Table of Contents

Investment banking courses fees often look confusing at first glance. Two programs promise similar outcomes. One costs a fraction of the other. Another charges more without explaining why. This is usually where doubt begins. Not because the fees are high. Because the logic behind them is missing.

Most people approach fees the way they approach shopping. They scan numbers. They compare price tags. They move on. That works for everyday purchases. It breaks down when learning is involved. Education behaves differently because it compounds. Another common assumption is that investment banking certification fees rise only because of brand names or location. That belief does not hold up once you look closer. Fees rise when learning moves from theory to application.

Many learners feel stuck choosing between short and long programs. Some worry about cost. Others worry about time. Both concerns are valid. The missing piece is understanding how investment banking courses’ fees align with learning momentum. Short programs give exposure. Longer ones build rhythm. Rhythm is what turns knowledge into habit.

This guide is meant to remove the fog. Not by pushing choices. Not by ranking programs. But by explaining how fees behave and why they do. Once that clarity settles in, choosing the right path becomes less stressful and far more deliberate.

Understanding the Investment Banking Basics

Before looking at investment banking courses fees, it helps to slow down and understand the work itself. Many fee decisions become clearer once the role is understood properly. Without that context, fees feel arbitrary. With it, they start to follow a pattern.

At its core, investment banking is about helping companies raise capital, manage large financial decisions, and execute complex transactions. This includes activities like mergers and acquisitions, valuations, capital raising, and advisory work. When someone asks what is investment banking, the simplest answer is that it sits at the intersection of finance, strategy, and execution.

The work is detail-driven. Analysts and associates spend long hours building financial models, reviewing financial statements, and preparing materials that guide high-value decisions. Precision matters because small errors can lead to large consequences. This intensity explains why investment banking training focuses heavily on structure and practice.

To make this easier to visualise, here is how typical investment banking work breaks down.

| Area of Work | What It Involves |

| Financial analysis | Studying company performance and forecasts |

| Valuation | Estimating company value using structured methods |

| Deal execution | Supporting mergers, acquisitions, and capital raises |

| Client support | Preparing presentations and transaction materials |

Each of these areas requires different skills. Learning all of them at a surface level takes time. Learning them well takes structured effort. This is where investment banking courses fees begin to vary.

Courses that introduce investment banking focus on awareness and fundamentals. They explain terminology, basic valuation logic, and how roles fit together. These programs are shorter and usually cost less. Courses that prepare learners for analyst-level work go much deeper. They spend weeks on modelling, scenario analysis, and case-based learning. This depth directly impacts investment banking courses fees.

Another important point is how skills are built. Investment banking is not learned by reading alone. It relies on repetition. Models are built, reviewed, corrected, and rebuilt. Feedback plays a central role. Programs that create room for this process require more instructional time and support. That support influences fees.

Here is how learning depth typically aligns with course focus.

- Introductory programs explain what investment banking does and how roles function

- Skill-focused programs train learners in modelling and valuation tasks

- Advanced programs simulate real-world workflows and decision-making

Each level builds on the previous one. Each step adds complexity. Investment banking courses fees rise as learning moves closer to real job expectations.

Understanding investment banking starts with clarity on what the role actually involves on a day-to-day basis. This segment walks through the responsibilities of an investment banker, the skills used in real work situations, and how different roles fit within a bank. It helps connect course learning with practical expectations and makes the overall career path easier to visualise.

Also Read: How to Become an Investment Banker in India: Career Path, Skills & Certification Guide

What Do Investment Banking Fees Actually Pay For

Before looking at numbers, it helps to understand what sits inside them. Fees for investment banking courses are not just tuition.

They usually cover:

- Core finance concepts like valuation and accounting

- Practical tools such as Excel and modelling templates

- Industry-aligned case studies

- Faculty time and mentoring

- Assessments and certifications

- Career support in some formats

Think of it like buying a smartphone. You pay for the hardware, the software, and the service network. Courses work the same way.

Investment banking fees rise sharply when a program includes live simulations or deal-style projects. These need experienced trainers and structured evaluation. That cost flows into the fee.

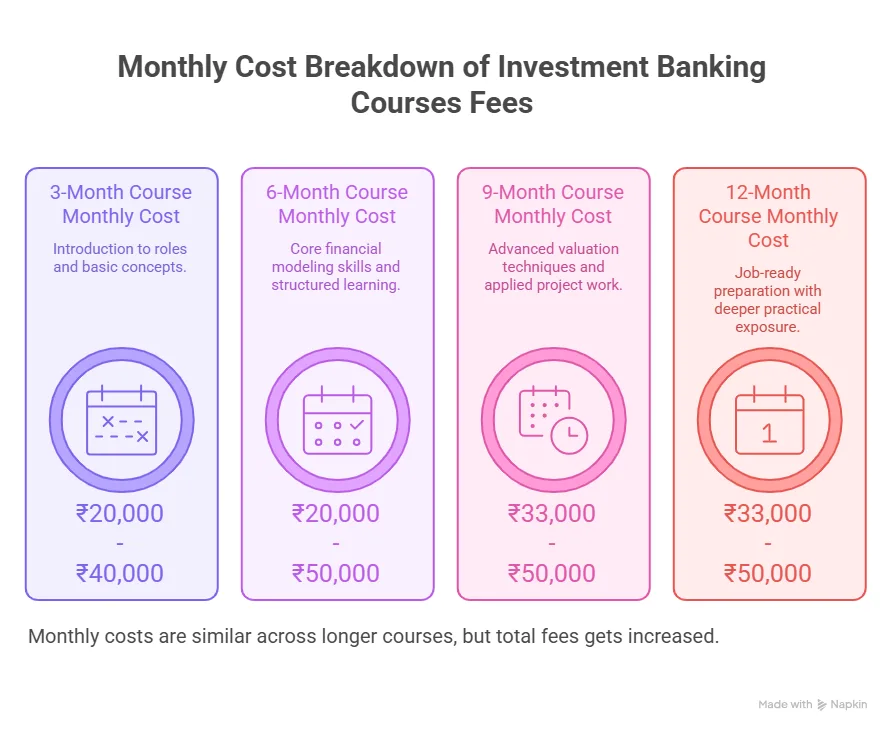

Investment Banking Course Duration and Fees Move Together

Duration plays a major role in pricing. Short programs cost less. Longer programs cost more due to extended access and depth.

Here is how investment banking course duration and fees usually align.

| Course Length | Typical Fee Range |

| 2 to 3 months | ₹40,000 to ₹90,000 |

| 4 to 6 months | ₹1lakh to ₹3lakh |

| 9 to 12 months | ₹3lakh to ₹6lakh |

Longer programs cover valuation in detail. They spend time on financial statements. They include scenario analysis. Short courses focus on the basics and role exposure.

When someone asks about the investment banking course fee, I always suggest matching the duration with the career stage. A student exploring finance needs less depth. A working professional needs more structure.

Also Read: The Best Investment Banking Course in India

Understanding Investment Banking Course Fees in India by Category

Investment banking course fees in India become easier to understand once courses are viewed by category rather than by name alone. Different programs are built for different learning goals, timelines, and career stages. When courses are grouped by structure and depth, the fee ranges begin to show a clear pattern instead of appearing random.

Investment banking courses in India fall into clear groups. Each group has a fee band.

Foundation level courses

- Focus on basics

- Short duration

- Lower investment banking fees

Skill-focused certifications

- Modelling and valuation-heavy

- Mid-range pricing

- Strong job relevance

Professional programs

- End-to-end investment banking coverage

- Longer duration

- Higher fees due to depth

| Course Category | Typical Duration | Investment Banking Courses Fees Range |

| Short Online Certifications | 1-3 months | ₹30,000 – ₹75,000 |

| Foundation Certificate Courses | 2-4 months | ₹50,000 – ₹1,20,000 |

| Professional Certification Programs | 3-6 months | ₹75,000 – ₹3,50,000 |

| Advanced Specialised Courses (Valuation/Modelling) | 3-6 months | ₹70,000 – ₹1,50,000 |

| Comprehensive Post Graduate or Diploma Level | 6-12 months or more | ₹1,50,000 – ₹6,00,000+ |

Investment banking courses fees in India increase as programs move closer to front-end roles. Courses that prepare for analyst or associate roles need more hands-on work.

Financial Modelling and Valuation Course Fees

Modelling sits at the heart of investment banking. Courses that teach valuation well command higher fees. Financial modelling and valuation course fees usually range from ₹60,000 to ₹3L. The range depends on the complexity taught. A basic DCF course costs less. A full valuation track costs more. These courses teach how numbers connect. Revenue flows into cash flow. Cash flow impacts valuation. This skill has strong market demand.

FMVA Course Fees in India

The FMVA program is popular among learners aiming for global standards. FMVA course fees in India typically fall between ₹3L and ₹5L. People choose FMVA when they want consistency and international alignment. The fee reflects that positioning.

FMVA course fees reflect:

- Global curriculum

- Case-based learning

- Structured assessments

CIBOP Course Fees and Operations Roles

Not all investment banking roles sit on the front end. Operations roles support deal execution. CIBOP course fees usually range from ₹1L to ₹2.5L. Certified Investment Banking Operations Professional fees stay lower than front office programs. The skill set focuses on trade processing and compliance. These courses suit those who want to enter banks through operations and later move internally.

AML Course Fees and Compliance Learning

Compliance has grown in importance. AML course fees remain affordable compared to investment banking programs. Anti-money laundering course fees range from ₹25,000 to 1 Lakh. These programs focus on risk control. They suit learners interested in governance roles. AML certifications often act as add-ons rather than full career tracks.

Institute of Professional Banking Course Fees

Institute-based programs offer structured learning. Institute of Professional Banking course fees vary widely. Fees depend on the delivery mode and recognition. Most programs fall between ₹1.5 and 4Lakh. Classroom access and mentorship raise the price.

Bank Course Fees vs Investment Banking Fees

Many confuse bank course fees with investment banking fees. Banking courses focus on retail and operations. Investment banking focuses on deals and capital markets. Bank course fees are usually lower. They range from ₹20,000 to 1 Lakh. Investment banking fees rise due to technical depth. When someone searches banking course near me with fees, they often see local options. These serve a different purpose than investment banking tracks.

Also Read: CIBOP Course Benefits For Your Investment Banking Career

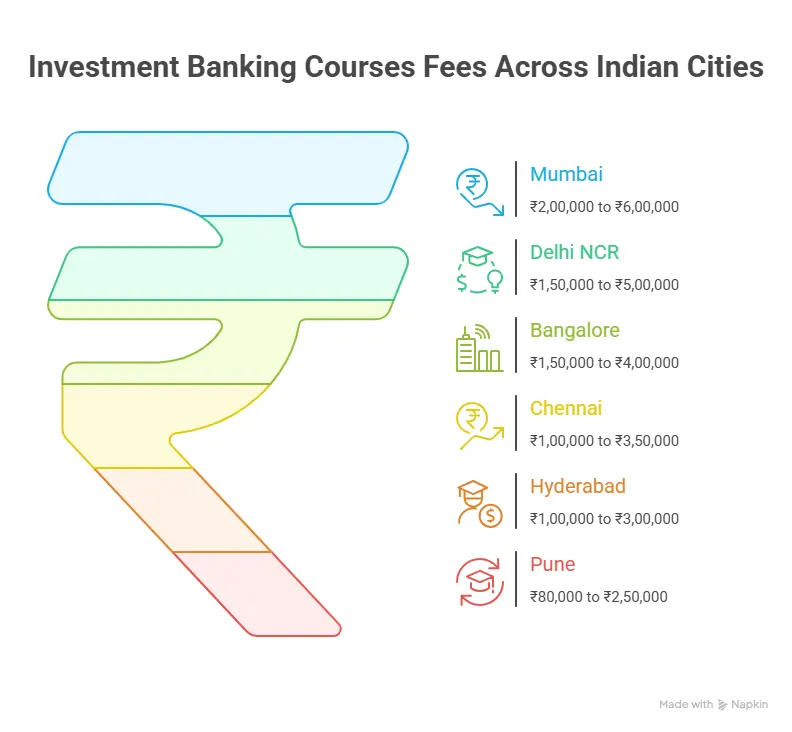

Location-based Investment Banking Courses Fees and Learning Exposure

Fees often change when the same course is offered in different cities. This is not random pricing. It reflects the cost of faculty, access to industry speakers, and placement exposure. Investment banking courses fees in India show clear city patterns once you look closely. A simple way to understand this is to think about rent. The same apartment costs more in a business district than in a residential area. Courses behave similarly.

| City | Typical Investment Banking Courses Fees | Why Fees Are in This Range |

| Mumbai | ₹1,60,000 – ₹4,00,000+ | Higher due to the city’s financial market hub status, greater industry exposure, and demand for practical finance programs. |

| Delhi NCR | ₹1,20,000 – ₹3,50,000 | Moderately high fees because of broader academic and industry linkages and structured certification options. |

| Bangalore | ₹90,000 – ₹3,00,000 | Strong focus on technical skills like financial modelling and analytics, where practical depth influences fees. |

| Hyderabad | ₹50,000 – ₹2,50,000 | Competitive fees with some affordable training options that balance practical and theoretical content. |

| Chennai | ₹50,000 – ₹2,50,000 | Fee ranges reflect programs that emphasise fundamentals and discipline at accessible pricing. |

| Pune | ₹50,000 – ₹3,00,000 | Lower operational costs and student-oriented programs keep fees moderate while maintaining quality training. |

Also Read: Global Salary Report: What Investment Bankers Earn in US, UK, India & Singapore

Investment Banking Courses Fees in Mumbai

Mumbai remains the financial centre of India. Many banks and advisory firms operate here. This proximity affects investment banking courses fees in Mumbai. Learners pay more because exposure is higher. Classroom discussions often include live market examples. This raises value and cost.

Most programs in Mumbai fall between ₹2L and ₹6L. Fees rise when:

- Faculty are active professionals

- Guest sessions include deal teams

- Placements link to front office roles

Investment Banking Course Fees in Delhi NCR

Delhi offers a different mix. Courses blend finance with consulting and policy exposure. Investment banking course fees in Delhi usually range from ₹1.5 to 5 Lakhs. Delhi programs suit learners who like structured theory mixed with practical finance.

Fees depend on:

- Strong presence of business schools and finance institutions that emphasise academically rigorous curricula

- Heavy use of consulting-style case discussions alongside investment banking concepts

- Faculty profiles that often include former consultants, policy advisors, or corporate finance professionals

Investment Banking Courses Fees in Bangalore

Bangalore focuses strongly on analytics and modelling. Investment banking courses fees in Bangalore range from ₹1.5 to 4 Lakhs. This city attracts learners with tech and engineering backgrounds. Fees reflect the technical orientation.

Courses here emphasise:

- Access to a large pool of professionals from fintech, analytics, and technology consulting who contribute to faculty and guest instruction

- Strong alignment between finance programs and corporate finance teams within global technology firms headquartered in the city

- Course design that assumes higher baseline comfort with numbers, reducing time spent on fundamentals and increasing time spent on advanced modelling

Investment Banking Courses Fees in Chennai

Chennai programs often focus on strong fundamentals. Investment banking courses fees in Chennai range between ₹1 and 3.5 Lakhs. Fees remain moderate due to lower operating costs.

These courses suit learners who prefer:

- Strong presence of commerce and accounting colleges that feed into investment banking training pipelines

- Curriculum frameworks influenced by traditional finance education and audit-linked skill sets

- Faculty profiles rooted in academic finance, accounting, and corporate finance roles

Investment Banking Courses Fees in Hyderabad

Hyderabad offers growing finance education options. Investment banking courses fees in Hyderabad range from ₹1 to 3 Lakhs. This keeps fees accessible for early-career learners.

Programs focus on:

- Presence of global banks and financial institutions with large operations, risk, and analytics teams based in the city

- Strong demand for entry-level talent in middle-office and back-office investment banking functions

- Curriculum designs that prioritise process understanding, reporting, and analytical accuracy

Investment Banking Courses Fees in Pune

Pune stands out for affordability. Investment banking courses fees in Pune often range from ₹80,000 to ₹2.5L. Pune suits learners testing finance before committing heavily.

Investment banking courses in Pune fees remain lower due to:

- High concentration of universities and professional colleges that support academically driven finance programs

- Course design that prioritises foundational understanding over immediate role readiness

- Faculty networks drawn largely from academia and local industry, rather than national finance hubs

Also Read: A Beginner’s Guide to Understanding Investment Banking Operations

Understanding Fees for Different Learner Profiles

Most blogs list courses. A better way is to look at who the course suits. Fees change with the learner’s stage.

Students and Fresh Graduates

They need exposure and basics. Fees usually stay between ₹50,000 and ₹2L. Programs focus on:

- Accounting basics

- Introduction to valuation

- Role awareness

Investment banking course fees in India at this stage should stay controlled.

Working Professionals Switching Careers

They need depth and structure. Fees rise to ₹2L to ₹5L. Programs include:

- Advanced modeling

- Deal logic

- Case analysis

Investment banking fees increase due to complexity.

| Learner Profile | Typical Investment Banking Courses Fees in India | Skills & Focus Areas |

| Students and Fresh Graduates | ₹50,000 – ₹2,00,000 | Accounting basics, introduction to valuation, and role awareness |

| Working Professionals Switching Careers | ₹2,00,000 – ₹5,00,000 | Advanced financial modelling, deal logic, case analysis, and applied projects |

| Mid-Career Finance Professionals | ₹1,50,000 – ₹4,00,000 | Advanced valuation, portfolio insights, and deal strategy |

| Career Enhancers / Role Upgraders | ₹1,00,000 – ₹3,50,000 | Skill refreshers, real case simulations, and advanced Excel tools |

| International Certification Seekers | ₹3,00,000 – ₹6,00,000+ | Global standards, multi-module assessment, and industry projects |

| Part-Time Working Learners | ₹1,50,000 – ₹4,50,000 | Flexible pacing, modeling and valuation spread over a longer duration |

How Six-Month Investment Banking Courses Are Priced

Many search for short formats. A six-month program balances time and depth.

Typical fees for a 6-month banking course range from ₹1L to ₹3L. Fees rise if:

- Live projects are included

- Mentorship is offered

- Placement support exists

Duration alone does not decide fees. Content depth matters more.

Also Read: How BCom Graduates Can Secure a Job in Investment Banking?

Choosing Investment Banking Courses Based on Budget Bands

Choosing an investment banking course becomes much easier when the decision starts with a clear budget. Different fee ranges open access to different levels of learning, depth, and career preparation. By grouping investment banking courses based on budget bands, it becomes simpler to match fees with expectations and avoid overcommitting too early or underinvesting in essential skills.

| Budget Band | Typical Course Types | What Learners Usually Gain | Who Does This Band Suit Best |

| Under ₹50,000 | Introductory programs, AML courses, basic banking certifications | Awareness of investment banking roles, basic finance terminology, and early exposure to the industry | Students and beginners exploring finance before a deeper commitment |

| ₹50,000 to ₹2,00,000 | Foundation investment banking courses, entry-level modelling programs | Core accounting knowledge, basic valuation skills, structured understanding of workflows | Fresh graduates and early-career learners building fundamentals |

| ₹2,00,000 to ₹5,00,000 | Professional investment banking programs, FMVA and advanced tracks | Advanced financial modelling, valuation depth, job-ready skills, and applied learning | Career switchers and professionals aiming for analyst-level roles |

Fees for investment banking courses align well within these bands.

Building a career in investment banking often comes down to preparation, timing, and understanding how roles actually work behind the scenes. This segment brings together practical perspectives on how candidates position themselves for investment banking roles, the skills employers look for, and the steps that can move a profile from interest to opportunity.

Also Read: Who Earns More: Chartered Accountant or Investment Banker?

Who Can Take Investment Banking Courses

Eligibility is broad. Most investment banking courses accept graduates from any stream. Commerce students find it easier at first. Engineers and science graduates catch up quickly with practice.

Basic eligibility usually includes:

- A graduate degree or final year status

- Comfort with numbers

- Willingness to learn Excel and finance basics

Investment banking course fees in India do not depend on academic background. They depend on course depth.

Exams That Support Investment Banking Careers

There is no single entrance exam for investment banking. Skills matter more than scores. Each exam targets a different role. Fees vary based on preparation support.

Common exams and certifications include:

- CFA Program

- FMVA certification

- CIBOP certification

- Short-term valuation tests

Best Age to Start Investment Banking Preparation

Age is flexible. Many start early. Some switch careers later. Investment banking fees remain the same across age groups. Outcomes depend on effort and clarity.

Typical age ranges:

- 18 to 22 for students exploring finance

- 23 to 30 for career switchers

- 30 plus for skill-focused upgrades

Entry Path for Various Investment Banking Courses

Joining investment banking happens through structured steps.

| Entry Path | How This Path Works | Prerequisites for Entry |

| Campus Placements | Students are hired directly from colleges through structured recruitment drives | Strong fundamentals, accounting clarity, and basic valuation awareness |

| Internships During Courses | Learners take internships alongside or after course completion to gain exposure | Excel skills, basic modelling, and understanding of deal workflows |

| Analyst Roles Through Certification Programs | Candidates qualify for analyst roles after completing skill-focused certifications | Financial modelling, valuation techniques, and attention to detail |

| Operations Entry Followed by Internal Movement | Learners enter banks in operations roles and later move to core teams | Process understanding, compliance knowledge, and reporting skills |

| Career Switch Through Professional Programs | Working professionals transition from other fields into investment banking | Strong modelling skills, business understanding, and time management |

Courses with a strong structure make these paths clearer. This is why fees differ.

Also Read: Investment Banking vs. Commercial Banking: Know the Difference

Why Choose Imarticus Learning for Your Investment Banking Certification

When evaluating investment banking courses fees, it helps to connect cost with the value you receive in return. Not all programs are built the same. Some focus just on theory. Others are designed with industry input, placement confidence, and applied learning at their core. For learners who want transparent skills, real exposure, and a practical path into finance, here’s a clear look at the key reasons why doing an investment banking course with Imarticus Learning can be a smart choice:

- The Certified Investment Banking Operations Professional (CIBOP™) program equips learners with a deep understanding of complex financial products and trade life cycles.

- The program offers flexible duration options (e.g., 3-month full-time or 6-month part-time) to suit both fresh graduates and working professionals.

- Imarticus Learning’s training includes practical, project-oriented exercises and case studies, not just theoretical modules, helping learners build applied competence.

- The CIBOP certification is backed by a track record of trained learners and placement outcomes, supported by an extensive network of hiring partners.

- The program connects learners with multiple guaranteed interview opportunities with financial firms, adding confidence around the investment of time and fees.

- Courses are offered both in classroom and live online formats, giving flexibility without compromising structure or support.

FAQs on Investment Banking Courses Fees

Questions about investment banking courses fees usually come up when people are trying to decide if a course fits their plans. Some want to know the cost. Others want to know if the fees are worth it. Here, I have answered the most frequently asked questions with clear explanations, so investment banking feels easier to understand and easier to plan for.

What is the cost of an investment banking course?

The cost of an investment banking course depends on depth and delivery. Investment Banking Fees in India usually range from ₹40,000 for short foundation programs to ₹6L for advanced professional tracks. Fees rise when courses include financial modelling, valuation, and career support. Imarticus Learning often sit in the mid to higher range because they combine skill training with placement-focused preparation. Investment Banking Fees should always be judged against duration and outcomes rather than the headline number.

Which course is best for investment banking?

The best course depends on career goals. For front-end roles, courses that focus on valuation and modelling work best. These courses usually have higher Investment Banking Fees because they teach practical skills used daily at work. Certifications like FMVA and structured programs offered by Imarticus Learning suit learners aiming for analyst roles. Investment Banking Fees feel justified when the course mirrors real job tasks.

What are the fees of 6 months banking course?

A six-month banking course usually costs between ₹1L and ₹3L. Investment Banking Fees in this range reflect balanced learning. These programs cover accounting, modelling basics, and industry exposure. Fees increase if mentorship and interview preparation are included. A six-month format works well for those who want depth without a long-term commitment. Investment Banking Fees here offer strong value when the content is applied immediately.

How much are investment banking fees?

Investment Banking Fees vary widely. In India, they start around ₹40,000 for short programs and go up to ₹6L for advanced professional courses. Fees change based on city, duration, and skill coverage. Investment Banking Fees in Mumbai and Delhi remain higher due to industry access. Fees also rise when courses include live projects and structured assessments.

Who is eligible for the investment banking course?

Most graduates are eligible for investment banking courses. There is no strict stream requirement. Investment Banking Fees do not change based on eligibility. What matters is commitment to learning finance. Courses often start from the basics and build gradually. Imarticus Learning design programs that support learners from diverse backgrounds while maintaining industry standards. Investment Banking Fees reflect this structured approach.

Which exam is for an investment banker?

There is no single exam for becoming an investment banker. Certifications like CFA, FMVA, and CIBOP support different roles. Investment Banking Fees related to exam preparation depend on the depth. CFA preparation costs more due to its long structure. FMVA course fees in India focus on modelling skills. Choosing the right exam helps align fees with career goals.

What is the best age to start investment banking?

There is no fixed age limit. Many start in college. Others begin after work experience. Investment Banking Fees remain the same across age groups. Younger learners gain a time advantage. Older learners bring clarity and discipline. The best age is when you can commit time and effort. Investment Banking Fees deliver value when learning is applied with focus.

How can I join investment banking?

Joining investment banking requires skills and exposure. Most people join through analyst roles or internships. Courses help bridge the gap between theory and work. Investment Banking Fees cover training, tools, and sometimes career support. Structured programs from Imarticus Learning guide learners through skills, interviews, and role readiness. Investment Banking Fees feel worthwhile when the joining path is clear.

Planning Investment Banking Courses Fees the Right Way

Investment banking courses fees make sense when they are seen as a learning path rather than a price tag. Across this guide, the pattern stays consistent. Fees change with duration. Fees rise with skill depth. Fees increase when learning moves closer to real work.

Short courses keep costs light and help with early clarity. Longer programs ask for higher commitment but return stronger readiness. City, format, and structure all shape what learners finally pay. None of these factors works in isolation. They move together.

The most practical approach is to start with a simple question. What kind of role am I preparing for? Once that answer is clear, investment banking courses fees stop feeling confusing. They start acting like a planning tool.

For learners who want structure, consistency, and industry alignment, guided preparation helps reduce guesswork. The Investment Banking Course offered by Imarticus Learning focus on building skills step by step while keeping fee decisions transparent and outcome-driven. This approach suits learners who prefer clarity over trial and error.

When fees align with skills and timelines, learning feels intentional. That is when investment banking preparation becomes easier to commit to and easier to complete.