Table of Contents

Most people search for the investment banking course duration because they want certainty. They want to know how long life will be on hold. They want to know when the effort starts paying back. They are not really asking about months or years. They are asking when things start making sense.

Think about the first time you learned to ride a bike. Someone may have told you it takes a week. Someone else said it takes a day. Neither answer helped. What mattered was when the balance clicked. Investment banking works the same way. The duration of investment banking certification is not fixed because understanding does not follow a calendar.

Some learners grasp valuation in weeks. Others take months. Some understand financial statements quickly but struggle with modelling. Others build models fast but take time to explain them. That is why asking only for the duration of investment banking course often leads to frustration.

Now pause for a moment and ask yourself a simpler question:

→ When do you want to read a deal headline and instantly understand what is happening behind it?

→ When do you want interviews to feel like conversations instead of interrogations?

→ When do you want Excel to feel familiar instead of intimidating?

Those moments define the real investment banking course duration. This blog is written to help you see timelines clearly. Not as promises. Not as shortcuts. But as practical paths that real people follow. Paths that respect how learning actually happens. If you stay with it, the rest will help you map your own duration with clarity rather than guesswork.

Did You Know? Recruitment reports published by firms like Michael Page show that candidates with hands-on modelling exposure receive interview calls faster than those with only theoretical finance degrees. This data explains why investment banking courses duration focuses heavily on applied learning today.

What Investment Banking Really Involves and Why Duration Is Never Fixed

Open a business newspaper on any random day. A company raises capital. Another acquires a competitor. A private equity fund exits an investment. These headlines look simple on the surface. Behind each one sits an investment banking team turning decisions into numbers and numbers into action.

That is what investment banking looks like in practice.

The work is not about theory. It is about execution. A client wants to raise money. The banker decides how. A company wants to buy another business. The banker checks if the price makes sense.

Every step needs structure. Every number needs logic. Every assumption needs support. This is where the investment banking course duration begins to make sense. The role demands more than basic finance knowledge. It demands the ability to connect numbers to real business outcomes under time pressure. When people ask me – What is investment banking, I often explain it through a simple example.

Imagine helping a friend buy a house. You compare prices. You check affordability. You think about future value. You explain risks. Now scale that decision to companies worth thousands of crores. Add deadlines. Add legal checks. Add investors. That is investment banking.

To handle this kind of work, bankers rely on a core set of activities.

| Core Activity | How It Shows Up in Daily Work |

| Financial modelling | Testing scenarios and deal outcomes |

| Valuation | Estimating what a business is worth |

| Deal analysis | Understanding why a transaction makes sense |

| Documentation | Preparing materials for clients and investors |

| Communication | Explaining numbers clearly to non-finance teams |

Each activity uses a different skill. Modelling needs accuracy. Valuation needs judgement. Communication needs clarity. These skills do not develop at the same speed. That is why the duration of the investment banking course varies so widely.

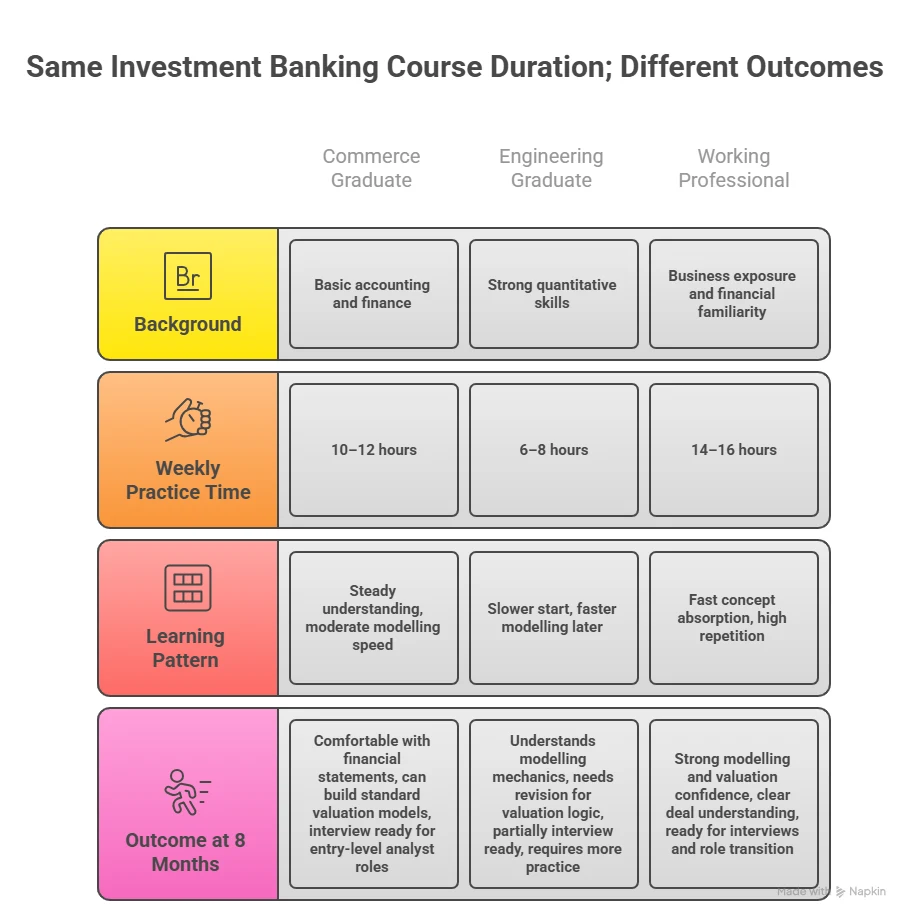

Someone with an accounting background may understand financial statements quickly but struggle with storytelling. Someone from engineering may build models fast, but needs time to grasp valuation logic. The investment banker’s duration stretches or compresses based on these gaps.

This also explains why the investment banking course duration cannot be measured only in months. Learning investment banking is closer to learning a language than memorising a subject. You start by understanding words. Then sentences and their meaning. Fluency arrives later.

Many aspiring finance professionals hear the term investment banking long before they fully understand what the work actually involves. Understanding what an investment banker really does brings clarity to why certain technical skills, analytical thinking, and communication abilities are emphasised during the investment banking course duration and later assessed during hiring.

Investment Banking Course Duration by Learning Route

People often compare course lengths without realising that the starting point changes everything. A finance graduate, an engineer, and a working professional will not follow the same learning curve, even if they enrol in similar programs. The investment banking course duration varies because each learning route builds on different foundations, prior knowledge, and career goals.

Understanding these routes, along with investment banking eligibility, helps set realistic expectations about how long skill development and job readiness will actually take. There is no single route into investment banking. Each route carries its own timeline.

Short Duration Certification Route

This route suits people who already work in finance or accounting. The investment banking course duration here usually ranges from 2 to 6 months. These are short-duration courses on investment banking. They focus on:

- Financial modelling

- Valuation

- Deal basics

They move fast because fundamentals already exist. Think of this like learning to drive an automatic car after years of driving a manual. The adjustment is quick.

Comprehensive Skill-Based Programs

This route suits fresh graduates and career switchers. The investment banking course duration here ranges from 6 to 12 months. This duration allows time for:

- Accounting basics

- Excel mastery

- Financial modelling

- Valuation

- Mergers and acquisitions concepts

This route builds confidence step by step towards building a robust investment banking career path and avoids overload.

Degree-Based Academic Route

This route includes graduation and post graduation. The investment banker duration here stretches longer. It often spans 5 to 7 years. This route suits people targeting global investment banks and long-term academic depth. This duration allows time for:

- In-depth finance and economics education

- Advanced corporate finance and valuation theory

- Research-oriented financial analysis

- Internships during undergraduate and postgraduate study

- Campus placements and global recruiting exposure

Also Read: How BCom Graduates Can Secure a Job in Investment Banking?

Investment Banking Course Duration in India

Investment banking course duration in India is shaped by how the local hiring market evaluates talent. Recruiters focus strongly on applied skills such as financial modelling, valuation, and deal understanding. Academic brand names may open doors, but role readiness depends on what you can do on the job from day one.

Because learners enter the field from very different backgrounds, the investment banking course duration in India does not follow a single path. Instead, timelines for how to become an investment banker depend on prior education, work exposure, and the depth of financial knowledge already built.

Below is a practical comparison of how the duration of investment banking course typically unfolds across major student and professional profiles in India.

Investment Banking Course Duration in India by Profile

This table shows how background changes learning speed.

| Profile | Investment Banking Course Duration |

| Commerce graduate | 6 to 12 months |

| Engineer switching careers | 9 to 12 months |

| CA or CFA candidate | 6 to 9 months |

| Working professional | 6 to 9 months |

| MBA finance student | 4 to 6 months |

Breaking into investment banking often feels competitive, but the path becomes clearer when preparation is structured and intentional. When learners align their investment banking course duration with consistent practice and interview preparation, the transition from training to landing a role becomes far more achievable.

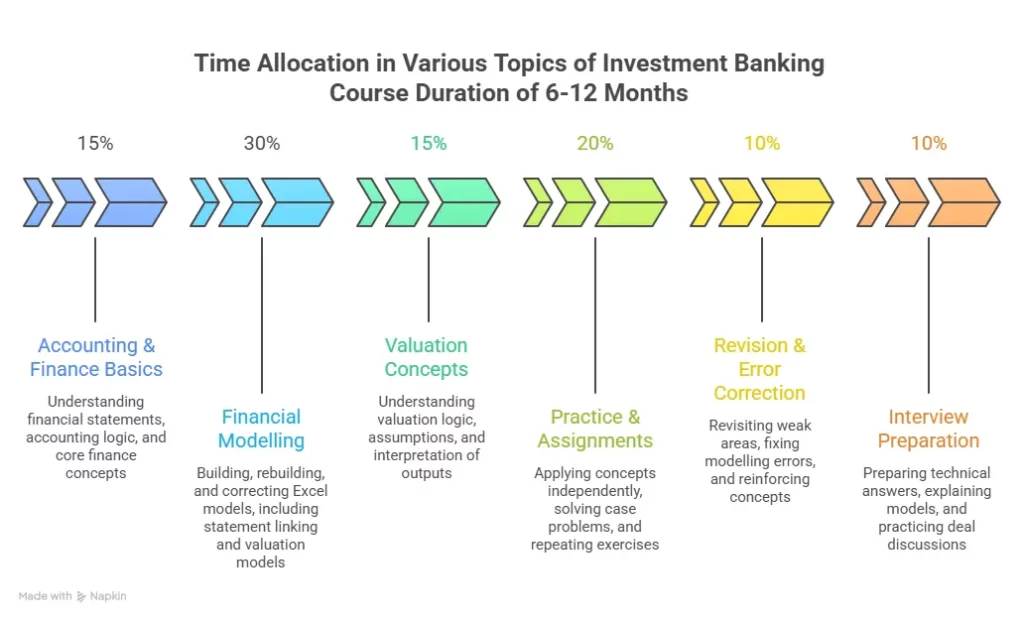

Financial Modelling Course Duration and Its Impact

Financial modelling decides how fast someone becomes employable. A financial modelling course duration usually ranges from 3 to 6 months.

I break this into stages.

- Excel foundations take two weeks

- Financial statement modelling takes one month

- Valuation models take two months

- Deal-based models take one month

The financial modelling course for investment banking duration depends on practice. Someone practicing daily finishes faster. Someone practising on weekends takes longer. This is similar to learning a musical instrument. Daily practice shortens the timeline.

How Financial Modelling Shortens Investment Banker Duration

Strong modelling skills reduce interview preparation time. They also reduce training time after joining. This is why many employers value candidates who complete a structured financial modelling course duration before applying.

- Reduces the time needed to prepare for technical interviews

- Makes valuation concepts easier to understand and apply

- Helps learners grasp deal structures more quickly

- Lowers the training time required after joining a firm

- Improves performance in modelling tests during hiring

There is no universal clock. There is only alignment between skills and opportunity.

Also Read:A Beginner’s Guide to Understanding Investment Banking Operations

How Structure Shapes Investment Banking Course Duration

Two people can spend the same number of months learning investment banking and still end up at very different places. The reason lies in structure. Investment banking course duration is not only about time. It is about how that time is used.

I often explain this with a simple example. Imagine two people learning to cook. One follows a recipe step by step. The other watches random videos. Both spend six months. Only one can cook a full meal without stress. Structure decides outcomes.

The same rule applies to the duration of investment banking course.

Full-Time and Part-Time Learning Timelines

Learning intensity changes timelines.

A full-time program compresses learning. A part-time program stretches it. The total investment banking course duration looks similar on paper but feels very different in practice.

A six-month full-time program often delivers the same depth as a nine-month part-time program. This matters for working professionals who balance jobs and study. Time gaps between sessions slow retention. Continuous exposure speeds it up.

Short Duration Courses on Investment Banking

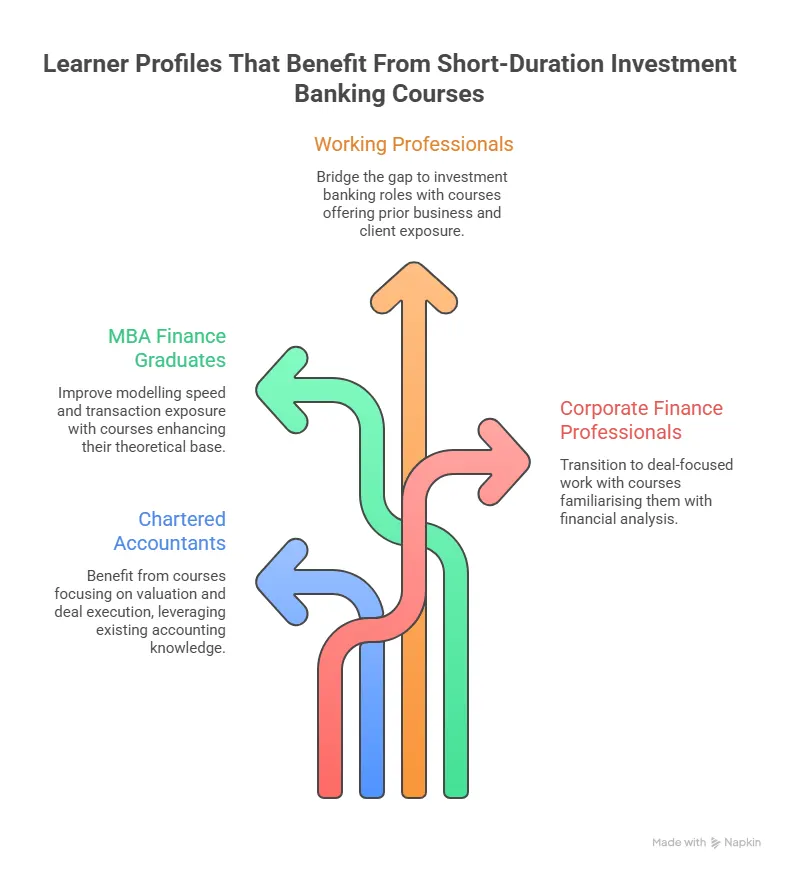

Short-duration courses on investment banking attract a lot of attention. They promise speed. They work well for a specific group.

They suit:

- Chartered accountants

- MBA finance graduates

- Consultants

- Corporate finance professionals

They do not suit complete beginners. The investment banking courses duration stays short here because the base already exists. Speed without base leads to confusion. Speed with base leads to clarity.

Also Read: Investment Banking vs Commercial Banking: What’s the Real Difference?

Investment Banking Course Duration Across Entry Roles

Investment banking job roles do not have a single front door. Many professionals enter through adjacent finance roles and move closer to core deal teams over time. Because of this, the investment banking course duration is not always completed before the first job. In many cases, learning continues alongside work.

Some roles after an investment banking degree provide direct modelling exposure. Others build industry understanding or due diligence skills. Each starting point changes how long it takes to become comfortable handling live transactions. Below is a comparison of common entry roles and how they influence the timeline toward core investment banking responsibilities.

Investment Banking Progression by Entry-Role:

| Entry Role | Typical Starting Responsibilities | Estimated Time to Move Toward Core Deal Roles |

| Research Support Analyst | Industry research, data gathering, and company profiles | 12-18 months |

| Valuation Analyst | Business valuation, financial analysis, and report preparation | 6-12 months |

| Transaction Support / Due Diligence | Financial due diligence, risk review, and data room work | 9-15 months |

| Corporate Finance Executive | Budgeting, forecasting, and internal financial analysis | 12-18 months |

| Audit Associate (Big 4 or similar) | Financial statement review, compliance checks | 9-15 months |

| Equity Research Associate | Financial modelling, sector analysis, and report writing | 6-12 months |

Also Read: Top Tools Every Aspiring Investment Banker Must Master

Interesting Insight→ A report published by the CFA Institute notes that candidates who spend over 300 hours on applied finance skills perform better in technical interviews. This explains why financial modelling course duration matters as much as total course length.

Investment Banking Course Duration and Job Readiness

Job readiness for investment banking roles arrives when three things align at the same time.

- Skill confidence

- Market timing

- Clear role targeting

The investment banking course duration should be long enough to build technical strength and short enough to maintain momentum toward applications.

Many learners finish their coursework but wait too long to start applying, which stretches the overall timeline. Others begin applying earlier and continue refining their skills while interviewing. Both approaches can work, but the balance between preparation and action determines how quickly job readiness turns into job offers.

Key Factors that Influence Job Readiness

Below is a breakdown of how each factor affects readiness and overall timelines.

| Factor | What It Means in Practice | Impact on Overall Timeline |

| Skill Confidence | Comfort with modelling, valuation, and financial statements | Extends preparation by several months |

| Market Timing | Applying when firms are actively hiring | Adds waiting time despite being prepared |

| Clear Role Targeting | Knowing which IB roles match your background | Longer job search and more rework |

| Interview Preparation | Practice with technical and HR questions | More interview attempts needed |

| Practical Exposure | Internships, live projects, or case practice | Slower recruiter confidence |

The duration of investment banking course must allow these three to meet. When one is missing, timelines stretch. Many learners complete coursework on time but delay applications. Others apply early and revise while interviewing. Both paths are valid.

Preparing for investment banking interviews requires more than just knowing formulas. Interviewers focus on how clearly you think, how well you understand financial logic, and how confidently you can explain your reasoning. It also highlights the gap between learning concepts during your investment banking course duration and applying them under pressure in an interview setting.

How Salary Connects With Investment Banking Course Duration

Investment banking salary in India depends on role, firm, and location. Course duration influences skill depth. Skill depth influences role quality.

Based on recruitment insights shared by firms like Michael Page and Hays, entry-level investment banking roles in India often fall within the following range.

| Experience Level | Monthly Salary Range in India |

| Fresher Analyst | INR 50,000 to 80,000 |

| Analyst with internship | INR 70,000 to 1,20,000 |

| Associate level | INR 1,50,000 and above |

Completing a structured investment banking course duration improves access to higher brackets by improving role fit.

How Investment Banking Course Duration Affects Salary Growth Speed

The investment banking course duration not only influences the starting salary. It also affects how quickly professionals move up the pay scale after entering the industry.

- Strong foundations reduce the time needed to become independently productive

- Faster productivity often leads to earlier performance-based raises

- Employees who require less supervision are considered for bigger responsibilities sooner

- Better technical readiness increases the chances of moving to higher-paying deal teams

- Strong early performance improves eligibility for bonuses and variable pay

Also Read: Investment Banking Pay Compared to Other Finance Career Options

Skills Acquired During the Investment Banking Course Duration

Investment banking skills do not arrive at once. They develop gradually. By the end of a well-paced duration of investment banking course, most learners build strength in the following areas.

| Skill Area | How It Develops Over Time |

| Financial analysis | Improves with repeated model building |

| Excel efficiency | Increases with daily use |

| Valuation logic | Deepens through case practice |

| Business understanding | Grows with deal exposure |

| Communication | Sharpens through explanations |

These skills compound. Early months feel slow. Later months feel faster.

Also Read: How to Break into Investment Banking: A Step-By-Step Guide for Students

Why Imarticus Learning Stands Out for Your Investment Banking Course?

If you are thinking about planning your investment banking course duration in a way that leads to real industry readiness, choosing the right learning partner matters. Imarticus Learning’s Investment Banking Course is designed with outcomes in mind, especially for finance graduates and early professionals seeking practical job skills and placement support.

- Structured Industry-Endorsed Curriculum that covers essential areas of investment banking operations, including securities operations, risk management, anti-money laundering, asset management, and financial markets.

- Flexible Program Duration Options offering both shorter and extended formats (such as 2.5 months on weekdays or 5 months on weekends), helping you plan your investment banking course duration around your current commitments.

- High Placement Record with an average placement rate of around 85% and job support for freshers and early professionals.

- Guaranteed Interview Opportunities with a minimum of 7 interviews, supported by a network of 1000+ recruiting partners.

- Job Assurance Support tailored for graduates with 0-3 years of experience, designed to convert training into real employment outcomes.

- Large Alumni Community of 50,000+ learners and 1200+ batches, giving you access to a wide professional network and peer support.

Choosing the right foundation for your investment banking course duration can make the difference between vague timelines and a plan that drives real opportunity. The investment banking program by Imarticus is structured to help learners move from understanding fundamentals to building job-ready capabilities in a time frame that respects practical expectations and industry demands.

FAQs on Investment Banking Course Duration

Questions around investment banking courses duration are common because learners come from different educational and career backgrounds. These frequently asked questions address the most important concerns students and professionals have while planning their investment banking course duration and career path.

How long is the investment banking course?

The investment banking course duration varies based on background and learning format. For most learners, the duration of investment banking course falls between six and twelve months. Short-duration programs work for professionals with finance exposure. Beginners benefit from longer timelines. Many learners complete investment banking courses duration in India through structured programs offered by Imarticus Learning, which focus on applied skills and gradual readiness.

Which is better, CA or an investment banker?

A CA follows a regulated exam-based path. An investment banker builds deal-focused skills. The investment banking course duration for a CA is shorter because accounting knowledge already exists. Both careers offer strong growth. The better option depends on interest, work style, and long-term goals rather than duration alone.

What are the top 3 courses in finance?

The most popular finance courses depend on career intent. Investment banking programs rank high due to deal exposure. Financial modelling programs rank high due to practical application. Risk and portfolio management courses attract those interested in markets. Programs that integrate a financial modelling course duration with an investment banking context offer faster employability. Imarticus Learning designs these combinations for career readiness.

Is investment banking very hard?

Investment banking feels demanding because it requires precision and discipline. The difficulty reduces when learning is structured. A realistic investment banking course duration spreads learning evenly. Concepts become familiar with repetition. With the right financial modelling course for investment banking duration, the workload feels manageable rather than overwhelming.

How to start a career in investment banking?

Starting requires clarity on the entry point. A student benefits from a full investment banking course duration that builds fundamentals. A professional benefits from short-duration courses on investment banking that focus on deal skills. Choosing the right learning path with Imarticus Learning reduces total investment banker duration and improves confidence during interviews.

Is 25 too old for investment banking?

Age does not restrict entry. At 25, the investment banking course duration fits well within career timelines. Many professionals switch roles at this stage. Maturity often improves communication and decision-making. With focused learning and a defined financial modelling course duration, transitions remain smooth.

What is the monthly salary for investment banking?

Monthly salary depends on role and skill level. Entry-level roles in India often range between ₹50,000 and ₹1,20,000 per month. Completing a structured investment banking course duration improves chances of entering higher-paying roles by improving skill alignment.

What skills are needed for investment banking?

Core skills include financial modelling, valuation, business understanding, and communication. These skills develop steadily over the investment banking courses duration. Technical confidence grows with practice. Communication improves with explanation. A balanced investment banking course duration ensures all skills mature together rather than in isolation.

Deciding the Right Investment Banking Course Duration for Your Journey

By now, the idea of investment banking course duration should feel clearer and calmer. There is no single clock that fits everyone. The duration of investment banking course depends on where you start, how you learn, and what role you aim for. Some paths move fast. Some take patience. Both can lead to strong outcomes when planned well.

The investment banking courses duration works best when learning follows a sequence. Concepts first. Practice next. Application after that. The balance lies in choosing a duration that allows repetition, confidence, and steady progress.

For students and professionals alike, the most effective investment banker duration is one that fits daily life. It should allow time to practice models, revisit concepts, and understand how deals actually work. When learning feels connected instead of scattered, timelines shorten naturally. The same applies to the financial modelling course duration. Strong modelling skills reduce confusion later. They improve interviews and shorten on-the-job learning. This is why many learners now treat modelling as the core of their investment banking course duration rather than an add-on.

If you are planning your next step, start by being honest about your starting point. Look at how much time you can give each week. Decide how quickly you want to be job-ready. Then choose a path that respects that reality. Structured programs help here. They reduce guesswork by organising learning in the right order. The Investment Banking Course with Imarticus Learning is designed around real hiring expectations in India. For many learners, this kind of structure helps turn the duration of investment banking course into a clear and achievable plan rather than an open-ended goal.