The Indian banking landscape is changing fast… driven by digital disruption, regulatory evolution, & an increasing demand for skilled professionals. In such a dynamic environment, choosing the right banking course can be the catalyst for launching a stable, high-growth finance career.

Whether you’re a recent graduate, a working professional seeking a shift, or someone aiming to explore banking career opportunities… a future-focused banking certification in India can give you both credibility & competence.

But how do you choose a program that isn’t just theoretical — but actually prepares you for the future of banking?

Let’s explore the kind of job oriented finance course that actually helps you get hired… while also building the core skills needed for banking jobs in India & beyond.

Why Traditional Banking Training Doesn’t Work Anymore

Until a few years ago, most banking aspirants leaned on classroom lectures & outdated textbooks. But today’s recruiters demand much more — practical knowledge, digital fluency & strong analytical thinking.

The future of finance belongs to professionals who:

- Understand risk, credit, compliance & investment strategy

- Can work with data, interpret trends, & build actionable reports

- Communicate financial insights to both internal teams & clients

- Are job-ready from day one

That’s why choosing a future-proof banking course with placement makes all the difference. It’s not just about passing exams… it’s about proving your value in the real banking world.

What Makes a Banking Course Truly Future-Ready?

Not all courses are created equal. If you’re serious about joining the Indian banking ecosystem — whether in retail banking, corporate lending, investment advisory, or fintech — you need a learning experience designed for 2025 & beyond.

Here’s what to look for:

| Feature | Why It Matters |

| Industry-relevant Curriculum | Covers lending, KYC, AML, digital banking, risk & regulations |

| Practical Application | Includes projects, modelling, live case studies |

| Excel & Financial Tools Training | Essential for analysis & reporting |

| Soft Skills & Interview Coaching | Helps you get through hiring rounds |

| Career Support & Placement | Increases ROI of your education investment |

A good banking certification in India is not just a certificate — it’s a launchpad for a successful, adaptable career.

Want to see how this looks in action? Watch this short video to get a glimpse of a real-world finance program that covers all the essentials.

How the Right Banking Course Opens Doors

The Indian BFSI sector is expected to become a $250 billion industry by 2030. That means more demand for professionals in roles such as:

- Credit Analyst

- Risk Manager

- Relationship Manager

- Investment Advisor

- Financial Analyst

- Compliance Officer

The right banking course doesn’t just teach — it connects you with real banking career opportunities. From campus recruitment drives to mock interviews, live projects to mentor support… it accelerates your journey into the finance world.

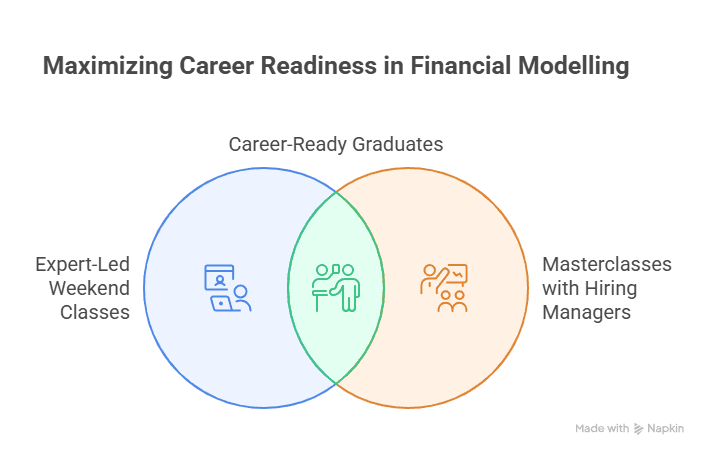

Take, for example, the Postgraduate Financial Analysis Program — designed in collaboration with industry veterans, this job oriented finance course offers:

- Expert-led weekend classes

- Hands-on training in financial modelling

- Masterclasses with hiring managers

- Placement support with guaranteed interviews

Skills Needed for Banking Jobs in 2025 & Beyond

Banking isn’t what it used to be. You need more than just communication skills & basic maths. Today’s recruiters are hiring for a mix of technical, analytical & digital fluency.

Core Skills Needed for Banking Jobs:

| Skill Set | Why It’s Needed |

| Financial Analysis | For evaluating credit risk, investment portfolios & lending |

| Excel & Data Visualisation | For building reports, dashboards & models |

| Regulatory & Compliance Know-how | To work with KYC, AML, RBI guidelines |

| Client Handling & Sales Skills | Especially in wealth & relationship management roles |

| Business Awareness | Understand market trends, economic shifts & policy impact |

Still not sure which skills matter most? Check out this detailed guide on mastering the time value of money — it explains why concepts like interest, NPV & risk matter so much in banking roles.

Why You Should Choose a Banking Course With Placement

Let’s be real… no one wants to finish a course & then struggle to find a job.

A well-structured banking course with placement offers you:

- Confidence in your ROI — you’re not just learning, you’re also earning

- Career clarity — with support in resume building & mock interviews

- Networking — meeting real recruiters, mentors & industry insiders

- A faster track to results — especially important if you’re switching careers

When you enrol in a program that aligns education with employment, you save time… reduce stress… & focus on growth.

Curious how this works in practice? Here’s a success story shared in this blog on how a financial analysis course can transform your career — a must-read for anyone serious about long-term growth in banking.

Who Should Consider a Future-Ready Banking Course?

This kind of banking certification in India is ideal for:

- Graduates in commerce, business, economics or finance

- MBA students looking to specialise in banking or analysis

- Working professionals who want to shift into BFSI or fintech

- Jobseekers looking for structured, placement-driven guidance

And if you’re unsure whether you want to go into investment banking, retail finance, or credit analysis — don’t worry. A good job oriented finance course will expose you to all of them… so you can choose what fits your skills & interests best.

Banking Career Opportunities in a Changing Economy

Even as automation reshapes banking operations, human decision-making remains central to finance.

Here’s how banking career opportunities are evolving:

| Area | New-Age Roles |

| Retail Banking | Digital KYC Analysts, Personal Finance Advisors |

| Corporate Lending | Credit Appraisal Executives, Treasury Managers |

| Investment Services | Portfolio Managers, ESG Analysts |

| Compliance & Risk | Forensic Auditors, Regulatory Reporting Analysts |

| Fintech | Product Managers, Data-Driven Loan Officers |

This mix of digital & human roles means continuous upskilling is not optional — it’s essential.

Looking to understand how professionals stay relevant with smart strategies? This blog on fintech investment strategies gives you a sharp overview.

FAQs

1. What are the best banking career opportunities today?

Roles in credit, risk, digital banking… & investment services are in high demand across India.

2. How can a banking certification in India help my career?

It builds core finance skills… adds credibility… & prepares you for competitive roles in BFSI.

3. Who should consider a job oriented finance course?

Fresh graduates… career switchers… & anyone looking to get hired faster in the banking sector.

4. Why choose a banking course with placement support?

It saves time… builds interview confidence… & connects you directly with top recruiters.

5. What are the key skills needed for banking jobs today?

You’ll need financial analysis… Excel modelling… compliance knowledge… & client handling skills.

6. Is a job oriented finance course better than traditional degrees?

Yes… it’s practical, faster… & designed for real-world banking career opportunities.

7. What’s the value of a banking certification in India post-pandemic?

It proves job readiness… offers flexibility… & aligns with digital banking transformations.

8. How do I choose the right banking course with placement?

Look for industry-relevant content… hands-on training… & strong job support after completion.

Final Thoughts: The Right Banking Course is Your Future Investment

As India’s economy grows & digital transformation accelerates, the future of finance is wide open — but only for those with the right preparation.

A well-designed banking cour se helps you build practical skills, gain industry exposure, & access real banking career opportunities — all while aligning with the digital-first direction of the BFSI sector.

So if you’re ready to move beyond theory… & step into the world of high-impact finance roles… the time to act is now.

Explore a program that offers the full package — training, tools, mentors & guaranteed interviews — like the Postgraduate Financial Analysis Program and make your move today.

Because the future of banking in India belongs to those who prepare for it… not just dream about it.