become familiar. Learners who follow structured classes and revision cycles with Imarticus Learning can clear exams steadily. Difficulty reduces when preparation is consistent.

What is the CMA’s salary?

CMAs earn a median total compensation of around USD 110,000 globally, which is roughly 25-30% higher than non-certified professionals in similar roles. In India, CMA salaries typically range from ₹6-10 LPA at the entry level, ₹10–18 LPA at the mid level, and can go to ₹20–30+ LPA in senior and leadership roles, depending on experience and responsibility. CMA Classes build strong decision-making and analytical skills, which directly support salary growth and role progression. Structured preparation and career guidance offered by Imarticus Learning further help learners position themselves better during role transitions and salary negotiations.

Can I do CMA in 6 months?

Completing CMA in six months is rare but possible for full-time learners. Most working professionals need more time. CMA Classes recommend realistic pacing. Attempting both parts in six months demands intense study hours. Online classes support flexible planning to avoid burnout.

What is the age limit for CMA?

There is no age limit for CMA. Learners of different ages pursue CMA certification classes. Career switches, promotions, and skill upgrades happen at any stage. CMA Classes value professional maturity and judgment. Age does not restrict exam eligibility.

Can I pass the CMA on the first attempt?

Yes. Many learners pass CMA exams on the first attempt. CMA Classes that emphasise mock exams and concept clarity improve first-attempt success. Passing depends on preparation quality, not luck. CMA coaching that follows IMA exam patterns closely improves outcomes.

What is the CMA exam pass rate?

The CMA exam pass rate published by the IMA shows that the global pass rate is approximately 50% for Part 1 and around 45% for Part 2 in recent testing windows. These numbers reflect the application-based nature of the exam rather than the difficulty in calculations. Imarticus Learning focuses on guided preparation and exam strategy, which helps learners approach the CMA exams with better clarity and confidence.

How many papers are in CMA?

CMA prepares learners for two exam parts. Each part tests different skill areas. CMA Classes often recommend clearing Part 1 before Part 2. This builds confidence and momentum. Two papers make the qualification focused and efficient.

How to start a CMA course?

Starting the CMA course involves three steps. First, understand eligibility through the IMA website. Second, choose CMA Classes that match your learning style. Third, register for exams and create a study plan. CMA prep provided by Imarticus Learning often assists with registration and planning. Institutes like Imarticus Learning also guide learners on structured preparation paths.

Finding the Right Path Through CMA Classes

Choosing CMA Classes is less about chasing a credential and more about choosing how you want to think and work in the long run. Throughout this guide, the focus has been on clarity. What CMA really teaches. How does the learning fit into daily life? How do different formats support different kinds of learners? And how consistent preparation shapes outcomes more than speed or background?

CMA Classes reward patience, structure, and steady effort. The syllabus builds logical thinking. The exam tests the application. The career impact grows over time as learners start connecting numbers with decisions at work. This is why the qualification continues to attract students, working professionals, and career switchers across cities and industries.

As you move from reading to planning, the next step is often finding guidance that keeps things simple and structured. Learning environments that balance exam preparation with real-world context tend to make the journey smoother. This is where Imarticus Learning fit naturally for many learners, especially those looking for organised CMA Course preparation and long-term career alignment.

Wherever you choose to begin, approach CMA preparation with realistic timelines, steady discipline, and curiosity about how businesses actually work. That mindset is what turns CMA learning into lasting professional value.