Will a course really land you a job in investment banking? It is a question posed by thousands of finance wannabes annually. Investment banking is the most competitive sector, requiring specialist knowledge, technical skills, and lightning-fast analytical skills. Unless you are well-prepared, even best candidates are unable to pass through interviews.

This is where an investment banking training course syllabus proves useful. Generic finance qualifications are of no use, whereas a well-structured investment banking training program is designed with skill-based training, industry-focused modules, and on-to-job streams. With such as the Certified Investment Banking Operations Professional (CIBOP) guaranteeing 100% job placement and 7 interviews, the answer has to be an emphatic yes—a properly structured course can significantly enhance your job prospects.

In this blog, we’ll explore the investment banking course syllabus, discuss investment banking course benefits, examine how programs offer a job guarantee in banking, and evaluate whether such training can support a career switch to investment banking.

Why Investment Banking Needs Specialised Training?

Unlike other fields, investment banking requires mastery across multiple domains—financial modeling, risk management, asset operations, and compliance.

Key challenges aspirants face:

- High competition: Thousands of applicants for limited IB roles.

- Skill gap: No on-the-job training in traditional degrees.

- Practical knowledge: Actual situations never covered in schools.

- Recruiter expectations: Employer-friendly job-ready professionals are what employers want.

A concentrated investment banking course fills the gaps by marrying theory with actual-case studies, practice interviews, and placements support.

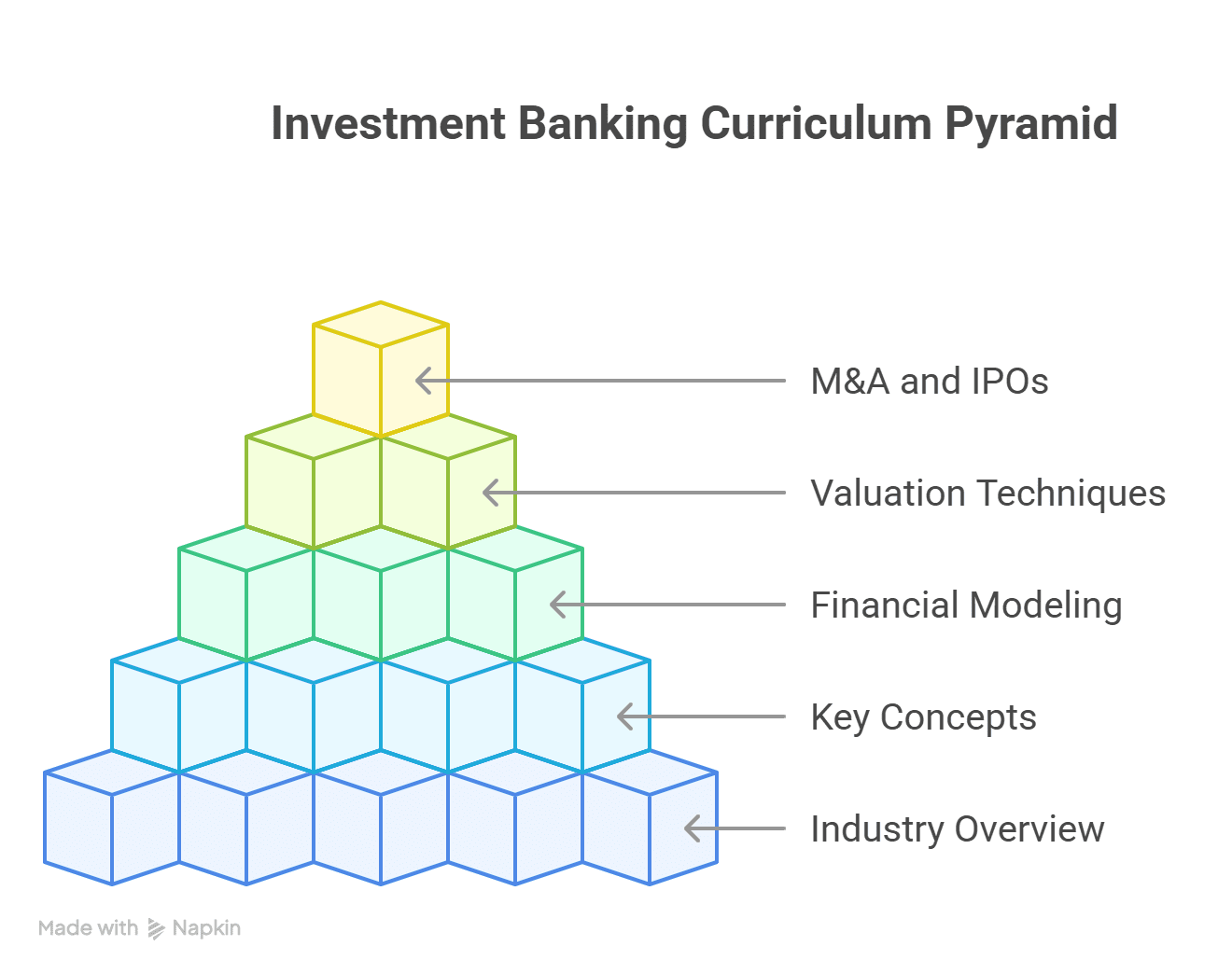

Investment Banking Course Syllabus: What’s Included

The basis of any investment banking course program is its syllabus. Investment banking course syllabus is specially designed to deliver employer-friendly job-ready professionals.

Modules Usually Covered:

- Financial Markets & Instruments

Equities, bonds, derivatives, and structured products.

- Investment Banking Essentials

Mergers & acquisitions, IPOs, private placements, advisory services.

- Securities Operations & Settlements

Clearing, custody, and back-office operations.

- Risk Management

Operational risk, credit risk, and market risk practices.

- Wealth & Asset Management

Fund structures, NAV calculations, performance analysis.

- Anti-Money Laundering (AML) & Compliance

KYC regulations, global compliance frameworks, ethical finance.

- Soft Skills & Interview Preparation

Resume writing, communication skills, and mock interview preparation.

This course syllabus in investment banking prepares candidates professionally and technically to work in front-line jobs in employment.

Investment Banking Course Benefits

Why invest in an investment banking course training compared to learning through self-study? The most prominent benefits enumerated below are:

1. Bank Guarantee Job

CIBOP courses provide 100% job guarantee and interview guarantees with high-hiring partners.

2. Practical Learning

Practical Exposure is provided through real case studies, role-play, and simulation that ready you for work.

3. Acceptance in the Industry

Certified programmes have significant value in the employment market, differentiating you from the crowd.

4. Quick Career Transition to Investment Banking

Finance or related industry graduates or professionals can transition smoothly into IB careers.

5. Placement Assistance

Resume sessions, interview practice, and soft skills training ensure confidence and placement.

6. Pay Increase

CIBOP has a 60% average salary increase, which indicates the real value of formal education.

Can You Get a Job with Just a Course?

The short answer: Yes, given that the course is well-rounded and domain-specific.

For instance, Imarticus Learning’s CIBOP has:

- 85% placement with a maximum of 9 LPA packages.

- 1000+ hiring organizations partner with us.

- 50,000+ placed professionals in leading IB companies.

This is a positive indication that with the right course curriculum in investment banking, placement guarantee, and employability training, candidates find themselves in the pleasant situation of being able to respond positively to the query of how to get a job in IB.

Career Switch to Investment Banking: Is It Possible?

Specialist training is one of the biggest attractions of one of the most desirable career changes around—into investment banking.

- New graduates: Can be absorbed into IB operations teams immediately.

- Chartered Accountants / MBAs: Can shift from financial background with additional IB knowledge.

- Working professionals (0-3 years): Can shift from finance, accounts, or analytics background to IB.

CIBOP gives flexibility—2.5 months (weekdays) or 5 months (weekends)—so it’s perfect even for working professionals.

Investment Banking Training Program: Why CIBOP Stands Out?

Certified Investment Banking Operations Professional (CIBOP) is the most prestigious course in India that has been formulated keeping specifically the candidate preparation for the role in mind.

Highlights of CIBOP:

- 100% Job Guarantee with assured interviews.

- Best Education Provider in Finance at 30th Elets World Education Summit 2024.

- More than 1200 batches and 50,000+ students trained.

- Practice-first methodology with live practice exercises.

- Resume creation to mock interview, end-to-end training.

Unlike other generic finance certifications, CIBOP is constructed with the intention of addressing specifically how to get hired in IB and to prepare students for recruiter-readiness.

Know important topics covered in CIBOP here- All About Foreign Exchange Market, Currency Quotes, NDF & Trade Examples, Swaps.

How to Get Hired in IB: Step-by-Step

If an IB career success is your goal, this is the way a systematic process with a course like CIBOP can benefit you:

- Know the Role – Learn about operations, risk, and asset management.

- Take a Structured Course – Opt for one with an excellent investment banking course syllabus and placement track record.

- Master Technical Skills – Place particular emphasis on financial instruments, settlements, and compliance.

- Develop Soft Skills – Communications, problem-solving, and leadership are also important.

- Practice Interviews – Utilize mock interview sessions to hone answers.

- Use Placement Assistance – Avail yourself of guaranteed interviews and recruiter networks.

By following this path, you’ll not just learn investment banking course benefits, but also secure real outcomes.

FAQs

Q1. What is covered in a typical investment banking course syllabus?

Topics include securities operations, risk management, wealth management, compliance, and soft skills.

Q2. Are investment banking course benefits worth the cost?

Yes—programmes such as CIBOP provide job assurances, industry validation, and salary increases.

Q3. Do programmes truly provide job guarantee in banking?

Courses like CIBOP provide 100% job assurance and 7 assured interviews.

Q4. Can a career switch to investment banking be made after finance experience with some years of work?

Yes, CIBOP is suitable for freshers as well as professionals having 0–3 years work experience.

Q5. Best investment banking training program in India?

CIBOP by Imarticus Learning, with high success in placements and industry accolades.

Q6. What is the CIBOP duration?

2.5 months (working days) or 5 months (weekends).

Q7. How to get an IB hire post-course?

By taking benefit of the placement support, mock interviews, and recruiter introduction provided by the course.

Q8. What is the average salary after completing CIBOP?

Up to 9 LPA, with the average increasing 60% from past earnings.

Q9. Is self-study sufficient to land in investment banking?

Not typically—practical training, simulated interviews, and industry networking in a course are required.

Q10. Can investment banking training be accessed by anyone?

Finance graduates, MBAs, CAs, or career switchers looking for a career shift to IB.

Conclusion

The proper investment banking course syllabus can definitely get you placed in IB industry—if it is industry-oriented, practical, and supported by effective placement facilities. Whether investment banking course advantages such as salary increments and career development or the assurance of being placed in banks, courses like CIBOP fill the void between the student and the industry needs.

For those interested in a career transition to investment banking, these courses give them a straightforward road map. Through structured training, interview guarantees, and mentorship by 1000+ hiring partners, how to get IB-hired becomes clear and obtainable.

By 2025 and beyond, professional training will still determine who succeeds in investment banking. If you dream of getting ahead, an investment in a structured program such as CIBOP may prove to be the wisest career decision you’ll ever make.