Table of Contents

Are you someone who has finished your finance degree, or maybe you’re already working in banking? You’ve spent late nights studying VaR models, stress testing scenarios, and wondering what certification will actually move your risk management career forward. Now you’re asking the question every serious risk professional wants answered: How long is the FRM course duration?

Here’s the real picture: most driven candidates finish the FRM certification in about 8 to 12 months. That means you can move from being an Indian banking professional to a GARP-certified Financial Risk Manager in just a year.

But that timeline only tells half the story. What truly matters is how you use those months – your study strategy, how you plan around exam windows, the consistency you maintain, and the smart decisions you make along the way. That’s what separates those who clear it in one go from those who end up retaking exams.

In this guide, I’ll walk you through every part of that timeline: what the FRM course duration really means for Indian professionals, how to plan your study and clear milestones, the exact FRM Level 1 exam dates, FRM Part 1 fees in India, syllabus breakdown, best books including free PDF options, question banks, and results timeline.

Did you know?

FRM Level 1 pass rates hover around 45%, but structured coaching boosts success to 80%+, making smart prep the difference between 6 months and 18 months total duration.

What Is the FRM Course?

Before diving into the FRM course duration, I’ll clarify – what is FRM and what Financial Risk Management actually prepares you for.

The Financial Risk Manager credential, awarded by GARP(Global Association of Risk Professionals), equips you to identify, analyse, and manage financial risks across banks, hedge funds, insurance firms, and corporates. Unlike broad finance qualifications, FRM deeply focuses specifically on quantitative risk analysis – think VaR models, stress testing, derivatives pricing, and credit risk frameworks.

FRM prepares you for real-world risk roles in:

- Banks

- Fintech companies

- Investment firms

- Hedge funds

- Insurance companies

- Consulting firms

- Corporate treasury teams

Unlike general finance courses, FRM goes deep into risk analytics:

- Value at Risk (VaR)

- Stress testing

- Credit risk

- Market risk

- Derivatives

- Quantitative models

This is why FRM professionals are trusted by RBI stress testing teams, bank risk committees, and global trading desks in cities such as Mumbai, Bangalore, and Delhi. It doesn’t just improve your CV. It changes the level of responsibility you’re trusted with.

Who Should Consider FRM?

FRM is perfect for you if:

- You want to build a career in risk management, treasury, or trading support roles.

- You enjoy numbers, data, and financial decision-making.

- You are a Finance graduate, Banking professional, CA / CFA / MBA, looking to specialise, or an Analyst working in credit, compliance, or operations.

There is no strict eligibility, but you are required to have strong basics in finance, statistics, and accounting to make the journey smoother.

| Goal | Best Choice |

| Want a recession-proof finance career | FRM |

| Want to specialise in financial risk | FRM |

| Want global risk & banking roles | FRM |

| Want the fastest entry into high-impact finance roles | FRM |

After FRM, you become eligible for roles such as:

- Risk Analyst

- Market Risk Manager

- Credit Risk Analyst

- Treasury Risk Manager

- Portfolio Risk Analyst

- Quantitative Risk Associate

- Risk Consultant

These roles are not only prestigious but also among the highest-paying specialist positions in finance. If you’re curious about earning potential, this is where understanding the FRM salary structure becomes important, especially when evaluating long-term career growth.

To give you a visual overview of the FRM journey, including course duration, fees, eligibility, and scope, here’s a quick video that breaks down the entire certification path from start to finish.

Understanding FRM Course Duration

Let’s address the core question: How long does FRM really take? For most Indian candidates, the FRM course duration spans 8 to 12 months total:

- FRM Part 1: 4 to 6 months preparation

- FRM Part 2: 4 to 6 months after passing FRM Exam Part 1.

The total certification period is usually under 1 year with consecutive windows.

Here’s the month-by-month reality of how the FRM course duration looks for most of the candidates:

| Stage | Duration | What Happens |

| Part 1 Prep | 4 – 6 months | 200 – 240 study hours |

| Part 1 Exam | Exam week | 100 MCQs, 4 hours |

| Part 2 Prep | 4 – 6 months | 200 – 240 study hours |

| Certification | 1 – 2 months | Experience validation |

FRM While Working: Is It Really Manageable?

Yes. In fact, most of the FRM candidates are working professionals. All you need is to start with 12 to 15 hours per week, to comfortably prepare, where on weekdays you spend 2 hours per day, and on weekends you dedicate 4 to 5 hours. This is exactly why the FRM course duration fits so well into a working professional’s lifestyle.

FRM is designed to run alongside your job. You don’t pause your career for FRM. You grow inside it.

That’s why many candidates finish FRM Part 1 in 4 months and FRM Part 2 in another 4 months, even while working full-time.

One of the biggest reasons professionals choose FRM alongside a full-time job is the financial upside. The FRM salary in India has grown sharply in recent years as banks, fintech firms, and risk consulting teams compete for skilled risk professionals.

Did You Know?

Working professionals often complete FRM Level 1 in just 4 months with 12 to 15 hours of study per week, which shows how efficiently the FRM course duration can be managed alongside a full-time job when preparation is structured and consistent.

What Determines FRM Course Duration

Your FRM course duration depends on:

- Your finance background

- Study consistency

- Coaching vs self-study

- Mock test practice

- Exam window planning

Two people can start together. One finishes in 9 months. The other takes 18. The difference is in structure.

FRM Course Duration and Study Timeline

The FRM course duration is not just about how many months you study. The table below shows what FRM Part 1 and Part 2 look like in terms of study:

| Aspect | FRM Part 1 | FRM Part 2 |

| Typical Preparation Time | 4 – 6 months | 4 – 6 months |

| Focus | Building strong foundations | Applying risk concepts in real-world scenarios |

| Nature of Learning | Conceptual + technical | Practical + decision-oriented |

| Key Subjects | Quantitative analysis, financial markets, valuation & risk models | Market risk, credit risk, liquidity risk, operational & cyber risk, investment risk, current issues |

| Daily Study Time | 2 – 3 hours (weekdays) | 2 – 3 hours (weekdays) |

| Weekend Study Time | 4 – 6 hours | 4 – 6 hours |

| Practice Style | MCQs, formula application, mock tests | Case-based questions, scenario analysis, mock tests |

| Main Challenge | Understanding concepts correctly | Applying concepts to real risk situations |

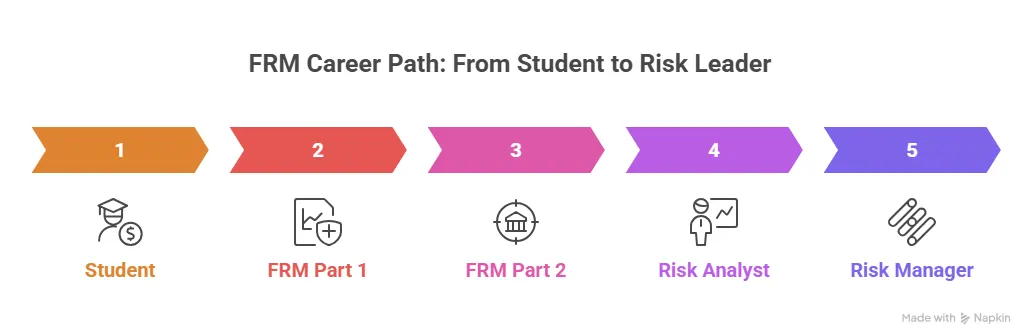

| What It Trains You For | Thinking like a risk analyst | Thinking like a risk manager |

This video breaks down why the FRM certification continues to be valuable in 2026, especially for risk professionals and working finance graduates.

FRM Books

When it comes to FRM certification, your study material is not a small decision. It’s the backbone of your preparation. This is a professional exam, and the quality of resources you choose directly affects not only how confidently you walk into the exam hall but also how short your FRM course duration can be.

Here are the resources that most serious FRM candidates rely on:

GARP Official Books

These are the primary sources and non-negotiables. They come straight from the exam body, which means every concept, framework, and definition is exactly how GARP expects you to understand it.

They may feel dense at times, but they build real conceptual depth. If you want clarity on what FRM truly tests, this is your primary source.

Schweser Notes

Think of Schweser as your translator. Where GARP is detailed and academic, Schweser is crisp and exam-oriented, simplifying complex topics, highlighting what matters most, and making revision faster.

Most students use GARP to learn and Schweser to revise.

Practice Question Banks

Reading alone doesn’t pass FRM. Practice does. Question banks train your brain to think in the way the exam expects:

- Applying formulas

- Interpreting risk scenarios

- Managing time under pressure

GARP Mock Exams

These are as close as it gets to the real exam.

They show you:

- Your weak areas

- Your speed

- Your exam temperament

If you do only one mock, make it GARP’s. About Free PDFs, yes, free material exists. And yes, it can help supplement your prep. But building your entire preparation on scattered PDFs is risky:

- Content may be outdated.

- Coverage is often incomplete.

- Concept flow is broken.

FRM isn’t an exam where shortcuts work well. It rewards structure, consistency, and quality inputs.

A Smart Combination Looks Like This:

- GARP Books → Conceptual foundation

- Schweser Notes → Simplification + revision

- AnalystPrep / Bionic Turtle → Practice + confidence

- GARP Mock Exams → Final reality check

Treat FRM like a professional investment, not a casual exam.

The right resources don’t just help you pass – they shape how well you understand risk in the real world.

Did You Know?

If you’re searching for the best book for FRM Part 1, most toppers agree it’s a combination, not a single source. GARP Official Books give you the exact exam mindset, while Schweser Notes make revision faster and more practical. Together, they form the strongest foundation for clearing Part 1 in your first attempt.

FRM Exam Dates

GARP conducts the FRM exam multiple times in a year, typically in:

- May

- August

- November

This flexibility is what makes an 8 to 12 month FRM course duration realistically possible for candidates who plan their exam windows and preparation schedule wisely.

FRM Results Timeline

After each exam results are usually declared in 6 to 8 weeks. You receive a pass or fail status. After clearing both parts, you are required to submit your work experience. GARP then awards the official FRM certification. So, from exam to certification, you can expect 1 to 2 additional months after your final result.

This short video compares FRM with other globally recognised finance qualifications such as ACCA, CMA, CFA, and CPA – helping you see how FRM stacks up in terms of scope, career path, and professional value.

FRM Fees

Before you start your FRM journey, it’s important to understand the fee structure clearly so there are no surprises later. The FRM fees are paid directly to GARP and are split into two main parts, and they go hand in hand with how you plan your FRM course duration.

| Type | Cost |

| Enrolment Fee | USD 400 (one-time) |

| Exam Fee | USD 600 – 800, depending on registration time |

| Total | ₹90,000 – 1.1 lakh approximately |

The enrollment fee is something you pay just once, when you register for FRM for the very first time. After that, you don’t have to worry about it again. For each level, you only pay the exam fee, which makes managing your overall FRM course fees and duration much simpler when your exam attempts are planned back-to-back.

And here’s where smart planning really helps. The exam fee changes based on when you register. If you register early, you pay less. If you wait till the last window, you pay more. It’s that simple. So the earlier you commit, the more money you save.

That’s why FRM rewards people who plan. You’re not just reducing last-minute stress, you’re also being financially smarter.

Instead of seeing this as a cost, try looking at it as an investment. FRM is a globally respected certification. The fees reflect the value, credibility, and career doors it opens. When you compare it to the kind of roles, salary growth, and international opportunities it can unlock, the return usually far outweighs what you put in.

Did You Know?

Choosing the best question bank for FRM Part 1 can dramatically improve your chances of clearing the exam on your first attempt. Most high scorers rely on platforms like AnalystPrep and Bionic Turtle because their questions closely match GARP’s difficulty level and exam style, helping you master concepts, improve speed, and build real exam confidence.

FRM Course vs Top Finance Courses

When you start thinking seriously about a career in finance, it’s easy to feel confused. FRM, CA, MBA – every option sounds impressive, and every one promises growth and stability. But the truth is, they don’t take you to the same place. Each course shapes a very different kind of career.

That’s why comparing the FRM course with other top finance courses really matters. It’s not about which one is better. It’s about which one fits you. Your interests, your strengths, and the kind of work you see yourself doing every day should guide your choice.

FRM stands out because it isn’t a general finance or management degree. It’s a specialised certification for people who want to work in risk, treasury, and quantitative finance. While other courses give you a wide view of finance or business, FRM trains you to deal with uncertainty, protect capital, and make smart decisions when markets are unpredictable.

Another major advantage is its speed. The FRM course duration is much shorter than most traditional qualifications like CA or an MBA, allowing you to become career-ready in under a year instead of spending two to five years in long academic programs.

This comparison will help you see how FRM is different from other popular finance courses, what kind of careers each one leads to, and why FRM is often considered one of the most recession-proof and high-impact paths in the finance world.

| Career Factor | FRM Course | CA / MBA |

| Recession-proof finance career | ✅ | ❌ |

| Demand during market crashes | ✅ | ❌ |

| High level of specialisation | ✅ | ❌ |

| Strong global recognition | ✅ | ❌ |

| Strong quantitative & analytics focus | ✅ | ❌ |

| Core banking & treasury roles | ✅ | ❌ |

| Direct entry into market & credit risk jobs | ✅ | ❌ |

| Suitable for hedge fund/trading desk roles | ✅ | ❌ |

| High demand in regulatory & stress testing teams | ✅ | ❌ |

| Long-term career stability | ✅ | ❌ |

| High salary growth for specialists | ✅ | ❌ |

| Faster time to become job-ready | ✅ | ❌ |

| Specialist certification | ✅ | ❌ |

What FRM Really Gives You

FRM Course Duration: 8 to 12 months

Career Impact: 10 to 20 years

Value Created: Stability, authority, income, trust

FRM is one of the rare qualifications where a short-term effort creates long-term professional power. You invest less than a year of focused preparation, and you build a career foundation that supports you for decades.

Why Choose Imarticus Learning for FRM?

The FRM program is not just about clearing an exam. It’s about becoming job-ready for real risk roles. That’s where Imarticus makes a practical difference.

Most candidates struggle not because FRM is impossible, but because their preparation lacks structure. They study hard, but without direction. Imarticus solves that problem by turning FRM preparation into a guided, disciplined process.

Here’s why serious FRM aspirants prefer Imarticus:

1. Structured Study Plan

Imarticus breaks the entire FRM syllabus into a week-by-week roadmap. You always know:

- What to study

- When to revise

- When to practice

- When to attempt mocks

This structure alone can reduce your FRM course duration by months.

2. Industry-Focused Teaching

You’re not taught just to pass the exam. You’re trained to think like a risk professional:

- How banks apply VaR

- How stress testing is used by RBI

- How credit risk is evaluated in real portfolios

This bridges the gap between certification and employment.

3. Expert Faculty

Classes are conducted by professionals who have worked in:

- Banking

- Risk consulting

- Investment management

- Treasury & analytics

They don’t just explain formulas. They explain how those formulas are used in real-world risk teams.

4. High-Quality Mock Tests

Imarticus mocks are:

- Exam-level difficulty

- Time-bound

- Performance-tracked

You don’t just get marks. You get diagnostic feedback that shows your weak topics, accuracy, and speed. This is what pushes pass rates above average.

5. Career Support

Imarticus doesn’t stop at certification:

- Resume building

- Interview preparation

- Placement assistance

- Corporate connections

So FRM becomes a career transformation, not just an academic milestone.

6. Higher Success Rate

With guided coaching, candidates achieve:

- Faster completion timelines

- Fewer retakes reduce your overall FRM course duration.

- Stronger conceptual clarity

- Higher confidence under exam pressure

That’s why structured coaching can lift success rates from 45% to 80%+.

In simple terms, if FRM is your career investment, Imarticus is the system that protects it and multiplies the benefits.

FAQs About FRM Course Duration

If you’re planning to pursue FRM, questions about time commitment are natural. In these frequently asked questions, I’ll cover everything about the FRM course duration, from how long each level takes to whether you can manage it with a full-time job, so you can move forward with clarity and confidence.

Can I complete FRM in 8 months?

Yes. If you plan your exam windows well and study consistently, you can complete:

- Part 1 in 4 months

- Part 2 in another 4 months

This is achievable for disciplined working professionals.

Is FRM tougher than CFA?

FRM feels harder for those weak in statistics and models, but easier for people who enjoy analytics. FRM is more quantitative and risk-focused, whereas CFA is broader and covers multiple areas of finance.

Can I do FRM without quitting my job?

Absolutely. In fact, FRM duration is built for working professionals. Most candidates who pursue FRM are already employed in banking, finance, or related fields. Imarticus Learning makes it easier with flexible schedules, recorded sessions, and guided preparation, so you can study alongside your job without career breaks. With a structured plan, 12 to 15 hours of study per week is more than enough to stay on track.

How long after passing both exams do I get the FRM title?

Once you clear both parts and submit 2 years of relevant work experience, GARP awards your FRM certification. This usually takes 1 to 2 months after your final result.

How long is the duration of FRM course?

The FRM course duration is around 8 to 12 months. Most candidates spend 4 to 6 months preparing for FRM Part 1, and another 4 to 6 months for FRM Part 2. With the right planning, steady study routine, a learning partner like Imarticus Learning, staying consistent and choosing your exam windows wisely, it’s completely possible to finish both levels within a year.

What is the FRM course duration after graduation?

The FRM course duration is the same for all candidates. It usually takes 8 to 12 months. Since you’re fresh out of college and already in study mode, many students actually find it easier to stay consistent and finish faster. With regular preparation and the right guidance, you can complete FRM within a year and enter the job market with a strong, globally recognised certification.

What is the FRM course duration in India?

In India, the FRM course duration usually ranges between 8 and 12 months. I have seen candidates spend 4 to 6 months on Part 1 and another 4 to 6 months on Part 2. With proper planning and consecutive exam windows, both levels can be cleared within a year.

What is the FRM course duration after 12th?

After 12th, the FRM course duration is not counted in months, the way it is for graduates or working professionals. This is because FRM certification requires both clearing Part 1 and Part 2 and completing two years of relevant work experience. In short, after the 12th, FRM is a long-term plan. You start early, clear the exams around graduation, and become a certified FRM once your professional experience is completed.

Can I clear FRM Level 1 in 3 months?

Yes, it’s possible, and while it still looks aspirational, it requires a very focused and disciplined study plan. This timeline works best if you already have a strong background in finance or statistics and can dedicate more hours each week.

What is the FRM course duration and fees in India?

The FRM course duration in India is typically 8 to 12 months if you complete both levels without long gaps. The FRM fees in India are approximately ₹90,000 to 1.1 lakh per level. These are the official costs from GARP. Additional expenses like coaching, books, mock tests, or question banks are separate.

How the FRM Course Shapes Your Career

The FRM course duration is not just about months on a calendar. It’s about how efficiently you use those months. If you’re serious about building a future in financial risk management, start with a plan, not just motivation. FRM rewards those who prepare early, stay consistent, and choose the right guidance. With the right structure, you’re not just preparing for an exam – you’re stepping into a career that protects capital and commands trust.

FRM is one of the few certifications where the syllabus matches real job roles, the demand rises during financial crises, the career stability is long-term, and the work is intellectually respected. If you want to build a career where your decisions protect capital, guide institutions, and shape financial stability, FRM is not just a course. It’s a professional identity.

And when combined with structured training from Imarticus, FRM becomes faster to complete, easier to manage, stronger in impact, and more powerful in career outcomes. The FRM Course isn’t about clearing an exam. It’s about becoming someone the financial system trusts.