Last updated on September 1st, 2025 at 03:38 pm

In the past few years, the popularity of fintech has seen a sudden rise around the globe although this concept has existed from the cusp of the 21st century. Companies have witnessed huge success after switching to newer technology from traditional methods.

The concept of blockchain applications in fintech is still relatively new and it is rapidly evolving. Nowadays, various brand-new finance applications appear every day, providing updated and creative approaches for handling and processing payments.

Read on to explore the applications of blockchain in the fintech industry and how it transforms the way people send, receive, store and manage their money.

What is Fintech Blockchain?

Blockchain is a decentralised ledger or a peer-to-peer (P2P) ledger that is used to study data and transactions of various public computer networks. Various industries have adopted the usage of blockchain technology including the fintech industry. This adoption by the fintech industry has given birth to a new blockchain model that is known as decentralised finance (DeFi).

Decentralised finance (DeFi) is the perfect amalgamation of fintech and blockchain technologies. There are various similarities between these two technologies hence many companies are investing in the further growth of DeFi. This growth of blockchain applications in the fintech industry will eventually eliminate all third parties and will create a stronger security system with the help of a decentralised and transparent digital ledger.

The market value of blockchain is going to grow rapidly and most of the companies will become extremely dependent on this technology. Therefore, it is advisable to learn more about blockchain from various online certification courses to sustain in the competition.

Why has the Fintech Industry Adopted Blockchain?

In recent years, plenty of fintech companies have adopted blockchain applications in their business management. Previously there were various challenges like delayed targets, immense losses, and failed fundraising that fintech companies used to face. With the help of blockchain technology, fintech companies have overcome those challenges.

Here is a list of challenges that a company can overcome by using blockchain technology:

Inflated Operational Cost

Operational cost in a fintech market is usually very high. The work related to operation is often dealt with by various third parties which usually takes a lot of time. In this industry, time is considered to be money hence eliminating the third parties will save a lot of time as well as money.

Blockchain applications allow a fintech company to eliminate these third parties as a result, these companies can easily save half of the capital they were spending for the operational cost. This technology also saves a lot of time which the third parties use to take.

High Dependency on Third Parties

High dependency on third parties is one of the most common challenges that the fintech industry often faces. Most of the transactional and operational power is in the hands of the third parties which creates a huge problem with commitments and deadlines. Currently, this challenge has been optimised and resolved as the fintech industry has adopted blockchain technology.

Lack of Reliability

Previously the performers who were using the fintech applications did not have any knowledge about the operations that were taking place on the other side. Therefore, gradually people lost their trust in such fintech applications. However, after the incorporation of various blockchain applications, the fintech companies are more transparent and reliable.

Hence, this challenge that was frequently faced by fintech was easily solved by the latest blockchain technology.

Slow Procedures

Previously, the operational procedures were extremely slow as the entire fintech industry depended heavily on third parties. These third parties had contracts to work for various fintech companies. This resulted in slow procedures and poor outcomes along with client dissatisfaction.

However, this challenge was easily solved with the help of blockchain technology.

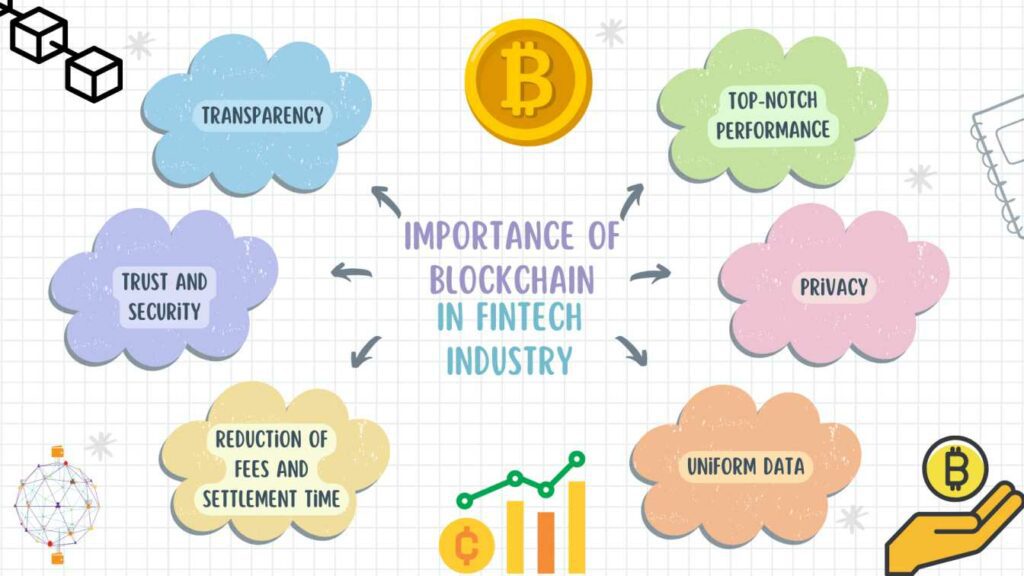

Importance of Blockchain in Fintech Industry

Blockchain applications are extremely important for the fintech industry, here are a few points that will justify this statement.

-

Transparency

Various blockchain applications often update the information of various procedures and standards with the client as well. This creates a transparent relationship between the company and its clients. Transparency helps a company enhance its data integrity along with customer experience.

-

Top-Notch Performance

Blockchain technology usually works with hybrid and private networks while dealing with financial works. This increases the rate of transaction to a hundred per second. Hence, blockchain enhances the performance and scalability of a company.

-

Privacy

Fintech companies are adopting blockchain applications as they provide better privacy with the help of various tools. This technology can easily enhance the privacy of a company while making it extremely transparent for consumers and clients.

-

Uniform Data

Blockchain applications make sure that a company has uniform data by implementing the same rule for data transmission and data nodes. This method also keeps the data unalterable.

-

Reduction of Fees and Settlement Time

Blockchain applications allow a fintech company to eliminate all the third parties with whom it used to work earlier. This shift from the traditional financial system to the blockchain system reduces the service fees of such companies by almost 80%.

With the assistance of blockchain applications, a fintech company can reduce its settlement time as well. Waiting time for certain transactions has been reduced from three or four days to a few seconds.

-

Trust and Security

Blockchain applications have improved security for various fintech companies. Due to this reason consumers and clients have re-gained their trust in such fintech companies. Blockchain technology allows the usage of security code that can not be easily tampered with by any hacker or third party.

This makes it impossible for the hacker to hack the system. This kind of security and transparency by blockchain technology automatically builds trust among the clients as well as the customers. Blockchain also acts as a trusted ledger that can be used for managing, storing, and transmitting data.

Real-Life Blockchain Use Cases in Fintech Industry

There are various real-life blockchain use cases in the fintech industry. These cases have been elucidated below:

-

Digital Payments

Fintech companies use various blockchain applications to make digital payments easier with the assistance of certain services. These services are cross-border money transactions, security settlements, trading of cryptocurrency, etc. In real life, some platforms like Coinbase allow users to buy and transfer digital currencies like cryptocurrency.

-

Trading

With the introduction of the decentralised finance (DeFi) system, trading has become decentralised from various exchanges. The technology no longer allows intermediaries to intervene during a trading procedure. It also supervises the demand and supply of a trade before creating a rate.

Uniswap is a real-life decentralised trading company that allows users to trade independently without involving intermediaries.

Conclusion

Blockchain technology is going to stay and evolve in the fintech industry. Hence, companies are steadily hiring employees who are well-versed with blockchain. To stay in the competition various companies are enrolling their senior employees in the senior leadership programme that will provide knowledge about blockchain.

Imarticus Learning in collaboration with the Indian School of Business (ISB) has a senior leadership programme in fintech. This programme is ideal for those who want to learn more about blockchain and fintech. Enrol now to boost your career.

Frequently Asked Questions (FAQs)

- What is Fintech Blockchain?

The amalgamation of fintech and blockchain together is known as fintech blockchain or decentralised finance (DeFi). It assists in creating a new and stronger security and operation system for a fintech company.

- What are the various blockchain tools?

The various blockchain tools are solidity, geth, Web3.js, ganache, embark, remix, etc.

- What are the most common blockchain use cases in the fintech industry?

There are various blockchain use cases in the real world. Blockchain can be used in healthcare, cross-border payment, asset management, cryptocurrency, etc.

- What are the different types of Blockchain?

There are four various types of blockchains. These are plain blockchain, private blockchain, hybrid blockchain, and consortium blockchain.