Table of Contents

Last updated on October 31st, 2025 at 10:32 am

When you hear about the Financial Risk Manager (FRM) certification, one of the biggest questions you probably have is: What kind of salary does an FRM in India actually earn? Because let’s be honest- salary talks matter. They’re not just numbers; they symbolise career growth, recognition, and the return on investment you’re making in your education and skills.

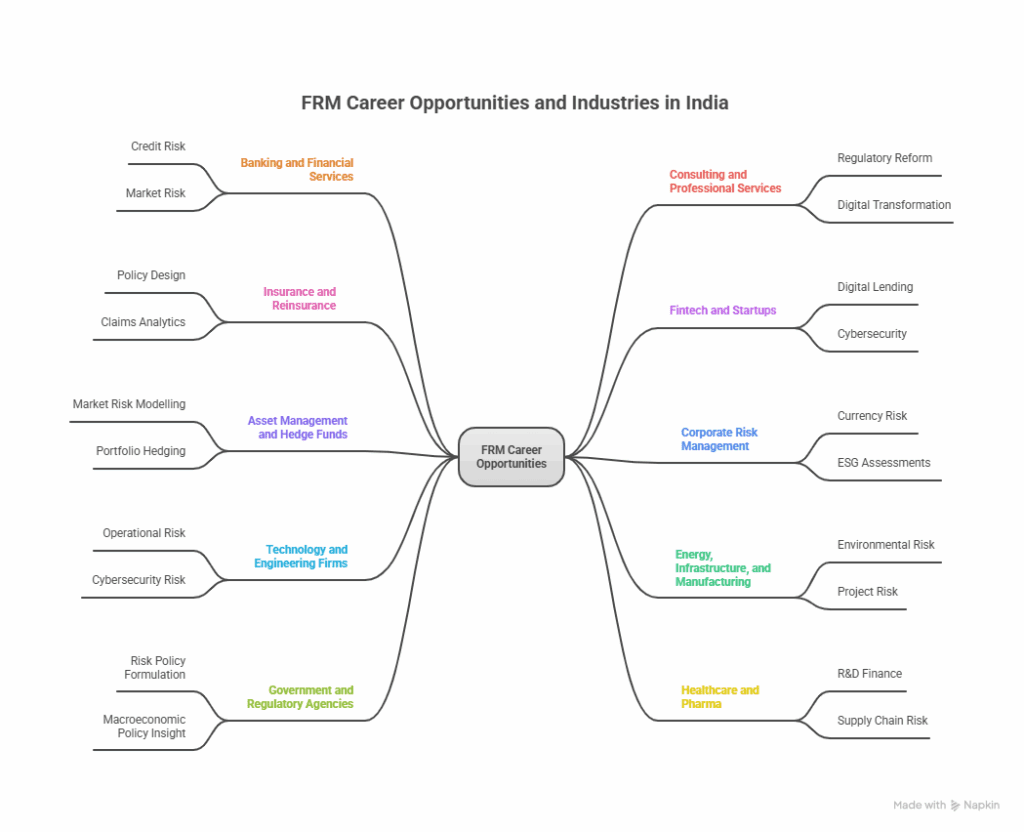

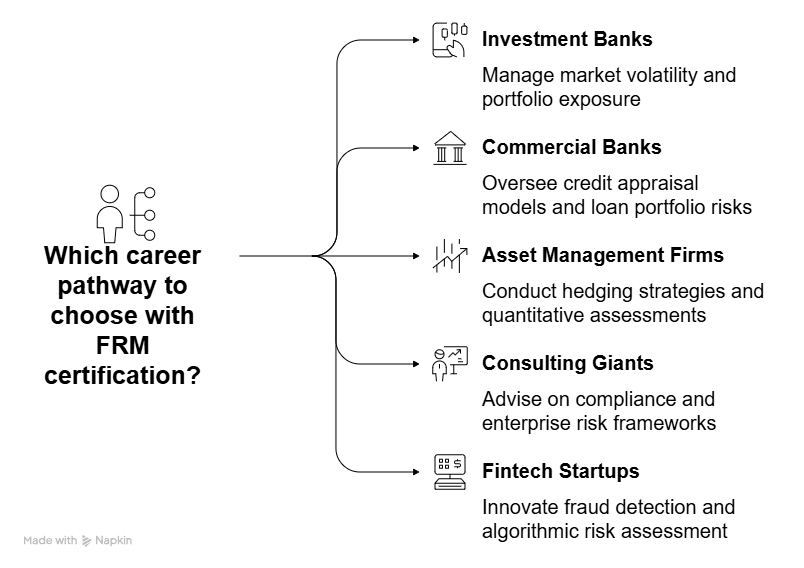

The FRM Certification isn’t just about pay; it offers diverse opportunities across banking, asset management, fintech, and consulting, unmatched by most finance certifications.

If you’re curious about the FRM salary journey in India – how it starts, how it grows, and what top professionals are earning – this guide breaks it all down. From early-career paychecks to six-figure packages, we will explore the full picture based on real data and industry insights of the Indian finance industry.

What is FRM?

You might be wondering, What is FRM? Firstly, the FRM certification, offered by the Global Association of Risk Professionals (GARP), isn’t just a fancy line on your resume. It’s a global gold standard for risk management professionals. When you earn your FRM, you’re telling employers you understand market risk, credit risk, operational challenges, and how to manage financial uncertainty.

That specialisation makes you highly sought after, especially by banks, asset management firms, insurance companies, and consulting agencies. This demand is what pushes the salary numbers higher.

FRMs aren’t limited to one sector- they work in banking, fintech, consulting, insurance, and asset management, offering unmatched career flexibility.

When markets swing unexpectedly, FRMs are already a step ahead, running scenarios to prevent huge losses. At a fintech startup, they use their FRM skills to spot risky loans before they turn sour. A consultant dives into flawed models to fix mistakes and guide smarter decisions. Day to day, FRMs are the ones who anticipate problems, weigh risks, and keep big financial moves safe, just like having a financial safety net on a massive scale.

If you want to get a Global Finance Certification, this video will guide you in your journey.

Comparing FRM Salaries Across Career Stages

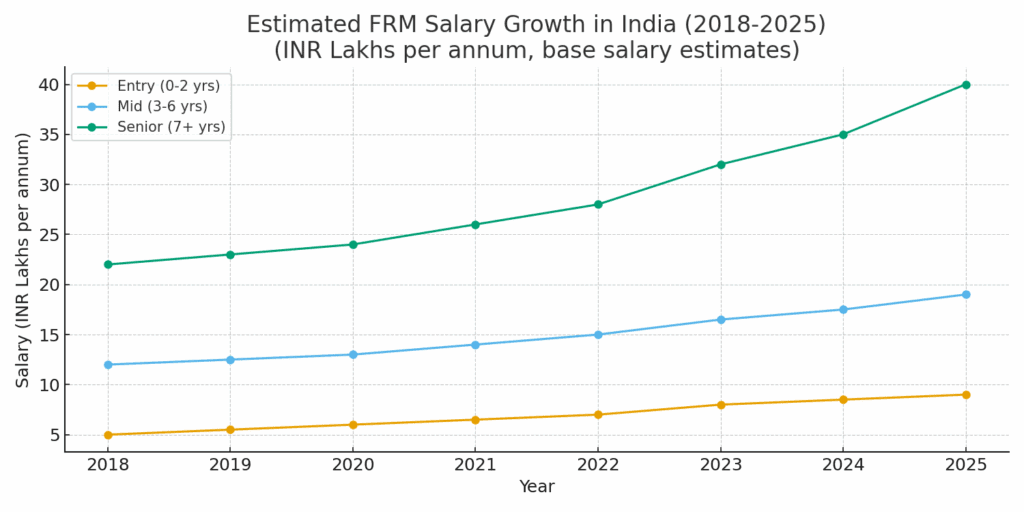

This table shows a rough overview of the salary range across various stages of FRM.

| Experience Level | Typical Salary Range (INR) | Common Roles |

| 0-2 Years | ₹4-7 LPA | Risk Analyst, Junior Risk Consultant |

| 3-7 Years | ₹8-15 LPA | Risk Manager, Senior Risk Analyst |

| 8+ Years | ₹20-35+ LPA | Head of Risk, CRO, Director of Risk |

For highly experienced professionals with global portfolios, salaries have been recorded at or above ₹1 crore per annum, especially in multinational banks or risk consulting firms headquartered abroad.

This upward trajectory reflects not just market demand but how the FRM equips professionals to keep adding more quantifiable value year after year.

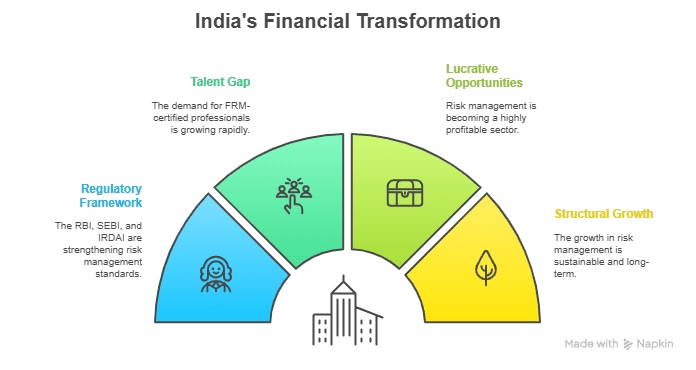

The Growing Demand for FRMs in India

The Indian financial sector is not what it was a decade ago. It is moving at a fast pace with rapid digitisation, security measures, increased compliance and regulatory requirements, and dynamic market risks have transformed how financial institutions operate. Banks, NBFCs, fintech companies, and investment firms now view risk management not as a support function but as a strategic one.

That’s where Financial Risk Managers come into play. FRMs are professionals trained to identify, measure, and mitigate risks from market and credit risks to operational and liquidity challenges. The certification, offered by the Global Association of Risk Professionals (GARP), has become the global benchmark for risk expertise.

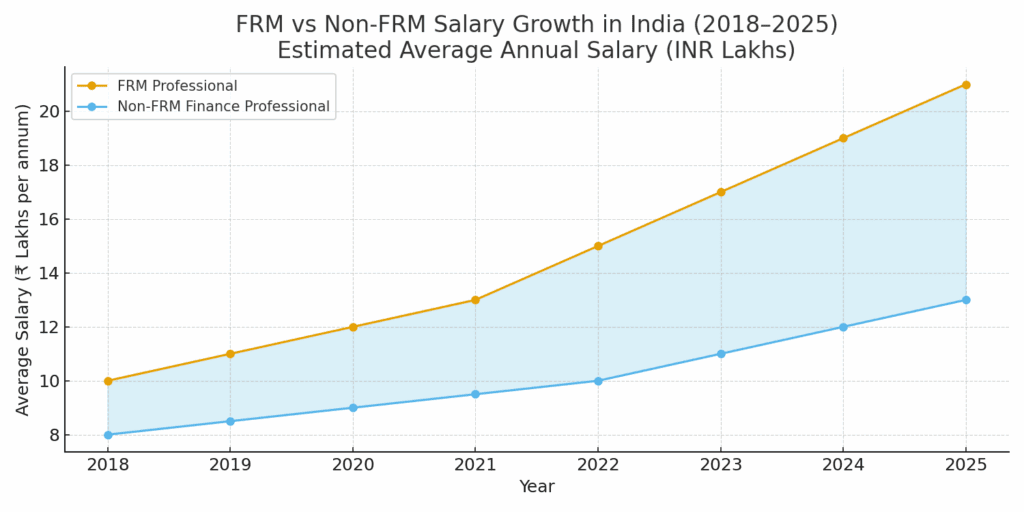

In India alone, the surge in demand is remarkable. As financial institutions expand globally, the need for professionals who can anticipate and manage risk exposure has multiplied. According to recent GARP data and industry reports, FRM-certified professionals consistently fall within the top 15% of finance earners across roles.

Why FRM Certification Has High Salary Potential

When people talk about the FRM, they often focus on the exams – the formulas, the case studies, and the long nights spent with risk models and quantitative analysis. But what truly gives the FRM its value is what it represents to employers:

An FRM-certified professional signals the ability to think strategically under uncertainty, manage measurable risk, and align financial decision-making with long-term stability.

This combination of technical precision and business understanding is exactly what companies pay a premium for.

If you want to boost your earning potential, this video will help you choose the right career track.

FRM Salary for Freshers

For most professionals, it starts soon after passing Part I (or sometimes both parts) of the FRM exams and stepping into their first analytical or risk-related role.

At this stage, roles typically include:

- Risk Analyst or Market Risk Analyst

- Junior Risk Consultant

- Financial Analyst – Risk Division

- Credit Analyst (Banking/Fintech)

The salary range for these entry-level professionals generally falls between ₹4-7 LPA.

While that may sound modest at first glance, the distinction lies in what the FRM credential represents. Unlike most fresh entrants into finance or banking, FRM holders are seen as technically trained specialists, not generalists. This perception allows them to command 20-30% higher starting pay compared to their non-certified peers.

In cities like Mumbai, Bengaluru, Pune, and Delhi-NCR, where multinational financial institutions and risk consulting firms dominate, FRM freshers often receive offers on the higher end of this range.

But what really makes this stage powerful is how fast things begin to move once you start applying what you learned. The early exposure to risk analytics, data modelling, and compliance systems sets the foundation for accelerated career and salary growth.

Mid-level and Managerial FRM Salaries

Once you’ve spent a few years in the trenches – reading financial statements, building stress-testing models, running VaR simulations, and reporting risk forecasts – your value multiplies rapidly.

This phase, typically between 3-7 years of experience, is where FRMs begin to transition into roles that combine technical work with decision-making responsibilities.

Common titles at this level include:

- Risk Manager

- Credit Risk Consultant

- Operational Risk Specialist

- Finance Controller – Risk Analytics

- Senior Financial Analyst (Risk)

The salary range for these mid-level FRMs in India generally falls between ₹8 to ₹15 LPA.

This is also the point where your compensation starts to reflect impact. Companies don’t just pay you for identifying risks – they pay you for protecting assets, anticipating losses, and building frameworks that save millions.

That’s why professionals who actively develop cross-functional skills, especially in Python, R, SQL, Power BI, or Tableau, see faster jumps. Additionally, working alongside business strategy or treasury teams exposes mid-level FRMs to decision-making layers that later qualify them for managerial positions.

One of the most rewarding aspects at this stage is recognition.

Within five years, many FRM professionals find themselves managing teams, leading compliance audits, or presenting risk analysis reports directly to CFOs or risk committees. Every such milestone justifies the upward salary climb.

Senior and Leadership-level FRM Salaries

Reaching this stage is like crossing the summit of a steep but rewarding mountain. By now, you’ve accumulated 8-15 years of experience and are often handling risk across functions, divisions, or even regional units for large enterprises.

Senior and executive-level roles often come with titles like:

- Head of Risk

- Chief Risk Officer (CRO)

- Senior Vice President – Risk and Compliance

- Director – Enterprise Risk Management

The salary range at this level typically spans ₹20-35+ LPA, with certain roles – particularly in global investment banks, Big 4 consulting firms, or multinational corporations touching and even exceeding ₹50 lakhs annually.

If you’re part of international risk teams or manage compliance across regions, these numbers can cross into seven-figure salaries in global terms ($100,000+).

This phase is less about technical modelling and more about strategic leadership – guiding corporate policy, ensuring regulatory alignment, and shaping a company’s risk culture at the macro level.

What’s most notable? The FRM doesn’t just add financial value; it compounds it over time. Each stage amplifies your skill set, experience, and earning potential.

With FRM skills in risk modelling, stress testing, and forecasting, professionals stay in demand even during market downturns- job security that many other finance certifications can’t match.

Factors That Shape FRM Salary in India

Even though the certification provides a solid base, several factors influence how much an FRM earns at any stage. Understanding these helps you plan your career trajectory more strategically.

1. Industry or Sector

Risk professionals earn the highest pay in banking and investment firms due to the complex demands of risk management, followed by competitive salaries in insurance and asset management for actuaries and claims risks, while consulting and fintech offer fast growth and performance-based bonuses, with smaller firms providing broader, multi-dimensional roles.

2. Company Size and Reputation

Large multinational firms and global banks pay significantly more than startups or regional institutions due to the scale of their financial exposure and compliance requirements.

3. Location

Salary packages differ geographically.

- Mumbai leads as India’s financial capital, offering the highest pay.

- Bengaluru and Delhi NCR follow closely, thanks to their corporate risk hubs.

- Tier-2 cities may offer slightly lower compensation, but often balance it with a better cost of living.

4. Additional Certifications & Education

Professionals who combine FRM with CFA, CPA, or MBA in Finance see stronger salary growth. Employers value multi-certified experts who can bridge investment decision-making with risk policy.

5. Skill Set

Quantitative proficiency alone isn’t enough anymore. Mastery of data analytics tools, modelling software, and coding languages like Python, R, or VBA can lift salaries by up to 20–30%.

6. Soft Skills and Communication

FRMs with the ability to communicate risk in business language, mentor teams, and manage stakeholders elevate compensation, especially in leadership roles.

FRM Salary Insight: India and International

FRM is a global designation, and it’s common to hear that FRMs in countries like the US, UK, or Singapore earn significantly more. While nominal earnings are indeed higher abroad, the real story lies in purchasing power parity.

The advantage here is growth at home. Indian FRMs working for global teams in domestic offices can often draw international compensation bands, especially in cities like Mumbai, Hyderabad, and Gurugram. So, even while based in India, FRMs have the potential to achieve seven-figure (in INR terms) salaries with global exposure.

Local Impact, Global Reach

Indian FRMs today are writing a new chapter in global finance- one that’s no longer limited by location, but enriched by global opportunities right here at home. While the FRM designation is recognised across continents, for professionals in India, the world is increasingly coming to them. Instead of an apples-to-apples comparison of salaries abroad, the modern FRM journey is about leveraging international opportunities and enjoying the unique advantages of India’s thriving financial sector.

What sets the Indian FRM experience apart is the ability to access international compensation bands and exposure, without leaving the country. Many multinational employers now match global pay scales for top Indian talent, especially for those in strategic roles or leading regional risk functions.

A Journey Fueled by Opportunity

For those considering the FRM credential, the most powerful narrative isn’t just about salary numbers, but about the quality of opportunities. Indian risk managers are now shaping global best practices, networking with leaders across time zones, and building careers that blend international experience with local advantages.

Risk professionals based in India increasingly work on cross-border risk mandates, participate in global strategy meetings, and manage portfolios that span continents. A ₹30 LPA salary in India can offer a lifestyle comparable to a $120,000 package in the US due to differences in the cost of living. Plus, India’s risk management ecosystem is now globally integrated. Many international investment banks and financial tech giants operate their risk control centres in India, giving professionals local access to global pay scales.

The Big Picture

Ultimately, the FRM salary story in India today is about aligning ambition with unique opportunities close to home. As financial markets integrate and global firms deepen their roots here, Indian FRMs find themselves at the centre of high-value, globally relevant roles- living the kind of career journey that past generations could only imagine.

FRMs in the US or Europe typically earn higher nominal salaries (think $100,000 and beyond).

How to Accelerate Your FRM Salary Growth

While earning potential is a hallmark of the FRM journey, how fast you reach your goals depends largely on strategy. Here’s what consistently makes the difference for high-earning FRM professionals:

- Get Certified Early

Passing both FRM exam parts early lets you dedicate more energy to specialised learning, project work, and networking. The earlier you earn your designation, the faster your salary compounding begins. - Gain Diverse Experience

Exposure across multiple risk domains – credit, market, liquidity, and operational- makes you versatile. Recruiters pay a premium for professionals capable of handling multi-dimensional risk mandates. - Keep Learning

Continuous education in regulatory changes, data analytics, and financial modelling ensures your profile stays in demand. Upskill with AI in risk, fintech regulation, or quantitative methods. - Network Effectively

Engage with the GARP community, LinkedIn groups, webinars, and industry events. Referrals and informational connections can unlock exclusive job offers that may not be publicly listed. - Demonstrate Business Impact

Don’t just quantify risks, quantify outcomes. When your analysis leads to measurable profit protection or compliance cost savings, those tangible contributions justify salary hikes and promotions.

A Day in the Life of an FRM: Turning Planning into Risk Management

An FRM starts their day like most of us- planning. Just as we budget for our dream vacation by measuring all scenarios for travel, they run stress tests to see how sudden market changes could affect their firm’s investments.

When they help a fintech client design a lending algorithm, it’s like figuring out how much to spend on a wedding without going into debt- balancing opportunity with caution.

Later, reviewing risk models for a corporate client feels like checking loan options before buying a house, making sure every decision is safe and informed.

FRM skills turn the careful planning we do in daily life into strategies that protect millions, helping companies navigate uncertainty with confidence.

FRM Salaries Across Industries in India

One of the most fascinating aspects of an FRM career is how versatile the certification is. From banks to fintechs, and even energy companies and regulatory agencies, risk management expertise is now indispensable everywhere. But how much do FRM-certified professionals really make across different industries?

This table shows an overview of the top employers for FRM across various industries.

| Industry | Top Employers |

| Banking and Financial Services | HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra, SBI, Citibank, Barclays, JP Morgan India |

| Consulting and Professional Services (Big 4 & Beyond) | Deloitte, KPMG, PwC, EY, McKinsey, Boston Consulting Group (BCG) |

| Insurance and Actuaries | LIC, HDFC Life, ICICI Prudential, SBI Life, Bajaj Allianz, Future Generali |

| Fintech and Startups | Paytm, Razorpay, Groww, Cred, PolicyBazaar, Lendingkart, Pine Labs |

| Asset Management & Hedge Funds | BlackRock, Franklin Templeton, Nippon India AMC, AQR Capital, HDFC Asset Management |

| Corporate Risk Management (Non-Financial Firms) | Tata Group, Reliance Industries, Mahindra Group, Aditya Birla Group, Larsen & Toubro |

| Technology and Engineering Firms | Infosys, TCS, Wipro, Accenture, Fractal Analytics |

| Energy, Infrastructure, Manufacturing | Indian Oil, ONGC, Adani Energy, NTPC, Siemens |

| Government and Regulatory Agencies | Reserve Bank of India (RBI), SEBI, NABARD, Ministry of Finance |

| Healthcare and Pharmaceuticals | Sun Pharma, Dr. Reddy’s, Biocon, Apollo Hospitals |

The Broader View

Across all these industries, the average FRM salary in India is now approximately ₹21-22 LPA, with senior professionals easily exceeding ₹35 lakhs or more, depending on specialisation.

Career Pathways Beyond Salaries

Sure, salary is a big motivator, but the real win of being an FRM goes beyond the paycheck. Think of it this way: one year, you could be analysing credit risk for a global bank; a few years later, you might be helping a fintech startup design AI-driven risk models.

The variety ensures that as you climb the salary ladder, you’re also expanding your professional horizon in tangible, rewarding ways.

FAQs About FRM Salary

Here are a few frequently asked questions about the FRM Salary.

Can a fresher earn a decent salary after FRM?

Yes, freshers with FRM certification typically start at ₹4-7 LPA, which is competitive compared to non-certified peers.

Does FRM certification guarantee a salary hike?

While not automatic, FRM significantly enhances your profile and chances of a salary increase, especially when paired with relevant experience.

How long does it take to reach six figures as an FRM in India?

Typically, 7-10 years of experience combined with FRM certification can lead to six-figure salaries, depending on the company and role.

Is the FRM salary higher than the CFA in India?

Both certifications have value in different finance areas; FRMs generally earn more in risk management roles, while CFAs often lead in investment management. At senior levels, the salary gap between the two tends to even out.

How does location affect FRM salaries?

Location plays a big role. Major cities with a dense financial ecosystem or hubs, such as Mumbai, Bengaluru, and Delhi, likely pay 20-40% more on average than other cities due to higher corporate presence and the cost of living.

Which industries hire FRM professionals?

FRMs are in huge demand across all sectors due to globalisation and business expansions. Banks, financial institutions, asset management and hedge fund companies, insurance firms, actuarial firms, consulting agencies, fintech startups, corporate risk management, engineering companies, energy, infrastructure and manufacturing companies, government and regulatory agencies, healthcare and pharmaceutical industries, and even tech companies dealing with financial data hire FRMs in large numbers.

FRM Salary in India: Key Takeaways and Career Insights

The FRM isn’t just a credential that pays well; it’s a career multiplier that combines intellectual satisfaction with financial reward. And what’s even more inspiring is that the FRM journey aligns with India’s own economic trajectory. As financial systems evolve, the value of certified risk professionals grows exponentially.

The journey may start small, but with focus, resilience, and continual learning, it leads to something far bigger – the power to turn financial risk into professional opportunity. From the first ₹4-lakh paycheck to ₹30+ lakh leadership salaries, every stage is a step toward mastery, confidence, and influence in the financial world.

If you’re passionate about finance, analytics, and strategy, and you want a career where your decisions directly shape business outcomes, then the FRM is far more than an exam. It’s a pathway to security, respect, and six-figure success. Take charge of your career and step into the world of financial risk management. The FRM certification offers a proven path to both professional excellence and financial success.

FRM is recognised as the gold standard in risk management, with top global companies actively hiring certified professionals. In India, FRM holders command an average salary of ₹18 LPA, and with Imarticus’s program fees at just ₹90,000, the return on investment is exceptional. Beyond the financials, the certification equips you with globally relevant skills, opens doors across banking, fintech, consulting, and asset management, and positions you for leadership roles. If you’re aiming for a high-growth, high-impact career in finance, FRM is the sure-shot next step.