The global finance landscape is changing quicker than ever before and the driving force behind it is something to be admired but scarcely cherished: investment banking certification. Whether you are a fresh college graduate in need of junior investment banker positions or an experienced executive in need of rejuvenating yourself in the course of a recessionary employment environment, an investment banking certification is the professional winner you have been searching for.

The Rise of Investment Banking Certification in a Globalised Economy

As investment banking business became increasingly digital and complex, companies are more in need of business managers with technical, hands-on skills. An investment banking certification gives them just that—a compact, industry-specific curriculum that offers technical skills, day-to-day working know-how, and international views needed to succeed in careers in finance these days.

Those times are over when a conventional finance degree would suffice. As markets get more dynamic, and analytics, digitalization, and compliance are the key areas, training for investment banking operations became a requirement. Certifications fill this void by giving working professionals the ability to do better in actual situations.

How Investment Banking Certification Sets You Apart?

When it comes to splitting entry-level investment banking positions, competition is fierce. Employers desire external vanilla degrees. They desire candidates who’ve taken the effort to learn trade skills that are applicable to investment banking analysts, including:

- Trade life cycle awareness

- Regulatory systems (Basel III, MiFID, etc.)

- Securities and derivatives operations

- AML/KYC processes

- Wealth and asset management principles

An investment bank certificate guarantees that you not only have a clear understanding of these principles but are also sufficiently qualified to manage them under high-stress, multicultural settings. These programs imitate actual banking situations, teaching you how to anticipate the unknown and placing you ahead of the rest of the candidates.

Aligning with Global Finance Career Trends

Finance practitioners no longer need to limit themselves to local markets. Virtual banking, international transactions, and global compliance standards have rendered a career certification for international finance an essential key. Getting certified as an investment banker with an international certification makes you an international citizen—global practitioner with the capacity to manage multi-jurisdictional operations, work according to global stakeholders, and manage global portfolios.

In addition to that, the certifications are updated from time to time in order to stay current with appropriate global finance subject matter, ranging from ESG reporting through blockchain-affected trading platforms. Not only do these add value to your resume, but they also make you useful to strategic financial choices.

Unlocking Entry-level Investment Banking Jobs

Lower-level investment banking positions demand more than being book-smart; it demands flexibility, precision, and responsiveness. Successful investment banking operations training programs incorporate real-case studies, simulation, and real-world projects that mimic real-world investment banking settings.

Experience proves invaluable in interviews, aptitude testing, and in-situ testing. Prospective employers view certified candidates as pre-trained professionals, lessening their training expense and hiring time. Certification is your documentary proof of your employability and technical ability.

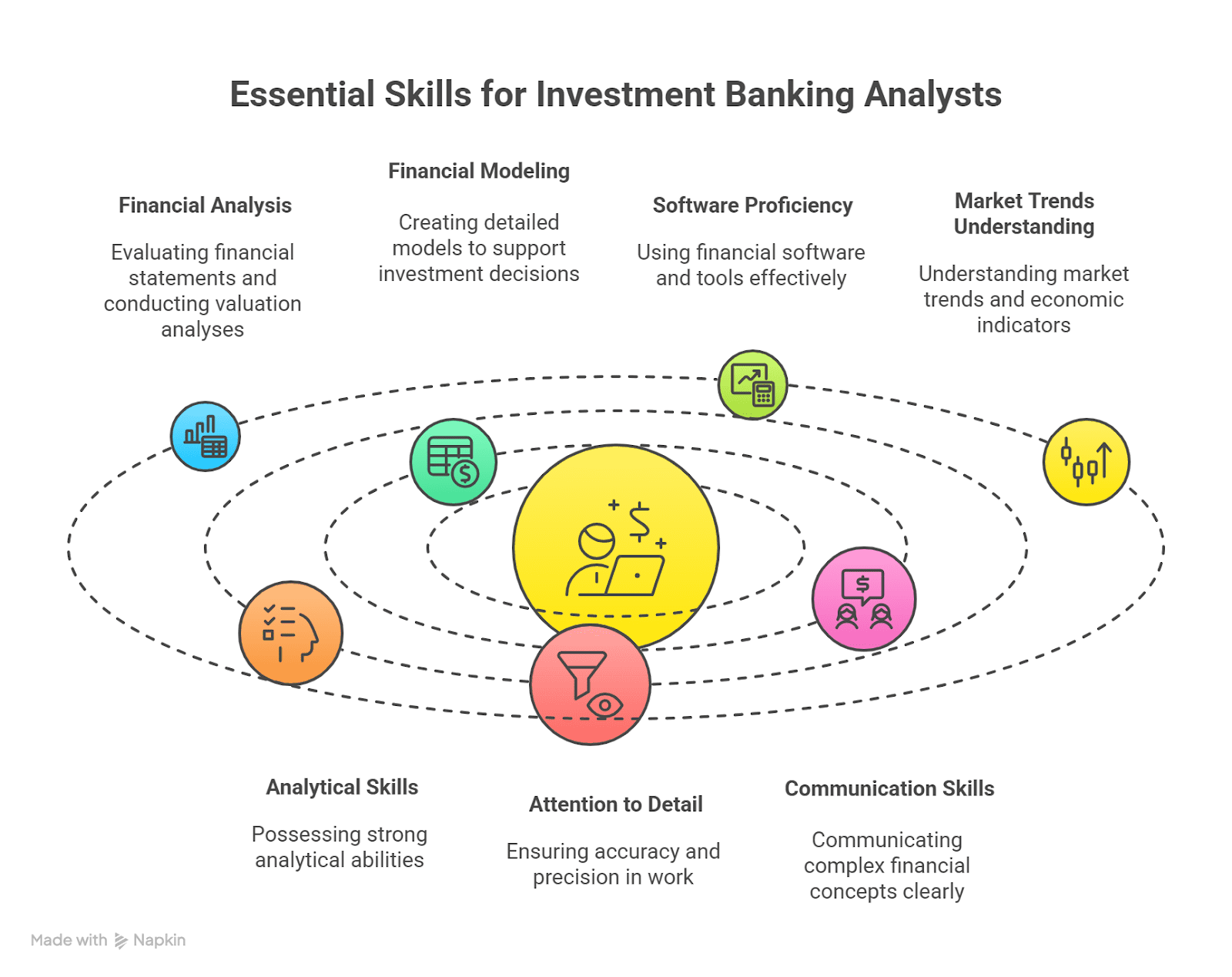

The Demand for Skills for Investment Banking Analysts

The expectations from investment banking analysts are higher than ever before. You’re not only required to crunch numbers but also to:

- Understand financial statements from an investment strategy perspective

- Assess risk exposures and compliance requirements

- Communicate with clients and stakeholders

- Interact horizontally (legal, IT, audit, etc.)

It is in this context that investment banking analyst skills gained via a certificate program emerge into the fore. Be it the art of preparing regulatory reports or financial modeling, these certificates bridge pedagogic learning with professional capital.

Why India Needs the Best Investment Banking Courses More Than Ever?

India is developing as a hub for financial services outsourcing and thus generates mammoth investment banking professionals’ needs for supervision of global work flows. Best investment banking schools in India fulfill this need by providing curriculum as per world-best practice standards.

If you want to find employment with Indian banks or with overseas investment houses that have branches in India, theory-based certification practice is no longer escapable. Top programs now provide:

- Living with business colleagues

- Industry mentoring through engagement

- Career support centers such as mock interview and resume building

These suite of programs are so much more than academic achievement; they drive career acceleration.

Spotlight on Certified Investment Banking Operations Professional (CIBOP)

When it comes to successful certifications, the Certified Investment Banking Operations Professional (CIBOP™) by Imarticus Learning is a watershed for anyone looking to become a finance professional.

What Makes CIBOP Unique?

- 100% job assurance for 0–3 years of experienced graduates

- Up to 9 LPA offers with over 85% placement

- Various programme lengths (3 & 6 months) for flexibility

- 7 interview guarantees with 1000+ hiring partners

It provides extremely interactive study material with teaching all from compliance and trade-based money laundering to wealth management and reporting to regulators. It transforms students into productive professionals with a proper understanding of investment banking operations.

Key Metrics:

- 60% average salary increase

- 1200+ batches done

- 50,000+ successful graduates

- Awarded as Best Education Provider in Finance (30th Elets World Education Summit 2024)

Career Outcomes:

Upon completion of CIBOP, learners unlock a spectrum of job roles including:

- Investment Banking Associate

- Risk Management Consultant

- Collateral Management Analyst

- Client Onboarding Associate

- KYC Analyst

- Regulatory Reporting Analyst

This broad spectrum of opportunities ensures that you’re not locked into one path but can evolve with the changing tides of global finance.

FAQs

1. What is an investment banking certification?

Investment banking certification is a professional certification whose aim is to offer experiential training in the essential subjects of investment banking, i.e., operations, compliance, risk management, and settlement of trades.

2. How does investment banking certification help in getting a job?

It makes you employable via case studies, projects, and modules industry-focused. Employers hire certified candidates because they are employable.

3. Is investment banking operations training necessary for beginners?

Yes, if you’d like to make an application for entry-level positions. It makes you practical and regulation-nik skills over basic finance courses.

4. What are the best investment banking courses in India?

Courses such as CIBOP by Imarticus Learning excel because of job placements, practical courseware, and good industry connections.

5. Can I pursue investment banking certification without prior experience?

Yes. They are primarily for the freshers and give a fundamental level of knowledge to start a career in finance.

6. What skills do investment banking analysts need?

They would require analytical skills, financial modeling skills, risk management skills, and communication skills.

7. How long does it take to complete an investment banking certification?

It may be achieved within 3-6 months depending on the program and given the flexibility of working professionals’ schedules.

Conclusion: Elevate Your Career With the Right Certification

In the high-reward, high-risk finance world of today, an investment banking qualification is not just a requirement but a career driver. From assisting you in securing entry-level investment banker positions to demolishing obstacles to opportunities globally, the proper certification has the ability to redefine your path.

If you are prepared to take your finance profession to the next level, Certified Investment Banking Operations Professional (CIBOP) is where to start. With its career guarantee, latest curriculum, and overall guidance of one’s profession, it’s not only a course—it’s your key to financial success in this new age of global finance.