The confusion around ACCA vs CFA usually does not begin with exams. It begins much earlier, often at the point where someone realises that finance is not one single career. Two people can both work in finance, sit in the same office building, and yet think about problems in completely different ways. One spends the day ensuring numbers reflect reality. The other spends the day questioning what those numbers could become.

This is the gap that ACCA and CFA quietly occupy.

When I look at how careers evolve, the difference between ACCA certification and CFA shows up in everyday moments. It shows up in whether your work revolves around closing books, managing controls, and advising leadership on sustainable decisions, or around analysing companies, interpreting market signals, and assessing risk under uncertainty. These are not small differences. Over time, they shape your professional identity.

Most articles approach ACCA vs CFA which is better by listing syllabus topics, pass rates, or average salaries. Those details are useful, but they do not explain why some professionals thrive after choosing one path and feel misaligned after choosing the other. The alignment happens at the level of thinking, not credentials.

This is also why debates around ACCA vs CFA which is harder or CFA vs ACCA salary often feel inconclusive. Difficulty and pay are experienced differently depending on the kind of work you enjoy doing and the environments you grow in. A qualification that feels demanding to one person can feel intuitive to another, even when both are equally capable.

In this guide, I approach ACCA vs CFA from a practical, work-led perspective. I look at how each qualification shapes daily responsibilities, how careers progress across roles and regions, how salary evolves with responsibility rather than headlines, and where comparisons like ACCA vs CA vs CFA or ACCA vs CPA vs CFA start to matter in real planning.

If you are trying to decide between ACCA and CFA, this is not about pushing you toward one answer. It is about helping you recognise which path fits the way you want to think, grow, and work over the long term. That clarity tends to stay relevant long after exams are over.

Did you know?

According to the CFA Institute, more than 70% of CFA charterholders work in portfolio management, research, or investment advisory roles globally.

What is ACCA and the Careers It Is Designed For

In most finance teams, there is always one role that sits quietly at the centre of everything. It touches reporting deadlines, audit conversations, budget reviews, and leadership decisions, often without drawing attention to itself. ACCA is designed around this exact space.

When people ask what is ACCA, they usually expect a short definition. In reality, ACCA represents a way of training finance professionals to understand how numbers move through an organisation and why they matter at each stage. It focuses on building clarity, control, and judgment around financial information, rather than treating numbers as abstract outputs.

This internal perspective is what gives ACCA its shape in the wider ACCA vs CFA conversation.

What ACCA actually trains you to handle

Instead of viewing ACCA as a list of subjects, I find it more useful to look at the kind of work it prepares you for. ACCA builds capability in areas such as:

- Preparing and interpreting financial statements

- Understanding audit processes and internal controls

- Cost management, budgets, and performance metrics

- Applying ethics and governance in real business situations

- Supporting management decisions with financial insight

These skills show up daily in corporate finance teams, audit firms, shared service centres, and consulting environments.

Roles where ACCA thinking is most visible

Rather than listing titles alone, it helps to understand where ACCA thinking shows up. ACCA naturally aligns with roles that involve:

- Ownership of financial statements and reporting quality.

- Interaction with auditors, regulators, and leadership.

- Oversight of costs, budgets, and performance.

- Long-term planning and internal advisory work.

Job titles may vary, but the core responsibility remains accountability.

Looking ahead to 2025, changes in the ACCA structure, exam approach, and employer expectations are shaping how the qualification fits into modern finance careers and long-term professional planning.

Understanding What is CFA

In finance, there is a category of roles where decisions are made without full certainty. These roles deal with financial forecasting, probabilities, and market behaviour rather than completed transactions. CFA is built around this environment.

When people ask what is CFA, the most accurate way to understand it is as a qualification designed for professionals who work with capital in motion. CFA, or the Chartered Financial Analyst program, focuses on analysing assets, measuring risk, valuing businesses, and managing portfolios across changing market conditions. This market-facing orientation is what defines its position in the broader ACCA vs CFA discussion.

What CFA trains you to think about daily

CFA does not prepare someone for a single job title. It develops a way of analysing financial information under uncertainty.

CFA builds capability in areas such as:

- Valuing companies and financial instruments

- Analysing financial statements for investment insight

- Understanding macroeconomic and market drivers

- Measuring and managing portfolio risk

- Applying ethics in investment decision-making

These skills are used continuously in investment analysis, asset management, and advisory roles.

Roles where CFA thinking is most visible

Instead of listing industries, it helps to see where CFA logic is applied.

CFA commonly aligns with roles that involve:

- Evaluating investment opportunities

- Managing or supporting portfolios

- Interpreting financial and market data

- Communicating risk and return to stakeholders

- Supporting capital allocation decisions

These roles are closely tied to market performance rather than internal reporting cycles.

Exam Structure and Cognitive Load Explained

To understand ACCA vs CFA, which is harder, I prefer breaking it down into how the brain is used during preparation.

ACCA exams are spread across multiple papers. Each paper focuses on a defined domain. The challenge lies in retention across breadth. A learner switches between standards, calculations, written explanations, and professional judgment.

CFA exams are fewer in number but intense. Each level is a single exam sitting. The challenge lies in integration. Questions often require linking economics, valuation, ethics, and risk in one flow.

This creates two different types of pressure.

ACCA pressure builds gradually and rewards disciplined preparation across time.

CFA pressure peaks sharply and rewards stamina and conceptual clarity under exam conditions.

Neither approach is easier. The difficulty is different in nature, which is why CFA vs ACCA difficulty debates rarely reach consensus.

How the Learning Philosophy Differs Between ACCA and CFA

The difference between ACCA and CFA becomes clearer when looking at how learning is structured and tested in real exam settings.

ACCA Learning Approach

- Papers build progressively across business and finance functions

- Concepts are revisited through reporting, audit, performance, and strategy

- Strong focus on application, written judgment, and professional ethics

- Mirrors how finance teams operate inside organisations

CFA Learning Approach

- Core topics repeat across all three levels with increasing depth

- Heavy focus on valuation, risk analysis, and portfolio thinking

- Ethics is tested at every level to reinforce market conduct

- Designed for decision-making in uncertain, market-driven environments

This difference explains why the CFA vs ACCA difficulty is experienced differently. ACCA requires consistency across a broad syllabus, while CFA requires analytical endurance across fewer but denser areas.

A Practical Look at Daily Work Roles After The Qualification

Career outcomes are where ACCA vs CFA starts making practical sense.

ACCA qualified professionals typically move into roles such as:

- Financial accountant

- Audit associate or manager

- Management accountant

- Internal auditor

- Finance business partner

These roles involve preparing reports, analysing costs, supporting audits, ensuring compliance, and advising management.

CFA qualified professionals commonly move into roles such as:

- Equity research analyst

- Portfolio manager

- Investment analyst

- Risk analyst

- Wealth management advisor

These roles involve analysing companies, valuing assets, monitoring markets, managing portfolios, and communicating investment insights.

There is overlap in corporate finance and consulting, but the core day-to-day thinking remains different. This distinction is often missing in generic ACCA and CFA comparisons.

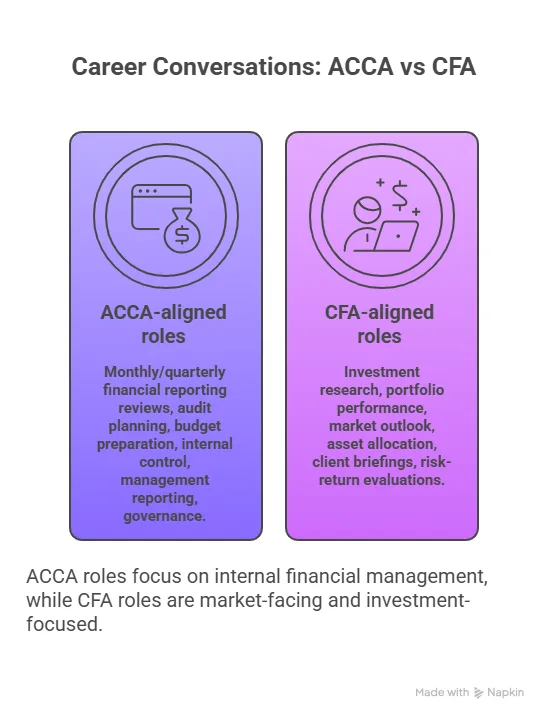

Career conversations for ACCA and CFA professionals tend to centre on very different priorities, reflecting how each qualification shapes daily responsibilities, decision-making focus, and long-term role expectations within organisations and financial markets:

Eligibility and Entry Pathways Explained with Context

Eligibility is often simplified in ACCA vs CFA discussions, but entry pathways play a major role in how learners plan their timelines and careers. Looking at ACCA eligibility and CFA eligibility side by side makes the differences easier to understand.

ACCA Entry Pathways

- Open to students after Class 12

- Graduates may receive paper exemptions based on their degree

- Working professionals can start at any stage

- No fixed age requirement

- Flexible progression across exam sessions

CFA Entry Pathways

- Bachelor’s degree required or final-year undergraduate status

- Alternatively, relevant work experience can meet eligibility requirements

- Registration begins at Level 1 only

- No subject-specific degree requirement

- Designed for learners closer to professional roles

Eligibility comparison snapshot

| Criteria | ACCA | CFA |

| Minimum education | Class 12 | Bachelor’s degree or equivalent |

| Entry flexibility | Multiple entry points | Single entry point at Level 1 |

| Exemptions | Available based on education | No exemptions |

| Suitable for | Students and professionals | Graduates and working professionals |

| Academic timeline | Early entry possible | Later academic entry |

This eligibility difference explains why ACCA vs CFA fit different stages of a learner’s journey and why planning early makes a meaningful difference in outcomes.

Did you know?

As per CFA Institute data, nearly 40% of Level 1 candidates globally are still completing their undergraduate studies.

Time Commitment and Study Rhythm Comparison

Time investment plays a key role in the ACCA vs CFA which is better decision, especially for learners balancing work, internships, or personal responsibilities. The difference lies less in total CFA and ACCA course duration more in how study effort is distributed.

ACCA Study Rhythm

- Typical completion time of three to four years

- Duration varies based on exemptions and exam pace

- Flexible exam sessions across the year

- Option to attempt one or multiple papers per session

- Suits learners who prefer a steady, long-term study cycle

CFA Study Rhythm

- Typical completion time of three to four years

- Fixed progression through three exam levels

- High study intensity around each exam window

- Candidates report 300 to 350 study hours per level

- Suits learners comfortable with concentrated preparation periods

Study commitment comparison snapshot

| Aspect | ACCA | CFA |

| Total duration | 3 to 4 years | 3 to 4 years |

| Study distribution | Spread across papers | Concentrated per level |

| Exam flexibility | High | Limited |

| Intensity pattern | Consistent | Peak-based |

| Suitable for | Flexible schedules | Focused exam cycles |

This difference in study rhythm explains why ACCA vs CFA outcomes feel very different for working professionals and students managing multiple commitments.

CFA levels typically takes three to four years as well, but the study rhythm is intense around each level. Candidates often report 300 to 350 hours of study per level.

This difference matters for working professionals balancing jobs, internships, or family responsibilities.

How Salary Outcomes Evolve Over Time

Salary is often the loudest question in the ACCA vs CFA discussion, yet it is also the most misunderstood. Numbers are usually quoted without context, which creates unrealistic expectations. I find it far more useful to look at CFA and ACCA salary insights as a progression curve rather than a single figure.

For ACCA-qualified professionals, early career salaries are closely tied to role and geography. Entry-level positions in audit, accounting, and finance reporting usually offer steady but moderate pay. As professionals move into managerial roles, compensation rises through responsibility rather than market cycles.

CFA compensation behaves differently. Early roles in research or analysis may not always start high, especially outside major financial hubs. Over time, pay becomes strongly linked to performance, asset size handled, and market exposure.

Did you know?

According to the CFA Institute Compensation Study, senior portfolio managers in developed markets earn significantly higher variable pay than fixed pay.

This is why CFA vs ACCA salary comparisons without role clarity often feel confusing.

A Grounded Salary Comparison Across Career Stages

Before looking at numbers, it helps to understand what they represent. These ranges are indicative and vary by region, firm size, and industry.

| Career Stage | ACCA Typical Roles | CFA Typical Roles |

| Entry level | Audit associate, junior accountant | Research analyst, junior investment analyst |

| Mid career | Finance manager, internal audit lead | Portfolio analyst, risk manager |

| Senior level | Financial controller, CFO track | Portfolio manager, fund manager |

Salary data reflects these trajectories rather than the qualification alone.

This perspective helps answer ACCA vs CFA which is better in a more realistic way.

After completing BCom, career outcomes in 2025 are increasingly shaped by specialised finance certifications such as ACCA, FRM, CFA, and CMA, each opening distinct pathways across accounting, risk, investment, and management finance roles with strong earning potential:

Global Recognition and Regulatory Alignment

Both qualifications enjoy strong global recognition, but in different ecosystems.

ACCA is widely recognised, enabling you to work in 180+ countries across audit firms, multinational companies, and regulatory environments that follow IFRS. It aligns closely with corporate governance and statutory reporting frameworks.

CFA is globally respected in investment management, banking, and asset management. Employers associate the charter with analytical rigour and ethical market practice.

This distinction becomes important later when comparing ACCA vs CA vs CFA or ACCA vs cpa vs CFA, where regulatory alignment plays a central role.

How ACCA and CFA Shape Professional Thinking

Beyond exams and job titles, ACCA and CFA influence how professionals process information and approach decisions at work. This difference becomes more visible as careers progress.

How ACCA Shapes Thinking

- Encourages viewing finance as an interconnected system

- Focuses on processes, controls, and accountability

- Builds comfort with standards, compliance, and governance

- Supports long-term decision-making within organisations

- Emphasises consistency, structure, and sustainability

How CFA Shapes Thinking

- Encourages probabilistic and forward-looking analysis

- Focuses on risk, return, and uncertainty

- Builds comfort with assumptions and market behaviour

- Supports decision-making under incomplete information

- Emphasises data-driven judgment and scenario analysis

Various Finance Certifications in Practical Career Planning

This section places various finance certifications in a real career planning context, explaining how qualifications like ACCA, CFA, CPA, and CMA fit different roles, industries, and stages of professional growth rather than treating them as interchangeable credentials.

The ACCA vs CA vs CFA Decision

The ACCA vs CA vs CFA comparison often appears in regions like India, where CA is well established. Each qualification serves a different market need.

| Qualification | Best suited for |

| CA | Roles focused on local laws, taxation, and statutory compliance |

| ACCA | Roles in multinational companies and global finance teams using IFRS |

| CFA | Roles in investment analysis, asset management, and equity research |

| ACCA | Professionals seeking international exposure and career mobility |

| CFA | Careers driven by markets, investments, and portfolio performance |

ACCA vs CPA vs CFA from a Global Mobility View

Global mobility is another area where comparisons are frequently oversimplified.

| Qualification | Global mobility focus |

| CPA | Strongly aligned with US GAAP and the American regulatory environment |

| ACCA | Aligned with IFRS and recognised across multiple international regions |

| CFA | Recognised globally in investment management regardless of accounting frameworks |

Did you know?

More than 60% of ACCA members work outside their country of qualification.

Where CFA vs CPA vs ACCA vs CMA Fits in Mid-Career Decisions

Mid-career professionals often explore multiple certifications together, leading to comparisons like CFA vs CPA vs ACCA vs CMA.

CMA focuses on management accounting and internal decision support. ACCA covers a broader financial and regulatory scope. CPA is region-specific. CFA is market-focused.

For someone already in corporate finance, combining ACCA with CMA can strengthen leadership readiness. For someone in finance analytics or markets, CFA adds depth that accounting qualifications do not provide.

This layered understanding helps professionals avoid redundant qualifications.

How Employers Interpret These Qualifications

Employers rarely rank qualifications in isolation. They evaluate fit.

Audit firms value ACCA for consistency and regulatory competence. Investment firms value CFA for analytical depth. Consulting firms value combinations depending on service lines.

This employer perspective is often missing in generic ACCA and CFA comparisons, but plays a major role in hiring decisions.

Comparing ACCA, CMA, CFA, CPA, and FRM highlights how each qualification aligns with different finance functions, from corporate accounting and management finance to investments, risk, and global regulatory roles, helping learners see where each path fits in practical career planning:

Can ACCA and CFA Be Combined Meaningfully

A common question I encounter is whether pursuing both makes sense. The answer depends on timing and intent.

Whether combining ACCA and CFA makes sense depends on timing, background, and career intent.

- Pursuing ACCA and CFA together is possible but mentally demanding.

- Both qualifications require focused preparation and disciplined study plans.

- Attempting both at the same time can dilute attention unless one foundation is already strong.

A sequential approach often works better:

- Many professionals complete ACCA first to build strength in financial reporting, controls, and business operations.

- CFA can then add analytical depth in valuation, markets, and investment decision-making.

- Some CFA holders later pursue ACCA to move into broader corporate or leadership roles.

This layered pathway explains why professionals holding both ACCA and CFA are more commonly seen at senior career levels rather than in early roles.

Myth-busting common assumptions around ACCA vs CFA

Several myths continue to circulate around ACCA vs CFA and influence decisions unnecessarily.

| Myth | Reality |

| CFA always pays more than ACCA | CFA vs ACCA salary outcomes depend on role, geography, and market exposure. Senior ACCA professionals in large firms can out-earn many CFA holders. |

| ACCA is only for accountants | ACCA careers extend into analytics, advisory, sustainability reporting, and strategic finance roles. |

| CFA guarantees front-office investment roles | Investment roles depend on networking, internships, and market conditions alongside the CFA qualification. |

Clearing these myths allows decisions to rest on facts rather than assumptions.

How Imarticus Strengthens ACCA Preparation

When evaluating ACCA vs CFA, the choice of where you study ACCA can influence not just exam performance, but how well you build real skills, confidence, and career readiness.

Imarticus Learning offers a structured ACCA Course preparation that aligns closely with what the qualification demands in the real world, rather than just preparing for exam questions. A few core aspects of this training stand out:

- Gold Status Learning Partner: Imarticus Learning is recognised as a gold status learning partner of ACCA, UK, which means its curriculum and delivery meet ACCA’s quality benchmarks, giving you globally aligned preparation rather than generic coaching.

- Kaplan-Powered Study Materials: The course includes Kaplan-powered books, question banks, practice papers, MCQs, flashcards, and videos. Kaplan is a major ACCA-approved content provider, ensuring that study material matches the actual depth and style of ACCA exams.

- Industry-Led Case Studies and Practical Focus: Rather than just textbook theory, the programme uses real-world case studies and business scenarios mapped to the ACCA syllabus so learners understand how concepts apply to real jobs.

- Live Sessions and Webinars with Practitioners: Monthly webinars and live sessions conducted by experienced professionals, including practitioners associated with KPMG in India, help bridge the gap between academic preparation and industry application.

- Internship Opportunities Through Top Firms: Top performers in the ACCA programme may become eligible for internships with KPMG in India, offering hands-on exposure to processes and practices used in Big 4 and global finance environments, a step toward building market-relevant experience.

- Flexible Learning Options: Imarticus supports both online and offline modes, and schedules that accommodate working students or professionals, making it easier to balance preparation alongside other responsibilities.

FAQs on ACCA vs CFA

This section brings together clear, practical answers to the most frequently asked questions learners ask while comparing the two qualifications. It addresses difficulty levels, salary expectations, study timelines, and career outcomes in a simple, grounded manner, helping readers understand how ACCA vs CFA differs across real-world roles, long-term growth, and preparation demands without adding confusion or exaggeration.

Is ACCA harder than the CFA?

ACCA demands consistency across a wide syllabus that includes accounting standards, audit logic, taxation, and strategic thinking. CFA concentrates difficulty into fewer exams with dense content, time pressure, and analytical integration. For some learners, ACCA feels demanding due to its length. For others, CFA feels more intense because of exam-day pressure. With guided support from Imarticus Learning, learners can help manage this challenge more effectively by aligning study plans with how the exams are actually tested.

Which pays more, CFA or ACCA?

CFA vs ACCA salary outcomes differ because CFA compensation often includes variable pay linked to performance and assets managed, while ACCA compensation grows steadily with responsibility and seniority. In long-term leadership roles, both qualifications can reach very high earning potential. Market exposure, geography, and employer scale matter more than the qualification label alone.

Is CFA worth it after ACCA?

CFA can be worth pursuing after ACCA if career goals shift toward investment analysis, portfolio management, or capital markets. In the ACCA vs CFA context, ACCA builds a strong base in financial reporting and governance, while CFA adds market-facing depth. Many professionals use CFA to pivot roles rather than restart careers. Structured preparation support offered by Imarticus Learning can make this transition smoother by aligning learning with practical outcomes.

Can CFA earn 1 crore?

Earning 1 crore is possible but not guaranteed in the ACCA vs CFA journey. CFA holders in senior investment roles managing large portfolios or working in high-performing funds can reach this level, especially in global markets. However, compensation depends on performance, market cycles, and experience. Similarly, senior ACCA professionals in executive finance leadership roles can reach comparable compensation. The qualification opens doors, but sustained results determine income.

Is 27 too late for CFA?

Age is rarely a limiting factor in the ACCA vs CFA decision. Many candidates begin CFA in their late twenties or early thirties after gaining work experience. CFA values professional maturity and applied understanding, which often improve with age. Starting at 27 allows candidates to connect theory with real-world exposure, which can strengthen outcomes across all three levels. With Imarticus Learning, candidates can align preparation with both career experience and exam demands more effectively.

What is the CFA Level 1 salary?

CFA Level 1 in India typically leads to entry-level analyst or support roles with salaries ranging from ₹4 to ₹8 lakh per annum, depending on the employer, location, and prior experience. Salary growth becomes more pronounced as candidates progress to Levels 2 and 3 and move into core research or portfolio-related roles.

Can I do CFA and ACCA together?

It is possible to pursue CFA and ACCA together, but it requires careful planning. In the ACCA vs CFA context, both demand disciplined preparation and mental bandwidth. Simultaneous attempts work best for individuals with strong academic foundations and flexible schedules. For most learners, a staggered path leads to better retention and lower burnout, especially when supported by structured preparation and guided study planning through Imarticus Learning.

Is 60 per cent enough to pass CFA Level 1?

CFA exams do not publish a fixed passing percentage. It is important to understand that CFA uses a minimum passing score that varies by exam difficulty. A raw score around 60% may or may not be sufficient depending on exam conditions. Consistent conceptual clarity across topics improves the odds more than targeting a specific percentage.

Can I study for CFA in 4 months?

Studying for CFA in four months is possible but demanding. Within the ACCA vs CFA framework, CFA requires disciplined daily study, strong quantitative comfort, and focused revision cycles. Candidates with prior finance or economics exposure adapt faster. Guided preparation with Imarticus Learning can significantly improve efficiency within shorter timelines.

Bringing the ACCA vs CFA Choice Into Focus

By the time the ACCA vs CFA discussion reaches the end, one thing becomes clear. It is a choice between two ways of working in finance and two directions a career can take over time.

ACCA fits those who want to grow inside organisations, understand how decisions are shaped by numbers, and build credibility through structure, governance, and long-term responsibility. CFA fits those who are drawn to markets, valuation, and managing risk in environments where outcomes are never fully certain. Both paths reward effort.

Both demand discipline. The difference lies in where that effort eventually shows up in your working life.

For those leaning toward ACCA, preparation quality becomes an important part of the journey. A structured approach that connects exam learning with real business applications can make the process clearer and more sustainable. This is where ACCA Course preparation with Imarticus Learning quietly adds value, especially for learners who want guidance that reflects how finance roles actually operate beyond exams.

Whichever direction you choose in the ACCA vs CFA decision, clarity at the start saves time, effort, and uncertainty later.