Table of Contents

Why does ‘risk’ even need a separate qualification? Markets already have finance degrees. Companies already have analysts. So what gap is FRM trying to fill? You see, Most finance education explains outcomes. FRM Part 1 is concerned with what can go wrong before outcomes appear. Because risk is easy to ignore when markets behave. FRM exists for the moments when they do not.

The answer sits in moments when things do not behave as expected. Prices move together when they should not. Losses arrive faster than models predict. Liquidity disappears without warning. These are not accounting problems; they are risk problems.

FRM certification exists because traditional finance education often explains how markets work in stable conditions. Risk management focuses on what happens when stability breaks. It studies uncertainty itself. Not as a theory. As something that shows up in balance sheets, portfolios, and decisions.

FRM Part 1 is designed as the entry point into this way of thinking. It does not start by asking how to price an asset. It starts by asking how fragile that price might be. It does not assume that averages will hold. It assumes they will fail at some point.

Think of it like learning to drive in clear weather versus learning to drive in heavy rain. Both involve the same vehicle. The second demands a different kind of attention. FRM trains that attention.

For someone opening the Part 1 curriculum for the first time, this can feel scattered. In reality, it is layered. Each topic adds a lens. Each subject changes how the previous one is interpreted. Over time, patterns emerge. Volatility stops being a number. Correlation stops being a formula. They start behaving like signals.

This blog is built around that reality. It treats FRM course Part 1 as a system, not a checklist. Everything that follows, from syllabus and study planning to books, practice, results, and careers, connects back to how risk is meant to be understood, not just cleared.

Understanding What is FRM

Before getting into FRM Part 1, it helps to pause and understand the larger framework it belongs to. FRM is not a standalone exam. It is a structured risk qualification built around how financial institutions identify, measure, and manage uncertainty.

At its core, FRM is about decision-making under risk. It explains how banks survive market shocks, how funds protect capital, and how firms prepare for events that cannot be predicted but can be planned for. If you are new to this field, this is where what is FRM will help set things in place.

What FRM Stands For in Practical Terms

FRM stands for Financial Risk Manager. The certification is awarded by GARP. It is globally recognised and focused entirely on risk management roles. FRM does not train general managers. It trains specialists who work with numbers, models, and controls. Some common areas where FRM knowledge is applied:

- Market risk in banks

- Credit risk in lending institutions

- Risk consulting in advisory firms

- Portfolio risk in asset management

This focus explains why FRM Part 1 feels analytical from the start.

How the FRM Program Is Structured

The FRM certification has two levels. Each level serves a clear purpose.

| Level | Purpose |

| FRM Part 1 | Builds core risk concepts and tools |

| FRM Part 2 | Applies risk tools to real-world scenarios |

FRM Part 1 is the entry point. It builds the language of risk. Without this base, Part 2 becomes difficult to follow.

Why FRM Part 1 Is Not Just an Entry Exam

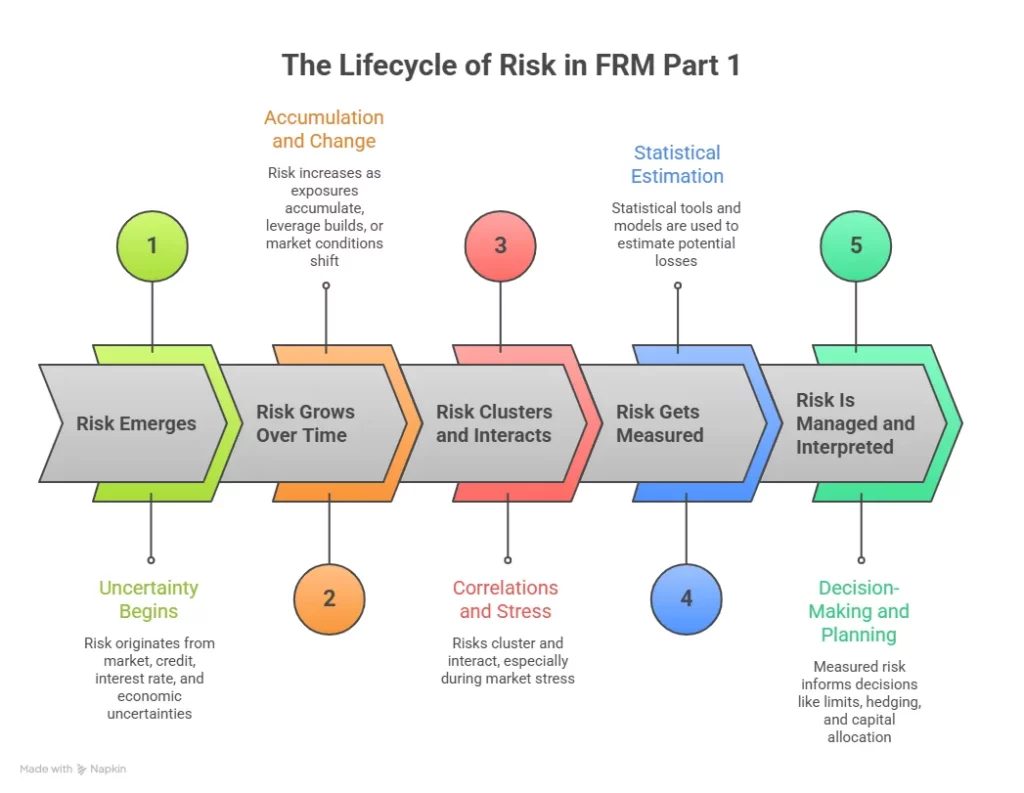

FRM Part 1 introduces how risk behaves across markets and time. It explains why losses cluster, why correlations change, and why models break under stress. The subjects in FRM Part 1 are designed to answer four questions:

→ What is risk?

→ How can it be measured?

→ Where does it appear in markets?

→ How do firms respond to it?

These questions repeat across the syllabus. This repetition builds intuition.

Who FRM Is Meant For

FRM attracts candidates from varied backgrounds. The common thread is interest in risk and analysis. FRM is well-suited for:

- Finance graduates

- Commerce students

- Engineers moving into finance

- Working professionals in banks or analytics roles

FRM Part 1 does not assume deep finance knowledge. It builds it step by step.

Also Read: Why FRM Certification is the Best Career Option for Finance Experts

How FRM Differs From Other Finance Certifications

FRM is narrow by design. It focuses only on risk.

| Aspect | FRM |

| Core focus | Risk management |

| Skill type | Analytical and model-driven |

| Industry use | Banking, funds, consulting |

| Structure | Two exam levels |

This focus explains why FRM Part 1 spends time on probability, models, and market instruments early.

FRM is a globally recognised certification focused on financial risk management, covering market, credit, and operational risk. A clear view of the course structure, exam levels, syllabus focus, and career relevance helps aspirants understand what the FRM program involves and how it fits into long-term finance and risk roles.

FRM Part 1 Curriculum and Its Real Purpose

The FRM Part 1 curriculum is divided into four core areas. Each subject builds a base for Part 2. I always explain this using a house example. You cannot design the interiors if the structure is weak. FRM Part 1 builds that structure.

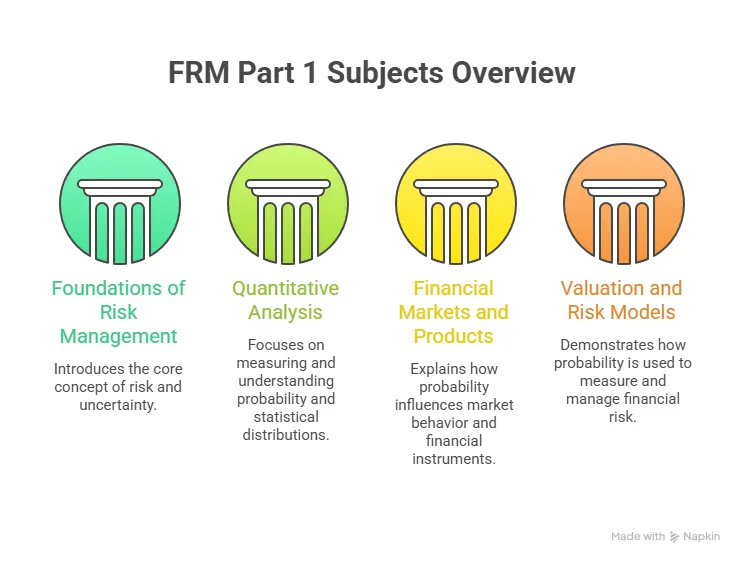

FRM Part 1 Subjects and Weightage

Before listing topics, it helps to know how marks are spread. Part 1 of the FRM Course Structure weightage decides how much effort each subject needs.

| FRM Part 1 Subjects | Approx Weightage |

| Foundations of Risk Management | 20% |

| Quantitative Analysis | 20% |

| Financial Markets and Products | 30% |

| Valuation and Risk Models | 30% |

This balance matters. Many candidates overdo Quantitative Analysis and ignore theory. The exam does not reward that.

Foundations of Risk Management

This subject shapes how risk is defined. It explains why firms failed and how governance works. Think of a company as a bus. Risk management decides who drives. It sets rules for speed and direction. It also plans what happens if the bus breaks down.

Key FRM Part 1 topics here include:

- Risk types and definitions

- Corporate governance

- Basel norms

- Financial disasters and lessons

Many learners search for the FRM Part 1 Foundations of Risk Management PDF. The official reading from GARP explains concepts clearly. Supplement notes help only after the basics are clear.

Quantitative Analysis in FRM Part 1

FRM Part 1 quantitative analysis scares many people. The math is not advanced. The logic is. I can compare this to cooking. You may know the recipe. You still need timing and judgment. Quantitative Analysis tests how formulas behave in real cases.

Topics include:

- Probability and distributions

- Hypothesis testing

- Regression

- Time value of money

Many candidates look for FRM Part 1 quantitative analysis PDF or formula lists. A FRM Part 1 formula sheet helps with revision. It does not replace practice.

Financial Markets and Products

This is the largest section by weight. It also feels the most practical. Capital markets work like traffic systems. Instruments are vehicles. Risk managers track congestion and crashes. Important FRM Part 1 topics here include:

- Bonds and yields

- Derivatives

- FX markets

- Commodity markets

Understanding instruments helps later in valuation models. This is why FRM subjects Part 1 flows into each other.

Valuation and Risk Models

This subject links math with markets. It explains how risk is measured. Topics include:

- Value at Risk (VaR)

- Expected shortfall

- Option valuation

- Stress testing

Questions here mix formulas and judgment. Reading the FRM exam Part 1 books alone is not enough. Practice is essential.

Also Read: Essential Risk Management Skills Taught in the FRM Program

FRM Part 1 Exam Pattern Explained Simply

The FRM Part 1 exam pattern is direct. The pressure comes from time.

| Feature | Details |

| Questions | 100 MCQs |

| Duration | 4 hours |

| Negative marking | None |

| Exam mode | Computer-based |

The FRM Part 1 exam questions are concept-driven. Two options often look correct. Only one fits fully. The FRM Part 1 passing score is not fixed. GARP uses a quartile system. Scores depend on paper difficulty.

FRM Part 1 Exam Dates and Registration Flow

The FRM Part 1 exam date is offered multiple times each year. Registration opens early. Fees increase with time.

| Stage | Typical Cost |

| Early registration | Lower |

| Standard registration | Medium |

| Late registration | Highest |

This is why planning matters. The FRM Part 1 registration fee and the FRM Part 1 exam fees together form the FRM Part 1 cost. Candidates often underestimate this.

Also Read: FRM Course: Empowering Finance Minds to Lead

Did You Know? According to GARP data, the FRM Part 1 pass rate usually stays near 45%.

FRM Part 1 Fees and Total Cost Reality

FRM Part 1 fees are often misunderstood because the exam fee is only one part of the total cost. The overall expense builds gradually as candidates register, gather study material, and prepare seriously for the exam.

Some candidates rely mainly on official reading material and self-practice. Others invest in structured classes, mocks, and guided revision to save time and reduce trial and error.

Typical Cost Components for FRM Part 1 Preparation

The table below breaks down the typical cost components involved in FRM Part 1 preparation so candidates can plan realistically.

| Cost Component | What It Covers | Cost Range (Indicative) |

| Enrolment Fee | One-time registration with GARP | $400 |

| Exam Fee | The FRM Part 1 exam fee is based on the registration window | $550 – $950 |

| Official Study Material | Core curriculum readings aligned with the GARP syllabus | Included with registration or purchased separately |

| Supplementary Study Material | Notes, revision guides, formula references | Varies by choice |

| Mock Exams and Practice Sets | Full-length exams and question practice | Varies by provider |

| Coaching or Online Classes (Optional) | Structured guidance, live sessions, and doubt support | Optional and varies widely |

Note: Exam fees vary depending on whether you register early, standard, or late in the exam cycle.

Many candidates ask if FRM is costly. The answer depends on preparation choices. Self-study costs less. Coaching increases cost but saves time.

Also Read: FRM Certification: Turn Your Finance Knowledge into Global Credibility

How You Can Prepare for FRM Part 1

FRM Part 1 preparation works best when it follows a structure. I treat it like training for a long walk. Speed comes later. Balance comes first.

Many people ask how to prepare for FRM Part 1 or how to study for FRM Part 1. The answer depends on time, background, and discipline. The exam rewards steady effort more than bursts of study.

Before choosing books or classes, I always decide three things:

- How many hours can I study each week

- My comfort with math

- My exam target window

This clarity saves weeks of confusion later.

How Many Hours to Study for FRM Part 1

This is one of the most searched questions. The answer varies. Still, ranges help.

| Background | Total Hours Needed |

| Finance or math background | 200 to 250 hours |

| Commerce background | 250 to 300 hours |

| Non-finance background | 300 plus hours |

These hours include reading, revision, and practice. Many underestimate practice time. That is where scores are built. When someone asks how many hours to study for FRM Part 1, I also remind them that quality matters. One focused hour beats three distracted hours.

FRM Part 1 Study Planner That Actually Works

A FRM Part 1 study planner should feel boring and predictable. Yes, that is a good sign. I break preparation into four phases.

Phase 1: Concept Building

- Read core material

- Make short FRM Part 1 notes

- Focus on FRM Part 1 topics clarity

Phase 2: Subject-Wise Practice

- Solve FRM Part 1 practice questions

- Use topic-wise quizzes

- Refer to the FRM Part 1 formula sheet

Phase 3: Mixed Practice

- Attempt FRM Part 1 mock exam

- Review mistakes

- Track weak areas

Phase 4: Final Revision

- Revise the FRM Part 1 study material

- Solve FRM Part 1 previous year question paper style sets

This flow avoids panic near the exam.

Also Read: Best FRM Coaching in India to become a Global Risk Leader.

Choosing the Right FRM Part 1 Books

When you prepare for FRM Part 1, your choice of books should do three things at once: explain concepts clearly, reflect the official syllabus, and help you translate theory into exam-style questions. Not all books serve these needs equally. As part of the official FRM framework, GARP publishes reading material that aligns directly with the exam curriculum. GARP‘s material introduces concepts in the sequence and language the exam expects.

Using this as your base helps reduce confusion about priorities and topic flow. Beyond that, study books should reinforce those core readings with additional explanations, examples, and structured practice questions.

How to Choose the Right FRM Part 1 Books

The table below outlines the role that different types of FRM Part 1 books should play in your preparation, with guidance on how to use each category effectively.

| Book Category | Primary Purpose | How to Use It |

| GARP Official Reading Material | Core curriculum coverage | Read thoroughly to understand the exact concepts tested in the exam |

| Concept Explanation Supplement | Breaks down complex ideas | Use to clarify topics after reading the core material |

| Practice-Focused Workbook | Reinforces application through examples | Solve chapter-wise questions that mirror the FRM Part 1 exam style |

| Topic Quick-Revision Guide | Summarises big topics for revision | Use close to exam date to refresh high-yield concepts |

| Formula and Concepts Pocket Reference | Lists key formulas and definitions | Use throughout preparation to build recall |

| Exam Pattern and Strategy Companion | Helps with approach and mindset | Use for mock review and timing strategy |

Also Read: Predictive Analytics in Financial Risk Management: Building Models with R

Many search for the FRM Part 1 book 1 PDF or the FRM Part 1 book 2 PDF. Official access comes through registration. Third-party summaries help revision.

The best book for FRM Part 1 depends on learning style. Visual learners prefer summaries. Analytical learners prefer original text.

FRM Part 1 Notes, PDFs, and Free Study Material

FRM Part 1 notes should stay short. Long notes rarely get revised.

Some candidates look for:

- FRM Part 1 pdf

- FRM Part 1 free study material

- FRM Part 1 foundations of risk management pdf

Free material helps early understanding. It should not replace structured study material for FRM Part 1.

Good notes explain ideas in simple language. For example, Value at Risk can be explained like daily spending limits on a credit card. The limit shows expected loss. It does not show the worst loss.

FRM Part 1 Question Banks and Practice Strategy

Practice separates passers from repeaters.

A good FRM Part 1 question bank:

- Explains answers

- Mixes easy and tough questions

- Matches exam tone

Many search for the FRM Part 1 question bank free download or FRM Part 1 question bank pdf free download. Ethical platforms provide trial questions without piracy.

The best question bank for FRM Part 1 forces thinking. Memorised patterns fail in the exam.

FRM Part 1 Mock Exam Strategy

Mock test readiness. They also test emotions. I suggest:

- At least 3 full FRM Part 1 mock exam attempts

- One mock every two weeks in the final phase

After each mock:

- Review wrong answers

- Note weak FRM subjects Part 1

- Update revision list

Mock scores improve slowly. That is normal.

FRM Part 1 Online Classes and Coaching Choices

FRM Part 1 online classes help candidates who need structure.

Good FRM Part 1 classes provide:

- Fixed schedules

- Doubt support

- Mock analysis

Interesting Insight→ FRM candidates come from engineering, commerce, and finance backgrounds.

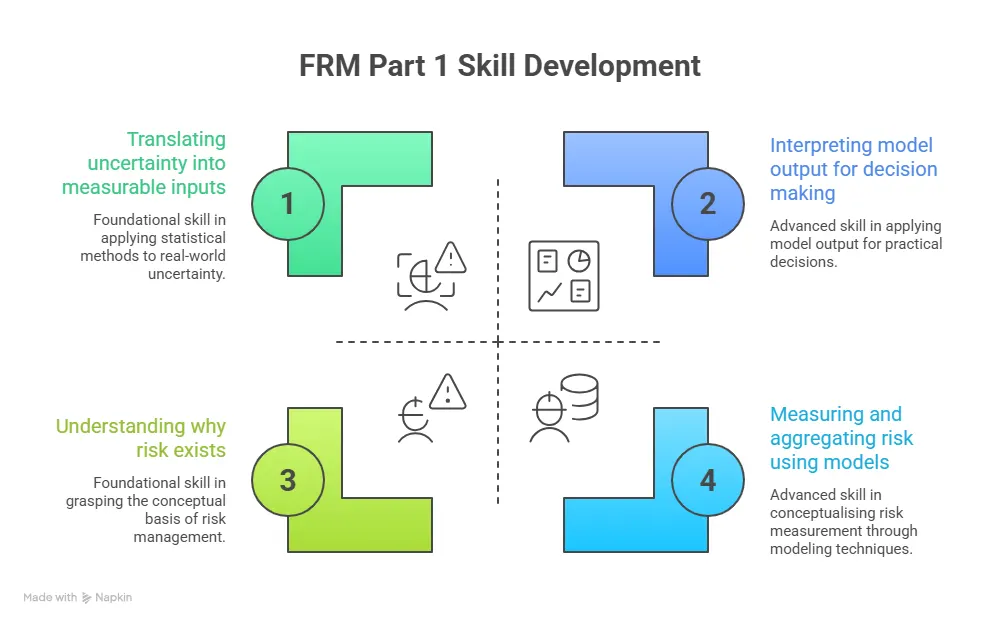

Skills You Build Through FRM Part 1

FRM Part 1 does more than prepare you for an exam. It builds a specific way of thinking that risk roles demand. The skills developed during preparation stay relevant long after the exam, especially in banking, consulting, asset management, and analytics-driven roles.

At an early stage, these skills may feel academic. Over time, they become practical tools used to assess uncertainty, evaluate exposure, and support decision-making in real business environments.

Core Skills Developed Through FRM Part 1

- Ability to think in probabilities rather than certainties

- Comfort with interpreting data instead of just calculating numbers

- Understanding how different risks interact across markets

- Structured decision-making under uncertainty

- Reading financial situations with a downside-focused lens

These skills form the base of most risk management roles.

Also Read: FRM Salary in 2025: Career Path, Experience, & Industries

FRM Part 1 Results and What They Mean

FRM Part 1 results usually arrive a few weeks after the exam window closes. The wait feels long because the FRM exam does not give instant feedback. Results are released on the official GARP portal. The result does not show marks. It shows quartiles. Each subject is graded relative to others. This system explains why two candidates with similar preparation may experience different outcomes.

When someone clears FRM Part 1, it signals that they understand risk basics well. When someone does not, it signals gaps in structure or execution. It does not label intelligence.

FRM Part 1 Pass Rate and Passing Score Reality

The FRM Part 1 pass rate usually stays around the mid 40% range. There is no declared FRM Part 1 passing score. The exam uses relative performance. This means paper difficulty matters. It also means that guessing strategies rarely work.

| Aspect | How FRM Part 1 Actually Works |

| Average pass rate | Typically ranges between 40% to 50% across exam cycles |

| Fixed passing score | No fixed passing score is declared by GARP |

| Scoring method | Relative performance-based scoring |

| Evaluation style | Candidates are ranked against others who appeared in the same exam window |

| Impact of exam difficulty | Harder papers lower the effective cut-off and vice versa |

I see this exam like airport security checks. Everyone passes through the same scanner. The scanner changes sensitivity each time. Preparation must be consistent.

What Happens After Clearing FRM Part 1

Clearing FRM Part 1 unlocks eligibility for Part 2. It also strengthens resumes for risk-focused roles. FRM Part 1 jobs are usually entry or mid-level roles, such as:

- Risk analyst

- Credit risk associate

- Market risk support roles

- Risk consulting analyst

These roles value strong basics. They do not expect mastery yet.

As risk roles continue to evolve across banking, consulting, and financial services, the relevance of FRM is often evaluated through its skill focus, career outcomes, and long-term value. Looking at how FRM aligns with industry demand in 2026 helps you judge how the certification remains a worthwhile investment of time and effort.

Salary Expectations After FRM Part 1

Clearing FRM Part 1 is a strong signal to employers that you understand core risk concepts and financial tools. It boosts your chances of securing interviews for roles like risk analyst, credit risk associate, or junior market risk positions. However, clearing Part 1 alone does not guarantee a high salary immediately. FRM Salary in India outcomes depend on location, company, experience, and how you leverage the certification alongside practical skills.

Typical Salary Ranges for Risk Roles After FRM Part 1 (India)

| Experience Level | Common Job Titles | Approx. Annual Salary (₹) |

| Entry Level (0-2 yrs) | Risk Analyst, Credit Risk Associate | ₹6 – 10 LPA |

| Early Mid (2-4 yrs) | Risk Specialist, Junior Market Risk | ₹10 – 14 LPA |

| Mid Level (4-7 yrs) | Senior Risk Analyst, Risk Reporting | ₹14 – 20 LPA |

| Senior Level (7+ yrs) | Risk Manager, Lead Risk Consultant | ₹20 – 30 LPA+ |

(Note – The data is based on industry salary insights for risk management roles in India)

Different Job Roles After FRM Part 1

- Entry roles typically involve supporting credit, market, or operational risk teams and are heavily analytics-oriented.

- Mid-level positions may include responsibility for financial reporting, modelling support, or leading small projects.

- Senior roles often involve strategy, risk governance, or interfacing with business stakeholders to manage enterprise risk.

With FRM Part 1 knowledge, even without Part 2, candidates can enter risk functions that are highly data-centric and decision-driven. As experience grows and Part 2 is cleared, specialists are often groomed for roles with broader oversight and corresponding compensation.

Commerce graduates today have access to global certifications like ACCA, FRM, CFA, and CMA that lead to roles in finance, risk, and accounting with strong career growth. Understanding how these options differ in skills, roles, and earning potential helps BCom graduates choose the right path

Why Candidates Choose Imarticus Learning for FRM Part 1 Preparation

Preparing for FRM Part 1 often requires more than access to books and question banks. The challenge usually lies in maintaining structure, clarity, and consistency across a wide syllabus while balancing time constraints.

This is where a guided learning environment becomes useful, especially when it stays closely aligned with the official FRM framework and exam expectations. Imarticus Learning positions its FRM Program prep around this need for structured preparation rather than standalone content consumption.

- I find the mix of live online sessions and recorded classes useful because it lets you revisit difficult FRM Part 1 concepts whenever you need clarity, especially during revision.

- I prefer preparation that stays aligned with the official GARP curriculum, since it keeps the focus on what is actually tested in the FRM exam rather than unnecessary material.

- Having structured mentorship throughout the preparation cycle helps me stay on track, clarify doubts early, and avoid drifting during long study phases.

- Access to placement and career support, including resume guidance and interview preparation, makes the transition from exam preparation to risk roles feel more planned and less uncertain.

- The flexible 8 to 9 month course duration works well alongside work or other commitments, allowing me to prepare for FRM Part 1 without compressing or rushing the learning process.

FAQs on FRM Part 1

FRM Part 1 often raises practical questions around difficulty, preparation time, costs, results, and career outcomes. So I am addressing the most frequently asked questions candidates have when planning for FRM, with clear and straightforward answers to help set the right expectations.

Is FRM Level 1 tough?

FRM Part 1 is tough because it tests understanding across many areas at once. The syllabus is wide. The questions are short. The time pressure is real. FRM course Part 1 feels manageable when preparation follows a clear plan. Candidates who use structured study material for Part 1 and practice mock exams regularly find it less overwhelming.

Which is harder, CFA or FRM?

FRM and CFA test different skills. The former focuses more on risk, models, and quantitative thinking, while the latter focuses more on valuation and finance theory. Difficulty depends on background. For someone strong in math, FRM Part 1 may feel smoother. For someone strong in accounting, CFA may feel easier.

Is FRM maths heavy?

FRM uses math, but not advanced math. The focus is on application. Quantitative analysis FRM Part 1 includes probability and statistics. Calculations are simple. Interpretation is key. Many learners find that structured explanations and guided practice provided in Imarticus Learning’s FRM preparation programs help make the quantitative sections more approachable and easier to apply during the exam.

Can I clear FRM Part 1 in 3 months?

FRM Part 1 can be cleared in three months with discipline. This timeline suits candidates who study daily and follow a strict Part 1 study planner. Mock exams become very important here. Many working professionals choose guided support with Imarticus Learning to manage time better in short plans.

What is the salary of an FRM?

In India, professionals with FRM credentials typically see salaries vary by experience and role. After clearing FRM Part 1, entry-level risk roles such as risk analyst or credit risk associate usually offer salaries in the range of ₹6 to ₹10 lakh per annum. With FRM Part 2 completed and 3-5 years of relevant experience, compensation commonly rises to ₹12–20 lakh per annum. Imarticus Learning’s FRM program prep often helps candidates position themselves better for these roles and salary bands.

Is FRM tougher than MBA?

FRM Part 1 is academically tougher than many MBA courses. An MBA focuses on management and communication. FRM Part 1 focuses on analytical thinking and risk logic. Career outcomes differ. FRM suits risk-focused roles. MBA suits broader leadership paths.

What is the salary of an FRM in Deloitte?

In India, professionals entering risk consulting or advisory roles at Deloitte after clearing FRM Part 1 typically earn between ₹7 – ₹12 lakh per annum, depending on the team, location, and prior experience. Imarticus Learning helps its candidates align more effectively with the expectations of consulting teams.

Is FRM costly?

FRM Part 1 has a noticeable cost. Exam fees, books, and mocks add up. Over time, the value depends on career alignment. Those using FRM skills daily recover the cost faster. Planning early reduces unnecessary spending.

What if I fail FRM?

Failing FRM Part 1 is common. It shows preparation gaps, not ability limits. Candidates who review weak FRM Part course 1 subjects and increase practice usually improve in the next attempt. Imarticus Learning helps candidates restructure their preparation after failure.

Can I get a job after FRM?

Yes. FRM helps candidates enter risk-related roles. Jobs may not be senior roles immediately. They provide exposure. Combining FRM Part 1 with analytics, finance, or programming skills improves outcomes.

One Step Closer to Clearing FRM Part 1

FRM Part 1 changes the way risk is processed in the mind. It trains attention. Numbers stop being standalone values and start behaving like signals. Models stop feeling academic and begin to explain why markets move the way they do.

By the time you reach the end of this guide, the real shift has already happened. Questions are no longer read for formulas. They are read for assumptions. FRM subjects Part 1 feeds into this habit of structured thinking. Preparation works best when this flow is respected. Reading without practice breaks it. Practice without reflection weakens it. The candidates who perform well are usually the ones who allow enough time for ideas to settle before rushing ahead.

At some point, most serious candidates recognise that progress feels steady even when the syllabus feels demanding. The question stops being about finding more material. It becomes about aligning learning with how Part 1 of FRM is actually designed to be understood and tested. That alignment is difficult to maintain in isolation. It requires a structure that stays consistent from curriculum to practice to review.

This is where guided preparation environments make a real difference. The FRM Course preparation offered by Imarticus Learning is built around this exact flow, helping candidates stay anchored to the logic of FRM Part 1 rather than getting lost in its scale.

By the time the exam arrives, confidence comes less from memorised formulas and more from familiarity with how problems behave. That familiarity is the real outcome of FRM course Part 1 preparation.