Table of Contents

If you’re dreaming of a career in finance that’s challenging, rewarding & truly global… the CFA Career Path might be your gateway to it all.

The Chartered Financial Analyst (CFA) charter is considered one of the most prestigious finance credentials in the world. But what happens after you pass those rigorous exams? What roles can you step into? What industries will value your skill set?

In this blog, we’ll explore the top 5 CFA career paths, dive into real-world roles, expected pay & how to make the most of this prestigious qualification.

Why Understanding Your CFA Career Path Matters

Most candidates are so focused on clearing the exams… they don’t think far enough about where it actually leads. But clarity around your CFA job roles can help you:

- Choose the right electives

- Build relevant experience early

- Align your career goals with your strengths

Before we break it down, you might want to watch this quick video… it gives a great visual explanation of CFA outcomes.

1. Investment Banking: High Stakes, Big Returns

If you’re aiming for front-end finance, then exploring CFA in investment banking is a smart move.

While MBAs are still dominant in this field, more firms now value CFA candidates for their rigorous knowledge of:

- Financial modelling

- Valuations

- Deal structuring

- Ethics & regulations

Typical Roles:

| Title | Description |

| M&A Analyst | Works on mergers, acquisitions, valuations |

| Equity Capital Markets | Manages IPOs, equity offerings |

| Investment Banking Associate | Leads deal execution, client pitches |

This path is demanding… but the learning, compensation & growth are unmatched.

2. Portfolio Management: The Art of Asset Growth

Want to manage millions (or billions) in client assets? Portfolio management is a dream role for many on the CFA Career Path.

With a CFA charter, you’re qualified to analyse markets, assess risk & create investment strategies that align with client goals.

Skills Needed:

- Asset allocation

- Macroeconomic analysis

- Risk-return frameworks

- Communication with clients

| Career Stage | CFA Salary Prospects (INR/year) |

| Junior Analyst | ₹7–10 LPA |

| Portfolio Manager | ₹18–30 LPA |

| Head of Investments | ₹40 LPA+ |

This role is central to many financial careers with CFA, especially within mutual funds, AMCs, family offices & even insurance firms.

3. Equity Research: Deep Dives into Market Trends

If you enjoy analysis, storytelling with data & making predictions… equity research is one of the best CFA career options.

You’ll write research reports, recommend buy/sell calls & influence investment decisions across the board.

| Role | Focus Area |

| Buy-Side Analyst | Mutual Funds, PMS, Insurance |

| Sell-Side Analyst | Brokerage, Advisory Firms |

| Research Lead | Sectoral & thematic research |

Employers appreciate the ethics & analytical rigour of CFA charterholders… especially when making market calls that can affect millions.

Want to explore more in this space? Check out this detailed CFA job roles blog.

4. Risk Management: Keeping Companies Financially Safe

Risk is everywhere—credit risk, market risk, operational risk… & professionals with a CFA background are increasingly preferred in this space.

The CFA curriculum covers key risk concepts, making it a strong foundation for those who want to prevent financial disasters before they happen.

| Title | Responsibilities |

| Credit Risk Analyst | Evaluate creditworthiness |

| Market Risk Manager | Monitor portfolio exposures |

| Risk & Compliance Lead | Ensure internal controls & compliance |

The demand for this role is rising fast, especially among fintech firms, NBFCs & even central banks.

So if you’re eyeing long-term CFA opportunities in India, risk management is a path worth considering.

5. Corporate Finance & Strategy: Beyond the Balance Sheet

Not everyone wants to work in investment banks or AMCs… some prefer being at the heart of real business.

Roles in corporate finance allow you to manage capital structure, budgeting, valuations & even work on IPOs or strategic M&A for a company.

Many corporates now value CFA charterholders for these internal roles because they bring strategic thinking backed by deep financial analysis.

| Role Title | Industry |

| FP&A Analyst | Manufacturing, Retail, IT |

| Corporate Strategist | Conglomerates, Tech, Energy |

| Treasury Manager | Banking, FMCG, Pharma |

This is a growing slice of financial careers with CFA… & one that’s often more stable compared to high-volatility finance jobs.

The Rise of CFA Opportunities in India

India is now among the top 3 markets globally for CFA candidates.

Here’s why:

- Growth in asset management & wealth advisory firms

- Surge in private equity, VC & family offices

- Fintech boom… with demand for credible analysts

- Indian firms going global & needing valuation experts

| City | CFA Hiring Potential |

| Mumbai | Very High |

| Bangalore | High |

| Delhi NCR | High |

| Hyderabad | Moderate |

If you’re serious about long-term careers after CFA, now is the perfect time to plan ahead & build a roadmap.

CFA Career Path vs Traditional Finance Routes

| Feature | CFA Career Path | MBA Finance Route |

| Cost | Lower | Higher |

| Global Recognition | Very High | Moderate to High |

| Time Commitment | Flexible (while working) | Full-time (1–2 years) |

| Depth of Knowledge | Deep in finance | Broad business exposure |

| Best For | Analysts, Managers, Specialists | General Managers, Leaders |

For many finance roles, especially in India, the CFA route is emerging as a strong (and more affordable) alternative to an MBA.

Explore more about CFA course details here to see if it fits your journey.

Real Talk: What to Expect After Each CFA Level

| CFA Level | You Can Apply For |

| Level I | Finance Internships, Analyst Roles |

| Level II | Equity/Research Associate, Risk Analyst |

| Level III | Senior Analyst, Portfolio Manager, VP Roles |

Your credibility increases with each level cleared… but remember, work experience + CFA = career rocket fuel

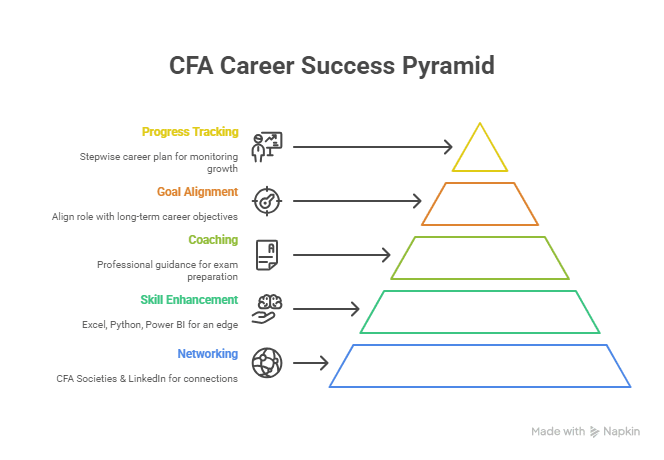

Tips to Maximise Your CFA Career Outcomes

- Network actively – CFA Societies & LinkedIn are great places to start

- Pair your CFA with Excel, Python or Power BI for an edge

- Consider professional coaching to fast-track exam prep

- Always align your role with long-term goals—don’t just chase salary

- Track your progress with a stepwise career plan

To get structured mentorship, doubt-clearing sessions & placement guidance, explore the CFA Certification Program at Imarticus. It’s designed for candidates who want expert-led support along the way.

FAQs

1. What are some top CFA job roles?

Think analyst, portfolio manager, risk expert… even investment banker & strategist.

2. What careers after CFA can I explore?

You can work in investment firms, banks, fintechs & global corporates… plenty of options.

3. Which CFA career options are best for freshers?

Research, risk analysis & equity roles are ideal… they help build strong finance foundations.

4. Is CFA in investment banking helpful?

Yes! It builds your skills in valuation, modelling & ethics… highly valued in IB.

5. Are there financial careers with CFA beyond banking?

Absolutely—think asset management, consulting, corporate finance & even fintech.

6. What are CFA salary prospects like in India?

They start strong… and rise fast with each level cleared & experience gained.

7. Where can I find CFA opportunities in India?

Major hubs include Mumbai, Delhi, Bangalore & Hyderabad… all hiring actively.

8. How soon can I see results from CFA job roles?

Even after Level I… better interviews, better pay & better roles come your way.

Final Thoughts

The world of finance is massive, but the CFA Career Path helps narrow your focus, sharpen your skills & build a credible career. From CFA in investment banking to risk management & equity research, there are multiple ways to grow… depending on your strengths & preferences.

With India becoming a hub for global finance, the timing couldn’t be better. So whether you’re a student, a working professional or a career switcher… now is your chance to build a powerful future in finance.

Already thinking about your first step? Start by understanding the CFA journey in detail… & then plan your move.