The field of accounting and finance continues to evolve, and organisations today look for professionals who can think strategically, analyse financial decisions, and adapt to global standards. The ACCA qualification is globally recognised, valued by multinational companies, and aligned with the skillsets modern finance roles demand.

That said, it’s also common to hear that the ACCA Course is challenging or “takes time.”

The reality is more balanced: ACCA is not difficult when approached with structure, discipline, and understanding. It’s a learning journey that develops your professional thinking step-by-step.

Let’s break this down honestly – what ACCA really is, where the challenges show up, and why thousands of students still choose it and succeed every year.

In this guide, we’ll explore:

What the ACCA Course really offers

Where students typically struggle

How to overcome those challenges

And why completing ACCA is absolutely worth it

ACCA is not hard – it requires the right structure, consistency, and approach.

What is ACCA?

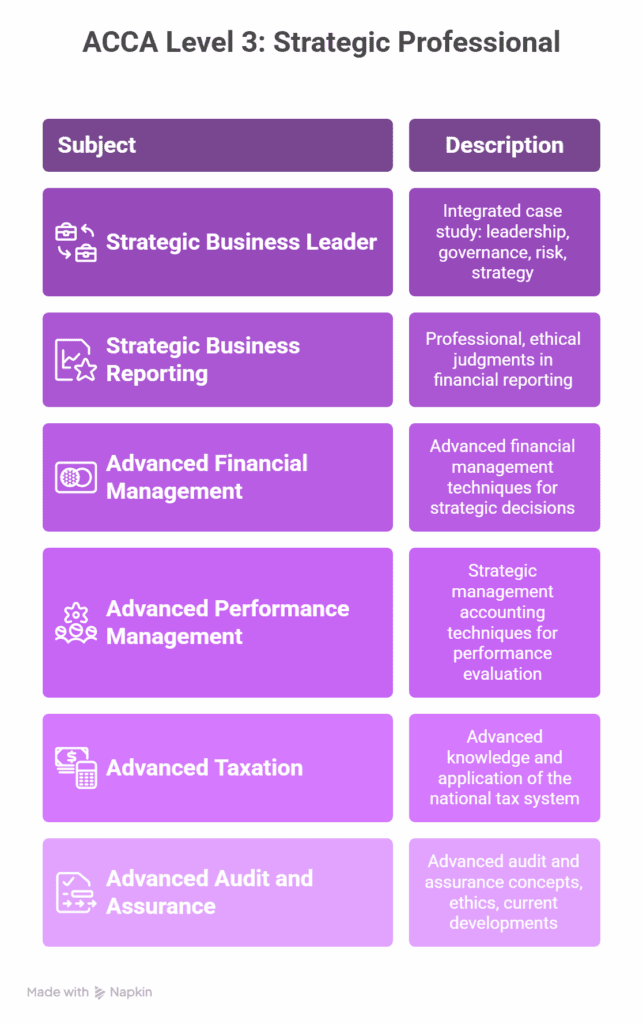

The ACCA qualification is a globally recognised professional certification for finance and accounting professionals. To gain a clear and detailed picture of the ACCA journey – including the syllabus structure, exam formats, study modules, and career opportunities – be sure to check out our comprehensive guide on Breaking Down ACCA Course Details: What to Expect. It’s an essential resource for anyone planning their route to ACCA success.

It prepares you for roles in:

- Financial Analysis

- Audit & Assurance

- Management Accounting

- Business Strategy

- Taxation

- Consulting & Advisory

ACCA is designed to make you think like a finance leader, not just a bookkeeper. After understanding what is ACCA, it’s important to recognise that ACCA’s syllabus not only covers core finance areas like audit and taxation but also integrates emerging topics such as digital transformation, data analytics, and sustainability reporting – equipping you with modern skills that are crucial to staying relevant in today’s fast-changing financial landscape.

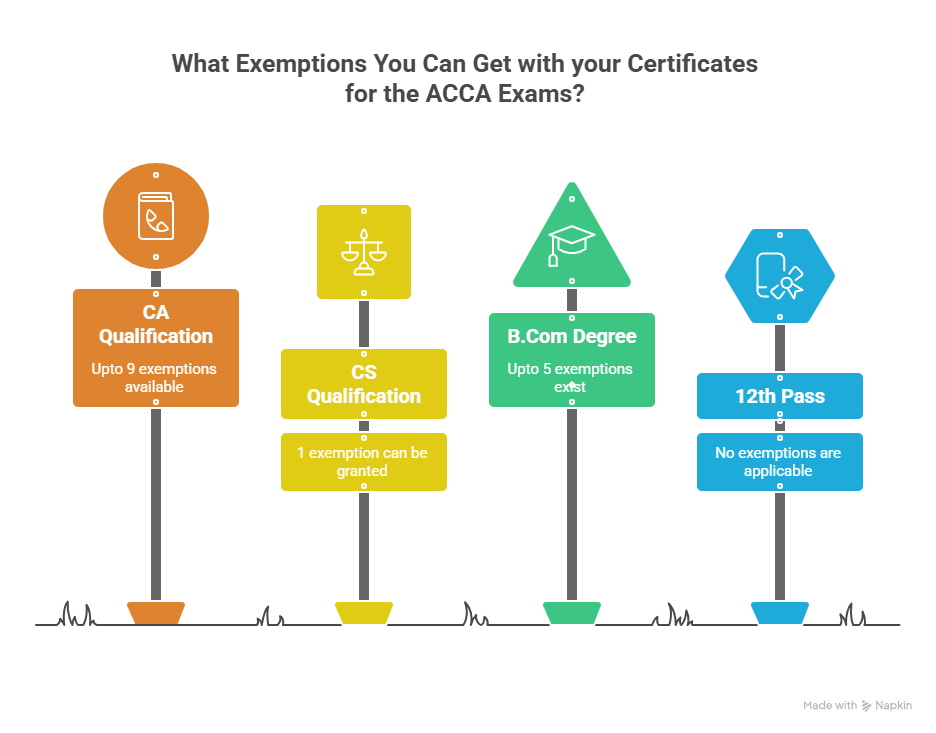

Want to get a clearer picture of what you’ll be studying in ACCA? Check out our ACCA Subject List guide – it explains each paper, the difficulty level, and tips to handle the tougher ones. And if you’re unsure about eligibility or exemptions, our ACCA Course Eligibility and Exemptions guide will help you understand how you can fast-track your ACCA journey.

How about boosting your finance career in 2025? Whether you’re a student, graduate, or CA, the ACCA qualification opens doors globally. Watch this video to get a detailed guide to ACCA.

Why ACCA Still Stands Out?

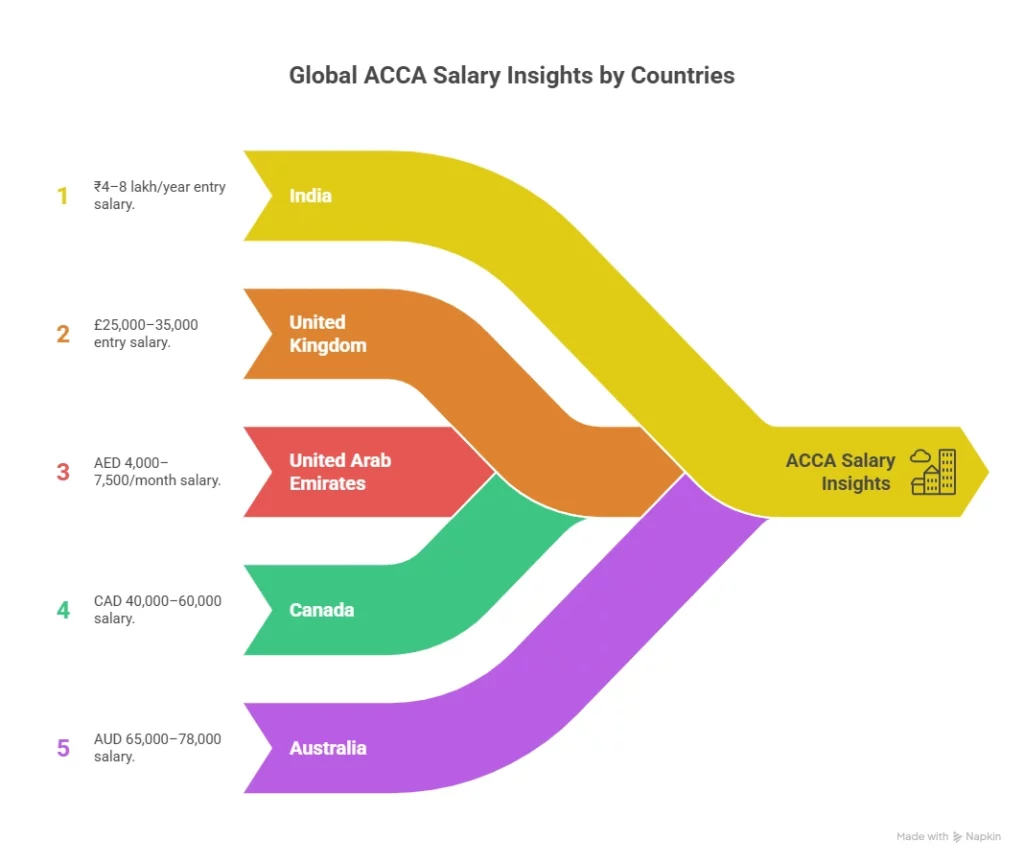

ACCA remains a premier qualification with unmatched global recognition. It equips you with the skills and strategic mindset required in the modern finance world. Holding an ACCA qualification opens doors to diverse career opportunities globally and offers salary prospects that can reach ₹12 LPA or higher, depending on your expertise and location.

What makes ACCA uniquely valuable today is its blend of:

- Global acceptance across industries

- Real-world, scenario-based learning

- Flexible exam structure suitable for students and working professionals

ACCA is not just a qualification – it’s a career passport.

To understand the immense global career opportunities that come with the ACCA qualification, check out our detailed guide on how you can leverage ACCA to work across 180+ countries and build a truly international finance career.

Why the ACCA Course Feels Tough?

Many students feel that ACCA is tough, and that feeling usually stems from what they’ve heard, rather than what they’ve experienced. The truth is, ACCA is absolutely achievable with the right approach and consistency. Here’s why it may seem challenging at first:

A Wide Syllabus to Cover

There’s a lot to learn across the papers, especially if you’re not eligible for exemptions. But when studied step-by-step, it becomes manageable, not overwhelming.

It Requires Real Understanding

ACCA isn’t about memorising notes. The exams are designed to help you think like a finance professional – applying concepts to real business situations.

Balancing Work and Study Can Be Tricky

Many students pursue ACCA alongside jobs or college, so planning your time well makes a big difference.

The Exam Test Analysis, Not Just Facts

You’re expected to explain, evaluate, and make decisions – the skills that are incredibly valuable in real-world roles.

The Standards Are High for a Reason

ACCA wants to ensure that its members are well-prepared, globally trusted, and professionally capable.

So yes, ACCA needs effort – but it’s not impossible. The difficulty is exactly what makes ACCA respected. With the right guidance, the right strategy, and a supportive learning environment, thousands of students clear it every year, and you can too.

Why Do Students Fail the ACCA Course?

Let’s be honest. Most students don’t fail because ACCA is impossible.

They fail because of how they study. Some common hurdles that cause failures include:

No Real Study Plan

Students often start ambitiously but don’t stick to their routine. Without structured learning, days go by, topics pile up, and suddenly everything feels overwhelming.

Not Practising Past Papers

You can understand every chapter and still struggle in the exam.

ACCA questions are application-based; they want to see how you think, not what you memorised. Students who don’t practise past papers and the entire syllabus often get surprised by the question style.

Skipping Technical Articles

ACCA notifies you of what they expect through technical articles. But many students ignore them. These articles explain how to approach answers, common mistakes and where marks are actually awarded. Not reading them is like skipping free hints.

Studying Completely Alone

Self-study is fine – but it needs direction.

A lot of students waste time on the wrong topics or don’t know how detailed their answers should be. Having guidance, even if minimal, keeps your preparation focused and clear.

Exam Pressure

Even when students know the concepts well, they often panic during the exam. Not practising under exam conditions with a timer doesn’t build confidence for the exam and increases anxiety.

So, the real takeaway?

ACCA isn’t “too hard.” With a steady study routine, regular practice, and the right approach to answering questions, it’s absolutely achievable. Thousands of students clear it every year – and so can you.

Preparing for the ACCA exams can feel overwhelming – there are different levels, case studies, and exemptions to track. But it doesn’t have to be stressful. In this video, we break down the ACCA exam structure, level-wise papers, exemptions, and proven study plans – giving you a clear roadmap to pass every paper with confidence and efficiency.

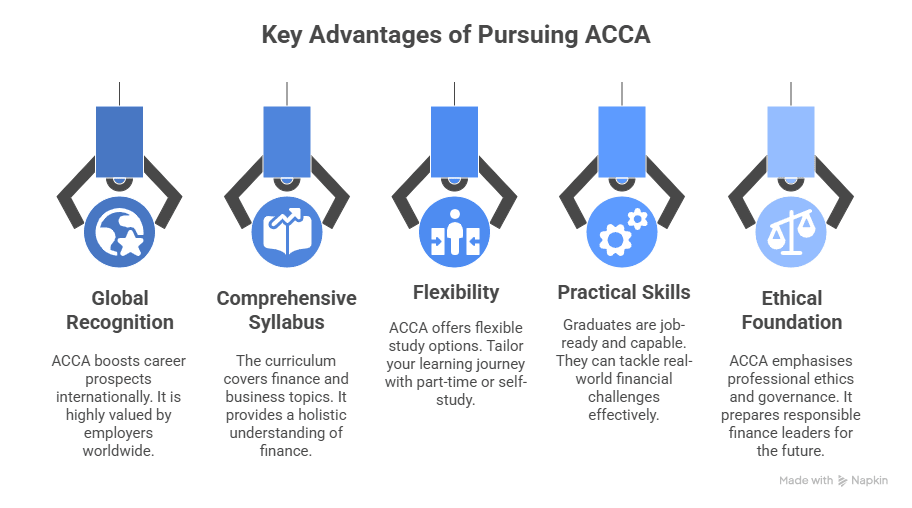

Advantages of Pursuing the ACCA Course

When considering any professional qualification, it’s important to know what makes it worth your time, effort, and investment. The ACCA course isn’t just another accounting certification; it’s a career game-changer. From global recognition to flexible learning and strong growth opportunities, here’s why thousands of students choose ACCA and reap the benefits.

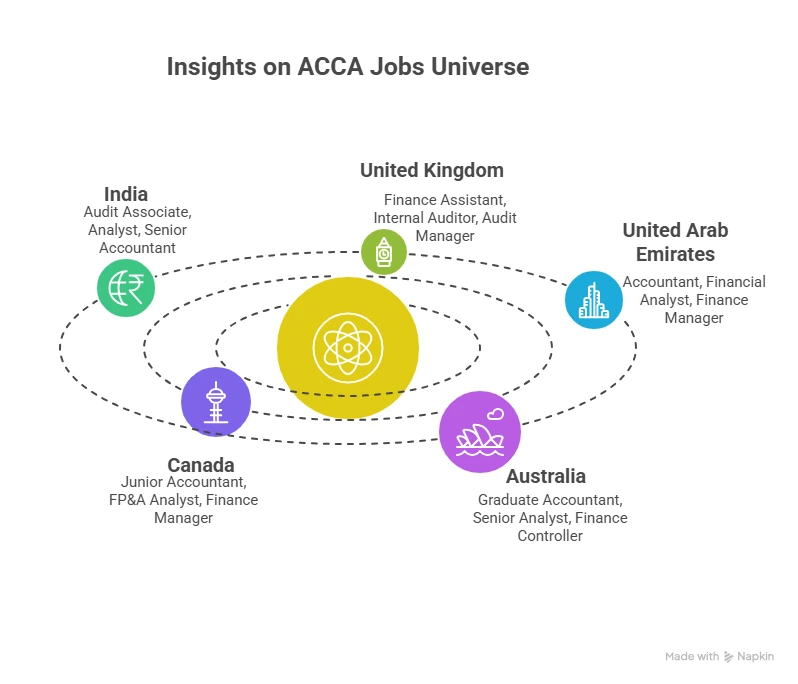

Recognised Around the World

One of the biggest perks of ACCA is that it’s truly global. Whether you want to work in India or move abroad later, your qualification stays valid. It opens doors in 180+ countries, especially in multinational companies, Big Four firms, banks, and consulting roles.

Exams That Fit Your Schedule

Life is busy – and ACCA understands that.

You get to choose when you want to attempt each paper, which means you can plan around college, work, or personal commitments. No unnecessary pressure. Just steady progress.

No Forced Articleship Lock-In

This is a relief for many students.

Unlike some other accounting courses that require a fixed 3-year articleship under one employer, ACCA lets you gain experience more flexibly. You can work in different companies, departments, or internships – whatever helps you grow.

Study Without Pressing Pause on Life

Already in college? Working? Managing responsibilities at home?

No problem. ACCA is designed so you can study alongside your routine. You don’t need to drop everything to pursue it.

Strong Salary & Career Growth

Because ACCA builds solid professional and decision-making skills, companies value ACCA-qualified candidates – and that often reflects in better salaries and faster promotions. As you gain experience, your earning potential increases significantly.

Develops a Strategic, Leadership Mindset

ACCA goes beyond accounting formulas. It trains you to:

- Understand business decisions

- Analyse financial results

- Think like management

- Lead with confidence

These are the same skills that shape future Finance Managers, CFOs, and strategic business leaders.

If you’ve been confused about whether to choose CA or ACCA, you’re not alone. Both are strong qualifications – but they lead to very different career paths. This video breaks the comparison down clearly, so you can decide based on your goals, not guesswork.

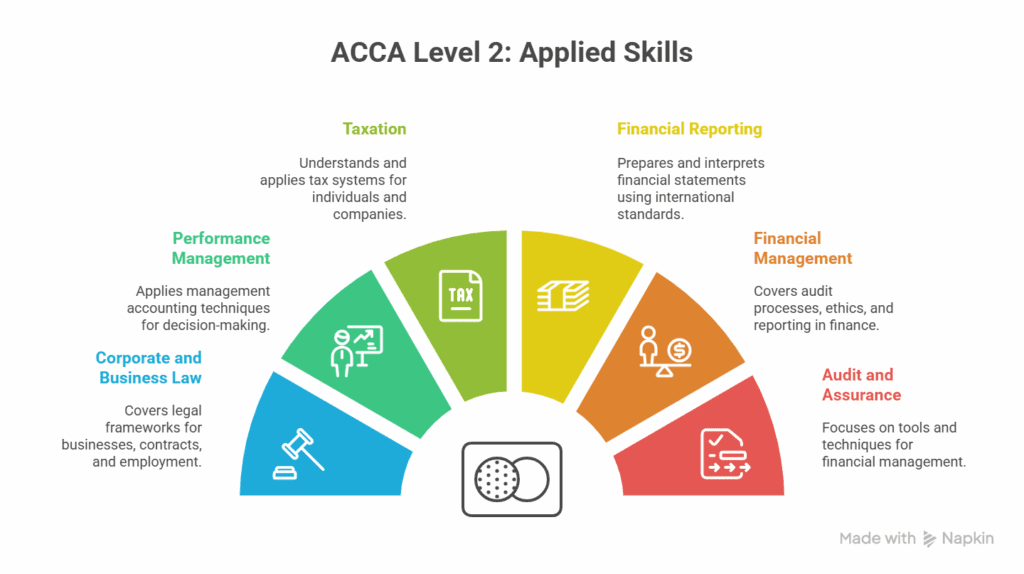

Toughest ACCA Papers

Certain papers consistently challenge students the most. These demand not only knowledge but also sharp analytical and professional skills:

| Paper | Subject | Approx. Pass Rate |

| AFM | Advanced Financial Management | ~38% |

| AAA | Advanced Audit & Assurance | ~35% |

| SBL | Strategic Business Leader | ~40% |

| PM | Performance Management | ~42% |

Source – ACCA Global Pass Rates

If you’re eyeing these papers, know that they require strong problem-solving abilities and real-world application skills.

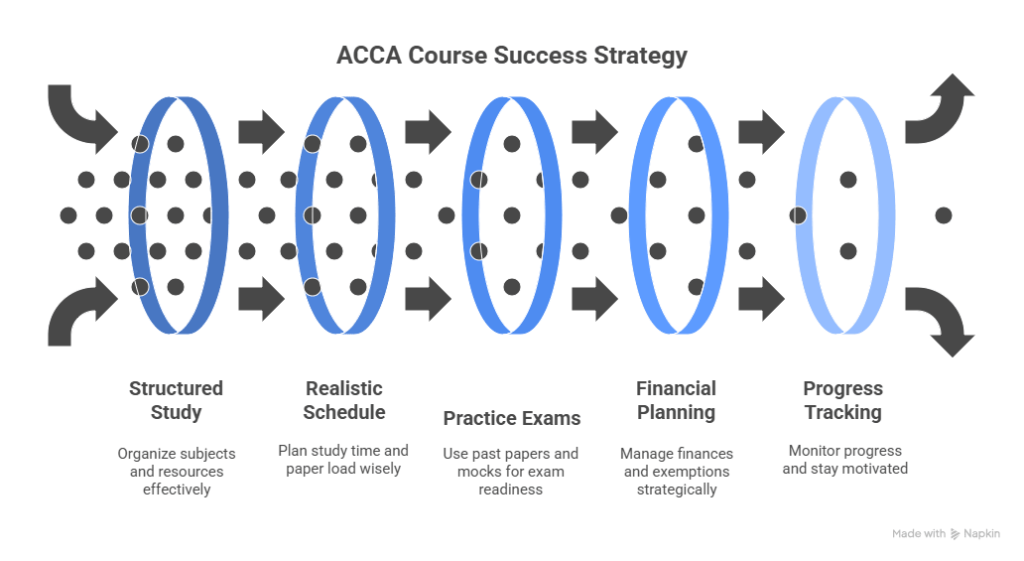

How to Overcome ACCA Course Challenges?

Here’s a step-by-step success strategy to overcome the challenges in the ACCA course:

- Learn Concepts Clearly – Use structured lectures or approved study materials.

- Summarise in Your Own Words – This ensures understanding – not memorisation.

- Practice Exam-Style Questions – Topic-wise practice builds accuracy.

- Solve Past Exam Papers – This teaches how examiners want answers written.

- Take Timed Mock Exams – Build writing speed + exam confidence.

In ACCA preparation, consistency matters more than long study hours.

Choosing the right finance qualification can be challenging. Should you go for an M.Com or pursue ACCA? In this video, we break down the real differences between the two – from salaries and skillsets to career demand and global opportunities – so you can make an informed decision for your finance career.

ACCA Course vs. Other Accounting Qualifications

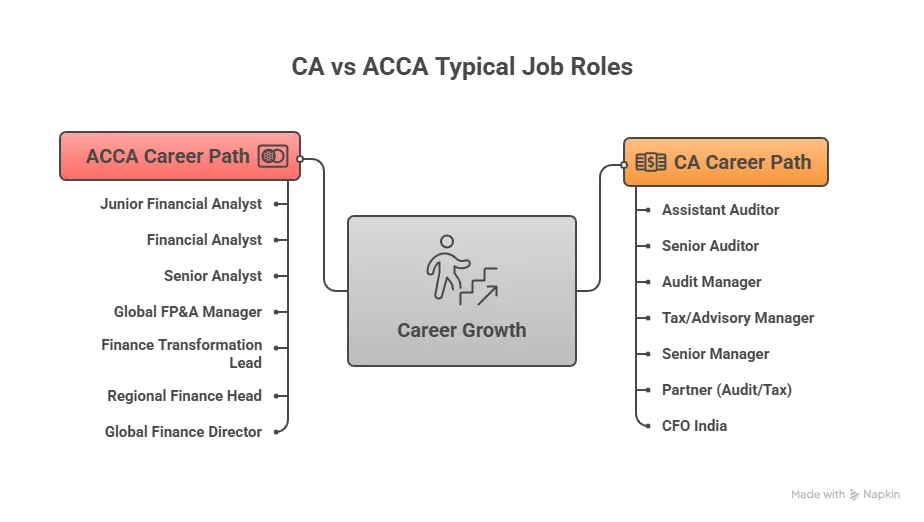

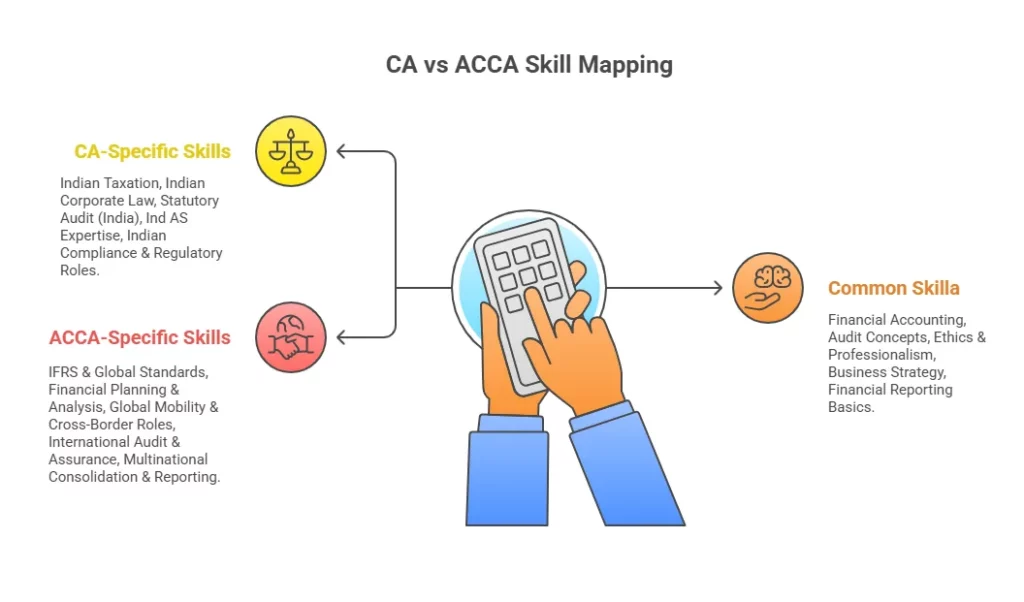

The ACCA qualification stands out as a globally recognised accounting certification, offering a flexible and comprehensive curriculum tailored for international finance careers, which makes it distinct from other accounting certifications like CA, CPA, and CMA.

Here is a comparison of the ACCA course with other popular accounting qualifications based on duration, global recognition, and pass rate:

| Qualification | Duration | Global Recognition | Pass Rate |

| ACCA | 2-3 Years | High | ~40% |

| CA (India) | 4-5 Years | High | ~15% |

| CPA (US) | 1-2 Years | High | ~50% |

| CFA | 3-4 Years | Moderate | ~45% |

While ACCA’s pass rate might seem challenging, its global reach, flexible entry pathways, and syllabus depth make it a highly practical choice compared to others.

Thinking about taking your finance career global? You’ve probably wondered how CA India compares to ACCA when it comes to international recognition, salaries, and opportunities abroad. In this video, we break it all down – why working overseas with a CA can be tricky, how ACCA opens doors in 180+ countries, and what it means for your career growth. Whether you’re a student, a graduate, or a working CA exploring your next move, this comparison might just change the way you plan your future.

ACCA Course Success Strategies

The key to clearing ACCA isn’t studying for endless hours – it’s following a clear, structured approach.

- Start by understanding concepts through good lectures or approved study material.

- Once you’ve got the basics, summarise each chapter in your own words so the ideas really stick.

- Then, practice exam-style questions, topic-by-topic, to build confidence.

- After that, move on to past papers and examiner reports – this is where you learn how questions are framed and what the examiners actually expect.

- Finally, take timed mock exams and do a focused revision to strengthen weak areas before the real exam.

In ACCA preparation, consistency always beats long study hours.

ACCA course success strategy.webp

Many students know what to study for ACCA, but not how to study it effectively. In this video, we share a clear, simple study strategy you can follow step-by-step to stay organised, stay confident, and improve your chances of passing – without stressing yourself out.

How Imarticus Learning Helps You Succeed in the ACCA Course

Preparing for ACCA is easier when you’re not doing it alone. Imarticus Learning’s ACCA training programme is designed to give you clarity, structure, and support at every stage of your preparation.

Here’s how we help you learn smarter – not harder:

• Live & Interactive Classes

Learn from industry experts and ACCA-qualified faculty who simplify complex concepts and help you apply them in real-world scenarios.

• Structured Study Roadmaps

No guessing what to study or when. You get a guided timeline that keeps your preparation consistent and stress-free.

• Practice-Focused Training

From Kaplan/BPP-backed study material to past papers, mocks, and examiner-style questions – everything is designed to build exam confidence.

• 1:1 Doubt Support & Mentoring

Whenever you’re stuck, you get personalised help. No wasting time searching for answers alone.

• Flexible Learning Options

Perfect for students, graduates, and working professionals – because your career shouldn’t have to pause for your qualification.

• Placement Assistance and Career Guidance

Once you’re ACCA-ready, our dedicated placement team helps connect you with roles in Big 4 firms, multinational companies, and high-growth organisations.

The goal isn’t just to help you clear exams – but to help you build a strong, global finance career.

FAQs About the ACCA Course

Still have a few doubts? You’re not alone – here are the most frequently asked questions students have while planning their ACCA Course journey.

Is the ACCA course recognised in India?

Yes, it’s gaining major popularity among recruiters, including Big 4 firms. The global recognition means ACCA professionals are in demand here, plus worldwide. It’s a solid credential for a finance career.

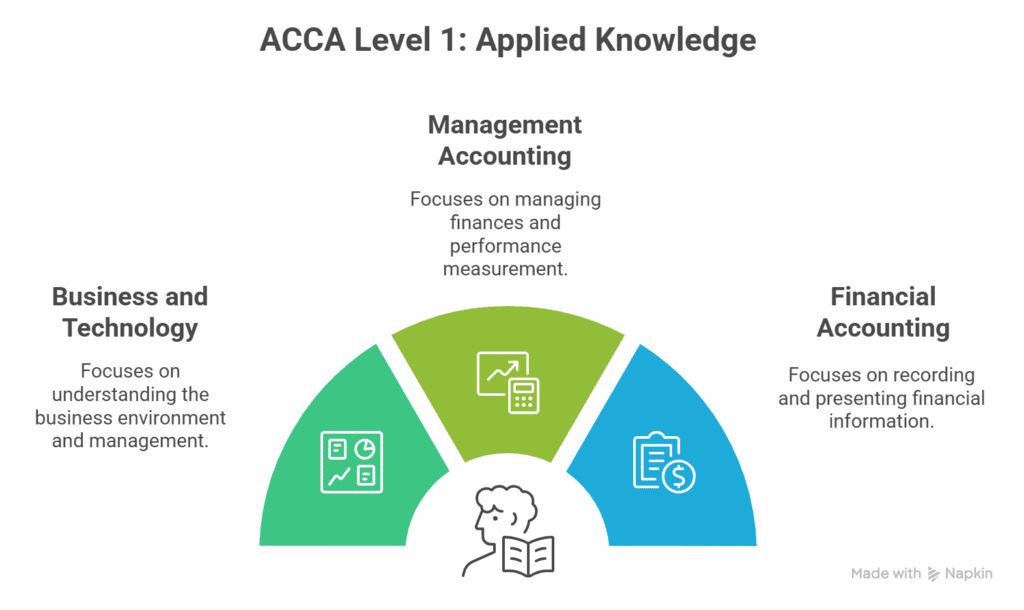

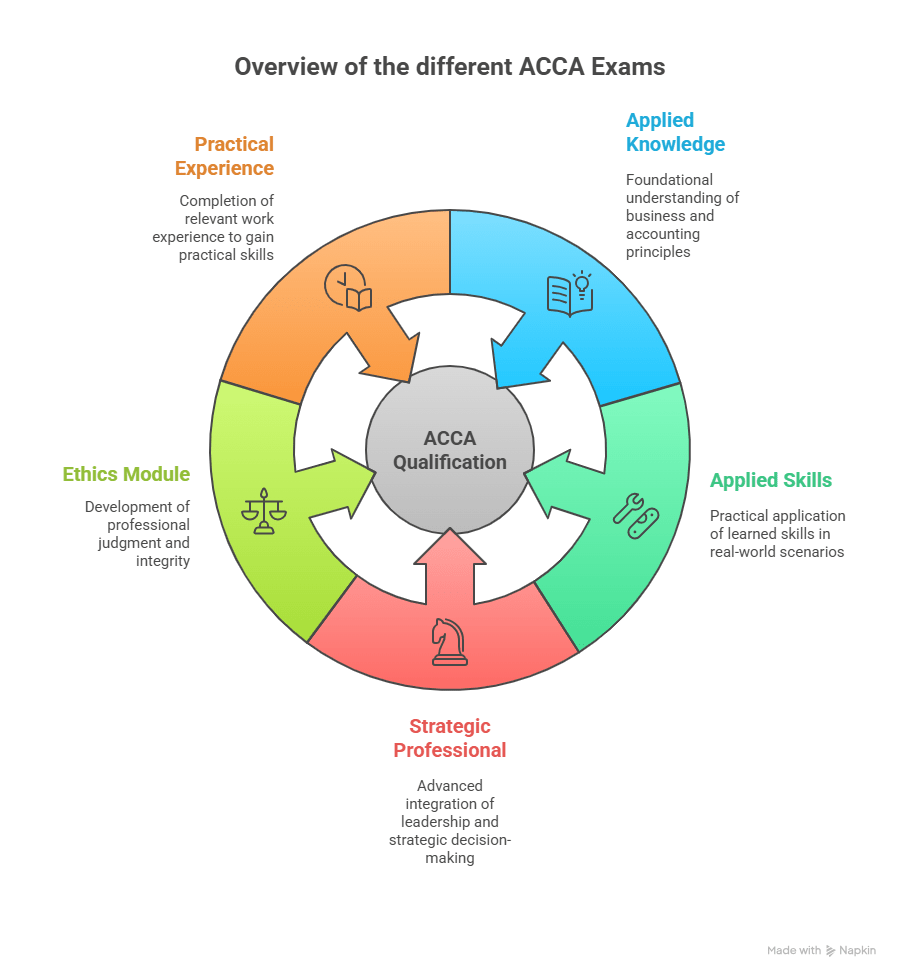

How is the ACCA course structured?

It has three levels: Applied Knowledge, Applied Skills, and Strategic Professional. You clear exams at each stage, plus the Ethics module and 36 months’ practical experience. This setup builds knowledge steadily and prepares you for leadership.

Who is eligible for the ACCA course?

If you’ve finished Class 12 with Maths or Accounts and English, you’re eligible to start the ACCA journey. Graduates and professionals with relevant backgrounds can join too, sometimes with exam exemptions. The course is designed to welcome learners from diverse academic paths. Imarticus Learning provides expert guidance to help you understand your eligibility and exemptions clearly.

Can commerce graduates apply directly for the ACCA course?

Yes, commerce grads like B.Com or BBA can dive straight into ACCA and often skip some papers due to exemptions. This makes the learning faster and more focused. It’s a great way to build on your existing knowledge.

Can I do self-study for the ACCA course?

Absolutely! Many students succeed through self-study. But structured courses, like those at Imarticus Learning, offer guidance and a roadmap that can make passing easier and boost success rates.

What’s the ideal starting subject for the ACCA course?

Start with the Applied Knowledge papers – Business and Technology, Management Accounting, and Financial Accounting. They lay a solid foundation that supports your progress. Getting these basics down early helps tackle tougher subjects later. Imarticus Learning’s tailored support ensures you build strong fundamentals from the start.

Can I finish the ACCA course quickly?

You can, especially if you have exemptions based on your previous qualifications. It takes discipline and a clear study plan to move fast. With the right approach, finishing in 1.5 to 2 years is realistic. Imarticus Learning provides personalised coaching to help you pace your journey effectively.

Is ACCA tougher than CA?

They each have their challenges, but differ in focus. CA is India-specific and more rigid, while ACCA offers global flexibility. Many find ACCA’s exam schedule and exemptions easier to manage. It depends on your goals and learning style.

What is the easiest subject in the ACCA course?

The Applied Knowledge papers, like Business and Technology (BT) and Management Accounting (MA), are usually seen as the easiest. They introduce the basics without heavy complexity. These help build confidence as you start.

What is the pass rate for the ACCA course?

Pass rates vary, from over 80% for entry-level papers to around 40-50% for advanced ones. It shows the increasing complexity as you progress. Consistent study and smart planning improve your chances.

Can I skip ACCA papers?

Yes, if you have relevant prior qualifications, you can get exemptions for certain exams. This helps cut down study time and focus on new content. Always check the official exemption calculator before starting.

What career opportunities are available after the ACCA course?

You can work as a Financial Analyst, Auditor, Tax Consultant, Management Accountant, or even progress to leadership roles like CFO. ACCA opens doors in multinational firms, banks, and growing sectors like fintech. The options are diverse and international.

What is the 7-year rule in the ACCA course?

Once you pass your first Strategic Professional paper, you have 7 years to finish the rest at that level. Applied Knowledge and Skills levels don’t have a time limit. It helps keep your progress steady without rushing early on.

Building Your Global Finance Career With the ACCA Course

The ACCA Course is more than just an accounting qualification – it’s a pathway to building a global finance career with credibility, mobility, and long-term growth. While the journey requires consistency and structured preparation, it is absolutely achievable with the right study approach.

The skills you develop – financial judgement, analytical thinking, strategic decision-making, and ethical responsibility are exactly what organisations seek in future finance leaders. When you focus on understanding concepts rather than memorising them, practise regularly, and stay disciplined, you’ll not only clear the exams, you’ll grow into a confident professional ready to create real impact.

With the right guidance, ACCA isn’t just a certification you earn – it’s a career you build.