Introduction

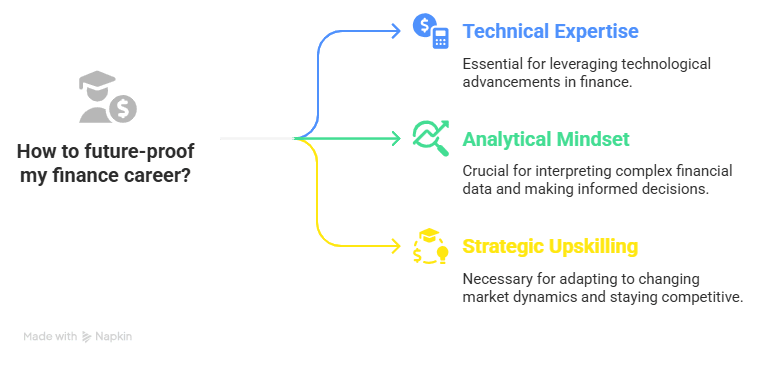

In the fast-changing world of finance today.. standing still is no longer an option. As a student looking to enter the finance industry or a professional already working in this fast-paced environment, here’s one thing that’s certain—future-proofing your career in finance is a must. With automation, fintech revolution, and evolving market needs, your long-term success hinges on ongoing learning and skill acquisition. But what exactly does it take to succeed in the finance landscape of the future?

This blog is your complete guide to future-proofing your finance career with the optimal combination of technical expertise, analytical mindset, and strategic upskilling. Let’s get started.

Table of Contents

- Understanding the Need to Future-Proof Your Finance Career

- Future Skills for Finance Professionals

- Finance Career Growth Strategies

- In-Demand Skills for Banking Jobs

- Financial Analyst Skill Development

- Adapting to Fintech Innovations

- Career Advancement in Finance

- Investment Banking Job Skills

- FAQs

- Key Takeaways

- Conclusion

Understanding the Need to Future-Proof Your Finance Career

The finance sector is transforming at an unprecedented pace-technology is reshaping roles, automation is redefining efficiency & new-age skills are replacing traditional expertise. To remain competitive, professionals must adapt proactively.

If you’re eyeing a long-term finance career, this means being agile, updated, and continuously learning. You must anticipate industry shifts and align your skills with future demands.

Key Trends Shaping the Future of Finance

- Automation & AI are eliminating repetitive tasks

- ESG and sustainable investing are gaining traction

- Demand for data-driven decision-making is rising

External Source: World Economic Forum – Future of Jobs

Future Skills for Finance Professionals

As the industry evolves, certain skills are becoming non-negotiable. The following are must-haves for finance professionals looking to thrive in the future.

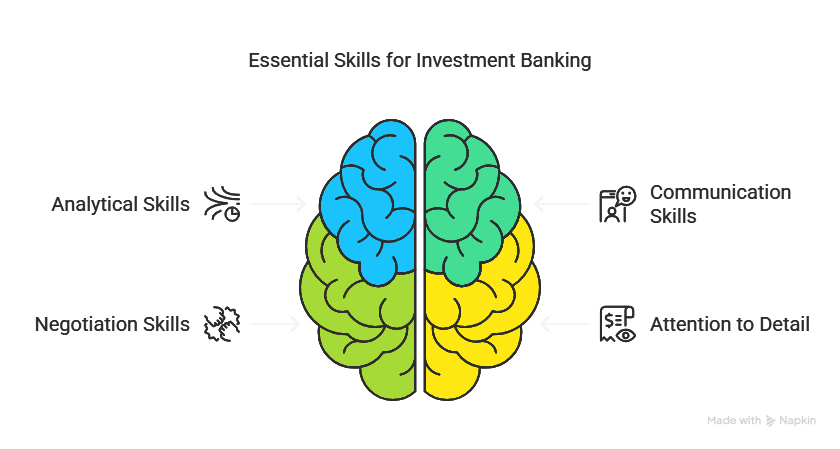

Technical expertise alone won’t cut it. You need a balanced portfolio of soft skills and digital acumen. Here’s what’s topping the charts today.

Essential Future Skills for Finance Professionals

| Skill Category | Specific Skills |

| Analytical Thinking | Financial modeling, forecasting, data mining |

| Digital Proficiency | Python, Power BI, Excel, SQL |

| Strategic Communication | Presentation skills, stakeholder reporting |

| Adaptability | Agile mindset, continuous learning |

Finance Career Growth Strategies

Career growth is no longer linear. You need to navigate through a mix of vertical and lateral moves, upskilling opportunities, and network building.

Whether you’re just starting or aiming for the next level, the right strategy can fast-track your finance career.

Practical Growth Strategies

- Pursue professional certifications like CFA, ACCA, or CPA

- Enroll in domain-specific online courses

- Attend industry webinars and workshops

- Seek mentorship from experienced professionals

- Keep a pulse on regulatory changes and market dynamics

External Source: Linkedin Learning New Skills in Finance

In-Demand Skills for Banking Jobs

The banking sector is evolving with -digitization, automation, and increased customer-centricity. To stay relevant, banking professionals need to adapt.

This section focuses on in-demand skills that can make or break your career in banking- especially if you’re eyeing private or investment banking roles.

Top In-Demand Skills for Banking Jobs

- Risk analysis and compliance knowledge

- Understanding of core banking software

- Customer relationship management (CRM) tools

- Digital payment systems expertise

- AI-based fraud detection systems

How to Develop These Skills

- Take hands-on CRM system tutorials

- Attend fintech-focused banking seminars

- Subscribe to regulatory newsletters

Financial Analyst Skill Development

Financial analysts play a critical role in guiding businesses through complex financial decisions. Their toolkit is becoming increasingly data-driven.

A robust finance career in analysis requires both technical accuracy and strategic insight.

Financial Analyst Skillset Table

| Core Competency | Tools & Techniques |

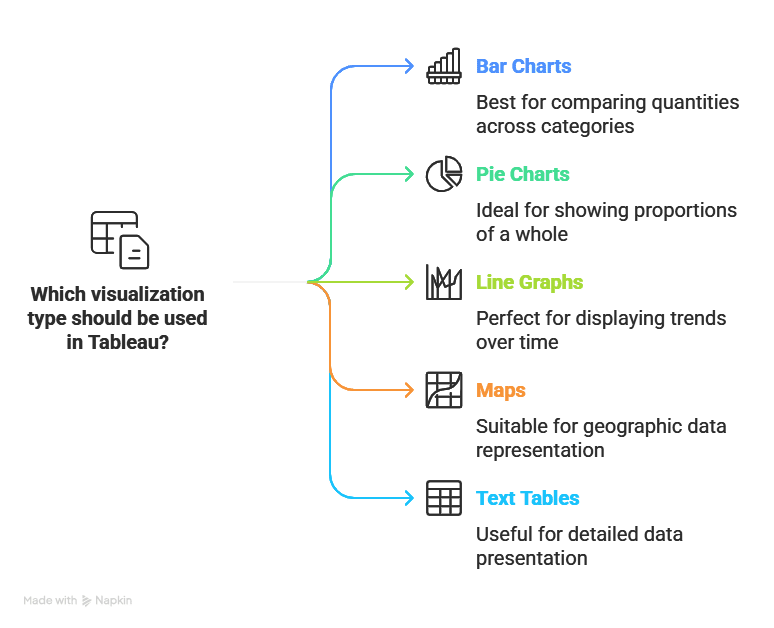

| Data Analysis | Excel, Tableau, R |

| Report Writing | PowerPoint, dashboard tools |

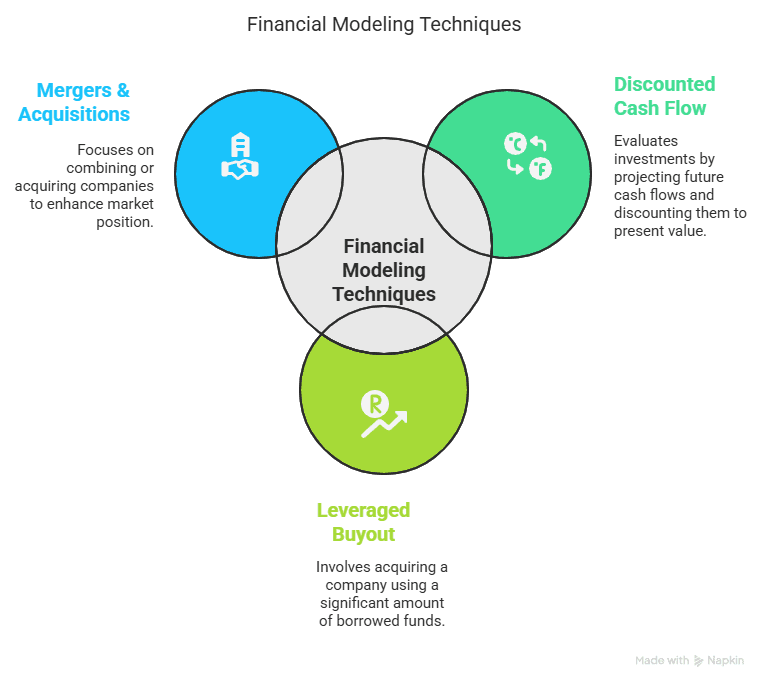

| Financial Modelling | DCF, LBO models |

| Sector Research | SWOT, PESTLE, industry databases |

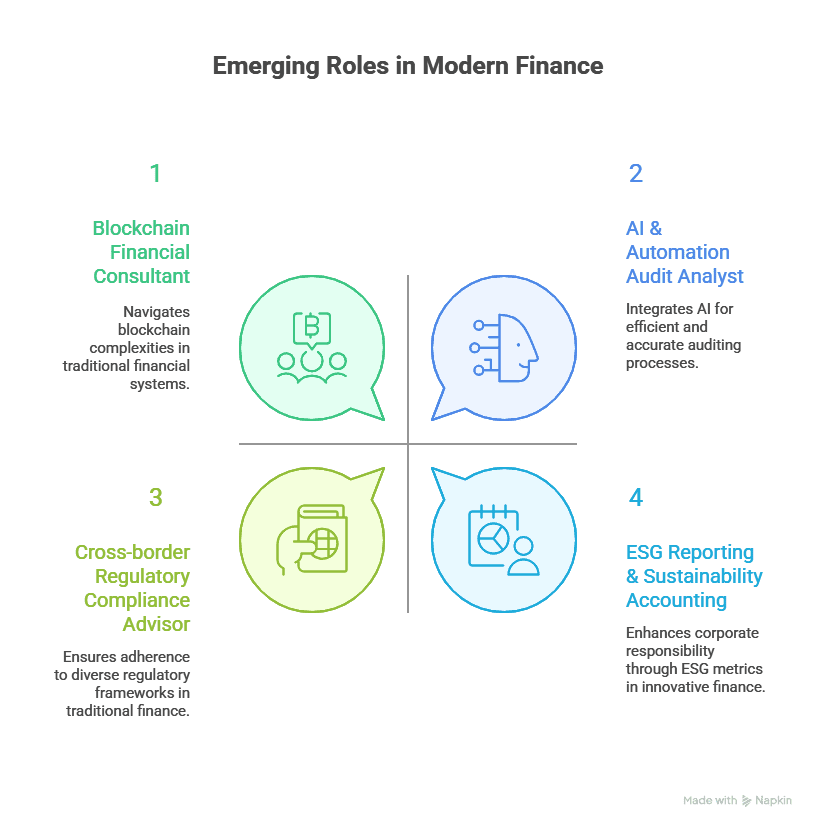

Adapting to Fintech Innovations

Fintech is not a disruption—it’s the new normal. From blockchain to robo-advisors, innovation is everywhere. Staying ahead means staying informed.

You don’t have to be a tech expert, but you do need to understand how technology affects the financial ecosystem.

How to Adapt to Fintech Innovations

- Understand blockchain fundamentals

- Explore digital wallets and decentralized finance

- Stay updated with AI and machine learning trends in finance

- Experiment with fintech products as a user

Career Advancement in Finance

Climbing the finance ladder requires more than just experience. Strategic positioning, visibility, and smart transitions are key.

This section outlines a structured plan to accelerate your finance career growth in a competitive job market.

Career Advancement Tips

- Build a strong LinkedIn presence

- Join finance forums and attend global finance summits

- Regularly publish financial insights or blogs

- Upskill every 6–12 months

- Volunteer for cross-functional finance projects

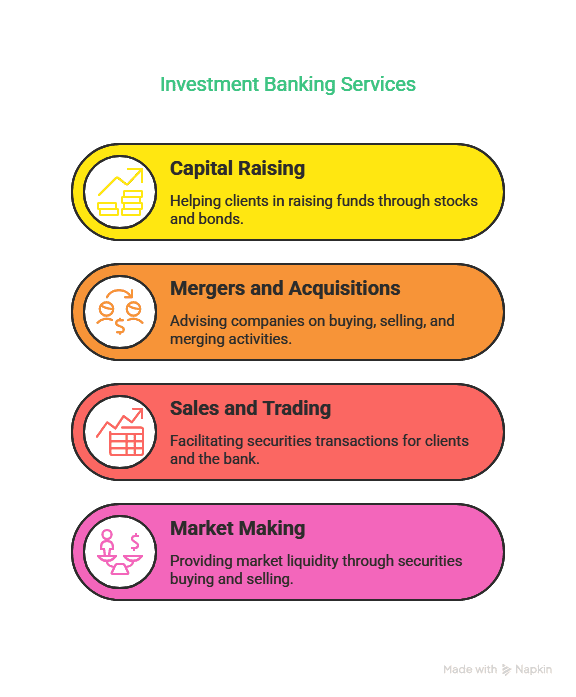

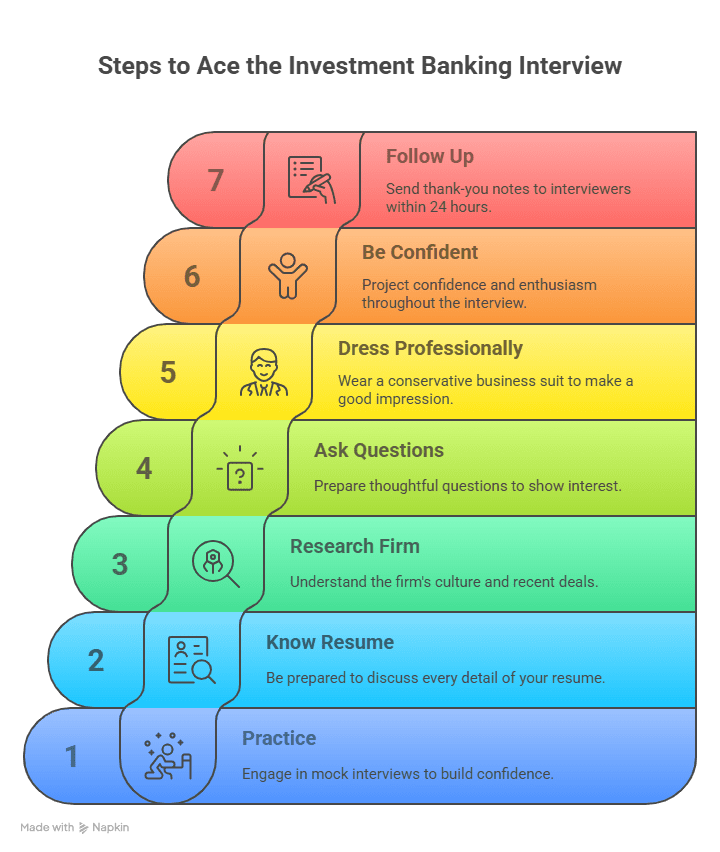

Investment Banking Job Skills

Investment banking is often seen as the pinnacle of a finance career. However, it’s also the most demanding in terms of skills and stamina.

If you aim to break into or rise within this domain, these are the non-negotiables.

Must-Have Skills for Investment Banking Jobs

- Financial modeling & valuation expertise

- Advanced Excel & PowerPoint proficiency

- Understanding of IPOs, M&A, and LBOs

- Strong analytical and quantitative skills

- Excellent written and verbal communication

FAQs

1. Which is the single most critical skill for a career in finance today?

The most important skill is adaptability, which enables one to learn, unlearn, and relearn in response to accelerated industry changes.

2. Am I required to learn coding for a career in finance?

Though not strictly required, learning elementary Python or SQL can provide a major advantage for financial analysis, modelling, and automation.

3. What finance certifications are most sought after in India?

CFA, CPA, and ACCA certifications are well-accepted for international finance positions and can greatly boost career advancement.

4. How do I switch from accounting to a career in financial analysis?

Begin by studying financial modelling, business analytics, and presentation skills. Familiarity with Excel and BI tools is also a must.

5. Is fintech a threat or opportunity for finance careers?

Fintech is rather a chance, bringing new jobs in digital finance, crypto, and AI-driven advisory systems for financial professionals.

6. What are the critical soft skills for finance professionals?

Communication, problem solving, emotional intelligence, and teamwork are all very useful for relationship management with clients and across different teams.

7. Can I get into finance without an MBA?

Yes, many positions now prioritise skill and/or certification more than they do a degree. What matters most is that you can show that you have the expertise and you are continually learning.

8. What is the impact of AI on finance?

AI is relying on predictive analytics to predict what will happen in the market, fraud detection, and portfolio management. Essentially, it comes down to efficiency and accuracy.

9. How often should I upskill?

You should ideally go back to your skillset every 6–12 month to stay on top of trends and technology in the industry.

10. How do I build a professional finance network?

Get onto LinkedIn, attend conferences specific to finance, join an online community, contribute to finance blogs or webinars, etc.

Key Takeaways

- Your finance career success depends on continuous skill development.

- Focus on digital, analytical, and communication skills.

- Understand and adapt to fintech innovations.

- Strategic certifications and networking are essential for growth.

- Roles like financial analyst and investment banker require a unique skill mix.

Conclusion

In time, the financial industry is evolving, and so would you. With an insightful mindset, prudent tools, and sharper strategies, your finance career merely doesn’t survive but thrives in the future. Invest in yourself, keep learning, and stay agile. The finance future is bright, and you have everything it takes to lead the way.